The Zacks Computer and Technology Sector has been crushed in 2022, down nearly 25% and coming nowhere near the general market’s performance. Over the last month, however, the tide has slowly begun to change, with the sector tacking on 4.2% in value.

A big name residing in the sector, VMware , is on deck to reveal Q2 earnings on Thursday, August 25th, after market close.

VMware assists its customers in managing their IT resources across private clouds and complex multi-cloud, multi-device environments by offering solutions across three categories: Software-Defined Data Center (SDDC), Hybrid and Multi-Cloud Computing, and Digital Workspace — End-User Computing (EUC).

As it stands, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a B. How does everything stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Undoubtedly a major positive, VMware shares have provided investors with a rock-solid 2.7% return year-to-date, easily outperforming the general market.

Image Source: Zacks Investment Research

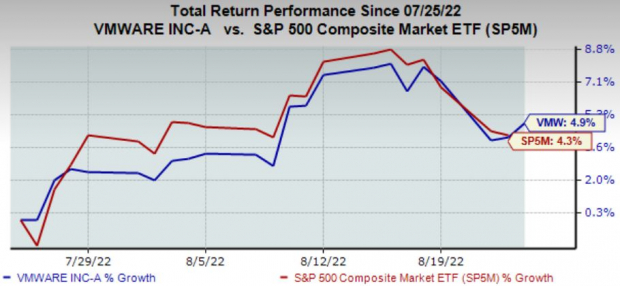

Over the last month, VMW shares have continued their strength, increasing nearly 5% in value and beating out the S&P 500 marginally.

Image Source: Zacks Investment Research

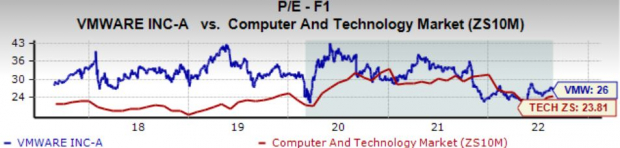

In addition, VMW’s forward earnings multiple resides at 26.0X, well beneath its five-year median of 31.7X but representing a 36% premium relative to its Zacks Sector.

VMware carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

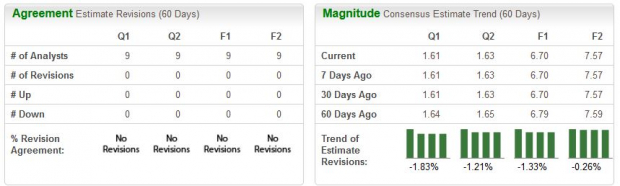

Surprisingly, analysts have been silent for the quarter to be reported over the last 60 days, with zero estimate revisions hitting the tape. Still, the Zacks Consensus EPS Estimate of $1.61 reflects an 8% drop in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

However, the company’s top-line appears to be in better health – the Zacks Consensus Sales Estimate for the quarter resides at $3.3 billion, reflecting growth of 5.5% from year-ago quarterly sales of $3.1 billion.

Quarterly Performance & Market Reactions

VMW has consistently reported bottom-line results above estimates, exceeding the Zack Consensus EPS Estimate in eight of its previous ten quarters. Although, in its latest quarter, the company posted an 18.5% EPS miss.

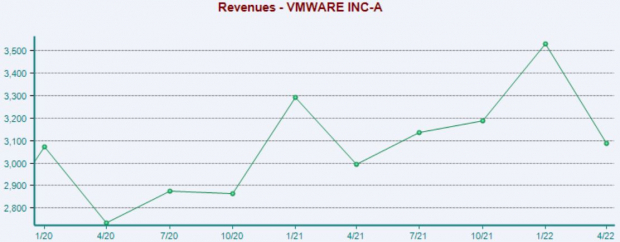

Top-line results have also been rock-solid; over the company’s previous ten quarterly reports, VMW has penciled in nine revenue beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has liked what it’s seen from VMW’s quarterly reports as of late, with shares moving upwards following each of its last three prints.

Putting Everything Together

VMware shares have posted market-beating returns not just year-to-date but also over the last month, indicating that buyers have been out in full force.

The company’s shares trade at steep valuation multiples but are well below their five-year median.

Analysts have been silent in their outlook, with estimates reflecting a declining bottom-line and an increasing top-line.

Furthermore, the company has consistently beaten quarterly estimates, and the market has reacted favorably following its last three prints.

Heading into the release, VMware carries a Zacks Rank #3 (Hold) with an overall VGM Score of a B.

Image: Bigstock

VMware Q2 Preview: Rebound Quarter Inbound?

The Zacks Computer and Technology Sector has been crushed in 2022, down nearly 25% and coming nowhere near the general market’s performance. Over the last month, however, the tide has slowly begun to change, with the sector tacking on 4.2% in value.

A big name residing in the sector, VMware , is on deck to reveal Q2 earnings on Thursday, August 25th, after market close.

VMware assists its customers in managing their IT resources across private clouds and complex multi-cloud, multi-device environments by offering solutions across three categories: Software-Defined Data Center (SDDC), Hybrid and Multi-Cloud Computing, and Digital Workspace — End-User Computing (EUC).

As it stands, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a B. How does everything stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Undoubtedly a major positive, VMware shares have provided investors with a rock-solid 2.7% return year-to-date, easily outperforming the general market.

Image Source: Zacks Investment Research

Over the last month, VMW shares have continued their strength, increasing nearly 5% in value and beating out the S&P 500 marginally.

Image Source: Zacks Investment Research

In addition, VMW’s forward earnings multiple resides at 26.0X, well beneath its five-year median of 31.7X but representing a 36% premium relative to its Zacks Sector.

VMware carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Surprisingly, analysts have been silent for the quarter to be reported over the last 60 days, with zero estimate revisions hitting the tape. Still, the Zacks Consensus EPS Estimate of $1.61 reflects an 8% drop in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

However, the company’s top-line appears to be in better health – the Zacks Consensus Sales Estimate for the quarter resides at $3.3 billion, reflecting growth of 5.5% from year-ago quarterly sales of $3.1 billion.

Quarterly Performance & Market Reactions

VMW has consistently reported bottom-line results above estimates, exceeding the Zack Consensus EPS Estimate in eight of its previous ten quarters. Although, in its latest quarter, the company posted an 18.5% EPS miss.

Top-line results have also been rock-solid; over the company’s previous ten quarterly reports, VMW has penciled in nine revenue beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has liked what it’s seen from VMW’s quarterly reports as of late, with shares moving upwards following each of its last three prints.

Putting Everything Together

VMware shares have posted market-beating returns not just year-to-date but also over the last month, indicating that buyers have been out in full force.

The company’s shares trade at steep valuation multiples but are well below their five-year median.

Analysts have been silent in their outlook, with estimates reflecting a declining bottom-line and an increasing top-line.

Furthermore, the company has consistently beaten quarterly estimates, and the market has reacted favorably following its last three prints.

Heading into the release, VMware carries a Zacks Rank #3 (Hold) with an overall VGM Score of a B.