This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here

Inventory (American English) or stock (British English) refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilization.

The concept of inventory, stock, or work in process (or work in progress) has been extended from manufacturing systems to service businesses and projects, by generalizing the definition to be "all work within the process of production — all work that is or has occurred prior to the completion of production.”

In the context of a manufacturing production system, inventory refers to all work that has occurred, including:

- Raw materials

- Partially finished products, and

- Finished products prior to sale and departure, from the manufacturing system

In the context of services, inventory refers to all work done prior to sale, including partially-processed information. (Wikipedia)

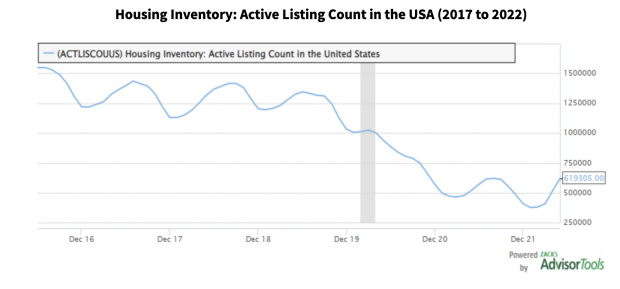

I. The Shortage of Houses

Image Source: Zacks Investment Research

According to Rocket Mortgage in “Why Is Housing Inventory So Low?”

A few key factors play a part in low inventory. The COVID-19 pandemic forced a lot of lifestyle changes and historically low interest rates had home buyers and sellers in a frenzy.

One of the largest contributing factors was record low mortgage rates.

A. Record Low Interest Rates

In the last year (2020), mortgage interest rates averaged 2.65% for a 30-year fixed-rate mortgage, which is lower than 2019’s average of 4.51%. Many existing homeowners took advantage of the dip in interest rates and refinanced their home with plans to stay put in their existing home.

As time progressed, some homeowners were given the choice to work remotely on a permanent basis. Many families chose to relocate to more affordable communities with more variety in housing options, land, space and proximity to family and friends. Small suburban communities saw an increase in population.

These “Zoom towns,” once considered commuter towns, are experiencing their own inventory shortages because of the influx of remote workers coming into the area with hefty down payments and the ability to pay over the asking price for homes.

B. Investors Purchasing Inventory

Average homeowners haven’t been the only ones buying homes throughout the past few years. Investors have also been taking advantage of the lower-than-average interest rates and have been buying up available inventory. This has increased competition for traditional home buyers by further reducing the number of homes on the market.

C. Fewer New Construction Homes

Another major factor contributing to low inventory is lack of new builds. New construction plays a vital role in the number of homes that are sold in a year. Builders have struggled with unstable building supply costs and a lack of skilled tradespeople to build new homes. Permits for new builds were behind by 24% in 2020 and have not yet recovered in 2022.

The lack of consistency in building supplies and skilled workers made it nearly impossible to make a profit on entry-level new home sales.

D. Some Sellers Aren’t Listing

Savvy sellers know that the lack of available inventory will affect them once they’re on the other side of the home buying process. Because of this, many homeowners who were planning on selling their homes have decided to hold off until the market stabilizes.

E. How Long Will the Housing Shortage Last?

We have seen housing inventory shortages before. A shortage occurs when there is only a 6-month housing supply. It typically takes 4 – 6 months to rebuild the real estate market supply.

However, it will take years before we know the damage done to the housing market caused by COVID-19.

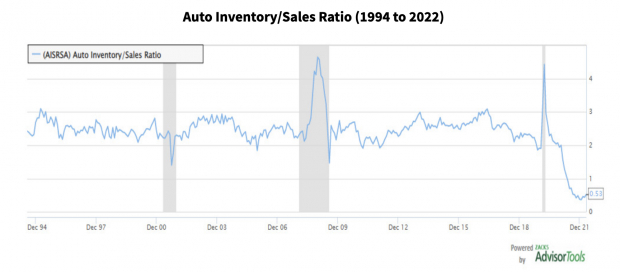

II. The Automotive Shortage

Image Source: Zacks Investment Research

According to Cars.com in “How Long Will the Vehicle Inventory Shortage Last?”

Written June 17th, 2021

Car shopping has been a rollercoaster ride since the COVID-19 pandemic hit the U.S. last spring, and customers shouldn’t unbuckle their seat belts quite yet.

