Investors are always looking for the next big thing. When they find it, the opportunity can pay out fast, or it can take a couple years to develop. The trades that work out over the longer-term are usually referred to as a market trend.

You might be shocked to find out that you missed out on one of the biggest hidden trends over the last year. I’m not talking Apple, Tesla, or even Bitcoin. While those are all very well-known outperformers, what I’m bringing you today was largely ignored for many years.

The Old Bull Market vs Today’s Bull Market

Up until recently, the equity bull market was euphoric and rewarded even the most amateur investor. Whether it was a SPAC, a tech stock, or even a meme stock, investors could do no wrong.

However, something changed late last year. All those high-flying stocks started coming down quickly and started to bleed out as 2022 began. Investors were feeling the pressure and started to capitulate.

Stocks were falling without the support of stimulus checks and the Fed. Sprinkle in high inflation and a Russian/Ukraine war, investors were hurting – unless they were involved in an often-ignored asset class.

If you haven’t guessed it yet, we are talking about commodities!

Oil, natural gas, grains, lumber, meats and coffee are the places to be over the last year. The gains not only came in those well-known commodities, but also the underlying stocks that deal in those products.

Check Out These Numbers

Let’s look at what some popular tech stocks have done over the last year versus what some commodities have done.

Continue . . .

------------------------------------------------------------------------------------------------------

Big Moves to Ride a Hidden Bull Market

Don’t miss the Sunday deadline to get in on Zacks’ unique approach to the skyrocketing potential of commodities including oil, gold, metals, agricultural products, lumber, currencies, coffee, and more.

As prices soar, you can invest in this overlooked asset class the easy way. No futures contracts or option moves – just quality stocks and ETFs.

New move: We’re about to post a brand new recommendation with significant upside. You can be the first to take advantage.

Important: Your chance to access our private recommendations ends midnight Sunday, April 3.

See Our Latest Buys Now >>

------------------------------------------------------------------------------------------------------

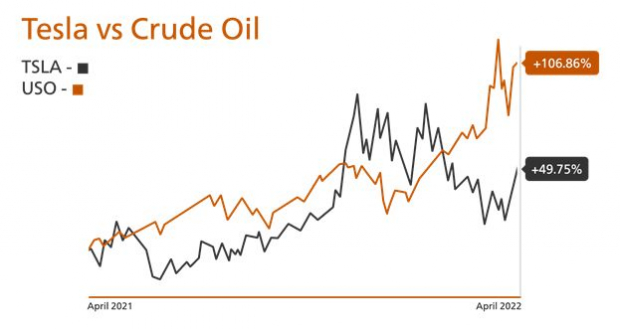

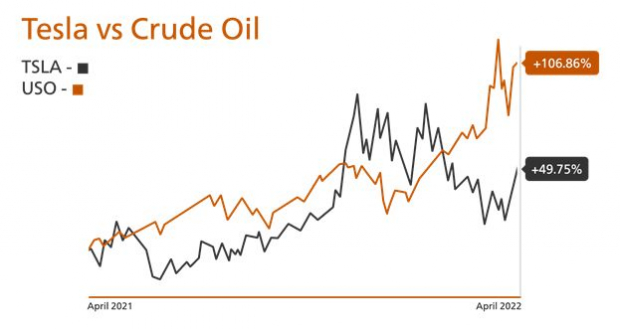

1) Tesla vs Crude Oil -- Tesla has been one of the hottest stocks since the pandemic lows. In fact, it’s one of the few tech stocks still up year over year, with Tesla up about 40% over the last year. Surely crude oil couldn’t beat that!

Well how about a move of over 100% from the crude oil ETF USO. After going negative in 2020 due to the COVID panic, demand destruction quickly shifted to supply constraint, fueling higher oil and gas prices.

