We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

T. Rowe Price (TROW) and Ascensus Team Up for 529 Business

Read MoreHide Full Article

T. Rowe Price Group, Inc. (TROW - Free Report) has announced a partnership with Ascensus to support its 529 business. This collaboration aims to strengthen the company’s commitment to enhancing the education savings journey for 529 account owners.

529 education savings accounts are designed to enable customers to contribute funds tax-efficiently for expenses related to public or private college, technical/vocational schools, apprenticeship programs, education loan repayment, and certain primary and secondary school costs.

Ascensus, a market-leading enabler of tax-advantaged savings, provides technology, services and expertise to help people save for a better future. As of Mar 31, 2024, the firm had more than $808 billion in assets under administration, along with 5,500 employees. Ascensus serves 6.5 million users through its industry-leading servicing technology. Also, the firm is the largest recordkeeper and third-party administrator of state-sponsored education savings programs in the United States. Consequently, Ascensus became TROW's best choice in the market.

The partnership is set to improve the online platform and mobile experience for 529 plan account holders. This collaboration will also ensure strong investment management while maintaining a high level of security that safeguards customers’ personal information.

Some other benefits include an explicitly designed mobile app for the users to manage their accounts from anywhere at any time. A user-friendly website to simplify customer experience and personalized features is set to drive better outcomes. Additionally, there is a simple and secure gifting platform with improved gift-tracking capabilities, along with the option to make effortless direct electronic payments to more than 800 educational institutions.

As part of this collaboration, TROW will remain as the investment and program manager for its four highly successful state-sponsored 529 plans, while Ascensus will take over recordkeeping and account servicing duties for these plans. At present, the company manages more than 675,000 account owners.

Phil Korenman, head of the Individual Investors division at T. Rowe Price, stated, "This partnership complements and expands our servicing capabilities and it will deliver an enhanced experience for account owners. We share a passion for instilling confidence in the families we help in pursuit of their education savings goals."

Peg Creonte, president of Ascensus Government Savings, said, "T. Rowe Price is one of the most respected investment management firms in the world and a highly successful program manager for 529 plans. It's a great fit for our world-class service and advanced technology, including mobile capabilities, 529 gifting, and payment integration with schools nationwide."

Given the efforts to strengthen its core business and provide secured online services, T. Rowe Price is likely to stand out among its peers and have a competitive edge. Additionally, in other efforts to grow its business, TROW acquired Retiree, a fintech firm providing innovative retirement income planning software, in 2023. This move expanded its existing retirement capabilities, enabling a comprehensive suite of retirement income solutions for investors and practitioner tools for financial professionals.

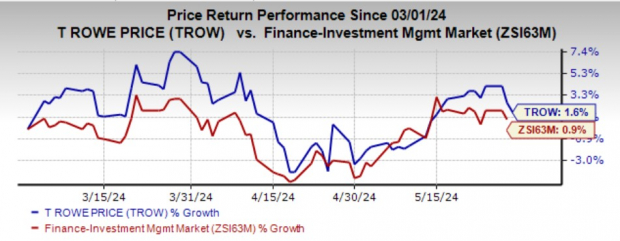

Over the past three months, shares of TROW have gained 1.6% compared with the industry’s growth of 0.9%.

Earlier this week, Stifel Financial Corp (SF - Free Report) and Marex Group PLC (MRX) entered into a prime brokerage referral partnership. This will enable both firms to use their broker-dealer affiliates to cater to their hedge fund and investment management clients in a better way.

Under the terms of the partnership, SF’s institutional sales and trading group will provide MRX’s trading and execution capabilities to its hedge fund’s institutional clients and investment managers. The services that will be part of this include multi-asset-class custody, financing, securities lending and capital introduction. On the other hand, Marex’s institutional client base will gain accessibility to SF’s sophisticated research, banking and corporate access offerings.

Last week, KKR & Co. Inc. (KKR - Free Report) entered into a strategic partnership with Capital Group to augment alternative investment solutions for client portfolios. This move aims to make hybrid public-private market investment solutions available to investors across asset classes, channels and geographies.

