Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- Total Q4 earnings for the 369 S&P 500 members that have reported results are up +5.8% from the same period last year on +3.6% higher revenues, with 79.1% beating EPS estimates and 64.8% beating revenue estimates.

- The Tech sector is solely responsible for keeping the Q4 earnings growth pace in the positive territory. Had it not been for the Tech sector's strong growth, the +5.8% earnings growth for the companies that have reported already drops to a decline of -0.1%.

- The Tech and Energy sectors are having the opposite effects on the Q4 earnings growth pace, with the Energy sector pulling it down and the Tech sector giving it a boost.

In this space, we have discussed the impressive earnings performance of the Magnificent 7 companies in the ongoing Q4 earnings season and how these strong growth numbers validate these companies’ market leadership.

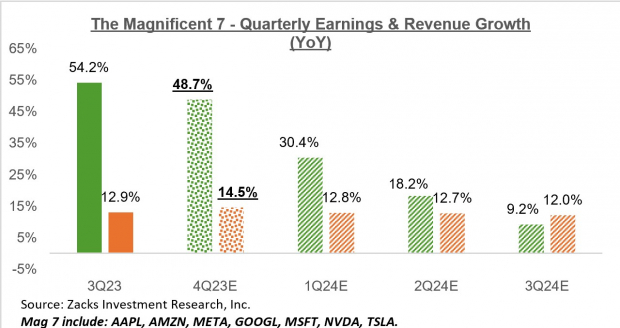

Using estimates for Nvidia, which reports quarterly results on February 21st, with actual results for the other 6 members of the group, total Mag 7 earnings for Q4 are on track to increase +48.7% from the same period last year on +14.5% higher revenues, which would follow the group’s +54.2% higher earnings on +12.9% higher revenues in 2023 Q3.

You can see the group’s earnings and revenue growth picture in the chart below.

Image Source: Zacks Investment Research

As you can see in the chart above, the group is currently expected to achieve +30.4% more earnings in 2024 Q1 on +12.8% higher revenues, with earnings growth in 2024 Q2 expected to be up +18.2%.

The Mag 7 companies combined are on track to account for 22.8% of all S&P 500 earnings in Q4; they account for 29.5% of the index’s total market capitalization. Had these 7 stocks been a sector, they would have the second biggest weight in the S&P 500 index, behind the Tech sector, which currently accounts for 37.5%. The Finance sector, which at one time was the biggest sector in the index, currently accounts for 12%.

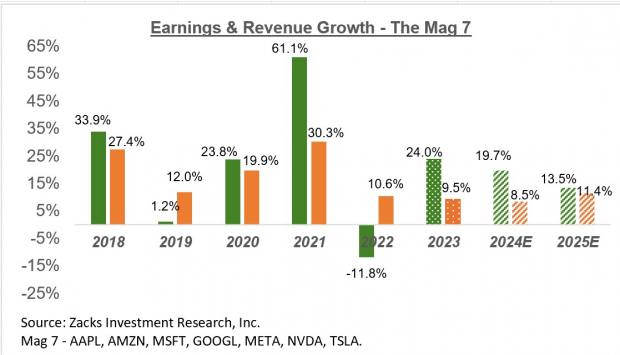

The chart below shows the group’s growth picture on an annual basis.

Image Source: Zacks Investment Research

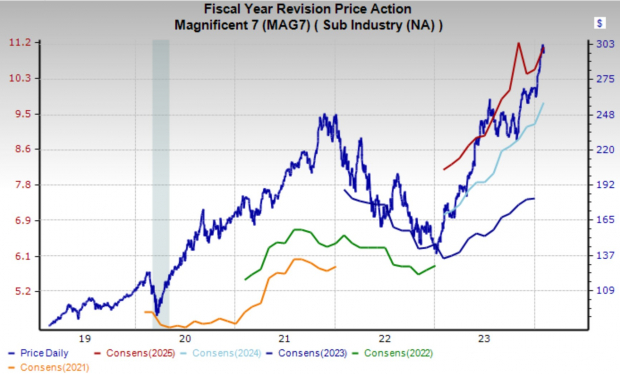

Importantly, the Mag 7 earnings outlook is steadily improving, as the revisions chart below shows.

