The Zacks Consumer Discretionary sector has sailed through rough waters in 2022, down more than 35% and widely lagging behind the general market.

A company in the realm that many are familiar with, Six Flags Entertainment , is slated to unveil quarterly earnings on November 10th, before the market open.

Six Flags Entertainment owns and operates regional parks comprised of theme, water, and zoological parks offering rides, water attractions, themed areas, concerts, shows, restaurants, game venues, and retail outlets.

Currently, the entertainment giant carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an A.

How does everything else stack up? Let’s take a closer look.

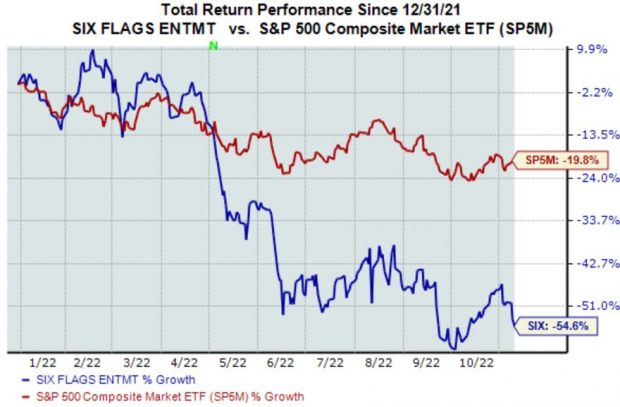

Share Performance & Valuation

SIX shares have struggled to find their footing in 2022, down more than 50% and coming nowhere near the general market’s performance.

Image Source: Zacks Investment Research

Over the last three months, the adverse price action of SIX shares has continued, down more than 25% and again underperforming the S&P 500 in this timeframe also.

Image Source: Zacks Investment Research

Shares don’t appear stretched in terms of valuation; the company’s 1.2X forward price-to-sales ratio sits well beneath its 2.9X five-year median and represents a 15% discount relative to its Zacks sector average.

Six Flags sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish in their earnings outlook over the last several months, with five negative earnings estimate revisions hitting the tape. The Zacks Consensus EPS Estimate of $1.65 indicates a Y/Y decline in earnings of roughly 8.3%.

Image Source: Zacks Investment Research

The company’s top-line is also undergoing some turbulence; the Zacks Consensus Sales Estimate of $565.4 million suggests an 11.4% decline from year-ago quarterly sales of $638.3 million.

Quarterly Performance

SIX has primarily exceeded earnings estimates, with seven EPS beats across its last ten quarters. Still, the company fell short of earnings expectations by nearly 30% in its latest release.

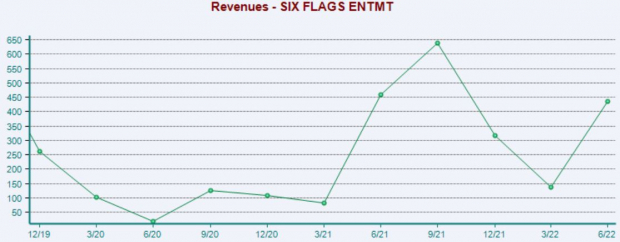

Top-line results paint precisely the same story; the company has registered seven revenue beats across its last ten quarters but fell short of sales expectations by 16% in its latest quarter. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

SIX shares have underperformed the general market across several timeframes in 2022, indicating that sellers have been in control.

The company’s forward price-to-sales ratio resides beneath its five-year median and Zacks sector average.

Analysts have been bearish in their earnings outlook, with estimates suggesting declines in both revenue and earnings.

The company fell short of revenue and earnings expectations by a wide margin in its latest print, snapping a long streak of better-than-expected results.

Heading into the release, Six Flags Entertainment carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -3.3%.

Image: Bigstock

Six Flags Q3 Preview: Rebound Quarter Inbound?

The Zacks Consumer Discretionary sector has sailed through rough waters in 2022, down more than 35% and widely lagging behind the general market.

A company in the realm that many are familiar with, Six Flags Entertainment , is slated to unveil quarterly earnings on November 10th, before the market open.

Six Flags Entertainment owns and operates regional parks comprised of theme, water, and zoological parks offering rides, water attractions, themed areas, concerts, shows, restaurants, game venues, and retail outlets.

Currently, the entertainment giant carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an A.

How does everything else stack up? Let’s take a closer look.

Share Performance & Valuation

SIX shares have struggled to find their footing in 2022, down more than 50% and coming nowhere near the general market’s performance.

Image Source: Zacks Investment Research

Over the last three months, the adverse price action of SIX shares has continued, down more than 25% and again underperforming the S&P 500 in this timeframe also.

Image Source: Zacks Investment Research

Shares don’t appear stretched in terms of valuation; the company’s 1.2X forward price-to-sales ratio sits well beneath its 2.9X five-year median and represents a 15% discount relative to its Zacks sector average.

Six Flags sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish in their earnings outlook over the last several months, with five negative earnings estimate revisions hitting the tape. The Zacks Consensus EPS Estimate of $1.65 indicates a Y/Y decline in earnings of roughly 8.3%.

Image Source: Zacks Investment Research

The company’s top-line is also undergoing some turbulence; the Zacks Consensus Sales Estimate of $565.4 million suggests an 11.4% decline from year-ago quarterly sales of $638.3 million.

Quarterly Performance

SIX has primarily exceeded earnings estimates, with seven EPS beats across its last ten quarters. Still, the company fell short of earnings expectations by nearly 30% in its latest release.

Top-line results paint precisely the same story; the company has registered seven revenue beats across its last ten quarters but fell short of sales expectations by 16% in its latest quarter. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

SIX shares have underperformed the general market across several timeframes in 2022, indicating that sellers have been in control.

The company’s forward price-to-sales ratio resides beneath its five-year median and Zacks sector average.

Analysts have been bearish in their earnings outlook, with estimates suggesting declines in both revenue and earnings.

The company fell short of revenue and earnings expectations by a wide margin in its latest print, snapping a long streak of better-than-expected results.

Heading into the release, Six Flags Entertainment carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -3.3%.