We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Caterpillar (CAT) Q4 Earnings & Sales Beat Estimates, Up Y/Y

Read MoreHide Full Article

Caterpillar Inc. (CAT - Free Report) reported fourth-quarter 2021 adjusted earnings per share of $2.69, which surpassed the Zacks Consensus Estimate of $2.22 by a margin of 21%. The bottom line improved 27% from the prior-year quarter. All of its segments witnessed strong end-market demand, which helped counter inflated input costs. A lower-than-expected effective tax rate contributed to the improvement in earnings.

Including one-time items, Caterpillar’s earnings per share was $3.91, reflecting a whopping improvement of 175% from the prior-year quarter figure of $1.42.

Revenues Up on High Demand in All Markets

The company’s fourth-quarter revenues of $13.8 billion beat the Zacks Consensus Estimate of $13.3 billion. The top line improved 23% from the year-ago quarter. This upbeat performance was driven by increasing sales volume, courtesy of higher end-user demand for equipment and services, favorable price realization, and the impact of change in dealer inventories. Sales increased across all of its three segments.

Caterpillar Inc. Price, Consensus and EPS Surprise

In the quarter under review, cost of sales increased 28.5% year over year to $10 billion. Manufacturing costs were higher in the quarter due to inflated material costs and freight costs. Gross profit improved 10% year over year to $3.8 billion, primarily on the back of improved sales, which negated the impact of higher costs. Gross margin was 27.5% in the quarter under review compared with 30.7% in the prior-year quarter.

Selling, general and administrative (SG&A) expenses increased 17% year over year to around $1,422 million. Research and development (R&D) expenses climbed 17% to $439 million. Both SG&A and R&D expenses in the quarter were up year over year due to higher short-term incentive compensation expenses, higher labor costs due to increased headcount and investments associated with the company's strategy for profitable growth, including acquisition-related expenses.

Adjusted operating profit in the quarter increased 10% year over year to $1,577 million. Increased volumes and favorable price realization were instrumental in driving the improved performance. These gains were partially negated by higher SG&A and R&D expenses, and inflated manufacturing costs. Adjusted operating margin was 11.4% in the reported quarter down from 12.8% in the prior-year quarter.

Segment Performances Backed by High Demand

Machinery and Energy & Transportation (ME&T) sales rose 24% year over year to $13 billion in the quarter under review. Construction Industries sales were up 27% year over year to $5.7 billion owing to increased sales volumes reflecting improving end-user demand, the impact from changes in dealer inventories and favorable price realization. Sales growth in other regions helped offset the 12% lower sales in the Asia Pacific, which was primarily dragged down by China.

Sales at Resource Industries surged 27% year over year to around $2.8 billion on higher sales volume backed by higher end-user demand for equipment and aftermarket parts, and favorable price realization. The segment witnessed increased demand in mining, heavy construction and quarry and aggregates.

Sales of the Energy & Transportation segment in the quarter were around $5.7 billion, reflecting growth of 19% from the prior-year quarter as sales were up in all applications.

The ME&T segment reported an operating profit of $1,475 million, which reflected an improvement of 13% year over year. The Construction Industries segment witnessed a 25% growth in operating profit to $788 million, courtesy of higher volume and favorable price realization that offset higher manufacturing costs, and SG&A and R&D expenses.

The Resource Industries segment’s operating profit improved 12% year over year to $305 million in the quarter under review as higher sales volume and favorable price realization partially offset inflated manufacturing costs and SG&A/R&D expenses. The Energy & Transportation segment’s operating profit declined 2% year over year to $675 million as increasing manufacturing and SG&A/R&D expenses negated the gains from higher sales volumes.

Financial Products’ revenues climbed 4% to $776 million from the prior-year quarter. Financial Products' profits were $248 million in the reported quarter — an improvement of 27% year over year.

Strong Cash Position

In 2021, the company’s operating cash flow was $7.2 billion compared with $6.3 billion in the prior year. The company returned $5 billion to shareholders through dividends and share repurchases through the year and ended 2021 with cash and equivalents of $9.25 billion.

