“Every moment is a golden one for he who has the vision to recognize it as such.” – Henry Miller

Gold is the shiny object that looks to offer exceptional potential in the near future.

Still, it should be remembered that investing in stocks builds greater wealth than any other traditional investing method. This is due to the fact that companies have the ability to grow and retain their earnings, increasing what is known as intrinsic value. We can think of intrinsic value as a measure of what an asset is worth.

Growth in intrinsic value creates economic value for shareholders. As a company’s intrinsic value grows, the true value of our stock investments increases. Ultimately, this is the reason why we invest in stocks and what separates stock investing from all other types of investments.

Growth in company intrinsic value has created trillions of dollars of economic value and is the foundation of a capitalist economy. As the intrinsic value of a company grows, that company can increase its production or services, which in turn creates more income.

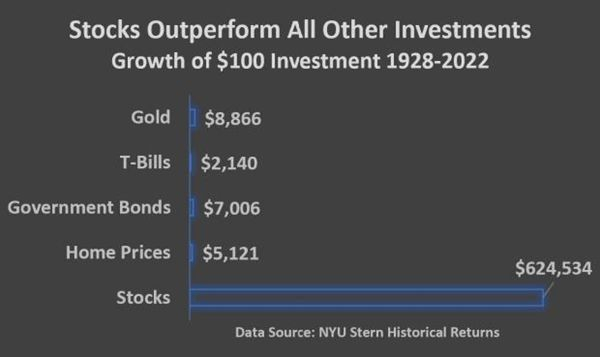

Below I’ve shared historical asset class returns. The graph compares the growth of a $100 investment dating back to 1928. The table reveals that stock investing outperforms all other asset classes over time by a wide margin. A meager $100 investment in stocks in 1928 grew to over $624,000 by 2022. As shown, a company's ability to increase their intrinsic value demonstrates that stocks provide the best profit opportunities.

Image Source: Zacks Investment Research

Establishing this fact is key to building a long-term asset allocation that can help us achieve our investment goals. But we must also understand that there will be periods of time (sometimes lengthy) where other asset classes will outperform. There’s no guarantee that what worked in one year will work the following year. In fact, over time I’ve found that the oft-forgotten, oversold areas of the market that underperformed in the past have strong potential – particularly at significant breakout levels.

That’s exactly where we find a certain asset class in the current investment landscape. As we’ll see, this particular investment is at a crucial level. And while it alone does not have the ability to create intrinsic value, many related stocks do – and they can trigger powerful upside momentum.

Golden Ages for Investors

While gold has underperformed over the long-term, there are significant periods of time when this shiny metal has outperformed by a wide margin. As we can see below, in the ten-year period ending August 2011, gold rose 562% - an annualized return of nearly 21% per year. Over the same time period, the S&P 500 delivered a total return of just 30.5% - including dividends!

Image Source: StockCharts

The returns for gold handily outperformed all other asset classes over this ten-year stretch. But we also know that stocks have the ability to create intrinsic value, and it is this fact that has enabled them to outperform all other investments. Let’s look at an individual gold stock over the same timeframe. We’ll call this gold company a Wealth Building Stock.

Image Source: StockCharts

Over the same ten-year period, this Wealth Building Stock delivered investors a 1,392% return! It is far more profitable to own stocks of companies that produce commodities than to own the commodities they produce. This example illustrates that the growth of intrinsic value for this Wealth Building Stock enabled the company to deliver a superior investment return compared to the underlying commodity.

Image Source: Zacks Investment Research

Intermarket Relationships: Gold and the Dollar

If we think of last year as the first half, we find that gold didn’t quite live up to its reputation as an inflation hedge. Generally speaking, precious metals have historically been viewed as a hedge against inflation and currency devaluation. Gold was relatively flat in 2022, and last year’s performance put a dent in the inflation hedge theory.

