Unique Zacks Analysis of Your Chosen Ticker

Pick one free report - opportunity may be withdrawn at any time

Franklin Resources, Inc. (BEN) - $25 value - yours FREE >>

Virtus Investment Partners, Inc. (VRTS) - $25 value - yours FREE >>

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Franklin Resources, Inc. (BEN) - $25 value - yours FREE >>

Virtus Investment Partners, Inc. (VRTS) - $25 value - yours FREE >>

Image: Shutterstock

Virtus Investment's (VRTS) May AUM Rises 1.9% Sequentially

Virtus Investment Partners, Inc. (VRTS - Free Report) recorded a sequential increase of 1.9% in its preliminary assets under management (AUM) balance for May 2024. The company reported a month-end AUM of $173.3 billion, indicating a rise from the Apr 31, 2024, level of $170.1 billion.

The company offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

In May, Virtus Investment’s open-end fund balance increased 1.9% from the end of the previous month to $56.2 billion. Also, the closed-end fund balance increased 2.1% to $10 billion.

Retail separate accounts balance and Institutional accounts balance increased 1.9% each on a sequential basis to $45.6 billion and $61.5 billion, respectively, from the prior month’s level.

Virtus Investment’s integrated multi-boutique business model within a rapidly expanding industry is expected to strengthen its financial performance. However, elevated operating expenses are expected to negatively impact the company's bottom line in the near term.

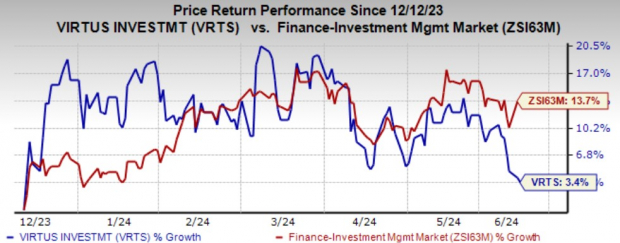

Over the past six months, shares of VRTS have gained 3.4% compared with 13.7% growth of the industry.

Image Source: Zacks Investment Research

Currently, Virtus Investment carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

Franklin Resources, Inc. (BEN - Free Report) reported its preliminary AUM of $1.64 trillion as of May 31, 2024. This reflected an increase of 2% from the prior month’s level. The improvement in BEN’s AUM balance was primarily due to the impact of positive markets, partially offset by long-term net outflows.

Cohen & Steers, Inc. (CNS - Free Report) reported its preliminary AUM of $80.5 billion as of May 31, 2024. This reflected growth of 4.3% from the prior month's level. The increase in CNS’ AUM balance was mainly attributable to a market appreciation of $3.6 billion. This was partly offset by net outflows of $93 million and distributions of $150 million.