We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Regions Financial (RF) Rides on Loan Growth, High Costs Ail

Read MoreHide Full Article

Regions Financial Corp. (RF - Free Report) is well-poised for revenue growth on the back of steady loan growth. The company’s capital distribution activities are backed by a strong liquidity profile. However, elevated expenses and lack of loan portfolio diversification remain near-term concerns.

The company currently operates in strategic markets with strong economic and business trends, which are likely to propel loan growth for the bank. In fact, over the past five years (ended 2023), the metric witnessed a compound annual growth rate (CAGR) of 3.4%. Management expects low single-digit average loan growth for 2024.

Driven by solid loan balance and high interest rates, both net interest income (NII) and net interest margin witnessed improvement in the past. NII saw a CAGR of 7.3% over the past five years, ending 2023. While loan growth will support spread income, a rise in deposit costs is likely to affect the metric in the near term.

In 2021, the bank acquired Clearsight, Sabal Capital and EnerBank USA for revenue diversification. Regions Financial continues to explore opportunities for bolt-on acquisition and enhancing wealth management capabilities. By committing to diversifying revenue streams and meeting customer needs via diverse services, we believe such endeavors will likely support its growth prospects in the long term.

Regions Financial boosts shareholder value through its capital-deployment activities. In July 2023, RF raised its quarterly common stock dividend by 20% to 24 cents per share. Under its $2.5 billion share repurchase program, as of the end of 2023, $2.2 billion remained available for buyback through the fourth quarter of 2024. Given the company’s robust liquidity, its capital deployment activities seem sustainable and will drive investors’ confidence in the stock.

Regions Financial prioritizes investment in talent and technology to support growth. The company introduced digital platforms and redesigned mobile apps for its business clients in order to grow active users of mobile banking and increase digital sales.

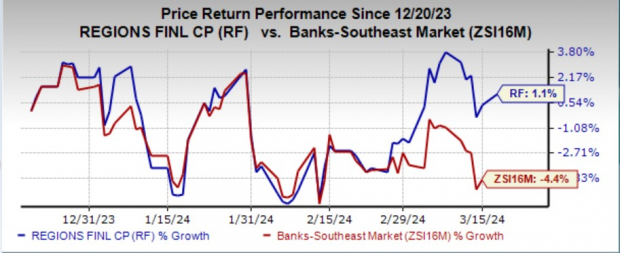

RF currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 1.1% over the past six months against the industry’s decline of 4.4%. Image Source: Zacks Investment Research

Despite the above-mentioned tailwinds, the company continues to record an increase in expenses. Non-interest expenses witnessed a CAGR of 4.3% between 2018 and 2023. The rise was primarily due to an increase in salaries and employee benefit expenses and other expenses. A rising expense base is likely to hurt the bottom line in the near term.

Regions Financial’s mortgage income, which is a key component of its non-interest income, witnessed a negative CAGR of 4.5% over the 2018-2023 period. The decrease in 2023 was mainly due to lower mortgage production and sales as a result of higher market interest rates. Moreover, high mortgage rates are likely to continue affecting residential first mortgage loan origination volume and margins in the upcoming period, further restricting mortgage income.

As of Dec 31, 2023, the company’s total commercial loans comprise 57% of its total loan portfolio. In the recent quarters, the company witnessed pressure in the commercial loan portfolio due to the rapidly changing macroeconomic backdrop and high interest rates. Going forward, in case of any economic downturn, the asset quality of the loan category may deteriorate. Thus, the lack of loan portfolio diversification is likely to hurt the company’s financials if the economic situation worsens.

Stocks to Consider

Some better-ranked bank stocks worth mentioning are Simmons First National Corp. (SFNC - Free Report) and Third Coast Bancshares, Inc. (TCBX - Free Report) .

