This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

As I pondered the U.S. and global economy, recently, I realized this…

I had no factual basis for my understanding, of how major flows of Foreign Direct Investment have played out, over the last 15 years. Basically, from a post-financial crisis 2009 to post-COVID 2024.

In simpler words, I really did not have a current picture, of the reality of this major investing topic.

Times do change. Corporate and technology structures inside the world economy can change dramatically. Oftentimes, our thoughts about key macro topics do not reflect the current reality.

For this FEB 2024 special economic topic, I thought: Just present the current structure of Foreign Direct Investment (termed FDI in short).

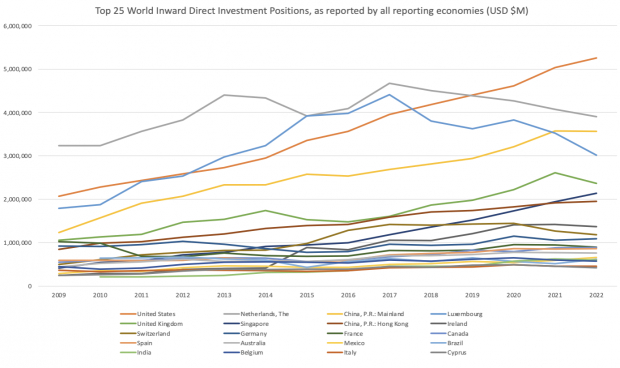

So, I present to you the “Top 25 World FDI positions” first.

Then, I show you the “U.S. outward FDI investment” in the world economy. Finally, I show “Top 25 inward FDI investors” into the U.S.A.

You may be surprised by what you see — inside these rankings. That is the point of this exercise.

The Top 25 World Inward Direct Investment Positions

“The United States recorded the largest increase of inward foreign direct investment of all economies in 2021 (and 2022).”

“The latest release of the IMF’s Coordinated Direct Investment Survey (CDIS) shows the U.S. position increasing by $506 billion, or 11.3 percent, last year.”

- “For the 112 economies that reported data, inward FDI positions rose by an average of 7.1 percent in national currencies.

- “In dollar terms, this global growth figure translates to only 2.3 percent, due to the recent strengthening of the greenback.”

Why the U.S. is the World’s Top Destination of Foreign Direct Investment

According to the IMF, “As the Chart of the Week (below) shows, the United States is now the world’s top destination for FDI, while Mainland China has moved up to the third position.”

“It also shows how smaller economies take prominent positions among the global top 10.”

“The Netherlands, Luxembourg, Hong Kong SAR, Singapore, Ireland, and Switzerland all appear on this list even though none of these economies rank among the top 10 when it comes to Gross Domestic Product (GDP).”

Image Source: Zacks Investment Research

“The apparent disconnect between FDI data and the real economy comes down to the fact that these numbers are fundamentally a set of financial statistics. They show cross-border financial flows and positions between entities tied to each other by a direct or indirect ownership share of at least 10 percent.”

“Such flows can end up as investments into productive activities within a country, like funds going into new factories and machinery, but they can also be purely financial investments with little to no link to the real economy.”

“For instance, many multinational companies set up Special Purpose Entities (SPEs) in offshore financial centers where funds just flow through the economy, as an intermediate step towards their final destination.”

“These entities are often established to obtain tax or regulatory benefits and can inflate FDI data considerably even though they have relatively little tangible impact on the host economy.”

“The latest data from the IMF’s Coordinated Direct Investment Survey (CDIS) shows that offshore financial centers still account for a disproportionately high share of global FDI.”

- “However, their share has gradually declined since 2017, while that of the largest economies such as the United States and China has increased.”

- “The exact drivers of this development are hard to disentangle, but are likely linked to several policy initiatives.”

- “For example, the fall in the offshore financial centers’ share of global FDI comes after the U.S. Tax Cuts and Jobs Act took effect in 2018. This legislation reduced incentives to keep profits in low-tax jurisdictions and led to a substantial US repatriation of funds from foreign subsidiaries.”

- “Additionally, sustained international efforts to reduce tax avoidance, like the OECD/G20 Base Erosion and Profit Shifting initiative, may have halted some flows to offshore financial centers.”

Image: Bigstock

A Look at Foreign Direct Investment Leaders

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

As I pondered the U.S. and global economy, recently, I realized this…

I had no factual basis for my understanding, of how major flows of Foreign Direct Investment have played out, over the last 15 years. Basically, from a post-financial crisis 2009 to post-COVID 2024.

In simpler words, I really did not have a current picture, of the reality of this major investing topic.

Times do change. Corporate and technology structures inside the world economy can change dramatically. Oftentimes, our thoughts about key macro topics do not reflect the current reality.

For this FEB 2024 special economic topic, I thought: Just present the current structure of Foreign Direct Investment (termed FDI in short).

So, I present to you the “Top 25 World FDI positions” first.

Then, I show you the “U.S. outward FDI investment” in the world economy. Finally, I show “Top 25 inward FDI investors” into the U.S.A.

You may be surprised by what you see — inside these rankings. That is the point of this exercise.

The Top 25 World Inward Direct Investment Positions

“The United States recorded the largest increase of inward foreign direct investment of all economies in 2021 (and 2022).”

“The latest release of the IMF’s Coordinated Direct Investment Survey (CDIS) shows the U.S. position increasing by $506 billion, or 11.3 percent, last year.”

Why the U.S. is the World’s Top Destination of Foreign Direct Investment

According to the IMF, “As the Chart of the Week (below) shows, the United States is now the world’s top destination for FDI, while Mainland China has moved up to the third position.”

“It also shows how smaller economies take prominent positions among the global top 10.”

“The Netherlands, Luxembourg, Hong Kong SAR, Singapore, Ireland, and Switzerland all appear on this list even though none of these economies rank among the top 10 when it comes to Gross Domestic Product (GDP).”

Image Source: Zacks Investment Research

“The apparent disconnect between FDI data and the real economy comes down to the fact that these numbers are fundamentally a set of financial statistics. They show cross-border financial flows and positions between entities tied to each other by a direct or indirect ownership share of at least 10 percent.”

“Such flows can end up as investments into productive activities within a country, like funds going into new factories and machinery, but they can also be purely financial investments with little to no link to the real economy.”

“For instance, many multinational companies set up Special Purpose Entities (SPEs) in offshore financial centers where funds just flow through the economy, as an intermediate step towards their final destination.”

“These entities are often established to obtain tax or regulatory benefits and can inflate FDI data considerably even though they have relatively little tangible impact on the host economy.”

“The latest data from the IMF’s Coordinated Direct Investment Survey (CDIS) shows that offshore financial centers still account for a disproportionately high share of global FDI.”