Fiscal 2021 Performance

For fiscal 2021, Caterpillar’s adjusted earnings was $10.81, which surpassed the Zacks Consensus Estimate of $10.34. It marked a 50% improvement from last year reflecting higher end-user demand for equipment and services and the impact from changes in dealer inventories. Including one-time items, the company’s earnings was $11.83 per share in fiscal 2021 compared with $5.46 in fiscal 2020.

Total revenues advanced 22% year over year to around $51 billion, ahead of the Zacks Consensus Estimate of $50.5 billion.

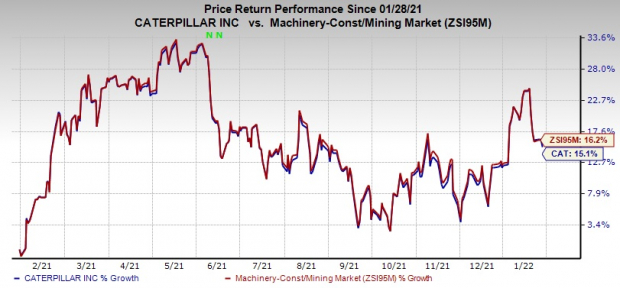

Price Performance

Image Source: Zacks Investment Research

Over the past year, Caterpillar stock has gained 15.1%, compared with the industry’s growth of 16.2%.

Zacks Rank & Stocks to Consider

Caterpillar currently carries a Zacks Rank #3 (Hold).

MRC Global has an estimated earnings growth rate of around 212% for fiscal 2022. In the past 90 days, the Zacks Consensus Estimate for fiscal 2022 earnings has been revised 11% upward.

In a year, MRC Global’s shares have gained 5%. MRC has a trailing four-quarter earnings surprise of 61.7%, on average.

Titan International has an expected earnings growth rate of 163% for 2022. The Zacks Consensus Estimate for current-year earnings has moved north by 19% in the past 60 days.

Titan International’s shares have surged 41% in the past year. TWI has a trailing four-quarter earnings surprise of 32.1%, on average.

Sealed Air has a projected earnings growth rate of 16.8% for the current year. The Zacks Consensus Estimate for 2022 earnings has moved north by 4% in the past 90 days.

SEE’s shares have appreciated 53% in a year. Sealed Air has a trailing four-quarter earnings surprise of 6.5%, on average.

Zacks' 7 Best Strong Buy Stocks (New Research Report)

Valued at $99, click below to receive our just-released report predicting the 7 stocks that will soar highest in the coming month.

Image: Bigstock

Caterpillar (CAT) Q4 Earnings & Sales Beat Estimates, Up Y/Y

Caterpillar Inc. (CAT - Free Report) reported fourth-quarter 2021 adjusted earnings per share of $2.69, which surpassed the Zacks Consensus Estimate of $2.22 by a margin of 21%. The bottom line improved 27% from the prior-year quarter. All of its segments witnessed strong end-market demand, which helped counter inflated input costs. A lower-than-expected effective tax rate contributed to the improvement in earnings.

Including one-time items, Caterpillar’s earnings per share was $3.91, reflecting a whopping improvement of 175% from the prior-year quarter figure of $1.42.

Revenues Up on High Demand in All Markets

The company’s fourth-quarter revenues of $13.8 billion beat the Zacks Consensus Estimate of $13.3 billion. The top line improved 23% from the year-ago quarter. This upbeat performance was driven by increasing sales volume, courtesy of higher end-user demand for equipment and services, favorable price realization, and the impact of change in dealer inventories. Sales increased across all of its three segments.

Caterpillar Inc. Price, Consensus and EPS Surprise

Caterpillar Inc. price-consensus-eps-surprise-chart | Caterpillar Inc. Quote

Inflated Costs Hurt Margins

In the quarter under review, cost of sales increased 28.5% year over year to $10 billion. Manufacturing costs were higher in the quarter due to inflated material costs and freight costs. Gross profit improved 10% year over year to $3.8 billion, primarily on the back of improved sales, which negated the impact of higher costs. Gross margin was 27.5% in the quarter under review compared with 30.7% in the prior-year quarter.

