Earnings season has officially begun. Investors are more than excited for companies to finally unveil their Q2 results, as we find ourselves in a highly unique economic environment coming out of a once-in-a-lifetime pandemic.

Many companies are slated to report quarterly results this week, one of them being the widely watched Twitter . Twitter is a global social media platform that connects users to networks of people, news, opinions, and information.

Of course, Twitter has been in the spotlight since Elon Musk announced his plans to buy the social media platform. However, he’s recently announced that the deal is a no-go, causing volatility to return to shares.

Let’s look at how the social media platform shapes up heading into its quarterly release; Twitter reports before the opening bell on Friday, July 22nd.

Share Performance & Valuation

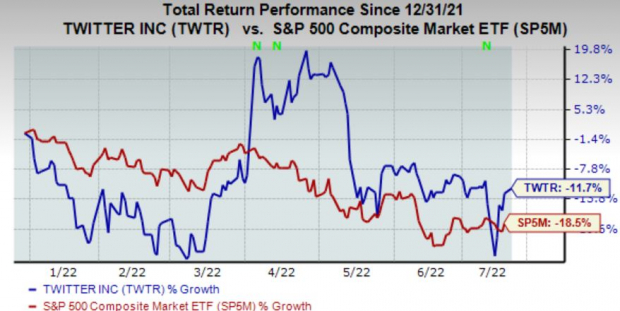

Year-to-date, Twitter shares have been on a rollercoaster, declining more than 10% in value and outperforming the S&P 500 by a wide margin. Upon Musk’s announcement of the acquisition, shares exploded near the middle of March but have since retraced.

Image Source: Zacks Investment Research

However, upon widening the timeframe to encompass a year’s worth of price action, Twitter shares have struggled notably, losing more than 40% in value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

Twitter sports a pricey 4.9X forward price-to-sales ratio, nowhere near its five-year median of 8.1X but well above its Zacks Sector’s average, reflecting a steep 43% premium.

Image Source: Zacks Investment Research

Quarterly Performance & Share Reactions

TWTR has primarily reported bottom-line results above expectations, exceeding the Zacks Consensus EPS Estimate in six of its previous ten quarters. In addition, the company posted a massive 2150% bottom-line beat in its latest quarter.

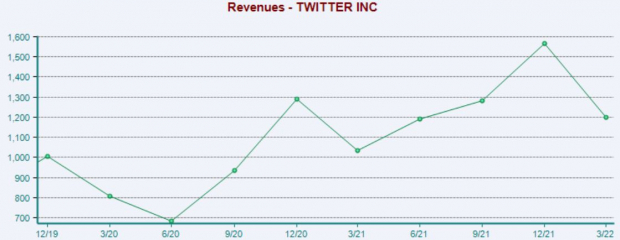

Top-line results have left much to be desired as of late; Twitter has posted quarterly sales results below expectations in three consecutive quarters.

Image Source: Zacks Investment Research

The market has reacted somewhat mixed to bottom-line beats – over the company’s last five EPS beats, shares have moved upwards three times.

Growth Estimates

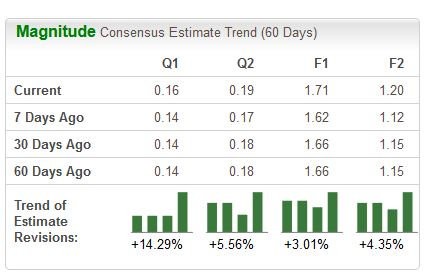

For the quarter to be reported, the Consensus Estimate Trend has climbed a sizable 14% over the last 60 days, reflecting quarterly EPS of $0.16 and a 20% decrease in earnings from the year-ago quarter.

Image Source: Zacks Investment Research

However, Twitter’s top-line appears to be in better shape, with the $1.3 billion revenue estimate penciling in a 12% jump in quarterly sales year-over-year.

Bottom Line

Twitter has been in the headlines since Elon Musk spoke about his intentions to purchase the company. With that deal thrown out the window, Twitter shares are on a seemingly never-ending rollercoaster.

The company’s earnings are forecasted to drop quite notably, shares appear overvalued, and are extremely volatile. For these reasons, it looks beneficial for investors to deploy a defense-first approach.

Image: Bigstock

Twitter Q2 Preview: With Elon Musk Out, Can Shares Find New Life?

Earnings season has officially begun. Investors are more than excited for companies to finally unveil their Q2 results, as we find ourselves in a highly unique economic environment coming out of a once-in-a-lifetime pandemic.

Many companies are slated to report quarterly results this week, one of them being the widely watched Twitter . Twitter is a global social media platform that connects users to networks of people, news, opinions, and information.

Of course, Twitter has been in the spotlight since Elon Musk announced his plans to buy the social media platform. However, he’s recently announced that the deal is a no-go, causing volatility to return to shares.

Let’s look at how the social media platform shapes up heading into its quarterly release; Twitter reports before the opening bell on Friday, July 22nd.

Share Performance & Valuation

Year-to-date, Twitter shares have been on a rollercoaster, declining more than 10% in value and outperforming the S&P 500 by a wide margin. Upon Musk’s announcement of the acquisition, shares exploded near the middle of March but have since retraced.

Image Source: Zacks Investment Research

However, upon widening the timeframe to encompass a year’s worth of price action, Twitter shares have struggled notably, losing more than 40% in value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

Twitter sports a pricey 4.9X forward price-to-sales ratio, nowhere near its five-year median of 8.1X but well above its Zacks Sector’s average, reflecting a steep 43% premium.

Image Source: Zacks Investment Research

Quarterly Performance & Share Reactions

TWTR has primarily reported bottom-line results above expectations, exceeding the Zacks Consensus EPS Estimate in six of its previous ten quarters. In addition, the company posted a massive 2150% bottom-line beat in its latest quarter.

Top-line results have left much to be desired as of late; Twitter has posted quarterly sales results below expectations in three consecutive quarters.

Image Source: Zacks Investment Research

The market has reacted somewhat mixed to bottom-line beats – over the company’s last five EPS beats, shares have moved upwards three times.

Growth Estimates

For the quarter to be reported, the Consensus Estimate Trend has climbed a sizable 14% over the last 60 days, reflecting quarterly EPS of $0.16 and a 20% decrease in earnings from the year-ago quarter.

Image Source: Zacks Investment Research

However, Twitter’s top-line appears to be in better shape, with the $1.3 billion revenue estimate penciling in a 12% jump in quarterly sales year-over-year.

Bottom Line

Twitter has been in the headlines since Elon Musk spoke about his intentions to purchase the company. With that deal thrown out the window, Twitter shares are on a seemingly never-ending rollercoaster.

The company’s earnings are forecasted to drop quite notably, shares appear overvalued, and are extremely volatile. For these reasons, it looks beneficial for investors to deploy a defense-first approach.