We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

3D Systems(DDD - Free Report) is a leading provider of 3D printing solutions, offering a range of products and services for the manufacturing, healthcare, aerospace, automotive, and consumer goods industries. The company specializes in additive manufacturing technologies, including 3D printers, materials, software, and on-demand manufacturing services.

Several years ago, the hopes of 3-D printing and its numerous applications were very high, and the industry saw a huge boom. Stocks in the sector experienced massive price appreciation with 3D Systems leading the way.

However, the big promises of the industry never materialized, the stocks became grossly overvalued, and the hype has since fizzled. 3D systems stock has fallen -91% over the last four years, and business fundamentals continue to deteriorate.

Additionally, the stock currently has declining earnings estimates and a Zacks Rank #5 (Strong Sell) rating. Based on the murky outlook for 3D Systems, I believe it should be avoided.

Image Source: TradingView

Poor Business Fundamentals

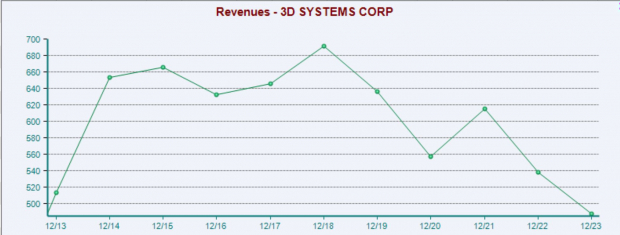

Following a brief pickup in sales at 3D Systems about a decade ago, sales have fallen significantly. After peaking around $700 million annually, they have declined to less than $500 million in the trailing 12 months.

Image Source: Zacks Investment Research

Profits at the technology company have suffered as well. After showing positive earnings for a few years, they flipped negative in 2017 and have not recovered.

Image Source: Zacks Investment Research

Earnings Revision Trend

Analysts are not expecting much from DDD in the coming quarters and years either. Over the last two months earnings estimates have been lowered across timeframes. Based on the consistently falling earnings revision trend, 3D Systems has a Zacks Rank #5 (Strong Sell) rating.

Image Source: Zacks Investment Research

Bottom Line

Things do not look good for 3D Systems. Falling sales and earnings is not what you see in winning stocks.

It is worth noting that DDD’s balance sheet is not bad, and they are still a leader in the 3d printing industry. If we were to see a resurgence in printing applications and sales and earnings pick up, DDD could be worth revisiting.

But, until the earnings revisions trend picks up, 3D Systems stock is best to be avoided for now.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Bear of the Day: 3D Systems (DDD)

3D Systems (DDD - Free Report) is a leading provider of 3D printing solutions, offering a range of products and services for the manufacturing, healthcare, aerospace, automotive, and consumer goods industries. The company specializes in additive manufacturing technologies, including 3D printers, materials, software, and on-demand manufacturing services.

Several years ago, the hopes of 3-D printing and its numerous applications were very high, and the industry saw a huge boom. Stocks in the sector experienced massive price appreciation with 3D Systems leading the way.

However, the big promises of the industry never materialized, the stocks became grossly overvalued, and the hype has since fizzled. 3D systems stock has fallen -91% over the last four years, and business fundamentals continue to deteriorate.

Additionally, the stock currently has declining earnings estimates and a Zacks Rank #5 (Strong Sell) rating. Based on the murky outlook for 3D Systems, I believe it should be avoided.

Image Source: TradingView

Poor Business Fundamentals

Following a brief pickup in sales at 3D Systems about a decade ago, sales have fallen significantly. After peaking around $700 million annually, they have declined to less than $500 million in the trailing 12 months.

Image Source: Zacks Investment Research

Profits at the technology company have suffered as well. After showing positive earnings for a few years, they flipped negative in 2017 and have not recovered.

Image Source: Zacks Investment Research

Earnings Revision Trend

Analysts are not expecting much from DDD in the coming quarters and years either. Over the last two months earnings estimates have been lowered across timeframes. Based on the consistently falling earnings revision trend, 3D Systems has a Zacks Rank #5 (Strong Sell) rating.

Image Source: Zacks Investment Research

Bottom Line

Things do not look good for 3D Systems. Falling sales and earnings is not what you see in winning stocks.

It is worth noting that DDD’s balance sheet is not bad, and they are still a leader in the 3d printing industry. If we were to see a resurgence in printing applications and sales and earnings pick up, DDD could be worth revisiting.

But, until the earnings revisions trend picks up, 3D Systems stock is best to be avoided for now.