We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Wells Fargo (WFC) Unveils New Credit Card With Cashback Feature

Read MoreHide Full Article

Wells Fargo & Company (WFC - Free Report) , together with Mastercard, announced the launch of the Attune World Elite Mastercard. The latest credit card offers unlimited 4% cash rewards on all eligible purchases, without any annual fee.

The card is intended to reward cardholders for purchases that benefit their health, pets and the planet around them.

Attune World Elite Mastercard holders can enjoy 4% cash rewards on fitness and wellness, like gym memberships, exercise classes, salons and spas. Additionally, cardholders can earn 4% cash rewards on selected sports, recreation and entertainment, which includes live shows and sporting events, gardening and floral stores, as well as pet supplies, boarding and grooming. The card also provides 4% cash rewards on purchases like public transit, EV charging stations and selected thrift stores with an additional 1% reward on other purchases.

Additional sparks comprise security benefits, including Mastercard Global Service, Mastercard ID Theft Protection and Zero Liability Protection, along with additional Mastercard travel benefits like Concierge Service and Mastercard Travel & Lifestyle Services.

Additionally, the cardholders have the opportunity to earn a $100 cash bonus on spending of $500 in qualifying purchases, within the first three months. For a limited time, WFC will also donate $50 to Capital Link for each cardholder who qualifies for the welcome bonus.

For investors’ note, Capital Link is a national non-profit organization, dedicated to creating clean energy solutions for health centers, particularly in supporting local communities during power outages.

Wells Fargo’s management commented, “We are thrilled to unveil the new Attune World Elite Mastercard, a product that is sure to stand out in the marketplace,” management also added “Attune was designed with the intention of rewarding cardholders for making purchases they are most passionate about. Whether it’s enjoying a live concert, taking public transit, exploring thrift shops, hitting the gym, or relaxing at a spa, the Attune card aligns with customers’ many interests.”

John Levitsky, president of U.S. Financial Institutions at Mastercard, stated, “We’re excited to partner with Wells Fargo to bring Mastercard’s best-in-class World Elite benefits to the new Attune Card program”. He further added, “Consumers can check out seamlessly, with the confidence of safety and security with every transaction, while earning rewards for activities that fuel their well-being.”

WFC currently offers nine different types of credit cards to its customers. These cards provide a unique set of benefits to its target audience. The bank is actively introducing attractive products to expand its credit card offerings.

In May 2024, WFC unveiled a new credit card called Signify Business Cash World Elite Mastercard. The new business credit card offers 2% unlimited cash rewards on business purchases. In March 2024, WFC launched Autograph Journey, which is designed for frequent travelers. The card allows cardholders to earn reward points from wherever they book travel.

Higher loan balances, an increase in point-of-sale volume and new account growth have aided credit card revenues for WFC in the first quarter of 2024. Identifying the right customers and strategically introducing new credit card products are set to position Wells Fargo for long-term success in the card business.

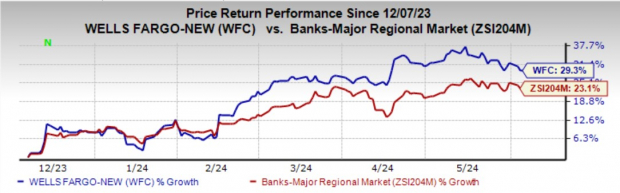

Over the past six months, shares of WFC have gained 29.3% compared with the industry’s 23.1% growth.

In May, The PNC Financial Services Group, Inc. (PNC - Free Report) launched the PNC Cash Unlimited Visa Signature credit card. The credit card offers simple but valuable rewards with an unlimited 2% cash back on all eligible purchases. The cashback earned has no expiry date, allowing the cardholders to redeem it whenever they like.

During the first year, PNC’s card offers a low Introductory annual percentage rate for transfers of balance and eligible purchases. Also, the card does not hold any annual fee or extra charges for foreign transactions.

Similarly, Citigroup Inc. (C - Free Report) introduced the Citi Strata Premier Card, an upgraded version of the current Citi Premier Card. The latest version of the card offers additional travel rewards and enhanced travel protections.

C’s cardholders will be entitled to earn 10 ThankYou points for every $1 spent on hotels, car rentals and attractions booked through the Citi Travel site. Similarly, customers can earn three ThankYou Points for every $1 spent at EV charging stations.

