It goes without saying that 2022 has been rough sailing in the market. Investors have had few hiding places and have witnessed deep valuation slashes left and right.

With inflation at levels not seen in decades, the Fed has been forced to become more aggressive, cranking borrowing rates. This monetary policy tightening, paired with geopolitical issues and supply chain bottlenecks, has created a challenging macroeconomic backdrop.

However, there have been a few bright spots in the market year-to-date, such as companies in the Zacks Consumer Staples Sector. Companies within this sector generate consistent and reliable revenues due to their products’ persistent demand – in the face of good and bad times.

The year-to-date chart below shows the sector’s performance while blending in the S&P 500 as a benchmark.

Image Source: Zacks Investment Research

As we can see, the sector has undoubtedly been a bright spot throughout 2022, providing investors with a much higher level of defense than other sectors.

One such company in the sector, Sanderson Farms , has been pushing all-time highs and sports the highly coveted Zacks Rank #1 (Strong Buy). In addition, the company has an overall VGM Score of an A.

The company resides in the Zacks Food – Meat Products Industry, which currently ranks in the top 13% of all industries. Studies have shown that roughly half of a stock's price movement can be attributed to a stock's industry group. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than two to one.

Let’s examine the company a little closer to see why it’d make a solid bet for investors looking to reap the rewards of a strong sector.

Overview

Sanderson Farms is a poultry processing company that produces, processes, markets, and distributes fresh and frozen chicken products.

Year-to-date, SAFM shares have been notably stronger than the S&P 500, increasing nearly 14% in value. The chart below illustrates the year-to-date performance of SAFM shares while blending in the S&P 500.

Image Source: Zacks Investment Research

Upon widening the timeframe to encompass a year’s worth of price action, we can see that SAFM shares have also outpaced the general market in this time frame.

Image Source: Zacks Investment Research

Growth Estimates & Quarterly Results

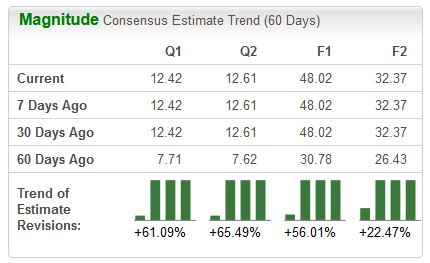

Analysts have been upping their earnings outlook substantially across all timeframes over the last 60 days, undoubtedly a bullish sign. The $12.42 per share estimate for the upcoming quarterly release reflects a substantial 70% growth in earnings from the year-ago quarter.

Additionally, the $48.02 per share estimate for FY22 represents a triple-digit 140% increase in earnings year-over-year.

Image Source: Zacks Investment Research

Sales estimates display top-line strength as well. For its upcoming quarterly release, the Zacks Consensus Sales Estimate resides at $1.7 billion – a 26% increase from year-ago quarterly sales of $1.3 billion.

Furthermore, current fiscal year sales are forecasted to reach $6.3 billion, a solid double-digit expansion of 30% within the top line year-over-year.

Sanderson Farms has beaten EPS Estimates by 60% on average over its last four quarters, and in its latest earnings release, the company crushed the quarterly EPS estimate by a triple-digit 111%.

Valuation & Dividends

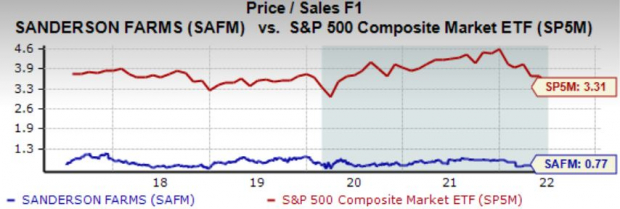

SAFM’s current forward price-to-sales ratio sits enticingly at 0.8X, well below its 1.2X high in 2017 and just a tick below its five-year median value of 0.9X. Additionally, the current value represents a staggering 73% discount relative to the S&P 500’s forward price-to-sales ratio of 3.3X.

Image Source: Zacks Investment Research

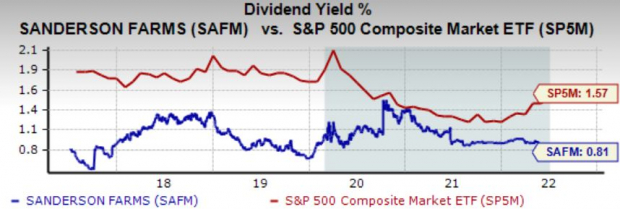

Sanderson Farms enjoys rewarding its shareholders via its 0.8% annual dividend yield with a payout ratio sitting more than sustainably at 5% of earnings. Over the last five years, the company has increased its dividend payout twice and has a five-year annualized dividend growth rate of a notable 10.9%.