First, automakers shuttered their factories as many states’ stay-at-home orders prompted dealership showrooms to shut down.

Demand plummeted and automakers quickly responded with incentives and financing offers to revive confidence.

The plan worked — only a little too well.

As dealers reopened, consumers snatched up vehicles faster than automakers could produce them.

Now, a global microchip shortage is causing major production delays, and vehicle inventory has sunk again.

How long will this situation last? And what should you do if you’re planning to buy a vehicle this year?

We interviewed three industry experts about the drivers of the shortage, its impact on auto brands and when we can expect to see inventory stabilize.

A. What’s Driving the Vehicle Shortage?

The current global microchip shortage may be the elephant in the room, but according to Tyson Jominy, J.D. Power’s vice president of data and analytics, the inventory struggles can be traced all the way back to May 2020, when increased demand and COVID-related supply challenges first created a shortage among pickup trucks.

“The incentives were kept on a little too high and a little too long,” Jominy said. “As we came into May, we were still running a lot of the 0%, 84-month offers, so the APR [annual percentage rate] support was very strong. It became apparent that we should have backed off. By the time we got to the end of May, pickup inventory was very much depleted.”

Before the industry was able to get back on its feet and replace diminishing inventory, a burgeoning microchip shortage layered on another supply shock. The chip shortage has disrupted production for every major auto brand, and a supply issue of this magnitude is uncharted territory. That’s according to Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions.

“There hasn’t been one component that has hampered this many companies and products,” Fiorani said. “It touches so many parts of the car, from power controllers to navigation, to power seats, everything like this has a semiconductor in it. It can stop everything. Any one of them can be a linchpin that brings everything down.”

Vehicle manufacturers aren’t only competing against each other for microchips, but also players in other industries, namely, consumer electronics.

Stephanie Brinley, principal automotive analyst at IHS Markit, explained: “Demand for semiconductors for nonautomotive uses increased dramatically,” Brinley said.

“In the third and fourth quarter of 2020, consumer demand for things like cellphones, laptops and video games skyrocketed as people worked and schooled from home. Demand for semiconductors grew far more rapidly than semiconductor manufacturers expected or could produce, creating a backlog of orders.”

III. The Retail Inventory Shortage

“A major theme coming out of 2020 was the idea of ‘just in case’ inventory, which is very much the antithesis of ‘just in time,’ which all operations management textbooks teach.

“I’m big on the idea of moving from an era marked by an emphasis on procurement for cost to an era marked by an emphasis on procurement for resilience.

“‘Black swan’ events are becoming normal occurrences due to macro-economic, political, and weather events.

“For a number of businesses, the impact of the Suez blockage was more devastating than COVID.”

—Matthew Hertz, co-Founder of Second Marathon

Image: Bigstock

The Inventory Crisis

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here

Inventory (American English) or stock (British English) refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilization.

The concept of inventory, stock, or work in process (or work in progress) has been extended from manufacturing systems to service businesses and projects, by generalizing the definition to be "all work within the process of production — all work that is or has occurred prior to the completion of production.”

In the context of a manufacturing production system, inventory refers to all work that has occurred, including:

In the context of services, inventory refers to all work done prior to sale, including partially-processed information. (Wikipedia)

I. The Shortage of Houses

Image Source: Zacks Investment Research

According to Rocket Mortgage in “Why Is Housing Inventory So Low?”

A few key factors play a part in low inventory. The COVID-19 pandemic forced a lot of lifestyle changes and historically low interest rates had home buyers and sellers in a frenzy.

One of the largest contributing factors was record low mortgage rates.

A. Record Low Interest Rates

In the last year (2020), mortgage interest rates averaged 2.65% for a 30-year fixed-rate mortgage, which is lower than 2019’s average of 4.51%. Many existing homeowners took advantage of the dip in interest rates and refinanced their home with plans to stay put in their existing home.

As time progressed, some homeowners were given the choice to work remotely on a permanent basis. Many families chose to relocate to more affordable communities with more variety in housing options, land, space and proximity to family and friends. Small suburban communities saw an increase in population.

These “Zoom towns,” once considered commuter towns, are experiencing their own inventory shortages because of the influx of remote workers coming into the area with hefty down payments and the ability to pay over the asking price for homes.