Changing intermarket relationships is an unpredictable risk, such as inflation not being a return driver for gold. But gold faced one major headwind last year that has now reversed course: a strong U.S. dollar.

The U.S. dollar went off the gold standard in 1971, and despite some short-term periods of strength, the dollar has been in a long-term downtrend ever since. The U.S. is the world’s largest debtor nation. As U.S. debt and deficits continue to balloon, they exert downward pressure on the dollar.

Gold and the dollar normally move in opposite directions. This inverse relationship is vital to understand. Gold protects investors from a falling dollar and can help us guard our wealth and maintain purchasing power as the long-term slide in the dollar continues. This dynamic is why gold has been known as a store of value and safe haven against the erosion of fiat currencies.

Sticking with the timeframe from our last example, note the inverse relationship between the U.S. dollar and gold prices:

Image Source: StockCharts

Gold Is Nearing a Major Long-Term Breakout

Shifting to the present, last year saw strength in the dollar and flat gold prices. But over the past few months we’ve seen a weaker dollar and higher gold. If we think of this year as the second half of this part of the cycle, a falling dollar now presents a major tailwind for gold prices moving forward.

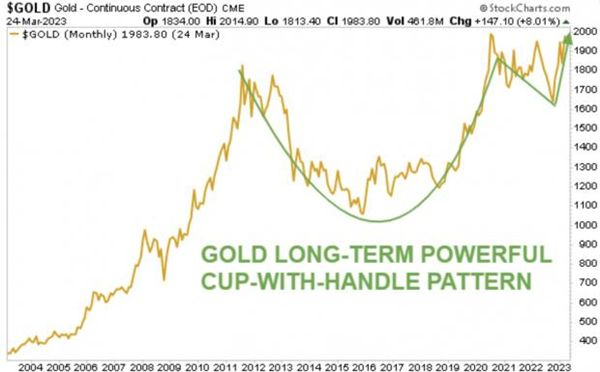

Gold is on the verge of a major long-term breakout, looking ready to ultimately surpass the 2011 levels we saw earlier. And if gold is your ‘cup of tea’, note the powerful cup-with-handle pattern that has taken place:

Image Source: StockCharts

A recent Financial Times article stated, “Central banks are scooping up gold at the fastest pace since 1967, with analysts pinning China and Russia as big buyers in an indication that some nations are keen to diversify their reserves away from the dollar.”

Gold is a unique precious metal known for its extreme durability, malleability, and heat and electricity conduction properties. Most investors are familiar with gold as an input for jewelry-making. The shiny metal is already up about 9% this year. As we know, gold stocks stand to benefit from higher gold prices, as growth in intrinsic value will allow their stocks to outperform.

Zacks Top 3 Stocks for the Coming Gold Rush

As the U.S. dollar reverses course from last year’s strength, the stage is now set for a long-term gold breakout. Gold could very well be in store for a period of outperformance, similar to the 2001-2011 decade.

The best way to take advantage of this move is via gold exploration and mining stocks. Unlike the underlying gold commodity, these stocks have the ability to create intrinsic value growth, which we know has enabled stocks to outperform all other traditional asset classes over time.

Click below, as I've been authorized to give you 3 serious Wealth-Builder Stocks with rising earnings estimates that are poised to bring gold from the earth to your portfolio:

Gold Stock #1: This precious metal producer is enjoying rampant growth throughout North and South America.

Gold Stock #2: With 23 operating mines and 13 developmental projects, this is one of the largest precious metals streaming companies in the world.

Gold Stock #3: Already red-hot, this future powerhouse is immersed in acquisition, exploration, development, and extraction.

But that’s not all.

You’ll also get full 30-day, real-time access to ALL Zacks’ private buys & sells as part of our celebrated Zacks Ultimate arrangement.

Don't miss your chance to follow our real-time moves from ready-to-fly stocks under $10, to professional options trades … from insider buys, to long-term value stocks …and from home run investments, to income recommendations. In fact, Zacks Ultimate closed 176 double- and triple-digit gains in 2022 alone.