The first two strategies are anticipated to be launched in the United States next year, incorporating public-private fixed-income offerings designed for finance professionals as well as for their clients. This strategic initiative by KKR and Capital Group paves the way for many finance professionals and their clients to access alternative investments and include them in their portfolios.

Unique Zacks Analysis of Your Chosen Ticker

Pick one free report - opportunity may be withdrawn at any time

Image: Shutterstock

T. Rowe Price (TROW) and Ascensus Team Up for 529 Business

T. Rowe Price Group, Inc. (TROW - Free Report) has announced a partnership with Ascensus to support its 529 business. This collaboration aims to strengthen the company’s commitment to enhancing the education savings journey for 529 account owners.

529 education savings accounts are designed to enable customers to contribute funds tax-efficiently for expenses related to public or private college, technical/vocational schools, apprenticeship programs, education loan repayment, and certain primary and secondary school costs.

Ascensus, a market-leading enabler of tax-advantaged savings, provides technology, services and expertise to help people save for a better future. As of Mar 31, 2024, the firm had more than $808 billion in assets under administration, along with 5,500 employees. Ascensus serves 6.5 million users through its industry-leading servicing technology. Also, the firm is the largest recordkeeper and third-party administrator of state-sponsored education savings programs in the United States. Consequently, Ascensus became TROW's best choice in the market.

The partnership is set to improve the online platform and mobile experience for 529 plan account holders. This collaboration will also ensure strong investment management while maintaining a high level of security that safeguards customers’ personal information.

Some other benefits include an explicitly designed mobile app for the users to manage their accounts from anywhere at any time. A user-friendly website to simplify customer experience and personalized features is set to drive better outcomes. Additionally, there is a simple and secure gifting platform with improved gift-tracking capabilities, along with the option to make effortless direct electronic payments to more than 800 educational institutions.

As part of this collaboration, TROW will remain as the investment and program manager for its four highly successful state-sponsored 529 plans, while Ascensus will take over recordkeeping and account servicing duties for these plans. At present, the company manages more than 675,000 account owners.

Phil Korenman, head of the Individual Investors division at T. Rowe Price, stated, "This partnership complements and expands our servicing capabilities and it will deliver an enhanced experience for account owners. We share a passion for instilling confidence in the families we help in pursuit of their education savings goals."

Peg Creonte, president of Ascensus Government Savings, said, "T. Rowe Price is one of the most respected investment management firms in the world and a highly successful program manager for 529 plans. It's a great fit for our world-class service and advanced technology, including mobile capabilities, 529 gifting, and payment integration with schools nationwide."

Given the efforts to strengthen its core business and provide secured online services, T. Rowe Price is likely to stand out among its peers and have a competitive edge. Additionally, in other efforts to grow its business, TROW acquired Retiree, a fintech firm providing innovative retirement income planning software, in 2023. This move expanded its existing retirement capabilities, enabling a comprehensive suite of retirement income solutions for investors and practitioner tools for financial professionals.

Over the past three months, shares of TROW have gained 1.6% compared with the industry’s growth of 0.9%.

Image Source: Zacks Investment Research

Currently, TROW sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Finance Stocks Taking Similar Steps:

Earlier this week, Stifel Financial Corp (SF - Free Report) and Marex Group PLC (MRX) entered into a prime brokerage referral partnership. This will enable both firms to use their broker-dealer affiliates to cater to their hedge fund and investment management clients in a better way.

Under the terms of the partnership, SF’s institutional sales and trading group will provide MRX’s trading and execution capabilities to its hedge fund’s institutional clients and investment managers. The services that will be part of this include multi-asset-class custody, financing, securities lending and capital introduction. On the other hand, Marex’s institutional client base will gain accessibility to SF’s sophisticated research, banking and corporate access offerings.

Last week, KKR & Co. Inc. (KKR - Free Report) entered into a strategic partnership with Capital Group to augment alternative investment solutions for client portfolios. This move aims to make hybrid public-private market investment solutions available to investors across asset classes, channels and geographies.

The first two strategies are anticipated to be launched in the United States next year, incorporating public-private fixed-income offerings designed for finance professionals as well as for their clients. This strategic initiative by KKR and Capital Group paves the way for many finance professionals and their clients to access alternative investments and include them in their portfolios.