This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

As any young entrepreneur that ever ran a lemonade stand will be able to confirm: having a line of customers around the block, but no inventory, is bad for business. As the U.S. economy is starting to recover briskly and sees consumers coming back out to play again (to stick to the theme of our previous analogy), producers of goods are increasingly finding themselves in a similar situation.

Shortages for various products (it wasn’t just toilet paper) seemed common throughout the pandemic last year, due to the lockdown of the U.S. economy. The gradual reopening of the U.S. economy has been accompanied by a continuation of the shortages across the board, too. While commodities are leading the charge, the latest shortage is more widespread, and subsequently affects final consumer products across the board.

While consumers have come to terms with the fact that orders might take longer than usual, investors are left wondering what the implication of this could be for the recovery process. Are we simply spinning our wheels for a while and will get back to business as usual soon? Or is this the sign of an overheating economy that will end up getting straightened out by our parents the Fed? (That was the last of the childhood analogies).

An old saying among economists describes supply shortages as a problem solved easily: “If the line is too long, the price is too low.” However, a massive U.S. sized economy, continuing to run hot for extended periods of time, might find itself presented with increasing inflationary pressures. That might force the Fed’s hand and trigger a policy response. And that might shut off the recovery in its still very early stages.

On the other hand (Harry Truman’s wish for a one-handed economist might never come true, it seems), if we find the bottlenecks in supply become less prevalent and consumers find their demand is met, this development might prove to be temporary. So, the latest inflationary pressures might be indeed transitory. When it comes to the degree to which the shortages are a systematic problem — or of a short-term nature — it is important to distinguish the underlying reasons.

(1) A number of currently experienced shortages can be traced back to the effects of one-off idiosyncratic industry supply events (such as particularly cold February this year) that paralyzed the U.S. petrochemical industry along the U.S. Gulf Coast. That caused ripple effects down the supply chain now. But these will eventually fade, in terms of its effect on the global economy.

Similarly, many disruptions along the transportation chain, such as the Suez Canal blockage, or the shortage in shipping containers caused and still continue to cause disruptions along transportation networks that ultimately are indistinguishable from actual supply shortages. These will also prove to be temporary.

(2) Similarly of a temporary nature will be the simple fact: Our entire economy went from complete shutdown to running on all cylinders (or close to) within a short period of time. Companies simply have to go through adjustment processes. Think of this in terms of rehiring staff that might have been let go, and getting closer to producing at full capacity.

(3) Factor in one-off effects from an unprecedented flow of U.S. stimulus checks. They did help those who needed help the most.

A new analysis of Census Bureau data found: Reports of food shortages fell -42%, a -43% decline in a gauge of financial instability was seen, and "frequent anxiety and depression" fell over -20%. $325B in cheques went out in March due to the American Recovery Act, versus $61B in April. There was a relatively trivial residual amount sent during May.

(4) A less-essential surge in pent up demand might be another temporary culprit. Being locked up at home for over a year, consumers have begun to work on their long “to-do” lists of fixes around the house. These, with hindsight, appear to be the obvious thing that was meant to happen.

But during the pandemic, such consumer activity was very likely difficult to forecast, particularly for producers who need to carefully balance their balance sheet health with placing orders for input factors for a potential surge in demand for their products. We expect that this will also prove to be of temporary nature. You can only fix so much around your house (some of our spouses might disagree).

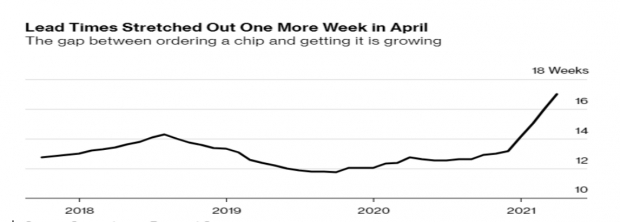

(5) Separate from this laundry list of factors, the shortage in semiconductors might prove to be the one with the longest impact. While there is a wide range of reasons for the shortage, one of the drivers of the shortage will be somewhat relentless throughout the next few years.

Namely, demand. That is, with the increased reliance of our society on advanced technology throughout the pandemic (in the forms of video meetings, cloud computing etc.) the line of products that rely on these products is only getting longer.

It is our expectation the chip supply-side will benefit most from this development. In particular, demand for back-end semiconductor wafer fabrication help from the likes of Zacks #1 Ranked ASML and Lam Research. Ditto ‘new generation’ chip suppliers like Zacks #1 Ranked Advanced Micro Devices and Nvidia.

This part of the U.S. economy likely has to go through a possibly lengthy adjustment process, to be able to serve increased demand. Confirm that in the chart shown below.