Your cost for all this is only $1, and there’s not 1 cent of obligation to spend anything more.

Important: The number of investors who will see the gold stocks and many others must be limited. Your chance to take full advantage ends at midnight Thursday, April 13.

Click for Our Top 3 Gold Stocks and 30-day Zacks Ultimate trial >>

Cheers to Your Investing Success,

Bryan

Bryan Hayes, CFA manages our Zacks Income Investor and Headline Trader portfolios. He employs a combination of fundamental and technical analysis and has developed a unique approach to selecting stocks with the best profit potential. He invites you to follow all buys and sells from all Zacks trading and investing services for 30 days in our unique $1 Zacks Ultimate experience.

Image: Bigstock

Get Ahead of the Next Investor Gold Rush

“Every moment is a golden one for he who has the vision to recognize it as such.” – Henry Miller

Gold is the shiny object that looks to offer exceptional potential in the near future.

Still, it should be remembered that investing in stocks builds greater wealth than any other traditional investing method. This is due to the fact that companies have the ability to grow and retain their earnings, increasing what is known as intrinsic value. We can think of intrinsic value as a measure of what an asset is worth.

Growth in intrinsic value creates economic value for shareholders. As a company’s intrinsic value grows, the true value of our stock investments increases. Ultimately, this is the reason why we invest in stocks and what separates stock investing from all other types of investments.

Growth in company intrinsic value has created trillions of dollars of economic value and is the foundation of a capitalist economy. As the intrinsic value of a company grows, that company can increase its production or services, which in turn creates more income.

Below I’ve shared historical asset class returns. The graph compares the growth of a $100 investment dating back to 1928. The table reveals that stock investing outperforms all other asset classes over time by a wide margin. A meager $100 investment in stocks in 1928 grew to over $624,000 by 2022. As shown, a company's ability to increase their intrinsic value demonstrates that stocks provide the best profit opportunities.

Image Source: Zacks Investment Research

Establishing this fact is key to building a long-term asset allocation that can help us achieve our investment goals. But we must also understand that there will be periods of time (sometimes lengthy) where other asset classes will outperform. There’s no guarantee that what worked in one year will work the following year. In fact, over time I’ve found that the oft-forgotten, oversold areas of the market that underperformed in the past have strong potential – particularly at significant breakout levels.

That’s exactly where we find a certain asset class in the current investment landscape. As we’ll see, this particular investment is at a crucial level. And while it alone does not have the ability to create intrinsic value, many related stocks do – and they can trigger powerful upside momentum.

Golden Ages for Investors

While gold has underperformed over the long-term, there are significant periods of time when this shiny metal has outperformed by a wide margin. As we can see below, in the ten-year period ending August 2011, gold rose 562% - an annualized return of nearly 21% per year. Over the same time period, the S&P 500 delivered a total return of just 30.5% - including dividends!

Image Source: StockCharts

The returns for gold handily outperformed all other asset classes over this ten-year stretch. But we also know that stocks have the ability to create intrinsic value, and it is this fact that has enabled them to outperform all other investments. Let’s look at an individual gold stock over the same timeframe. We’ll call this gold company a Wealth Building Stock.

Image Source: StockCharts

Over the same ten-year period, this Wealth Building Stock delivered investors a 1,392% return! It is far more profitable to own stocks of companies that produce commodities than to own the commodities they produce. This example illustrates that the growth of intrinsic value for this Wealth Building Stock enabled the company to deliver a superior investment return compared to the underlying commodity.

Image Source: Zacks Investment Research

Intermarket Relationships: Gold and the Dollar

If we think of last year as the first half, we find that gold didn’t quite live up to its reputation as an inflation hedge. Generally speaking, precious metals have historically been viewed as a hedge against inflation and currency devaluation. Gold was relatively flat in 2022, and last year’s performance put a dent in the inflation hedge theory.

