We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

4 Stocks to Benefit from the Intensifying Global Energy Crisis

Read MoreHide Full Article

While energy prices have moderated significantly from their post-pandemic highs, there’s reason to believe that the crisis is far from over. A recent report from the International Energy Agency (IEA) has called this the “first truly global energy crisis.”

That is because geopolitics is exacerbating problems in an industry already battered by the pandemic. For consumers, especially in lower-income groups that spend a larger percentage of their wages on energy, it is a double whammy. Because whether they received free money during the pandemic or not, they’re certainly having to pay back as prices of everything, from food to gas, and housing to automotive have gone up. And now, the Fed is doing everything it can to further increase the pain. Because things have to get worse before they get better.

All their pain notwithstanding, this has been a windfall for American oil & gas companies that are positioned to keep raising prices while limiting production. The energy crisis has after all been building up over the years as oil companies continued to cut capacity even before clean energy was produced in quantities sufficient to replace it. And investors have been in favor of limited capacity because we’re talking about high-maintenance equipment that significantly hurts profitability when demand falls back.

But this year, the Biden administration had to release strategic reserves to bring prices down to sanity, so it was clear to all that some capacity increases were in order. And that is what we’re seeing now. It is likely to keep prices in the $70-$90 range possibly through most of 2023, which again will allow the government to replenish the strategic reserves. So whichever way we think about it, demand is not going away.

Globally, things are also supportive. If Russia had been a smaller player in this market, the disruption would have been of less consequence. But because of its position as the leading oil supplier, and also a major supplier of gas (to Europe), this has become such a big thing. In response to the West’s sanctions and their attempt to put a cap on Russian oil prices, Russia has said that it will reduce production by 7%. We don’t know how long it can keep doing this because higher prices of course hurt its customers.

However, another factor will come into play in 2023. And that is China. The Asian country has been in shutdowns through most of this year. So even if the US slows down a bit, China could start humming. Which will mean stronger demand (and pricing power) for these stocks.

Natural gas prices have fallen off a cliff, so there could be some moderate upside in that as well.

The IEA recommends increased spending on clean energy, not oil, meaning that the current crisis should continue until fossil fuel use, which has increased as a result of economic growth, peaks and then enters a phase of steady decline.

It predicts that “coal use falls back within the next few years, natural gas demand reaches a plateau by the end of the decade, and rising sales of electric vehicles (EVs) mean that oil demand levels off in the mid-2030s before ebbing slightly to mid-century."

However, in order to reach net zero emissions by 2050, clean energy investment needs to cross $4 trillion by 2030 while at the current levels, they can only get halfway there.

Bottom line, demand for oil will remain strong for the next several years and we may as well make the most of it by making some intelligent investments. See what I picked today-

Helmerich & Payne provides drilling services and solutions for oil exploration and production companies. It operates through three segments: North America Solutions, Offshore Gulf of Mexico and International Solutions.

The company’s fourth quarter earnings met the Zacks Consensus Estimate on revenue that beat by 6.8%.

In the last 60 days, estimates for its fiscal year 2023 and 2024 (ending in September) were raised by a respective 74 cents (19.9%) and 60 cents (12.4%). Analysts currently expect the company to generate revenue growth of 45.4% and 10.2% and earnings growth of 4,360% and 22.0% in the two years, respectively. The Zacks Rank #1 (Strong Buy) stock belongs to the Oil and Gas – Drilling industry (top 4% of Zacks-classified industries).

Management is optimistic about “significant momentum heading into fiscal 2023.” There are three significant factors investors should be encouraged about.

First of these is the Flexrig fleet that is making capital allocation more efficient. With this, there is minimal idle time for each rig because soon after a rig is released from one customer, it is re-contracted to another. This saves a lot in costs. Helmerich will also be reactivating 16 cold stacked rigs this year, for which it is entering into term contracts of at least 2 years. Roughly two-thirds of this is already committed with the majority going to large, publicly traded E&Ps, mostly in the first half of the fiscal year.

Second, rig pricing has been strong this year, which isn’t surprising given the energy crunch. But what’s particularly encouraging is that strong demand and term contract rollovers are expected to further raise average prices across the active fleet. Management is seeing significant momentum this fiscal year. Its technology products and automation solutions are clearly driving the strength in demand, since older rigs are not as effective any more.

International expansion and returning wealth to shareholders are also management priority.

NexTier Oilfield Solutions Inc.

NexTier Oilfield Solutions provides well completion and production services in active and other basins. The company operates through two segments, Completion Services, and Well Construction and Intervention Services.