Image Source: Zacks Investment Research

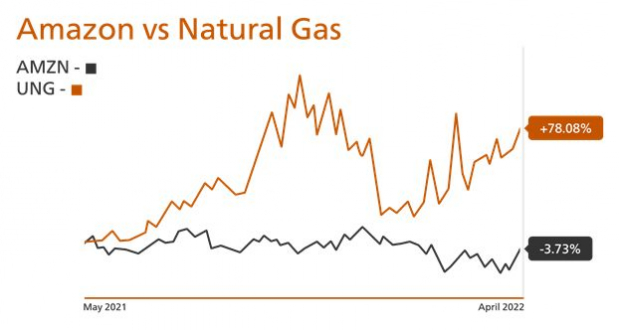

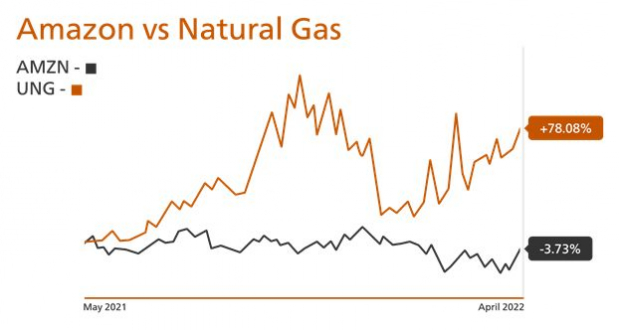

2) Amazon vs Natural Gas -- Everyone loves using Amazon products, but the stock really hasn’t performed very well. Amazon is actually down slightly year over year, and this is after a big rally on news that the stock will split.

Looking at natural gas, we have a huge move of 78% higher and it is still well-off last year’s highs. Natural gas is very energy dependent, but lack of supply in Europe has lifted prices.

Image Source: Zacks Investment Research

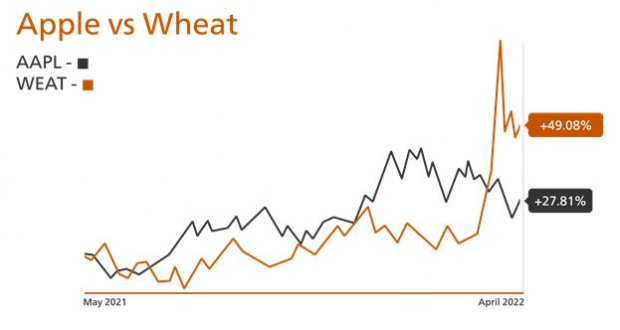

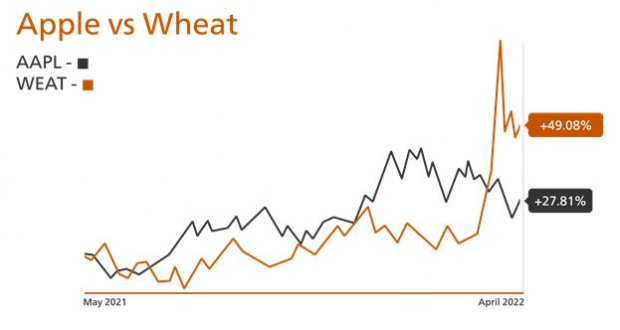

3) Apple vs Wheat -- Surely Apple can take down a commodity like wheat, right? Phones are far more important than bread, right?

Wrong!

Wheat ETF WEAT is up almost 50% year over year against Apples 28% gain. While Apple has outperformed most tech, it can’t’ match up to the necessity that is wheat. Ukraine and Russia produce a lot of the world’s grain needs, so if the conflict lasts long, the high wheat prices will remain.