Additionally, the yield is modestly lower than that of the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

SAFM shares have undoubtedly been a bright spot in an otherwise dim market. Companies within the Consumer Staples Sector are generally more defensive in nature and generate revenue in many sorts of economic environments.

Analysts have been pushing their earnings estimates substantially higher over the last 60 days, making the company appear even more enticing and helping push it into a Zacks Rank #1 (Strong Buy).

For investors seeking exposure to a rock-solid sector that provides a much higher level of defense, SAFM would be a great place to start.

This Consumer Staples Stock Has Been Hitting All-Time Highs

It goes without saying that 2022 has been rough sailing in the market. Investors have had few hiding places and have witnessed deep valuation slashes left and right.

With inflation at levels not seen in decades, the Fed has been forced to become more aggressive, cranking borrowing rates. This monetary policy tightening, paired with geopolitical issues and supply chain bottlenecks, has created a challenging macroeconomic backdrop.

However, there have been a few bright spots in the market year-to-date, such as companies in the Zacks Consumer Staples Sector. Companies within this sector generate consistent and reliable revenues due to their products’ persistent demand – in the face of good and bad times.

The year-to-date chart below shows the sector’s performance while blending in the S&P 500 as a benchmark.

Image Source: Zacks Investment Research

As we can see, the sector has undoubtedly been a bright spot throughout 2022, providing investors with a much higher level of defense than other sectors.

One such company in the sector, Sanderson Farms , has been pushing all-time highs and sports the highly coveted Zacks Rank #1 (Strong Buy). In addition, the company has an overall VGM Score of an A.

The company resides in the Zacks Food – Meat Products Industry, which currently ranks in the top 13% of all industries. Studies have shown that roughly half of a stock's price movement can be attributed to a stock's industry group. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than two to one.

Let’s examine the company a little closer to see why it’d make a solid bet for investors looking to reap the rewards of a strong sector.

Overview

Sanderson Farms is a poultry processing company that produces, processes, markets, and distributes fresh and frozen chicken products.

Year-to-date, SAFM shares have been notably stronger than the S&P 500, increasing nearly 14% in value. The chart below illustrates the year-to-date performance of SAFM shares while blending in the S&P 500.

Image Source: Zacks Investment Research

Upon widening the timeframe to encompass a year’s worth of price action, we can see that SAFM shares have also outpaced the general market in this time frame.

Image Source: Zacks Investment Research

Growth Estimates & Quarterly Results

Analysts have been upping their earnings outlook substantially across all timeframes over the last 60 days, undoubtedly a bullish sign. The $12.42 per share estimate for the upcoming quarterly release reflects a substantial 70% growth in earnings from the year-ago quarter.

Additionally, the $48.02 per share estimate for FY22 represents a triple-digit 140% increase in earnings year-over-year.

Image Source: Zacks Investment Research

Sales estimates display top-line strength as well. For its upcoming quarterly release, the Zacks Consensus Sales Estimate resides at $1.7 billion – a 26% increase from year-ago quarterly sales of $1.3 billion.

Furthermore, current fiscal year sales are forecasted to reach $6.3 billion, a solid double-digit expansion of 30% within the top line year-over-year.

Sanderson Farms has beaten EPS Estimates by 60% on average over its last four quarters, and in its latest earnings release, the company crushed the quarterly EPS estimate by a triple-digit 111%.

Valuation & Dividends

SAFM’s current forward price-to-sales ratio sits enticingly at 0.8X, well below its 1.2X high in 2017 and just a tick below its five-year median value of 0.9X. Additionally, the current value represents a staggering 73% discount relative to the S&P 500’s forward price-to-sales ratio of 3.3X.

Image Source: Zacks Investment Research

Sanderson Farms enjoys rewarding its shareholders via its 0.8% annual dividend yield with a payout ratio sitting more than sustainably at 5% of earnings. Over the last five years, the company has increased its dividend payout twice and has a five-year annualized dividend growth rate of a notable 10.9%.

Additionally, the yield is modestly lower than that of the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

SAFM shares have undoubtedly been a bright spot in an otherwise dim market. Companies within the Consumer Staples Sector are generally more defensive in nature and generate revenue in many sorts of economic environments.

Analysts have been pushing their earnings estimates substantially higher over the last 60 days, making the company appear even more enticing and helping push it into a Zacks Rank #1 (Strong Buy).

For investors seeking exposure to a rock-solid sector that provides a much higher level of defense, SAFM would be a great place to start.