Image Source: Zacks Investment Research

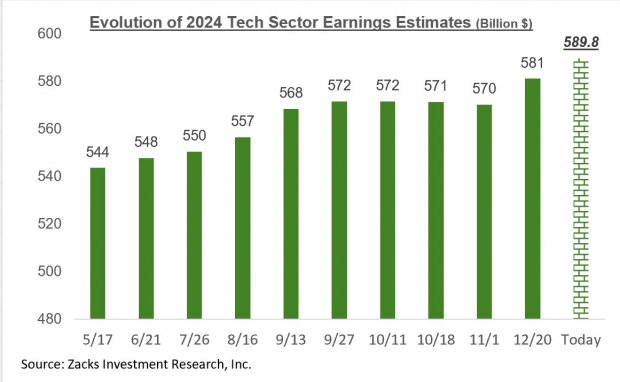

The revisions trend for the broader Tech sector also remains positive, even though the aggregate revisions trend is modestly negative. The chart below shows how the aggregate 2024 earnings estimate for the Zacks Tech sector has evolved.

Image Source: Zacks Investment Research

Beyond Mag 7, Q4 earnings for the S&P 500 index are currently expected to be up +5.5% above the year-earlier period on +3.2% higher revenues. This would follow the +3.8% increase in index earnings in 2023 Q3 on +2.3% higher revenues. The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

Given the expected moderation in the U.S. economy’s growth trajectory due to the cumulative effects of Fed tightening, these estimates likely need to come down. But the +4.7% revenue growth expectation is hardly aggressive, considering that the U.S. economy produced a nominal GDP growth rate in excess of +6% last year.

The rest of the 2024 earnings growth is coming from margin expansion, with 2024 net margins for the index going up to +12.4% from last year’s 11.7%. Embedded in this margin expectation is the view that the inflation cycle has run its course, with easing cost pressures letting net margins return to the 2022 level.

We don’t see this margin (or revenue) outlook as unreasonable or out-of-sync with the economic ground reality.

Image: Bigstock

Q4 Results Paint a Positive Earnings Picture

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

In this space, we have discussed the impressive earnings performance of the Magnificent 7 companies in the ongoing Q4 earnings season and how these strong growth numbers validate these companies’ market leadership.

Using estimates for Nvidia, which reports quarterly results on February 21st, with actual results for the other 6 members of the group, total Mag 7 earnings for Q4 are on track to increase +48.7% from the same period last year on +14.5% higher revenues, which would follow the group’s +54.2% higher earnings on +12.9% higher revenues in 2023 Q3.

You can see the group’s earnings and revenue growth picture in the chart below.

Image Source: Zacks Investment Research

As you can see in the chart above, the group is currently expected to achieve +30.4% more earnings in 2024 Q1 on +12.8% higher revenues, with earnings growth in 2024 Q2 expected to be up +18.2%.

The Mag 7 companies combined are on track to account for 22.8% of all S&P 500 earnings in Q4; they account for 29.5% of the index’s total market capitalization. Had these 7 stocks been a sector, they would have the second biggest weight in the S&P 500 index, behind the Tech sector, which currently accounts for 37.5%. The Finance sector, which at one time was the biggest sector in the index, currently accounts for 12%.

The chart below shows the group’s growth picture on an annual basis.

Image Source: Zacks Investment Research

Importantly, the Mag 7 earnings outlook is steadily improving, as the revisions chart below shows.

Image Source: Zacks Investment Research

The revisions trend for the broader Tech sector also remains positive, even though the aggregate revisions trend is modestly negative. The chart below shows how the aggregate 2024 earnings estimate for the Zacks Tech sector has evolved.

Image Source: Zacks Investment Research

Beyond Mag 7, Q4 earnings for the S&P 500 index are currently expected to be up +5.5% above the year-earlier period on +3.2% higher revenues. This would follow the +3.8% increase in index earnings in 2023 Q3 on +2.3% higher revenues. The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

Given the expected moderation in the U.S. economy’s growth trajectory due to the cumulative effects of Fed tightening, these estimates likely need to come down. But the +4.7% revenue growth expectation is hardly aggressive, considering that the U.S. economy produced a nominal GDP growth rate in excess of +6% last year.

The rest of the 2024 earnings growth is coming from margin expansion, with 2024 net margins for the index going up to +12.4% from last year’s 11.7%. Embedded in this margin expectation is the view that the inflation cycle has run its course, with easing cost pressures letting net margins return to the 2022 level.

We don’t see this margin (or revenue) outlook as unreasonable or out-of-sync with the economic ground reality.