Image Source: Zacks Investment Research

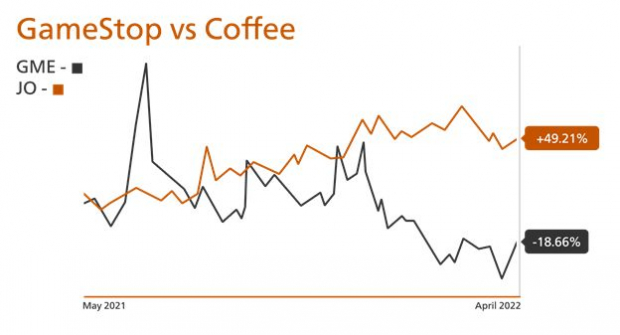

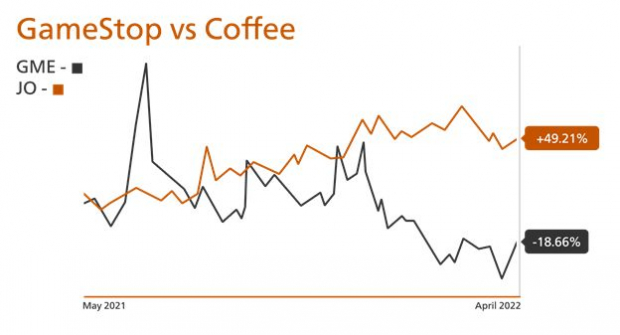

4) GameStop vs Coffee -- Everyone’s favorite meme stock entertained us in 2021, but the stock is down 20% year over year. The stock moved so fast; you needed a lot of coffee to keep up. Coffee ETF JO has been nonstop, gaining 50% in price over the last year.

Image Source: Zacks Investment Research

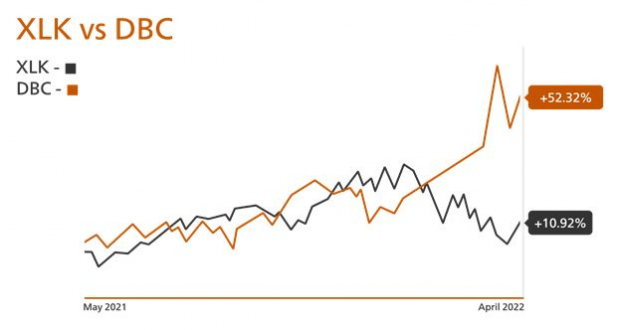

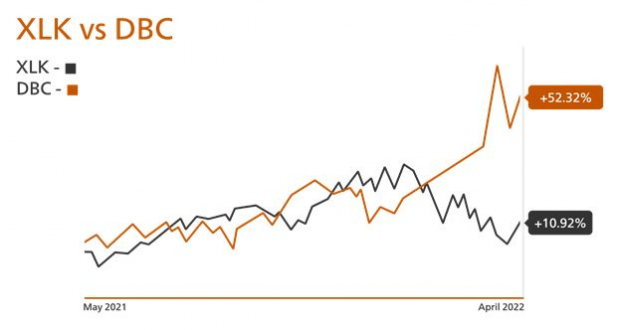

5) XLK vs DBC -- Some investors prefer ETFs over individual stocks and even the diversified tech investors are hurting, with XLK down 10% year over year. Compare that with the Commodity Index ETF DBC, which has seen a gain of more than 50% over this time frame.

Image Source: Zacks Investment Research

Is There More Meat on the Commodity Bone?

Commodities are all about speculation. Factors that move markets can include an increase in demand, a shortage of supply, economic growth or lack thereof. Moreover, the weather is a big catalyst for agriculture. While we might not be able to determine which way the wind blows, investors have tools that let them gain an edge. Technical analysis combined with analysis of individual markets can give an investor a good idea of where price may go.

Lately, there are some external factors that have really pressured the supply side for all commodities. While the Ukraine war is a big factor, supply chains and lack of supply that remains from COVID has helped commodities stay elevated.

Not only is there more room for prices to go higher, but they might go much higher if these supply constraints remain. Both commodity prices and commodity stocks could bull their way higher into the end of the year.

Zacks’ Top Commodity Plays for Today’s Market

The commodity markets are not for the faint of heart, but they do reward those willing to take risk. Now, more than ever, is perhaps the greatest time in a decade to find exposure to the ups and downs of this volatile market.