Selling, general and administrative (SG&A) expenses increased 17% year over year to around $1,422 million. Research and development (R&D) expenses climbed 17% to $439 million. Both SG&A and R&D expenses in the quarter were up year over year due to higher short-term incentive compensation expenses, higher labor costs due to increased headcount and investments associated with the company's strategy for profitable growth, including acquisition-related expenses.

Adjusted operating profit in the quarter increased 10% year over year to $1,577 million. Increased volumes and favorable price realization were instrumental in driving the improved performance. These gains were partially negated by higher SG&A and R&D expenses, and inflated manufacturing costs. Adjusted operating margin was 11.4% in the reported quarter down from 12.8% in the prior-year quarter.

Segment Performances Backed by High Demand

Machinery and Energy & Transportation (ME&T) sales rose 24% year over year to $13 billion in the quarter under review. Construction Industries sales were up 27% year over year to $5.7 billion owing to increased sales volumes reflecting improving end-user demand, the impact from changes in dealer inventories and favorable price realization. Sales growth in other regions helped offset the 12% lower sales in the Asia Pacific, which was primarily dragged down by China.

Sales at Resource Industries surged 27% year over year to around $2.8 billion on higher sales volume backed by higher end-user demand for equipment and aftermarket parts, and favorable price realization. The segment witnessed increased demand in mining, heavy construction and quarry and aggregates.

Sales of the Energy & Transportation segment in the quarter were around $5.7 billion, reflecting growth of 19% from the prior-year quarter as sales were up in all applications.

The ME&T segment reported an operating profit of $1,475 million, which reflected an improvement of 13% year over year. The Construction Industries segment witnessed a 25% growth in operating profit to $788 million, courtesy of higher volume and favorable price realization that offset higher manufacturing costs, and SG&A and R&D expenses.

The Resource Industries segment’s operating profit improved 12% year over year to $305 million in the quarter under review as higher sales volume and favorable price realization partially offset inflated manufacturing costs and SG&A/R&D expenses. The Energy & Transportation segment’s operating profit declined 2% year over year to $675 million as increasing manufacturing and SG&A/R&D expenses negated the gains from higher sales volumes.

Financial Products’ revenues climbed 4% to $776 million from the prior-year quarter. Financial Products' profits were $248 million in the reported quarter — an improvement of 27% year over year.

Strong Cash Position

In 2021, the company’s operating cash flow was $7.2 billion compared with $6.3 billion in the prior year. The company returned $5 billion to shareholders through dividends and share repurchases through the year and ended 2021 with cash and equivalents of $9.25 billion.

Fiscal 2021 Performance

For fiscal 2021, Caterpillar’s adjusted earnings was $10.81, which surpassed the Zacks Consensus Estimate of $10.34. It marked a 50% improvement from last year reflecting higher end-user demand for equipment and services and the impact from changes in dealer inventories. Including one-time items, the company’s earnings was $11.83 per share in fiscal 2021 compared with $5.46 in fiscal 2020.

Total revenues advanced 22% year over year to around $51 billion, ahead of the Zacks Consensus Estimate of $50.5 billion.

Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Over the past year, Caterpillar stock has gained 15.1%, compared with the industry’s growth of 16.2%.Zacks Rank & Stocks to Consider

Caterpillar currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are MRC Global (MRC - Free Report) , Titan International and Sealed Air Corporation (SEE - Free Report) . While MRC and TWI flaunt a Zacks Rank #1 (Strong Buy), SEE carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

MRC Global has an estimated earnings growth rate of around 212% for fiscal 2022. In the past 90 days, the Zacks Consensus Estimate for fiscal 2022 earnings has been revised 11% upward.

In a year, MRC Global’s shares have gained 5%. MRC has a trailing four-quarter earnings surprise of 61.7%, on average.

Titan International has an expected earnings growth rate of 163% for 2022. The Zacks Consensus Estimate for current-year earnings has moved north by 19% in the past 60 days.

Titan International’s shares have surged 41% in the past year. TWI has a trailing four-quarter earnings surprise of 32.1%, on average.

Sealed Air has a projected earnings growth rate of 16.8% for the current year. The Zacks Consensus Estimate for 2022 earnings has moved north by 4% in the past 90 days.

SEE’s shares have appreciated 53% in a year. Sealed Air has a trailing four-quarter earnings surprise of 6.5%, on average.