This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

This month, the choice of a special topic is an obvious one: the Regional Bank crisis.

No matter is getting more headlines, and creating more worry.

The major question posed is this one: Is the financial stress caused by this regional banking crisis so significant -- the U.S. economy staggers into a recession?

To answer that question, we must study the data that has been collected.

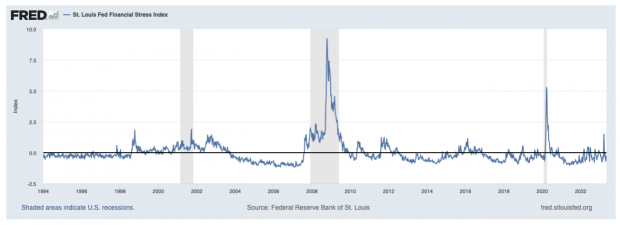

The Overall St. Louis Fed Financial Stress Index Shows -- a 1998 Financial Crisis Level -- in line with the March 2023 Regional Bank Crisis.

Identified as STLFSI4 (it’s the fourth version of this index), this FRED index measures the degree of financial stress actually seen in markets. It is constructed from 18 weekly data series: seven interest rate series, six bond yield spreads, and five other indicators.

I show you a 30-year timeline of this FRED stress index below…

Image Source: St Louis Fed

First off, if you look at the St. Louis Fed (FRED) Financial Stress Index, you can mark St. Patrick’s Day, Friday, March 17th, 2023 as the peak regional banking stress point.

The stress index hit 1.55 then:

- SVP and Signature Bank were gone.

- The First Republic Bank rescue was underway, led by the major banks with a $30B deposit.

- Credit Suisse was in turmoil. UBS would take over Credit Suisse the following weekend.

On Friday, Oct. 9th, 1998, the same stress index hit 1.86. That’s a very similar level.

Let’s look into the headlines then.

A financial crisis had started in Thailand in July 1997 and spread across East Asia, wreaking havoc on economies in that region and led to spillover effects in Latin America and Eastern Europe by late 1998.

Looking at the last 30 years, the financial stress index level was much greater during the 2008 Housing Crisis, and also greater during the first March 2020 COVID shutdowns.

On Friday, Oct. 10th, 2008, the stress index hit 9.24, a moment six times larger than most recent stress event, at 1.55:

- On that day, the Dow dropped -7.3%, the largest loss since the 1987 Crash

- President Bush planned to host an emergency meeting with finance leaders from the U.K., Italy, Germany, France, Canada and Japan

- GM and Ford were facing bankruptcy

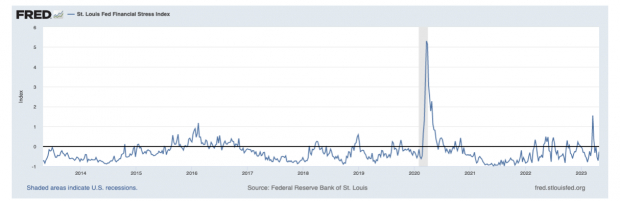

Image Source: St Louis Fed

On Friday, March 27th, 2020 the stress index hit 5.13. A moment 3.3 times larger than the March 2023 regional bank stress, at 1.55:

That 2020 moment held the first COVID shutdowns in the USA

Stay-at-home orders and the closure of non-essential retail businesses had been issued. 3.3 million filed unemployment claims, as the U.S. economy came apart

In sum, this regional banking crisis may feel like a big moment, a turning point.

But the actual measured level of U.S. financial market stress in March 2023 does not compare well, with the 2020 COVID shutdowns, or the 2008 housing collapse.

It looks more like the 1998 Asian financial crisis.

A blow, yes.

Still, it appears to be a second-order financial event, where broader economy-wide effects are contained by the swift actions of U.S. policymakers.

In 1998, the U.S. economy did not go into a recession from that Asian-centered crisis.

Keep that firmly in mind.

Image: Bigstock

Will the Regional Bank Crisis Cause a Recession?

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

This month, the choice of a special topic is an obvious one: the Regional Bank crisis.

No matter is getting more headlines, and creating more worry.

The major question posed is this one: Is the financial stress caused by this regional banking crisis so significant -- the U.S. economy staggers into a recession?

To answer that question, we must study the data that has been collected.

The Overall St. Louis Fed Financial Stress Index Shows -- a 1998 Financial Crisis Level -- in line with the March 2023 Regional Bank Crisis.

Identified as STLFSI4 (it’s the fourth version of this index), this FRED index measures the degree of financial stress actually seen in markets. It is constructed from 18 weekly data series: seven interest rate series, six bond yield spreads, and five other indicators.

I show you a 30-year timeline of this FRED stress index below…

Image Source: St Louis Fed

First off, if you look at the St. Louis Fed (FRED) Financial Stress Index, you can mark St. Patrick’s Day, Friday, March 17th, 2023 as the peak regional banking stress point.

The stress index hit 1.55 then:

On Friday, Oct. 9th, 1998, the same stress index hit 1.86. That’s a very similar level.

Let’s look into the headlines then.

A financial crisis had started in Thailand in July 1997 and spread across East Asia, wreaking havoc on economies in that region and led to spillover effects in Latin America and Eastern Europe by late 1998.

Looking at the last 30 years, the financial stress index level was much greater during the 2008 Housing Crisis, and also greater during the first March 2020 COVID shutdowns.

On Friday, Oct. 10th, 2008, the stress index hit 9.24, a moment six times larger than most recent stress event, at 1.55:

Image Source: St Louis Fed

On Friday, March 27th, 2020 the stress index hit 5.13. A moment 3.3 times larger than the March 2023 regional bank stress, at 1.55:

That 2020 moment held the first COVID shutdowns in the USA

Stay-at-home orders and the closure of non-essential retail businesses had been issued. 3.3 million filed unemployment claims, as the U.S. economy came apart

In sum, this regional banking crisis may feel like a big moment, a turning point.

But the actual measured level of U.S. financial market stress in March 2023 does not compare well, with the 2020 COVID shutdowns, or the 2008 housing collapse.

It looks more like the 1998 Asian financial crisis.

A blow, yes.

Still, it appears to be a second-order financial event, where broader economy-wide effects are contained by the swift actions of U.S. policymakers.

In 1998, the U.S. economy did not go into a recession from that Asian-centered crisis.

Keep that firmly in mind.