Even a 1% Change in Mortgage Rates Could Save You Thousands

Image: Bigstock

Interest rates. They're one of those things that seem small on paper but pack a huge punch when it comes to your mortgage payments. You've probably seen mortgage rates fluctuate over the years — from all-time lows of 2.65% in 2021 to highs near 8% in the past year. And while the difference between, say, 4% and 7% might not seem like much at first glance, trust me — it matters. A lot.

In fact, even a 1% change in your mortgage rate can translate into tens of thousands of dollars in interest over the life of your loan. And with the Federal Reserve's latest 0.5% interest rate cut, it's more important than ever to understand how those changes affect your wallet.

Whether you're a first-time buyer or looking to refinance, the bottom line is this: Mortgage rates matter, and even small shifts can have a big impact on what you end up paying.

Breaking Down the Impact of Interest Rates on Monthly Payments

Following the Fed's big rate cut, the average 30-year mortgage rate is close to hitting 6% — a two-year low. Just a few months back, it was above 7%.

Maybe you're reading this and thinking, so what? It's barely a single point — how much difference could it make?

Well, brace yourself, because that small difference adds up fast when you're talking about a 30-year mortgage.

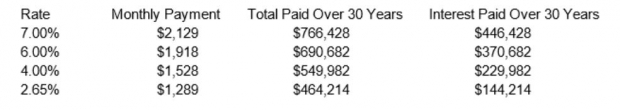

I've pulled the payment data for a few different mortgage rates to show how even a small change can affect your interest payments. All of the numbers in the chart are for a 30-year mortgage on a $400,000 house with 20% down (not including taxes or other costs).

Image Source: Zacks Investment Research

Because these numbers are all for the same hypothetical $400,000 mortgage (and I've taken out taxes and home insurance costs), the difference in costs are 100% due to how much you're paying in interest.

At first glance, the difference in the monthly payment isn't too alarming. You're only paying $211 extra each month for a mortgage rate of 7% compared to 6%. Over the course of the year, that comes out to about $2,500. That's not nothing!

But the real kicker is how much more you'll fork over in interest by the time you've paid off the loan. With the 7% rate, you'd pay about $446,428 in interest over 30 years. At 6%, you're looking at $370,682 in interest. That's nearly $76,000 you could save — just because of one less percentage point on your mortgage rate!

Fun fact: The interest amount at 7% is nearly as much as the entire loan amount for the same mortgage at the 2.65% rate homebuyers were able to snag just three years ago.

See what a difference a single percentage point — let alone a few points — can make over the life of your mortgage?

It's the kind of difference that makes you rethink whether that new house is actually affordable, or if it's going to saddle you with a financial burden for decades.

If today's rates feel painfully high, it's because we've been spoiled by low rates for the better part of the past decade. From 2010 to 2020, mortgage rates averaged around 4%. So when rates shot up to nearly 8% in 2023, it felt like hitting a financial wall. Even as rates have started to come back down, when you compare them to the all-time low of 2.65% in 2021, it's easy to see why buyers have felt squeezed.

Of course, rates have been much higher in the past. In the 1980s, mortgage rates peaked at an eye-watering 18% (although home prices were also significantly lower). So, while today's rates may feel steep compared to the past few years, they're nowhere near the historical highs.

But that doesn't mean they don't hurt.

When you're looking at potentially paying hundreds of thousands of dollars more in interest, it's clear that even a few percentage points can make or break your budget.

The Federal Reserve's Role in Interest Rates

Now that we've broken down how small changes in mortgage rates can have a huge impact on your payments, let's talk about where those rates actually come from.

Spoiler: It's not your bank pulling random numbers out of thin air.

It all starts with the Federal Reserve (or the Fed, as all the cool people call it).

The Federal Reserve doesn't set mortgage rates directly, but it does set something called the federal funds rate — which is the rate banks charge each other to borrow money overnight.