Unique Zacks Analysis of Your Chosen Ticker

Pick one free report - opportunity may be withdrawn at any time

Image: Bigstock

Wells Fargo (WFC) Unveils New Credit Card With Cashback Feature

Wells Fargo & Company (WFC - Free Report) , together with Mastercard, announced the launch of the Attune World Elite Mastercard. The latest credit card offers unlimited 4% cash rewards on all eligible purchases, without any annual fee.

The card is intended to reward cardholders for purchases that benefit their health, pets and the planet around them.

Attune World Elite Mastercard holders can enjoy 4% cash rewards on fitness and wellness, like gym memberships, exercise classes, salons and spas. Additionally, cardholders can earn 4% cash rewards on selected sports, recreation and entertainment, which includes live shows and sporting events, gardening and floral stores, as well as pet supplies, boarding and grooming. The card also provides 4% cash rewards on purchases like public transit, EV charging stations and selected thrift stores with an additional 1% reward on other purchases.

Additional sparks comprise security benefits, including Mastercard Global Service, Mastercard ID Theft Protection and Zero Liability Protection, along with additional Mastercard travel benefits like Concierge Service and Mastercard Travel & Lifestyle Services.

Additionally, the cardholders have the opportunity to earn a $100 cash bonus on spending of $500 in qualifying purchases, within the first three months. For a limited time, WFC will also donate $50 to Capital Link for each cardholder who qualifies for the welcome bonus.

For investors’ note, Capital Link is a national non-profit organization, dedicated to creating clean energy solutions for health centers, particularly in supporting local communities during power outages.

Wells Fargo’s management commented, “We are thrilled to unveil the new Attune World Elite Mastercard, a product that is sure to stand out in the marketplace,” management also added “Attune was designed with the intention of rewarding cardholders for making purchases they are most passionate about. Whether it’s enjoying a live concert, taking public transit, exploring thrift shops, hitting the gym, or relaxing at a spa, the Attune card aligns with customers’ many interests.”

John Levitsky, president of U.S. Financial Institutions at Mastercard, stated, “We’re excited to partner with Wells Fargo to bring Mastercard’s best-in-class World Elite benefits to the new Attune Card program”. He further added, “Consumers can check out seamlessly, with the confidence of safety and security with every transaction, while earning rewards for activities that fuel their well-being.”

WFC currently offers nine different types of credit cards to its customers. These cards provide a unique set of benefits to its target audience. The bank is actively introducing attractive products to expand its credit card offerings.

In May 2024, WFC unveiled a new credit card called Signify Business Cash World Elite Mastercard. The new business credit card offers 2% unlimited cash rewards on business purchases. In March 2024, WFC launched Autograph Journey, which is designed for frequent travelers. The card allows cardholders to earn reward points from wherever they book travel.

Higher loan balances, an increase in point-of-sale volume and new account growth have aided credit card revenues for WFC in the first quarter of 2024. Identifying the right customers and strategically introducing new credit card products are set to position Wells Fargo for long-term success in the card business.

Over the past six months, shares of WFC have gained 29.3% compared with the industry’s 23.1% growth.

Image Source: Zacks Investment Research

Currently, Wells Fargo sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Banks Taking Similar Steps

In May, The PNC Financial Services Group, Inc. (PNC - Free Report) launched the PNC Cash Unlimited Visa Signature credit card. The credit card offers simple but valuable rewards with an unlimited 2% cash back on all eligible purchases. The cashback earned has no expiry date, allowing the cardholders to redeem it whenever they like.

During the first year, PNC’s card offers a low Introductory annual percentage rate for transfers of balance and eligible purchases. Also, the card does not hold any annual fee or extra charges for foreign transactions.

Similarly, Citigroup Inc. (C - Free Report) introduced the Citi Strata Premier Card, an upgraded version of the current Citi Premier Card. The latest version of the card offers additional travel rewards and enhanced travel protections.

C’s cardholders will be entitled to earn 10 ThankYou points for every $1 spent on hotels, car rentals and attractions booked through the Citi Travel site. Similarly, customers can earn three ThankYou Points for every $1 spent at EV charging stations.