The Gap, Inc. shares tanked following its Q3 financial release on November 23. The apparel chain fell victim to the all too familiar hyper congested global supply chain that raised costs and hampered its revenue.

What’s The Story?

The Gap is a specialty apparel giant, with brands that include its namesake, as well as Old Navy, Banana Republic, and Athleta. The company’s sales fell 16% last year and dipped 1% in 2019. Clearly, covid crushed its business, as people didn’t need to get dressed up for much. That said, The Gap’s sales have fallen on a YoY basis in four out of the past six years.

The company’s Q3 sales came in essentially flat compared to the year-ago period. Along with lackluster revenue, The Gap missed our adjusted EPS estimate by 45%. Wall Street also focused on the fact that executives said “constrained inventory” cost the company $300 million in lost sales and added $100 million in “air freight costs.”

The Gap’s updated guidance disappointed investors in a big way. Its Q4 Zacks consensus EPS tumbled from +$0.41 a share prior to its release all the way down to an adjusted loss of -$0.12 a share. Meanwhile, its FY21 and FY22 adjusted earnings estimates are down roughly 35% and 19%, respectively compared to where they were before The Gap reported on November 23.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

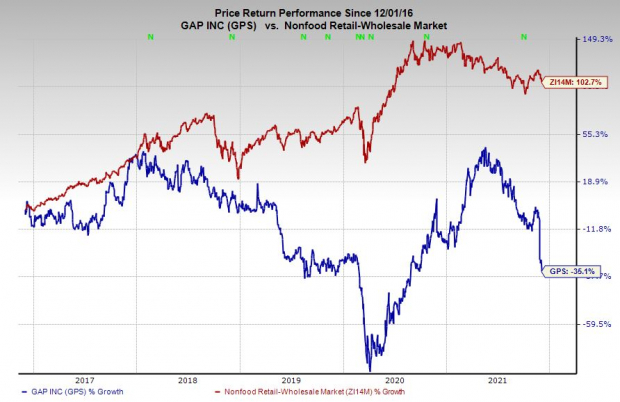

The Gap’s downward earnings revisions trends help it land a Zacks Rank #5 (Strong Sell) at the moment. The stock has also plummeted 30% since its third quarter release, as part of a 50% decline in the past six months.

The Gap’s rough guidance, which includes the all-important holiday period, forced some analysts to cut their price targets. Investors should also note that GPS shares are somewhat heavily shorted right now, at about 14% of the float. Therefore, it’s likely prudent to stay away from The Gap, at least for the time being.

Image: Bigstock

Bear of the Day: The Gap, Inc. (GPS)

The Gap, Inc. shares tanked following its Q3 financial release on November 23. The apparel chain fell victim to the all too familiar hyper congested global supply chain that raised costs and hampered its revenue.

What’s The Story?

The Gap is a specialty apparel giant, with brands that include its namesake, as well as Old Navy, Banana Republic, and Athleta. The company’s sales fell 16% last year and dipped 1% in 2019. Clearly, covid crushed its business, as people didn’t need to get dressed up for much. That said, The Gap’s sales have fallen on a YoY basis in four out of the past six years.

The company’s Q3 sales came in essentially flat compared to the year-ago period. Along with lackluster revenue, The Gap missed our adjusted EPS estimate by 45%. Wall Street also focused on the fact that executives said “constrained inventory” cost the company $300 million in lost sales and added $100 million in “air freight costs.”

The Gap’s updated guidance disappointed investors in a big way. Its Q4 Zacks consensus EPS tumbled from +$0.41 a share prior to its release all the way down to an adjusted loss of -$0.12 a share. Meanwhile, its FY21 and FY22 adjusted earnings estimates are down roughly 35% and 19%, respectively compared to where they were before The Gap reported on November 23.

Bottom Line

The Gap’s downward earnings revisions trends help it land a Zacks Rank #5 (Strong Sell) at the moment. The stock has also plummeted 30% since its third quarter release, as part of a 50% decline in the past six months.

The Gap’s rough guidance, which includes the all-important holiday period, forced some analysts to cut their price targets. Investors should also note that GPS shares are somewhat heavily shorted right now, at about 14% of the float. Therefore, it’s likely prudent to stay away from The Gap, at least for the time being.