In the last quarter, NexTier beat the Zacks Consensus Estimate by 6.5%. Revenue missed by 2.8%. Its 2023 earnings estimates have held steady in the last 60 days, but in the last 90 days they’ve increased 16 cents (7.8%). This represents earnings growth of 56.7% next year on revenue growth of 24.5%. The Zacks #1 ranked stock belongs to the Oil and Gas - Field Services industry (top 11%).

Management has talked about structural advantages that the company is benefiting from. The non-availability of fracking fleets is one of the primary bottlenecks restricting U.S. land production growth. Although new builds are supposed to increase the existing fleet count of 270 by around 25%, the excessive pressure from high demand and supply chain constraints on legacy fleets that were not built for the modern fracking job will take many off production. Fleets will thus remain in short supply. E&P companies are also keen on returning value to shareholders rather than building capacity.

Therefore, at year-end 2023, U.S. demand (1 million bpd, according to industry consensus, quoted by management) will continue to outstrip supply (1.5 million bpd), even if there is a moderate recession, with the mismatch likely to stay for at least the next 18 months.

While NexTier’s pricing will be higher in 2023, it will still be 10-15% off pre-pandemic levels. However, the company has taken advantage of the situation to renegotiate more advantageous commercial terms and locked in stronger partners. Meanwhile, its natural gas-powered equipment continues to fetch a better pricing because of the significant fuel cost advantage of natural gas. Therefore, these may be expected to remain active even in the event of a recession.

Patterson provides onshore contract drilling services to oil and natural gas operators in the United States and internationally. It operates through three segments: Contract Drilling Services, Pressure Pumping Services and Directional Drilling Services

The company reported very strong results in the last quarter with earnings beating the Zacks Consensus Estimate by 47.4% on sales that beat by 6.4%. The Zacks Consensus Estimate for 2023 has increased 26 cents (13.5%) in the last 60 days and represents earnings growth of 302.9%. Revenue growth is also expected to be extremely strong next year at 30.3%. The Zacks Rank #1 stock belongs to the Oil and Gas – Drilling industry (top 4%)

Strong results prompted management to increase the 2023 guidance for adjusted EBITDA and capex.

A recent survey conducted as a part of their 2023 planning process revealed that across the broad cross-section of Patterson’s 70 customers, including the largest super majors, to public independence and small private operators, there was great optimism about adding rigs. They currently plan to add 40 drilling rigs in the fourth quarter and another 50 in 2023. This is a positive indicator of business growth next year.

The company is taking advantage of the high demand for rigs to negotiate higher prices, while also increasing the number of rigs under term contracts, thus improving earnings visibility and increasing the prospects of steady cash flows. Its advanced gear, including a higher level of automation and lower emissions, is making it all possible.

Nine Energy Service is an onshore completion services provider to North American basins and internationally. It offers cementing; completion tools, such as liner hangers and accessories, fracture isolation packers, frac sleeves, stage one prep tools, frac plugs, casing flotation tools, etc.; as well as other services.

In the September quarter, its reported revenue was 8.6% ahead of the Zacks Consensus Estimate while earnings were 137.5% ahead. In the last 60 days, the Zacks Consensus Estimate increased by $1.15 (100.9%), representing a 301.8% increase in 2023 earnings. Analysts also expect solid revenue growth of 24.6%. The Zacks Rank #1 stock belongs to the Oil and Gas - Field Services industry (top 11%).

The positive environment that the above players are seeing is also reflected in Nine’s results. Management stated that most of the upside versus its guidance in the last quarter was driven by cementing and coiled tubing price increases as well as higher volumes of completion tools. Equipment and labor shortages continue to limit availability, which is why customers are willing to pay a higher price. Cement price increases over the last couple of years is however partially on account of the shortage of raw cement.

Nine holds a strong market share in the cementing and dissolvable plug segments. Its 20% share in cementing is helped by its innovative solutions in the face of raw material shortage and demand for lower emissions. Its dissolvable plug market share (it is one of four suppliers accounting for a 75% share) is secured by the high barriers to entry, as it involves advanced materials science that is not easy to replicate. This is also a fast-growing segment that management expects will grow 35% by the end of 2023.

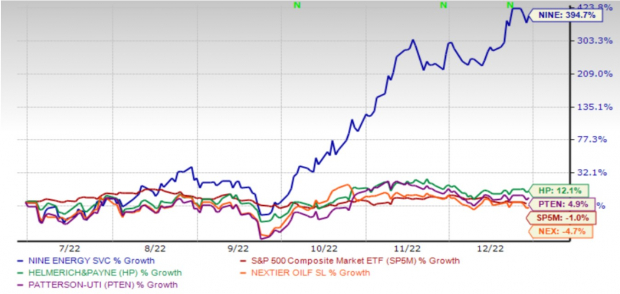

6-Month Price Performance

. Image Source: Zacks Investment Research

Zacks' 7 Best Strong Buy Stocks (New Research Report)

Valued at $99, click below to receive our just-released report predicting the 7 stocks that will soar highest in the coming month.

