We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Higher for Longer: 3 Stocks to Benefit from Falling Rate Cut Expectations

Read MoreHide Full Article

At the start of 2024, traders were pricing in an incredibly dovish six rate cuts this year, but not anymore. After strong economic growth, robust labor, and hotter than forecasted inflation data rolled in, expectations have fallen to just four cuts now.

And this makes sense. If the economy and labor market is strong, and there is a risk of inflation reaccelerating, why would the Central Bank rush to cut interest rates?

Interestingly, Fed Chair Jerome Powell was quite clear during the December meeting, that he and the committee were anticipating three cuts in 2024, but market participants clearly got ahead of themselves. Now it seems traders’ expectations have cooled off and are now falling in line with policy makers.

In the table below we can see the odds of a rate cut at the March and May meeting are now below 50%. A month ago the odds of a rate cut in March were 77% and the odds of a second cut in May were 71%.

Image Source: CME Group

I think that these shifting projections leave the stock market vulnerable to at least a minor correction in the coming weeks. As the rates market prices in higher interest rates, it may very well send stocks lower.

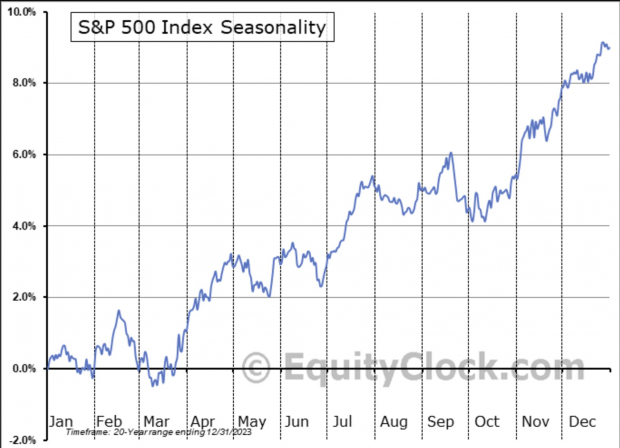

In the S&P 500 seasonality chart below, we can see that the second half of February can often bring with it some considerable volatility. Thus, I will share three top-ranked, defensive stocks that should outperform in the case of a market correction.

Image Source: Equity Clock

HCA Healthcare

HCA Healthcare(HCA - Free Report) is a leading for-profit operator of health care facilities in the US and UK, boasting 182 hospitals and over 2,300 sites of care. They offer a broad range of services, from basic urgent care to specialized hospital treatments. Known for their commitment to patient-centered care, they leverage their scale and skill to deliver superior healthcare.

I like adding to healthcare focused stocks during periods of uncertainty as they are well-known for being non-cyclical and defensive stocks.

HCA Healthcare enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting strongly trending earnings revisions. Analysts have near unanimously upgraded their estimates, with FY24 climbing by 4.6% in the last two months.

Image Source: Zacks Investment Research

HCA has also been forming a compelling bull flag over the last couple of weeks, which may well send the stock higher very soon. If the price can trade above the $309 level, it would signal a major breakout and likely send the stock to new highs.

Image Source: TradingView

The Progressive

The Progressive (PGR - Free Report) is a major auto insurance provider in the United States, ranking third largest amongst national carriers. They offer a variety of insurance types, including Personal auto insurance, Commercial auto insurance, and Specialty insurance.

In the chart below we can see why The Progressive has garnered a Zacks Rank #1 (Strong Buy) rating. In addition to a strong advance in the share price over the last two years, the earnings revision trend has curled higher since last fall.

Image Source: Zacks Investment Research

Furthermore, PGR is forecasting EPS growth of 21% annually over the next 3-5 years. And with a forward earnings multiple of 21.2x, PGR has a PEG ration of about 1x. This means that based on the PEG ratio metric, the company is fairly valued.

Image Source: Zacks Investment Research

Dell Technologies

Dell Technologies(DELL - Free Report) is a leading provider of servers, storage and PCs. It offers secure, integrated solutions that extend from the edge to the core to the cloud. Dell’s IT solutions support customers both in traditional infrastructure and multi-cloud environments.

Dell too boasts a Zacks Rank #1 (Strong Buy) rating, thanks to its upward trending earnings revisions. Earnings estimates have been climbing higher since the first half of 2023, and Dell Technologies has sat on the Zacks Rank for much of that time.

