We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Navient (NAVI) Rides on Loan Growth Amid High Debt Levels

Read MoreHide Full Article

Navient Corporation’s (NAVI - Free Report) focus on in-school originations and recurring revenue business model will aid its top-line growth. Also, its effective cost-control initiatives have been working well. However, limited servicing fee growth opportunities, unmanageable debt levels and unsustainable capital distributions are major concerns.

The company has been focused on boosting its loan volumes through in-school originations, with reduced acquisition costs in 2023. Management expects 10% growth in its in-school originations in 2024. While high interest rates have limited demand for refinance loans, the origination volumes for the same are likely to rebound with the resumption of direct federal loan repayments from October 2023. Management expects new refinance loan originations of approximately $1 billion in 2024.

Navient’s recurring revenue business model enhances top-line growth. The company’s education loan portfolio generates significant cash flows. Projections for undiscounted cash flows from Federal Education Loans and Consumer Lending are $6.2 billion and $6.7 billion, respectively, over the next 20 years.

The company’s expenses witnessed a negative compound annual growth rate of 4.9% over the last four years (ended 2023). In January 2024, it announced plans to undertake strategic initiatives, including three major actions to reduce its overall cost. Such moves are likely to reduce its expense base, thereby aiding bottom-line growth.

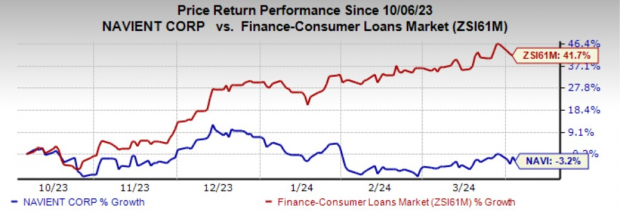

NAVI currently carries a Zacks Rank #3 (Hold). Over the past six months, shares of NAVI have lost 3.2% against the industry’s growth of 41.7%. Image Source: Zacks Investment Research

However, Navient’s top line is under pressure, given its limited growth opportunities. After receiving all necessary approvals in October 2021, the company transferred all its ED servicing contracts to Maximus. Servicing revenues declined $91 million and $13 million year over year in 2022 and 2023, respectively. Also, if NAVI fails to acquire new loans or expand or develop alternative sources of revenues, its fee income is likely to be under pressure.

As of Dec 31, 2023, Navient held total debt worth $57.63 billion, while cash and cash equivalents were $839 million. Given such a high debt burden compared with the available cash levels, it may fail to continue meeting debt obligations in the future. Also, the firm’s capital distribution activities might not be sustainable in the long term.

Additionally, interest earned on FFELP and private education loans are indexed to one-month LIBOR rates and either one-month LIBOR rates or the one-month Prime rate, respectively, whereas the cost of funds is primarily indexed to three-month LIBOR rates. During the current high interest rate environment, this difference in timing may create pressure on the net interest margin for Federal Education Loans and Consumer Lending segments. Relatively, high interest rates will lower Navient’s floor income, affecting margins.

Stocks to Consider

Some better-ranked finance stocks worth mentioning are Mr. Cooper Group Inc. (COOP - Free Report) and Sallie Mae (SLM - Free Report) .

Mr. Cooper Group’s earnings estimates for the current year have been revised upward by 3% in the past 30 days. The company’s shares have gained 39.5% over the past six months. At present, COOP sports a Zacks Rank #1 (Strong Buy). You can see see the complete list of today’s Zacks Rank #1 stocks here.

Sallie Mae’s 2024 earnings estimates have moved slightly upward in the past 60 days. The stock has gained 59.5% over the past six months. Currently, SLM carries a Zacks Rank #2 (Buy).

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Navient (NAVI) Rides on Loan Growth Amid High Debt Levels

Navient Corporation’s (NAVI - Free Report) focus on in-school originations and recurring revenue business model will aid its top-line growth. Also, its effective cost-control initiatives have been working well. However, limited servicing fee growth opportunities, unmanageable debt levels and unsustainable capital distributions are major concerns.

The company has been focused on boosting its loan volumes through in-school originations, with reduced acquisition costs in 2023. Management expects 10% growth in its in-school originations in 2024. While high interest rates have limited demand for refinance loans, the origination volumes for the same are likely to rebound with the resumption of direct federal loan repayments from October 2023. Management expects new refinance loan originations of approximately $1 billion in 2024.

Navient’s recurring revenue business model enhances top-line growth. The company’s education loan portfolio generates significant cash flows. Projections for undiscounted cash flows from Federal Education Loans and Consumer Lending are $6.2 billion and $6.7 billion, respectively, over the next 20 years.

The company’s expenses witnessed a negative compound annual growth rate of 4.9% over the last four years (ended 2023). In January 2024, it announced plans to undertake strategic initiatives, including three major actions to reduce its overall cost. Such moves are likely to reduce its expense base, thereby aiding bottom-line growth.

NAVI currently carries a Zacks Rank #3 (Hold). Over the past six months, shares of NAVI have lost 3.2% against the industry’s growth of 41.7%.

Image Source: Zacks Investment Research

However, Navient’s top line is under pressure, given its limited growth opportunities. After receiving all necessary approvals in October 2021, the company transferred all its ED servicing contracts to Maximus. Servicing revenues declined $91 million and $13 million year over year in 2022 and 2023, respectively. Also, if NAVI fails to acquire new loans or expand or develop alternative sources of revenues, its fee income is likely to be under pressure.

As of Dec 31, 2023, Navient held total debt worth $57.63 billion, while cash and cash equivalents were $839 million. Given such a high debt burden compared with the available cash levels, it may fail to continue meeting debt obligations in the future. Also, the firm’s capital distribution activities might not be sustainable in the long term.

Additionally, interest earned on FFELP and private education loans are indexed to one-month LIBOR rates and either one-month LIBOR rates or the one-month Prime rate, respectively, whereas the cost of funds is primarily indexed to three-month LIBOR rates. During the current high interest rate environment, this difference in timing may create pressure on the net interest margin for Federal Education Loans and Consumer Lending segments. Relatively, high interest rates will lower Navient’s floor income, affecting margins.

Stocks to Consider

Some better-ranked finance stocks worth mentioning are Mr. Cooper Group Inc. (COOP - Free Report) and Sallie Mae (SLM - Free Report) .

Mr. Cooper Group’s earnings estimates for the current year have been revised upward by 3% in the past 30 days. The company’s shares have gained 39.5% over the past six months. At present, COOP sports a Zacks Rank #1 (Strong Buy). You can see see the complete list of today’s Zacks Rank #1 stocks here.

Sallie Mae’s 2024 earnings estimates have moved slightly upward in the past 60 days. The stock has gained 59.5% over the past six months. Currently, SLM carries a Zacks Rank #2 (Buy).