We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

UBS Group (UBS), Mitsubishi to Sell Japanese Realty JV to KKR

Read MoreHide Full Article

UBS Group AG (UBS - Free Report) recently announced that UBS Asset Management along with its joint venture partner Mitsubishi Corporation has agreed to sell its Japan-based real estate joint venture (JV), Mitsubishi Corp.-UBS Realty Inc. to KKR & Co. Inc (KKR - Free Report) . The transaction is anticipated to be completed in April 2022, subject to required filings and regulatory approvals.

The all-cash transaction is valued at approximately $2 billion and is expected to result in a gain on sale of $0.9 billion in the company's Asset Management segment. The company’s Common Equity Tier 1 capital ratio is anticipated to increase as well.

UBS Group’s 20-year JV in the real estate segment with Mitsubishi in Japan will end following this divesture. The company’s other operations in the country, including wealth management, investment banking and asset management, will remain unaffected by the sale.

The JV was one of the largest real estate asset management companies in Japan, which managed two Tokyo Stock Exchange-listed J-REITs with total assets under management of nearly $15 billion.

The deal will bolster KKR’s presence in Japan, where it has been operating since 2006, with an increased scale in the global real estate market from $41 billion to $55 billion. The company is committed to leveraging its network and global resources in creating value for the J-REITS unitholders.

Over the past few years, UBS Group has been divesting its businesses to focus on core operations and improve efficiency. Last year, the company completed the sale of its wealth management business in Austria to LGT and divested its stake in UBS Fondcenter to Deutsche Börse AG.

These efforts have helped the company strengthen its balance sheet position and diversify revenues through the expansion of its lucrative businesses. In January 2022, UBS inked a $1.4-billion deal to acquire Wealthfront, which will accelerate its growth in the United States, strengthen its outreach among affluent investors and bolster distribution competencies.

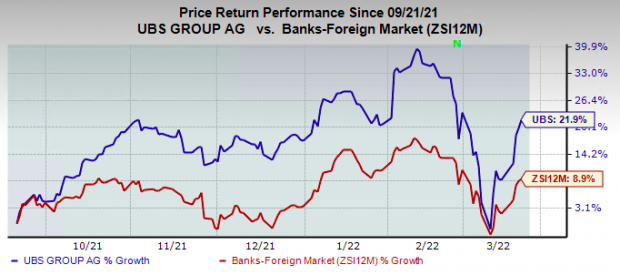

Over the past six months, shares of UBS have rallied 21.9%, outperforming the 8.9% growth of the industry it belongs to.

Of late, a number of finance companies have expanded through acquisitions. First Horizon Corporation (FHN - Free Report) and TD Bank Group (TD - Free Report) , in February 2022, signed a definitive agreement whereby the latter will acquire FHN in an all-cash deal valued at $13.4 billion or $25 for each FHN common share.

TD expects to close the FHN acquisition by Nov 1, 2022. The buyout is subject to customary closing conditions, including approvals from First Horizon's shareholders, and the U.S. and Canadian regulatory authorities.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Shutterstock

UBS Group (UBS), Mitsubishi to Sell Japanese Realty JV to KKR

UBS Group AG (UBS - Free Report) recently announced that UBS Asset Management along with its joint venture partner Mitsubishi Corporation has agreed to sell its Japan-based real estate joint venture (JV), Mitsubishi Corp.-UBS Realty Inc. to KKR & Co. Inc (KKR - Free Report) . The transaction is anticipated to be completed in April 2022, subject to required filings and regulatory approvals.

The all-cash transaction is valued at approximately $2 billion and is expected to result in a gain on sale of $0.9 billion in the company's Asset Management segment. The company’s Common Equity Tier 1 capital ratio is anticipated to increase as well.

UBS Group’s 20-year JV in the real estate segment with Mitsubishi in Japan will end following this divesture. The company’s other operations in the country, including wealth management, investment banking and asset management, will remain unaffected by the sale.

The JV was one of the largest real estate asset management companies in Japan, which managed two Tokyo Stock Exchange-listed J-REITs with total assets under management of nearly $15 billion.

The deal will bolster KKR’s presence in Japan, where it has been operating since 2006, with an increased scale in the global real estate market from $41 billion to $55 billion. The company is committed to leveraging its network and global resources in creating value for the J-REITS unitholders.

Over the past few years, UBS Group has been divesting its businesses to focus on core operations and improve efficiency. Last year, the company completed the sale of its wealth management business in Austria to LGT and divested its stake in UBS Fondcenter to Deutsche Börse AG.

These efforts have helped the company strengthen its balance sheet position and diversify revenues through the expansion of its lucrative businesses. In January 2022, UBS inked a $1.4-billion deal to acquire Wealthfront, which will accelerate its growth in the United States, strengthen its outreach among affluent investors and bolster distribution competencies.

Over the past six months, shares of UBS have rallied 21.9%, outperforming the 8.9% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Currently, UBS Group carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Of late, a number of finance companies have expanded through acquisitions. First Horizon Corporation (FHN - Free Report) and TD Bank Group (TD - Free Report) , in February 2022, signed a definitive agreement whereby the latter will acquire FHN in an all-cash deal valued at $13.4 billion or $25 for each FHN common share.

TD expects to close the FHN acquisition by Nov 1, 2022. The buyout is subject to customary closing conditions, including approvals from First Horizon's shareholders, and the U.S. and Canadian regulatory authorities.