The Zacks Finance sector has shown slightly more resiliency than the general market in 2022, down roughly 19% vs. the S&P 500’s decline of 22%.

Image Source: Zacks Investment Research

A titan in the sector, Discover Financial Services , is gearing up to unveil quarterly results on October 24th after the market close.

Discover Financial Services is a digital banking and payment services company in the United States, offering deposit products, credit cards, and personal, student, and home loans.

Currently, the financial titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a C.

How does everything shape up heading into the print? Let’s take a deeper dive to find out.

Share Performance & Valuation

Year-to-date, DFS shares have displayed a modest level of defense, down roughly 19% vs. the S&P 500’s decline of 22%.

Image Source: Zacks Investment Research

Over the last three months, the story has remained the same; DFS shares have slightly outperformed the S&P 500, down nearly 7%.

Image Source: Zacks Investment Research

In a historically-volatile 2022, any level of relative strength is undoubtedly a highlight.

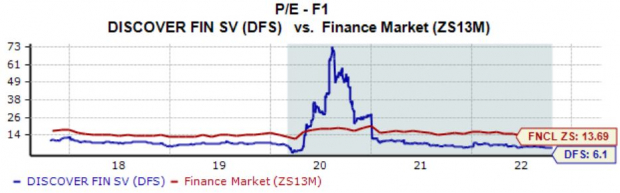

Shares don't seem expensive at all – the company’s current 6.1X forward P/E ratio is nowhere near the 9.1X five-year median and represents a 55% discount relative to its Zacks Finance sector.

DFS sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

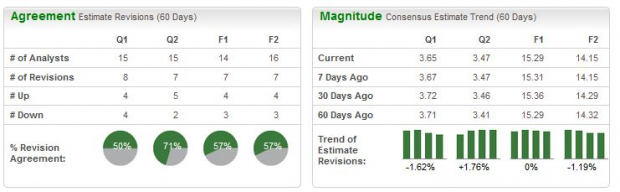

Analysts are split in their earnings outlook, with four negative and four positive estimate revisions coming in over the last several months. Still, the Zacks Consensus EPS Estimate of $3.65 suggests Y/Y earnings growth of 3.1%.

Image Source: Zacks Investment Research

Revenue estimates suggest notable growth also; the Zacks Consensus Sales Estimate of $3.4 billion indicates a rock-solid 21% Y/Y uptick in quarterly revenue.

Quarterly Performance & Market Reactions

DFS has an impressive earnings track record, exceeding the Zacks Consensus EPS Estimate in eight consecutive quarters, with three of those beats being greater than 50%. Just in its latest quarter, the financial titan registered a 5.6% bottom-line beat.

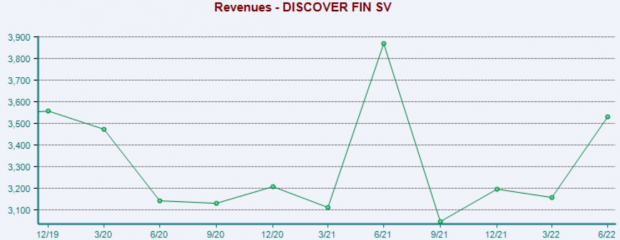

Revenue results have been under expectations in three of its last four prints, but the company penciled in a slight 2% revenue beat in its latest quarter, perhaps indicating that the tide is turning. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, DFS shares have experienced adverse price action following three of its last four quarterly prints, with shares declining by at least 4.8% in each instance.

Shares fell roughly 8% following its latest print.

Putting Everything Together

DFS shares have provided investors with a much-needed layer of defense in 2022, outperforming the general market across several timeframes.

Shares don’t appear to be pricey by any means, with the company’s forward P/E sitting nicely below its five-year median and Zacks sector average.

Analysts have had mixed reactions surrounding their earnings outlook, but estimates reflect increases in both revenue and earnings Y/Y.

Further, the company has consistently exceeded bottom-line expectations, but revenue results have been a bit lackluster as of late.

Heading into the print, Discover Financial Services carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -2.5%.

Image: Bigstock

Discover Financial Services Q3 Preview: Can The Earnings Streak Continue?

The Zacks Finance sector has shown slightly more resiliency than the general market in 2022, down roughly 19% vs. the S&P 500’s decline of 22%.

Image Source: Zacks Investment Research

A titan in the sector, Discover Financial Services , is gearing up to unveil quarterly results on October 24th after the market close.

Discover Financial Services is a digital banking and payment services company in the United States, offering deposit products, credit cards, and personal, student, and home loans.

Currently, the financial titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a C.

How does everything shape up heading into the print? Let’s take a deeper dive to find out.

Share Performance & Valuation

Year-to-date, DFS shares have displayed a modest level of defense, down roughly 19% vs. the S&P 500’s decline of 22%.

Image Source: Zacks Investment Research

Over the last three months, the story has remained the same; DFS shares have slightly outperformed the S&P 500, down nearly 7%.

Image Source: Zacks Investment Research

In a historically-volatile 2022, any level of relative strength is undoubtedly a highlight.

Shares don't seem expensive at all – the company’s current 6.1X forward P/E ratio is nowhere near the 9.1X five-year median and represents a 55% discount relative to its Zacks Finance sector.

DFS sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts are split in their earnings outlook, with four negative and four positive estimate revisions coming in over the last several months. Still, the Zacks Consensus EPS Estimate of $3.65 suggests Y/Y earnings growth of 3.1%.

Image Source: Zacks Investment Research

Revenue estimates suggest notable growth also; the Zacks Consensus Sales Estimate of $3.4 billion indicates a rock-solid 21% Y/Y uptick in quarterly revenue.

Quarterly Performance & Market Reactions

DFS has an impressive earnings track record, exceeding the Zacks Consensus EPS Estimate in eight consecutive quarters, with three of those beats being greater than 50%. Just in its latest quarter, the financial titan registered a 5.6% bottom-line beat.

Revenue results have been under expectations in three of its last four prints, but the company penciled in a slight 2% revenue beat in its latest quarter, perhaps indicating that the tide is turning. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, DFS shares have experienced adverse price action following three of its last four quarterly prints, with shares declining by at least 4.8% in each instance.

Shares fell roughly 8% following its latest print.

Putting Everything Together

DFS shares have provided investors with a much-needed layer of defense in 2022, outperforming the general market across several timeframes.

Shares don’t appear to be pricey by any means, with the company’s forward P/E sitting nicely below its five-year median and Zacks sector average.

Analysts have had mixed reactions surrounding their earnings outlook, but estimates reflect increases in both revenue and earnings Y/Y.

Further, the company has consistently exceeded bottom-line expectations, but revenue results have been a bit lackluster as of late.

Heading into the print, Discover Financial Services carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -2.5%.