Image: Shutterstock

4 Stocks to Benefit from the Intensifying Global Energy Crisis

While energy prices have moderated significantly from their post-pandemic highs, there’s reason to believe that the crisis is far from over. A recent report from the International Energy Agency (IEA) has called this the “first truly global energy crisis.”

That is because geopolitics is exacerbating problems in an industry already battered by the pandemic. For consumers, especially in lower-income groups that spend a larger percentage of their wages on energy, it is a double whammy. Because whether they received free money during the pandemic or not, they’re certainly having to pay back as prices of everything, from food to gas, and housing to automotive have gone up. And now, the Fed is doing everything it can to further increase the pain. Because things have to get worse before they get better.

All their pain notwithstanding, this has been a windfall for American oil & gas companies that are positioned to keep raising prices while limiting production. The energy crisis has after all been building up over the years as oil companies continued to cut capacity even before clean energy was produced in quantities sufficient to replace it. And investors have been in favor of limited capacity because we’re talking about high-maintenance equipment that significantly hurts profitability when demand falls back.

But this year, the Biden administration had to release strategic reserves to bring prices down to sanity, so it was clear to all that some capacity increases were in order. And that is what we’re seeing now. It is likely to keep prices in the $70-$90 range possibly through most of 2023, which again will allow the government to replenish the strategic reserves. So whichever way we think about it, demand is not going away.

Globally, things are also supportive. If Russia had been a smaller player in this market, the disruption would have been of less consequence. But because of its position as the leading oil supplier, and also a major supplier of gas (to Europe), this has become such a big thing. In response to the West’s sanctions and their attempt to put a cap on Russian oil prices, Russia has said that it will reduce production by 7%. We don’t know how long it can keep doing this because higher prices of course hurt its customers.

However, another factor will come into play in 2023. And that is China. The Asian country has been in shutdowns through most of this year. So even if the US slows down a bit, China could start humming. Which will mean stronger demand (and pricing power) for these stocks.

Natural gas prices have fallen off a cliff, so there could be some moderate upside in that as well.

The IEA recommends increased spending on clean energy, not oil, meaning that the current crisis should continue until fossil fuel use, which has increased as a result of economic growth, peaks and then enters a phase of steady decline.

It predicts that “coal use falls back within the next few years, natural gas demand reaches a plateau by the end of the decade, and rising sales of electric vehicles (EVs) mean that oil demand levels off in the mid-2030s before ebbing slightly to mid-century."

However, in order to reach net zero emissions by 2050, clean energy investment needs to cross $4 trillion by 2030 while at the current levels, they can only get halfway there.

Bottom line, demand for oil will remain strong for the next several years and we may as well make the most of it by making some intelligent investments. See what I picked today-

Helmerich & Payne, Inc. (HP - Free Report)

Helmerich & Payne provides drilling services and solutions for oil exploration and production companies. It operates through three segments: North America Solutions, Offshore Gulf of Mexico and International Solutions.

The company’s fourth quarter earnings met the Zacks Consensus Estimate on revenue that beat by 6.8%.

In the last 60 days, estimates for its fiscal year 2023 and 2024 (ending in September) were raised by a respective 74 cents (19.9%) and 60 cents (12.4%). Analysts currently expect the company to generate revenue growth of 45.4% and 10.2% and earnings growth of 4,360% and 22.0% in the two years, respectively. The Zacks Rank #1 (Strong Buy) stock belongs to the Oil and Gas – Drilling industry (top 4% of Zacks-classified industries).

Management is optimistic about “significant momentum heading into fiscal 2023.” There are three significant factors investors should be encouraged about.

First of these is the Flexrig fleet that is making capital allocation more efficient. With this, there is minimal idle time for each rig because soon after a rig is released from one customer, it is re-contracted to another. This saves a lot in costs. Helmerich will also be reactivating 16 cold stacked rigs this year, for which it is entering into term contracts of at least 2 years. Roughly two-thirds of this is already committed with the majority going to large, publicly traded E&Ps, mostly in the first half of the fiscal year.

Second, rig pricing has been strong this year, which isn’t surprising given the energy crunch. But what’s particularly encouraging is that strong demand and term contract rollovers are expected to further raise average prices across the active fleet. Management is seeing significant momentum this fiscal year. Its technology products and automation solutions are clearly driving the strength in demand, since older rigs are not as effective any more.

