Meta Platforms , formerly known as Facebook, tumbled after its fourth quarter financial release in early February. Wall Street dumped the stock because Apple’s privacy policies are hurting the tech firm’s mobile advertising-based business far more than previously projected.

The Name Change Says A Lot?

Facebook and CEO Mark Zuckerberg announced in October that the social media company that owns Instagram and WhatsApp was changing its name to Meta. Wall Street and investors appeared somewhat intrigued and slightly nervous about the firm’s heavy investment in building out a massive immersive virtual reality experience and betting a large chunk of its future on the so-called metaverse.

Meta is pouring billions of dollars and tons of resources into the metaverse. The bet is that people will decide to live some of, or much of their lives in this new digital world via an avatar. That reality is still years off and it might not ever come to fruition, at least not how Zuckerberg and Meta hope.

In the here and now, Facebook, or Meta still makes nearly all of its money from traditional digital advertising, with a large chunk of that coming from mobile. Companies pay to put their ads in front of users across Facebook, Instagram, and WhatsApp, and for good reason.

Image Source: Zacks Investment Research

Digital adverting is still a hugely lucrative business for Meta and a necessity for many companies, given that Meta closed fiscal 2021 with 2.82 billion “daily active people” on its family of platforms, up 8% YoY. Meanwhile, its “monthly active people” climbed 9% to 3.59 billion. These staggering figures helped Meta post 37% revenue growth last year to hit $118 billion.

The YoY growth is a bit misleading since 2020 marked its slowest top-line growth (22%) as a public firm. Meta then shocked Wall Street when it said Apple’s iOS privacy policies that allow users to opt out of data tracking is likely to cost it more than $10 billion in lost sales in 2022. These policies have also hurt other social media firms such as Snap and they aren’t going away.

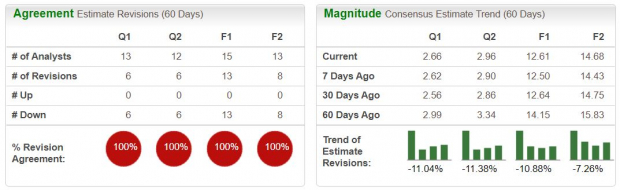

Zacks estimates call for Meta’s 2022 sales to climb just 12.3% and 17.4% in FY23, both of which would represent by far its lowest sales growth since its IPO—and likely ever. Meanwhile, its adjusted earnings are projected to slip 8.4% this year. And its FY22 Zacks consensus EPS is down 11% since its release, with FY23 over 7% lower.

Image Source: Zacks Investment Research

Bottom Line

Meta is still a stellar company when considering its overall revenue and earnings power, impressive balance sheet, and ability to reach nearly half of the global population. Nonetheless, Wall Street is based on what’s next and it faces growing competition from TikTok and others for people’s attention.

Some of the big money is clearly nervous about Meta’s slowing revenue growth and Apple’s privacy push. Others might be skeptical about the long-term viability of the metaverse, or some combination of it all. FB shares have fallen 26% in the last year and 40% in 2022.

Meta’s EPS revisions help it land a Zacks Rank #5 (Strong Sell) right now. Meta could, no doubt, make a comeback in the near and long term. But it is worth remembering the stock started lagging many of its big-tech peers such as Apple and Microsoft back in the early part of 2018.

Bear of the Day: Meta Platforms, Inc. (FB)

Meta Platforms , formerly known as Facebook, tumbled after its fourth quarter financial release in early February. Wall Street dumped the stock because Apple’s privacy policies are hurting the tech firm’s mobile advertising-based business far more than previously projected.

The Name Change Says A Lot?

Facebook and CEO Mark Zuckerberg announced in October that the social media company that owns Instagram and WhatsApp was changing its name to Meta. Wall Street and investors appeared somewhat intrigued and slightly nervous about the firm’s heavy investment in building out a massive immersive virtual reality experience and betting a large chunk of its future on the so-called metaverse.

Meta is pouring billions of dollars and tons of resources into the metaverse. The bet is that people will decide to live some of, or much of their lives in this new digital world via an avatar. That reality is still years off and it might not ever come to fruition, at least not how Zuckerberg and Meta hope.

In the here and now, Facebook, or Meta still makes nearly all of its money from traditional digital advertising, with a large chunk of that coming from mobile. Companies pay to put their ads in front of users across Facebook, Instagram, and WhatsApp, and for good reason.

Image Source: Zacks Investment Research

Digital adverting is still a hugely lucrative business for Meta and a necessity for many companies, given that Meta closed fiscal 2021 with 2.82 billion “daily active people” on its family of platforms, up 8% YoY. Meanwhile, its “monthly active people” climbed 9% to 3.59 billion. These staggering figures helped Meta post 37% revenue growth last year to hit $118 billion.

The YoY growth is a bit misleading since 2020 marked its slowest top-line growth (22%) as a public firm. Meta then shocked Wall Street when it said Apple’s iOS privacy policies that allow users to opt out of data tracking is likely to cost it more than $10 billion in lost sales in 2022. These policies have also hurt other social media firms such as Snap and they aren’t going away.

Zacks estimates call for Meta’s 2022 sales to climb just 12.3% and 17.4% in FY23, both of which would represent by far its lowest sales growth since its IPO—and likely ever. Meanwhile, its adjusted earnings are projected to slip 8.4% this year. And its FY22 Zacks consensus EPS is down 11% since its release, with FY23 over 7% lower.

Image Source: Zacks Investment Research

Bottom Line

Meta is still a stellar company when considering its overall revenue and earnings power, impressive balance sheet, and ability to reach nearly half of the global population. Nonetheless, Wall Street is based on what’s next and it faces growing competition from TikTok and others for people’s attention.

Some of the big money is clearly nervous about Meta’s slowing revenue growth and Apple’s privacy push. Others might be skeptical about the long-term viability of the metaverse, or some combination of it all. FB shares have fallen 26% in the last year and 40% in 2022.

Meta’s EPS revisions help it land a Zacks Rank #5 (Strong Sell) right now. Meta could, no doubt, make a comeback in the near and long term. But it is worth remembering the stock started lagging many of its big-tech peers such as Apple and Microsoft back in the early part of 2018.