We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

2 Internet Stocks to Buy for Breakout Sales Growth: DASH, SE

Read MoreHide Full Article

Sales growth can be a premier indicator of a company's future success which has catapulted DoorDash (DASH - Free Report) and Sea Limited’s (SE - Free Report) stock over the last year.

These internet-centric stocks have landed spots on the Zacks Rank #1 (Strong Buy) list and are starting to embark on their lucrative earnings potential.

Image Source: Zacks Investment Research

DoorDash Expansion

DoorDash’s expansion has been paramount with its online marketplace helping merchants interact with customers and fulfill orders through delivery personnel called “dashers”. Notably, DoorDash’s Zacks Internet-Services Industry is currently in the top 15% of nearly 250 Zacks industries.

Boosting DoorDash’s growth has been the acquisition of Finnish food delivery company Wolt in 2021. Acquiring Wolt has expanded DoorDash’s presence into over 20 European markets with its reach now extending far outside of the United States to Australia, Canada, Japan, and New Zealand as well.

As a beneficiary of its strong business industry, DoorDash’s total sales are now expected to increase 23% in fiscal 2024 and are projected to expand another 19% in FY25 to $12.72 billion. More impressive, FY25 sales projections would represent a 340% increase from sales of $2.89 billion in 2020 when DoorDash went public.

Image Source: Zacks Investment Research

Sea Limited Expansion

Similarly, Sea Limited is benefiting from a strong business environment as a consumer internet company that provides e-commerce services, digital entertainment, and digital financial services. Based in Singapore, Sea Limited’s reach extends to Indonesia, Taiwan, Vietnam, Thailand, Malaysia, and the Philippines.

Furthermore, Sea Limited’s Zacks Internet-Software Industry is in the top 10% of all Zacks industries. Correlating with such, Sea Limited’s top line is projected to expand 28% in FY24 and is forecasted to increase another 17% in FY25 to $19.62 billion. Astonishingly, FY25 sales projections would reflect an 800% increase from sales of $2.17 billion in 2020.

Image Source: Zacks Investment Research

Positive EPS Revisions

Taking advantage of their top line growth, DoorDash and Sea Limited have increased their profitability.

In this regard, DoorDash’s annual earnings are slated to come in at $0.26 a share in FY24 compared to an adjusted EPS loss of -$1.42 in 2023. Plus, FY25 EPS is projected to soar another 646% to $1.94. Reassuringly, FY24 and FY25 EPS estimates have continued to trend higher over the last quarter.

Image Source: Zacks Investment Research

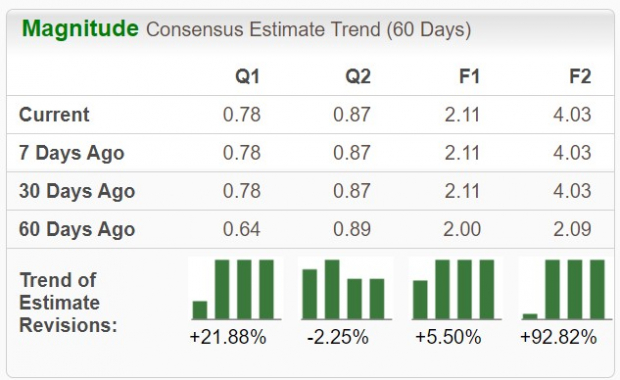

As for Sea Limited, 55% EPS growth is expected in FY24 with annual earnings projected to climb another 91% in FY25 to $4.03 per share. More intriguing, FY24 EPS estimates are up 5% over the last 60 days with FY25 EPS estimates soaring an eye-popping 93%.

Image Source: Zacks Investment Research

Bottom Line

The rally in DoorDash and Sea Limited stock could certainly continue based on their compelling growth trajectories. As two of this decade's fastest-growing companies, both should be viable investments for 2025 and beyond.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

2 Internet Stocks to Buy for Breakout Sales Growth: DASH, SE

Sales growth can be a premier indicator of a company's future success which has catapulted DoorDash (DASH - Free Report) and Sea Limited’s (SE - Free Report) stock over the last year.

These internet-centric stocks have landed spots on the Zacks Rank #1 (Strong Buy) list and are starting to embark on their lucrative earnings potential.

Image Source: Zacks Investment Research

DoorDash Expansion

DoorDash’s expansion has been paramount with its online marketplace helping merchants interact with customers and fulfill orders through delivery personnel called “dashers”. Notably, DoorDash’s Zacks Internet-Services Industry is currently in the top 15% of nearly 250 Zacks industries.

Boosting DoorDash’s growth has been the acquisition of Finnish food delivery company Wolt in 2021. Acquiring Wolt has expanded DoorDash’s presence into over 20 European markets with its reach now extending far outside of the United States to Australia, Canada, Japan, and New Zealand as well.

As a beneficiary of its strong business industry, DoorDash’s total sales are now expected to increase 23% in fiscal 2024 and are projected to expand another 19% in FY25 to $12.72 billion. More impressive, FY25 sales projections would represent a 340% increase from sales of $2.89 billion in 2020 when DoorDash went public.

Image Source: Zacks Investment Research

Sea Limited Expansion

Similarly, Sea Limited is benefiting from a strong business environment as a consumer internet company that provides e-commerce services, digital entertainment, and digital financial services. Based in Singapore, Sea Limited’s reach extends to Indonesia, Taiwan, Vietnam, Thailand, Malaysia, and the Philippines.

Furthermore, Sea Limited’s Zacks Internet-Software Industry is in the top 10% of all Zacks industries. Correlating with such, Sea Limited’s top line is projected to expand 28% in FY24 and is forecasted to increase another 17% in FY25 to $19.62 billion. Astonishingly, FY25 sales projections would reflect an 800% increase from sales of $2.17 billion in 2020.

Image Source: Zacks Investment Research

Positive EPS Revisions

Taking advantage of their top line growth, DoorDash and Sea Limited have increased their profitability.

In this regard, DoorDash’s annual earnings are slated to come in at $0.26 a share in FY24 compared to an adjusted EPS loss of -$1.42 in 2023. Plus, FY25 EPS is projected to soar another 646% to $1.94. Reassuringly, FY24 and FY25 EPS estimates have continued to trend higher over the last quarter.

Image Source: Zacks Investment Research

As for Sea Limited, 55% EPS growth is expected in FY24 with annual earnings projected to climb another 91% in FY25 to $4.03 per share. More intriguing, FY24 EPS estimates are up 5% over the last 60 days with FY25 EPS estimates soaring an eye-popping 93%.

Image Source: Zacks Investment Research

Bottom Line

The rally in DoorDash and Sea Limited stock could certainly continue based on their compelling growth trajectories. As two of this decade's fastest-growing companies, both should be viable investments for 2025 and beyond.