Additionally, while the prices of these commodities might see a lot of volatility, the stocks that benefit from the price of those commodities look to see big profits for years to come.

An easy way to get started is to follow my Commodity Innovators portfolio. We’re stalking the strongest trends to find commodity stocks with the most promise. We will minimize our risk without being exposed to the futures market, while keeping the same potential rewards.

Utilizing the Zacks Rank, we will have a plethora of ETFs and stocks to choose from that will allow us to capture this profit potential created within the commodity markets.

Over the past few months, we’ve pointed members to trades that generated gains of +50.8%, +65.3%, even +109.6%.¹ My research indicates current market trends are likely to continue producing big opportunities at least through the end of 2022.

On Monday morning, I’ll be adding a brand new pick with significant profit potential to the portfolio. You can be among the first to see it.

When you look into Commodity Innovators, you’re also invited to download The Great Inflation Threat: 5 Stocks to Preserve Wealth and Thrive. I wrote this urgent Special Report to reveal five ways investors can actually benefit from record high inflation. Each of the 5 stocks you’ll discover could hand you significant gains over the coming months.

I urge you to take advantage of this right away. The deadline to gain access to Commodity Innovators and claim The Great Inflation Threat free special report is Sunday, April 3rd.

Check out Commodity Innovators today >>

All the Best,

Jeremy Mullin

Zacks Strategist

Jeremy Mullin is a technical expert with 17 years' experience pinpointing the best times to buy and sell commodities. He is the editor of Zacks Commodity Innovators.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position.

Image: Bigstock

The Market Trend Outperforming Everyone's Favorite Stocks

Investors are always looking for the next big thing. When they find it, the opportunity can pay out fast, or it can take a couple years to develop. The trades that work out over the longer-term are usually referred to as a market trend.

You might be shocked to find out that you missed out on one of the biggest hidden trends over the last year. I’m not talking Apple, Tesla, or even Bitcoin. While those are all very well-known outperformers, what I’m bringing you today was largely ignored for many years.

The Old Bull Market vs Today’s Bull Market

Up until recently, the equity bull market was euphoric and rewarded even the most amateur investor. Whether it was a SPAC, a tech stock, or even a meme stock, investors could do no wrong.

However, something changed late last year. All those high-flying stocks started coming down quickly and started to bleed out as 2022 began. Investors were feeling the pressure and started to capitulate.

Stocks were falling without the support of stimulus checks and the Fed. Sprinkle in high inflation and a Russian/Ukraine war, investors were hurting – unless they were involved in an often-ignored asset class.

If you haven’t guessed it yet, we are talking about commodities!

Oil, natural gas, grains, lumber, meats and coffee are the places to be over the last year. The gains not only came in those well-known commodities, but also the underlying stocks that deal in those products.

Check Out These Numbers

Let’s look at what some popular tech stocks have done over the last year versus what some commodities have done.

Continue . . .

------------------------------------------------------------------------------------------------------

Big Moves to Ride a Hidden Bull Market

Don’t miss the Sunday deadline to get in on Zacks’ unique approach to the skyrocketing potential of commodities including oil, gold, metals, agricultural products, lumber, currencies, coffee, and more.

As prices soar, you can invest in this overlooked asset class the easy way. No futures contracts or option moves – just quality stocks and ETFs.

New move: We’re about to post a brand new recommendation with significant upside. You can be the first to take advantage.

Important: Your chance to access our private recommendations ends midnight Sunday, April 3.

See Our Latest Buys Now >>

------------------------------------------------------------------------------------------------------

1) Tesla vs Crude Oil -- Tesla has been one of the hottest stocks since the pandemic lows. In fact, it’s one of the few tech stocks still up year over year, with Tesla up about 40% over the last year. Surely crude oil couldn’t beat that!

Well how about a move of over 100% from the crude oil ETF USO. After going negative in 2020 due to the COVID panic, demand destruction quickly shifted to supply constraint, fueling higher oil and gas prices.