Think of it like the base of a pyramid. When the Fed changes the federal funds rate, it influences everything above it, including mortgage rates. A higher federal funds rate means higher borrowing costs for banks, and those costs get passed down to consumers in the form of higher mortgage rates (and vice versa when rates are cut).

So, why does the Fed mess with rates in the first place? It's all about managing the economy. When inflation is too high (like we've seen recently), the Fed raises rates to cool things down. Higher rates make borrowing more expensive, which slows down spending and eases inflation. On the flip side, when the economy needs a boost, the Fed cuts rates to encourage spending by making loans cheaper.

How Long Until You Feel the Rate Cut's Effects?

But let's get back to the good stuff — how and when this rate cut will affect you.

Normally, we'd expect to see a little bit of a lag between when the Fed cuts rates and when you see mortgage rates adjust. Typically, it can take a few weeks for the full impact to show up in the rates banks offer to borrowers.

However, the Fed did such a good job telegraphing their economic expectations for a rate cut that everyone and their dog was expecting the drop; the only real question going into the meeting was whether the cut would be 0.25% or 0.5%.

Because the rate cut was such a sure thing, mortgage rates actually started falling weeks ago, ahead of the announcement, and experts are now expecting them to come down even more.

What Does This Mean for You

Look, buying a house is a huge undertaking, and locking in a low mortgage can save you hundreds of thousands of dollars over the length of your loan.

But it's not necessarily the ultimate goal of home buying.

For some people, the need to buy a house now (or soon) outweighs the need to score the lowest possible mortgage rate. Others may be looking at a very specific house or neighborhood that fits their needs and wants, and they don't want to risk losing out on a house because they were waiting for a better interest rate.

However, if you're a homebuyer hoping to lock in the lowest possible mortgage rate — or a current homeowner thinking about refinancing — the key is patience and timing.

By timing your mortgage lock with falling rates, you can potentially save yourself thousands in interest payments. That's why it's smart to keep your ear to the ground, watch how the market reacts, and, if possible, consult a mortgage broker to help you lock in the best rate.

My biggest recommendation? Don't just think about these numbers in theory, get practical! There are plenty of easy-to-use tools that can help you see exactly how different mortgage rates will affect your payments — and even help you plan your next move.

Mortgage calculators are a simple way to play with the numbers and see how various interest rates can impact your monthly payment. Most calculators let you input different loan amounts, down payments, and interest rates, so you can quickly compare scenarios. It can actually be a lot of fun finding out exactly how far your money can go.

Want to know how much a 1% rate reduction would save you each month? Plug in the numbers and see for yourself!

Many calculators also break down how much of your payment goes toward principal and how much goes toward interest, which gives you a clearer picture of where your money is going.

Some popular mortgage calculators include:

Bankrate Mortgage Calculator:A straightforward, user-friendly tool that lets you adjust everything from interest rates to loan terms.

NerdWallet Mortgage Calculator:Similar to Bankrate's, but with added features like an affordability calculator to help you figure out how much house you can realistically afford.

Zillow Mortgage Calculator: A great option if you want to see real-time mortgage rates and get an idea of what your payments might look like in your specific area.

In addition to using a calculator, it's worth keeping tabs on mortgage rate trends. Websites like Freddie Mac and National Mortgage News provide regular updates on where rates are heading, so you can stay informed. Knowing whether rates are trending up or down can help you decide when it's the right time to lock in a rate or move forward with a purchase.

Stay Informed and Plan Ahead

Interest rates may seem like just another number, but they hold the power to shape a major factor of your financial future — especially when it comes to buying a home. By using tools like mortgage calculators and tracking rate trends, you can make smarter decisions about when to buy, refinance, or simply plan ahead.

The bottom line? Don't let even a small rate change catch you off guard. Whether you're buying, refinancing, or just curious about the market, understanding how these rates work — and how to take advantage of them — can put you in a much better position financially.

So, stay informed, play around with those mortgage calculators, and keep an eye on what the Federal Reserve is up to. It might just save you a whole lot of money in the long run.