Image Source: Susquehana Financial Group

Image Source: Susquehana Financial Group

(6) Ultimately, it is, however, our expectation the amalgamation of all these factors, while unfortunate, will prove to be temporary in nature. This remarkable combination of recent circumstances won’t be the cause for a major disruption of the U.S. recovery process.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Image: Shutterstock

Is There a Shortage Crisis Looming?

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

As any young entrepreneur that ever ran a lemonade stand will be able to confirm: having a line of customers around the block, but no inventory, is bad for business. As the U.S. economy is starting to recover briskly and sees consumers coming back out to play again (to stick to the theme of our previous analogy), producers of goods are increasingly finding themselves in a similar situation.

Shortages for various products (it wasn’t just toilet paper) seemed common throughout the pandemic last year, due to the lockdown of the U.S. economy. The gradual reopening of the U.S. economy has been accompanied by a continuation of the shortages across the board, too. While commodities are leading the charge, the latest shortage is more widespread, and subsequently affects final consumer products across the board.

While consumers have come to terms with the fact that orders might take longer than usual, investors are left wondering what the implication of this could be for the recovery process. Are we simply spinning our wheels for a while and will get back to business as usual soon? Or is this the sign of an overheating economy that will end up getting straightened out by our parents the Fed? (That was the last of the childhood analogies).

An old saying among economists describes supply shortages as a problem solved easily: “If the line is too long, the price is too low.” However, a massive U.S. sized economy, continuing to run hot for extended periods of time, might find itself presented with increasing inflationary pressures. That might force the Fed’s hand and trigger a policy response. And that might shut off the recovery in its still very early stages.

On the other hand (Harry Truman’s wish for a one-handed economist might never come true, it seems), if we find the bottlenecks in supply become less prevalent and consumers find their demand is met, this development might prove to be temporary. So, the latest inflationary pressures might be indeed transitory. When it comes to the degree to which the shortages are a systematic problem — or of a short-term nature — it is important to distinguish the underlying reasons.

(1) A number of currently experienced shortages can be traced back to the effects of one-off idiosyncratic industry supply events (such as particularly cold February this year) that paralyzed the U.S. petrochemical industry along the U.S. Gulf Coast. That caused ripple effects down the supply chain now. But these will eventually fade, in terms of its effect on the global economy.

Similarly, many disruptions along the transportation chain, such as the Suez Canal blockage, or the shortage in shipping containers caused and still continue to cause disruptions along transportation networks that ultimately are indistinguishable from actual supply shortages. These will also prove to be temporary.

(2) Similarly of a temporary nature will be the simple fact: Our entire economy went from complete shutdown to running on all cylinders (or close to) within a short period of time. Companies simply have to go through adjustment processes. Think of this in terms of rehiring staff that might have been let go, and getting closer to producing at full capacity.

(3) Factor in one-off effects from an unprecedented flow of U.S. stimulus checks. They did help those who needed help the most.

A new analysis of Census Bureau data found: Reports of food shortages fell -42%, a -43% decline in a gauge of financial instability was seen, and "frequent anxiety and depression" fell over -20%. $325B in cheques went out in March due to the American Recovery Act, versus $61B in April. There was a relatively trivial residual amount sent during May.

(4) A less-essential surge in pent up demand might be another temporary culprit. Being locked up at home for over a year, consumers have begun to work on their long “to-do” lists of fixes around the house. These, with hindsight, appear to be the obvious thing that was meant to happen.

But during the pandemic, such consumer activity was very likely difficult to forecast, particularly for producers who need to carefully balance their balance sheet health with placing orders for input factors for a potential surge in demand for their products. We expect that this will also prove to be of temporary nature. You can only fix so much around your house (some of our spouses might disagree).

(5) Separate from this laundry list of factors, the shortage in semiconductors might prove to be the one with the longest impact. While there is a wide range of reasons for the shortage, one of the drivers of the shortage will be somewhat relentless throughout the next few years.

Namely, demand. That is, with the increased reliance of our society on advanced technology throughout the pandemic (in the forms of video meetings, cloud computing etc.) the line of products that rely on these products is only getting longer.

It is our expectation the chip supply-side will benefit most from this development. In particular, demand for back-end semiconductor wafer fabrication help from the likes of Zacks #1 Ranked ASML and Lam Research. Ditto ‘new generation’ chip suppliers like Zacks #1 Ranked Advanced Micro Devices and Nvidia.

This part of the U.S. economy likely has to go through a possibly lengthy adjustment process, to be able to serve increased demand. Confirm that in the chart shown below.

(6) Ultimately, it is, however, our expectation the amalgamation of all these factors, while unfortunate, will prove to be temporary in nature. This remarkable combination of recent circumstances won’t be the cause for a major disruption of the U.S. recovery process.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>