Like PGR, DELL also has an appealing PEG ration. With EPS growth forecasts of 12% annually over the next 3-5 years, and a forward earnings multiple of 13.9x, it has a PEG of 1.15x. Additionally, this is a reasonable valuation, ideally limiting the downside potential in the stock.

Image Source: Zacks Investment Research

Bottom Line

Of course, nobody knows exactly what the stock market is going to do over the next week, month or year, but I do believe the next few weeks have the potential to be a bit rocky. Because this is an educated guess, investors should focus on having a broadly diversified portfolio with defensive stocks like those shared here, as well as some more speculative stocks.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Higher for Longer: 3 Stocks to Benefit from Falling Rate Cut Expectations

At the start of 2024, traders were pricing in an incredibly dovish six rate cuts this year, but not anymore. After strong economic growth, robust labor, and hotter than forecasted inflation data rolled in, expectations have fallen to just four cuts now.

And this makes sense. If the economy and labor market is strong, and there is a risk of inflation reaccelerating, why would the Central Bank rush to cut interest rates?

Interestingly, Fed Chair Jerome Powell was quite clear during the December meeting, that he and the committee were anticipating three cuts in 2024, but market participants clearly got ahead of themselves. Now it seems traders’ expectations have cooled off and are now falling in line with policy makers.

In the table below we can see the odds of a rate cut at the March and May meeting are now below 50%. A month ago the odds of a rate cut in March were 77% and the odds of a second cut in May were 71%.

Image Source: CME Group

I think that these shifting projections leave the stock market vulnerable to at least a minor correction in the coming weeks. As the rates market prices in higher interest rates, it may very well send stocks lower.

In the S&P 500 seasonality chart below, we can see that the second half of February can often bring with it some considerable volatility. Thus, I will share three top-ranked, defensive stocks that should outperform in the case of a market correction.

Image Source: Equity Clock

HCA Healthcare

HCA Healthcare (HCA - Free Report) is a leading for-profit operator of health care facilities in the US and UK, boasting 182 hospitals and over 2,300 sites of care. They offer a broad range of services, from basic urgent care to specialized hospital treatments. Known for their commitment to patient-centered care, they leverage their scale and skill to deliver superior healthcare.

I like adding to healthcare focused stocks during periods of uncertainty as they are well-known for being non-cyclical and defensive stocks.

HCA Healthcare enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting strongly trending earnings revisions. Analysts have near unanimously upgraded their estimates, with FY24 climbing by 4.6% in the last two months.

Image Source: Zacks Investment Research

HCA has also been forming a compelling bull flag over the last couple of weeks, which may well send the stock higher very soon. If the price can trade above the $309 level, it would signal a major breakout and likely send the stock to new highs.

Image Source: TradingView

The Progressive

The Progressive (PGR - Free Report) is a major auto insurance provider in the United States, ranking third largest amongst national carriers. They offer a variety of insurance types, including Personal auto insurance, Commercial auto insurance, and Specialty insurance.

In the chart below we can see why The Progressive has garnered a Zacks Rank #1 (Strong Buy) rating. In addition to a strong advance in the share price over the last two years, the earnings revision trend has curled higher since last fall.

Image Source: Zacks Investment Research

Furthermore, PGR is forecasting EPS growth of 21% annually over the next 3-5 years. And with a forward earnings multiple of 21.2x, PGR has a PEG ration of about 1x. This means that based on the PEG ratio metric, the company is fairly valued.

Image Source: Zacks Investment Research

Dell Technologies

Dell Technologies (DELL - Free Report) is a leading provider of servers, storage and PCs. It offers secure, integrated solutions that extend from the edge to the core to the cloud. Dell’s IT solutions support customers both in traditional infrastructure and multi-cloud environments.

Dell too boasts a Zacks Rank #1 (Strong Buy) rating, thanks to its upward trending earnings revisions. Earnings estimates have been climbing higher since the first half of 2023, and Dell Technologies has sat on the Zacks Rank for much of that time.

Like PGR, DELL also has an appealing PEG ration. With EPS growth forecasts of 12% annually over the next 3-5 years, and a forward earnings multiple of 13.9x, it has a PEG of 1.15x. Additionally, this is a reasonable valuation, ideally limiting the downside potential in the stock.

Image Source: Zacks Investment Research

Bottom Line

Of course, nobody knows exactly what the stock market is going to do over the next week, month or year, but I do believe the next few weeks have the potential to be a bit rocky. Because this is an educated guess, investors should focus on having a broadly diversified portfolio with defensive stocks like those shared here, as well as some more speculative stocks.