Simmon First’s 2024 earnings estimates have been revised 7.6% upward in the past 60 days. The company’s shares have gained 8.1% over the past six months. At present, SFNC sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Third Coast Bancshares’ 2024 earnings estimates have moved north by 13.8% in the past 60 days. The stock has gained 7.8% over the past six months. Currently, TCBX sports a Zacks Rank #1.

Zacks' 7 Best Strong Buy Stocks (New Research Report)

Valued at $99, click below to receive our just-released report predicting the 7 stocks that will soar highest in the coming month.

Image: Bigstock

Regions Financial (RF) Rides on Loan Growth, High Costs Ail

Regions Financial Corp. (RF - Free Report) is well-poised for revenue growth on the back of steady loan growth. The company’s capital distribution activities are backed by a strong liquidity profile. However, elevated expenses and lack of loan portfolio diversification remain near-term concerns.

The company currently operates in strategic markets with strong economic and business trends, which are likely to propel loan growth for the bank. In fact, over the past five years (ended 2023), the metric witnessed a compound annual growth rate (CAGR) of 3.4%. Management expects low single-digit average loan growth for 2024.

Driven by solid loan balance and high interest rates, both net interest income (NII) and net interest margin witnessed improvement in the past. NII saw a CAGR of 7.3% over the past five years, ending 2023. While loan growth will support spread income, a rise in deposit costs is likely to affect the metric in the near term.

In 2021, the bank acquired Clearsight, Sabal Capital and EnerBank USA for revenue diversification. Regions Financial continues to explore opportunities for bolt-on acquisition and enhancing wealth management capabilities. By committing to diversifying revenue streams and meeting customer needs via diverse services, we believe such endeavors will likely support its growth prospects in the long term.

Regions Financial boosts shareholder value through its capital-deployment activities. In July 2023, RF raised its quarterly common stock dividend by 20% to 24 cents per share. Under its $2.5 billion share repurchase program, as of the end of 2023, $2.2 billion remained available for buyback through the fourth quarter of 2024. Given the company’s robust liquidity, its capital deployment activities seem sustainable and will drive investors’ confidence in the stock.

Regions Financial prioritizes investment in talent and technology to support growth. The company introduced digital platforms and redesigned mobile apps for its business clients in order to grow active users of mobile banking and increase digital sales.

RF currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 1.1% over the past six months against the industry’s decline of 4.4%.

Image Source: Zacks Investment Research

Despite the above-mentioned tailwinds, the company continues to record an increase in expenses. Non-interest expenses witnessed a CAGR of 4.3% between 2018 and 2023. The rise was primarily due to an increase in salaries and employee benefit expenses and other expenses. A rising expense base is likely to hurt the bottom line in the near term.

Regions Financial’s mortgage income, which is a key component of its non-interest income, witnessed a negative CAGR of 4.5% over the 2018-2023 period. The decrease in 2023 was mainly due to lower mortgage production and sales as a result of higher market interest rates. Moreover, high mortgage rates are likely to continue affecting residential first mortgage loan origination volume and margins in the upcoming period, further restricting mortgage income.

As of Dec 31, 2023, the company’s total commercial loans comprise 57% of its total loan portfolio. In the recent quarters, the company witnessed pressure in the commercial loan portfolio due to the rapidly changing macroeconomic backdrop and high interest rates. Going forward, in case of any economic downturn, the asset quality of the loan category may deteriorate. Thus, the lack of loan portfolio diversification is likely to hurt the company’s financials if the economic situation worsens.

Stocks to Consider

Some better-ranked bank stocks worth mentioning are Simmons First National Corp. (SFNC - Free Report) and Third Coast Bancshares, Inc. (TCBX - Free Report) .

Simmon First’s 2024 earnings estimates have been revised 7.6% upward in the past 60 days. The company’s shares have gained 8.1% over the past six months. At present, SFNC sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Third Coast Bancshares’ 2024 earnings estimates have moved north by 13.8% in the past 60 days. The stock has gained 7.8% over the past six months. Currently, TCBX sports a Zacks Rank #1.