International expansion and returning wealth to shareholders are also management priority.

NexTier Oilfield Solutions Inc.

NexTier Oilfield Solutions provides well completion and production services in active and other basins. The company operates through two segments, Completion Services, and Well Construction and Intervention Services.

In the last quarter, NexTier beat the Zacks Consensus Estimate by 6.5%. Revenue missed by 2.8%. Its 2023 earnings estimates have held steady in the last 60 days, but in the last 90 days they’ve increased 16 cents (7.8%). This represents earnings growth of 56.7% next year on revenue growth of 24.5%. The Zacks #1 ranked stock belongs to the Oil and Gas - Field Services industry (top 11%).

Management has talked about structural advantages that the company is benefiting from. The non-availability of fracking fleets is one of the primary bottlenecks restricting U.S. land production growth. Although new builds are supposed to increase the existing fleet count of 270 by around 25%, the excessive pressure from high demand and supply chain constraints on legacy fleets that were not built for the modern fracking job will take many off production. Fleets will thus remain in short supply. E&P companies are also keen on returning value to shareholders rather than building capacity.

Therefore, at year-end 2023, U.S. demand (1 million bpd, according to industry consensus, quoted by management) will continue to outstrip supply (1.5 million bpd), even if there is a moderate recession, with the mismatch likely to stay for at least the next 18 months.

While NexTier’s pricing will be higher in 2023, it will still be 10-15% off pre-pandemic levels. However, the company has taken advantage of the situation to renegotiate more advantageous commercial terms and locked in stronger partners. Meanwhile, its natural gas-powered equipment continues to fetch a better pricing because of the significant fuel cost advantage of natural gas. Therefore, these may be expected to remain active even in the event of a recession.

Patterson-UTI Energy, Inc. (PTEN - Free Report)

Patterson provides onshore contract drilling services to oil and natural gas operators in the United States and internationally. It operates through three segments: Contract Drilling Services, Pressure Pumping Services and Directional Drilling Services

The company reported very strong results in the last quarter with earnings beating the Zacks Consensus Estimate by 47.4% on sales that beat by 6.4%. The Zacks Consensus Estimate for 2023 has increased 26 cents (13.5%) in the last 60 days and represents earnings growth of 302.9%. Revenue growth is also expected to be extremely strong next year at 30.3%. The Zacks Rank #1 stock belongs to the Oil and Gas – Drilling industry (top 4%)

Strong results prompted management to increase the 2023 guidance for adjusted EBITDA and capex.

A recent survey conducted as a part of their 2023 planning process revealed that across the broad cross-section of Patterson’s 70 customers, including the largest super majors, to public independence and small private operators, there was great optimism about adding rigs. They currently plan to add 40 drilling rigs in the fourth quarter and another 50 in 2023. This is a positive indicator of business growth next year.

The company is taking advantage of the high demand for rigs to negotiate higher prices, while also increasing the number of rigs under term contracts, thus improving earnings visibility and increasing the prospects of steady cash flows. Its advanced gear, including a higher level of automation and lower emissions, is making it all possible.

Nine Energy Service, Inc. (NINE - Free Report)

Nine Energy Service is an onshore completion services provider to North American basins and internationally. It offers cementing; completion tools, such as liner hangers and accessories, fracture isolation packers, frac sleeves, stage one prep tools, frac plugs, casing flotation tools, etc.; as well as other services.

In the September quarter, its reported revenue was 8.6% ahead of the Zacks Consensus Estimate while earnings were 137.5% ahead. In the last 60 days, the Zacks Consensus Estimate increased by $1.15 (100.9%), representing a 301.8% increase in 2023 earnings. Analysts also expect solid revenue growth of 24.6%. The Zacks Rank #1 stock belongs to the Oil and Gas - Field Services industry (top 11%).

The positive environment that the above players are seeing is also reflected in Nine’s results. Management stated that most of the upside versus its guidance in the last quarter was driven by cementing and coiled tubing price increases as well as higher volumes of completion tools. Equipment and labor shortages continue to limit availability, which is why customers are willing to pay a higher price. Cement price increases over the last couple of years is however partially on account of the shortage of raw cement.

Nine holds a strong market share in the cementing and dissolvable plug segments. Its 20% share in cementing is helped by its innovative solutions in the face of raw material shortage and demand for lower emissions. Its dissolvable plug market share (it is one of four suppliers accounting for a 75% share) is secured by the high barriers to entry, as it involves advanced materials science that is not easy to replicate. This is also a fast-growing segment that management expects will grow 35% by the end of 2023.

6-Month Price Performance

.

Image Source: Zacks Investment Research