Changing intermarket relationships is an unpredictable risk, such as inflation not being a return driver for gold. But gold faced one major headwind last year that has now reversed course: a strong U.S. dollar.

The U.S. dollar went off the gold standard in 1971, and despite some short-term periods of strength, the dollar has been in a long-term downtrend ever since. The U.S. is the world’s largest debtor nation. As U.S. debt and deficits continue to balloon, they exert downward pressure on the dollar.

Gold and the dollar normally move in opposite directions. This inverse relationship is vital to understand. Gold protects investors from a falling dollar and can help us guard our wealth and maintain purchasing power as the long-term slide in the dollar continues. This dynamic is why gold has been known as a store of value and safe haven against the erosion of fiat currencies.

Sticking with the timeframe from our last example, note the inverse relationship between the U.S. dollar and gold prices:

Image Source: StockCharts

Gold Is Nearing a Major Long-Term Breakout

Shifting to the present, last year saw strength in the dollar and flat gold prices. But over the past few months we’ve seen a weaker dollar and higher gold. If we think of this year as the second half of this part of the cycle, a falling dollar now presents a major tailwind for gold prices moving forward.

Gold is on the verge of a major long-term breakout, looking ready to ultimately surpass the 2011 levels we saw earlier. And if gold is your ‘cup of tea’, note the powerful cup-with-handle pattern that has taken place:

Image Source: StockCharts

A recent Financial Times article stated, “Central banks are scooping up gold at the fastest pace since 1967, with analysts pinning China and Russia as big buyers in an indication that some nations are keen to diversify their reserves away from the dollar.”

Gold is a unique precious metal known for its extreme durability, malleability, and heat and electricity conduction properties. Most investors are familiar with gold as an input for jewelry-making. The shiny metal is already up about 9% this year. As we know, gold stocks stand to benefit from higher gold prices, as growth in intrinsic value will allow their stocks to outperform.

Zacks Top 3 Stocks for the Coming Gold Rush

As the U.S. dollar reverses course from last year’s strength, the stage is now set for a long-term gold breakout. Gold could very well be in store for a period of outperformance, similar to the 2001-2011 decade.

The best way to take advantage of this move is via gold exploration and mining stocks. Unlike the underlying gold commodity, these stocks have the ability to create intrinsic value growth, which we know has enabled stocks to outperform all other traditional asset classes over time.

Click below, as I've been authorized to give you 3 serious Wealth-Builder Stocks with rising earnings estimates that are poised to bring gold from the earth to your portfolio:

Gold Stock #1: This precious metal producer is enjoying rampant growth throughout North and South America.

Gold Stock #2: With 23 operating mines and 13 developmental projects, this is one of the largest precious metals streaming companies in the world.

Gold Stock #3: Already red-hot, this future powerhouse is immersed in acquisition, exploration, development, and extraction.

But that’s not all.

You’ll also get full 30-day, real-time access to ALL Zacks’ private buys & sells as part of our celebrated Zacks Ultimate arrangement.

Don't miss your chance to follow our real-time moves from ready-to-fly stocks under $10, to professional options trades … from insider buys, to long-term value stocks …and from home run investments, to income recommendations. In fact, Zacks Ultimate closed 176 double- and triple-digit gains in 2022 alone.

Your cost for all this is only $1, and there’s not 1 cent of obligation to spend anything more.

Important: The number of investors who will see the gold stocks and many others must be limited. Your chance to take full advantage ends at midnight Thursday, April 13.

Click for Our Top 3 Gold Stocks and 30-day Zacks Ultimate trial >>

Cheers to Your Investing Success,

Bryan

Bryan Hayes, CFA manages our Zacks Income Investor and Headline Trader portfolios. He employs a combination of fundamental and technical analysis and has developed a unique approach to selecting stocks with the best profit potential. He invites you to follow all buys and sells from all Zacks trading and investing services for 30 days in our unique $1 Zacks Ultimate experience.