B. Investors Purchasing Inventory

Average homeowners haven’t been the only ones buying homes throughout the past few years. Investors have also been taking advantage of the lower-than-average interest rates and have been buying up available inventory. This has increased competition for traditional home buyers by further reducing the number of homes on the market.

C. Fewer New Construction Homes

Another major factor contributing to low inventory is lack of new builds. New construction plays a vital role in the number of homes that are sold in a year. Builders have struggled with unstable building supply costs and a lack of skilled tradespeople to build new homes. Permits for new builds were behind by 24% in 2020 and have not yet recovered in 2022.

The lack of consistency in building supplies and skilled workers made it nearly impossible to make a profit on entry-level new home sales.

D. Some Sellers Aren’t Listing

Savvy sellers know that the lack of available inventory will affect them once they’re on the other side of the home buying process. Because of this, many homeowners who were planning on selling their homes have decided to hold off until the market stabilizes.

E. How Long Will the Housing Shortage Last?

We have seen housing inventory shortages before. A shortage occurs when there is only a 6-month housing supply. It typically takes 4 – 6 months to rebuild the real estate market supply.

However, it will take years before we know the damage done to the housing market caused by COVID-19.

II. The Automotive Shortage

Image Source: Zacks Investment Research

According to Cars.com in “How Long Will the Vehicle Inventory Shortage Last?”

Written June 17th, 2021

Car shopping has been a rollercoaster ride since the COVID-19 pandemic hit the U.S. last spring, and customers shouldn’t unbuckle their seat belts quite yet.

First, automakers shuttered their factories as many states’ stay-at-home orders prompted dealership showrooms to shut down.

Demand plummeted and automakers quickly responded with incentives and financing offers to revive confidence.

The plan worked — only a little too well.

As dealers reopened, consumers snatched up vehicles faster than automakers could produce them.

Now, a global microchip shortage is causing major production delays, and vehicle inventory has sunk again.

How long will this situation last? And what should you do if you’re planning to buy a vehicle this year?

We interviewed three industry experts about the drivers of the shortage, its impact on auto brands and when we can expect to see inventory stabilize.

A. What’s Driving the Vehicle Shortage?

The current global microchip shortage may be the elephant in the room, but according to Tyson Jominy, J.D. Power’s vice president of data and analytics, the inventory struggles can be traced all the way back to May 2020, when increased demand and COVID-related supply challenges first created a shortage among pickup trucks.

“The incentives were kept on a little too high and a little too long,” Jominy said. “As we came into May, we were still running a lot of the 0%, 84-month offers, so the APR [annual percentage rate] support was very strong. It became apparent that we should have backed off. By the time we got to the end of May, pickup inventory was very much depleted.”

Before the industry was able to get back on its feet and replace diminishing inventory, a burgeoning microchip shortage layered on another supply shock. The chip shortage has disrupted production for every major auto brand, and a supply issue of this magnitude is uncharted territory. That’s according to Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions.

“There hasn’t been one component that has hampered this many companies and products,” Fiorani said. “It touches so many parts of the car, from power controllers to navigation, to power seats, everything like this has a semiconductor in it. It can stop everything. Any one of them can be a linchpin that brings everything down.”

Vehicle manufacturers aren’t only competing against each other for microchips, but also players in other industries, namely, consumer electronics.

Stephanie Brinley, principal automotive analyst at IHS Markit, explained: “Demand for semiconductors for nonautomotive uses increased dramatically,” Brinley said.

“In the third and fourth quarter of 2020, consumer demand for things like cellphones, laptops and video games skyrocketed as people worked and schooled from home. Demand for semiconductors grew far more rapidly than semiconductor manufacturers expected or could produce, creating a backlog of orders.”

III. The Retail Inventory Shortage

“A major theme coming out of 2020 was the idea of ‘just in case’ inventory, which is very much the antithesis of ‘just in time,’ which all operations management textbooks teach.

“I’m big on the idea of moving from an era marked by an emphasis on procurement for cost to an era marked by an emphasis on procurement for resilience.

“‘Black swan’ events are becoming normal occurrences due to macro-economic, political, and weather events.

“For a number of businesses, the impact of the Suez blockage was more devastating than COVID.”

—Matthew Hertz, co-Founder of Second Marathon