Image Source: Zacks Investment Research

2) Amazon vs Natural Gas -- Everyone loves using Amazon products, but the stock really hasn’t performed very well. Amazon is actually down slightly year over year, and this is after a big rally on news that the stock will split.

Looking at natural gas, we have a huge move of 78% higher and it is still well-off last year’s highs. Natural gas is very energy dependent, but lack of supply in Europe has lifted prices.

Image Source: Zacks Investment Research

3) Apple vs Wheat -- Surely Apple can take down a commodity like wheat, right? Phones are far more important than bread, right?

Wrong!

Wheat ETF WEAT is up almost 50% year over year against Apples 28% gain. While Apple has outperformed most tech, it can’t’ match up to the necessity that is wheat. Ukraine and Russia produce a lot of the world’s grain needs, so if the conflict lasts long, the high wheat prices will remain.

Image Source: Zacks Investment Research

4) GameStop vs Coffee -- Everyone’s favorite meme stock entertained us in 2021, but the stock is down 20% year over year. The stock moved so fast; you needed a lot of coffee to keep up. Coffee ETF JO has been nonstop, gaining 50% in price over the last year.

Image Source: Zacks Investment Research

5) XLK vs DBC -- Some investors prefer ETFs over individual stocks and even the diversified tech investors are hurting, with XLK down 10% year over year. Compare that with the Commodity Index ETF DBC, which has seen a gain of more than 50% over this time frame.

Image Source: Zacks Investment Research

Is There More Meat on the Commodity Bone?

Commodities are all about speculation. Factors that move markets can include an increase in demand, a shortage of supply, economic growth or lack thereof. Moreover, the weather is a big catalyst for agriculture. While we might not be able to determine which way the wind blows, investors have tools that let them gain an edge. Technical analysis combined with analysis of individual markets can give an investor a good idea of where price may go.

Lately, there are some external factors that have really pressured the supply side for all commodities. While the Ukraine war is a big factor, supply chains and lack of supply that remains from COVID has helped commodities stay elevated.

Not only is there more room for prices to go higher, but they might go much higher if these supply constraints remain. Both commodity prices and commodity stocks could bull their way higher into the end of the year.

Zacks’ Top Commodity Plays for Today’s Market

The commodity markets are not for the faint of heart, but they do reward those willing to take risk. Now, more than ever, is perhaps the greatest time in a decade to find exposure to the ups and downs of this volatile market.

Additionally, while the prices of these commodities might see a lot of volatility, the stocks that benefit from the price of those commodities look to see big profits for years to come.

An easy way to get started is to follow my Commodity Innovators portfolio. We’re stalking the strongest trends to find commodity stocks with the most promise. We will minimize our risk without being exposed to the futures market, while keeping the same potential rewards.

Utilizing the Zacks Rank, we will have a plethora of ETFs and stocks to choose from that will allow us to capture this profit potential created within the commodity markets.

Over the past few months, we’ve pointed members to trades that generated gains of +50.8%, +65.3%, even +109.6%.¹ My research indicates current market trends are likely to continue producing big opportunities at least through the end of 2022.

On Monday morning, I’ll be adding a brand new pick with significant profit potential to the portfolio. You can be among the first to see it.

When you look into Commodity Innovators, you’re also invited to download The Great Inflation Threat: 5 Stocks to Preserve Wealth and Thrive. I wrote this urgent Special Report to reveal five ways investors can actually benefit from record high inflation. Each of the 5 stocks you’ll discover could hand you significant gains over the coming months.

I urge you to take advantage of this right away. The deadline to gain access to Commodity Innovators and claim The Great Inflation Threat free special report is Sunday, April 3rd.

Check out Commodity Innovators today >>

All the Best,

Jeremy Mullin

Zacks Strategist

Jeremy Mullin is a technical expert with 17 years' experience pinpointing the best times to buy and sell commodities. He is the editor of Zacks Commodity Innovators.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position.