We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Deutsche Bank (DB) Buys Aviation Loans Portfolio From NORD/LB

Read MoreHide Full Article

Deutsche Bank AG (DB - Free Report) has acquired loans worth €1.67 billion ($1.77 billion) from Norddeutsche Landesbank’s (“NORD/LB”) aircraft financing portfolio of €2.75 billion. The deal is expected to close in the second half of 2024, subject to approval from the antitrust authorities.

The purchase price of the deal has been kept under wraps.

The loans were acquired through a competitive bidding process and are backed by commercial passenger aircraft.

The loan portfolio is being taken over by DB’s Global Credit Financing & Solutions unit, which holds a diversified lending portfolio, comprising renewable energy finance, energy transition finance, infrastructure and transportation finance and asset backed financing.

NORD/LB has been an active player in the aircraft financing business for more than 40 years. Its current portfolio includes approximately 300 financed aircraft and engines. By selling the majority of its aircraft financing portfolio to Deutsche Bank, NORD/LB is seeking to shift its focus to renewable energy financing sectors.

Ross Duncan, co-head of the global transportation finance team at Deutsche Bank, said, “This deal plays to our strengths and our deep experience in this sector. It is an opportunity for us to acquire high quality loans with an attractive return profile.”

DB’s previous efforts to grow inorganically include the acquisition of Numis, which was completed in October 2023. The deal with Numis is expected to support the bank’s Asset Management segment in the coming months. Such strategic initiatives are expected to aid revenues for the bank in the future.

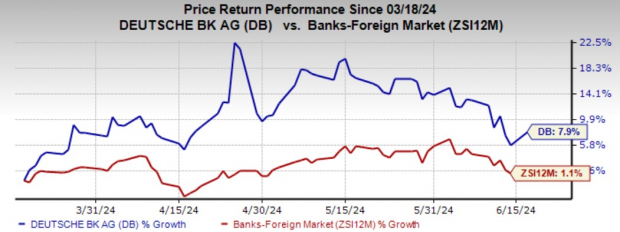

In the past three months, DB has gained 7.9% compared with the industry’s 1.1% growth.

Image Source: Zacks Investment Research

Currently, Deutsche Bank carries a Zacks Rank #3 (Hold).

Favorable Foreign Bank Stocks

Some better-ranked stocks from the finance space are Crédit Agricole S.A. (CRARY - Free Report) and Banco Macro S.A. (BMA - Free Report) .

CRARY’s 2024 earnings estimates have increased 8.9% over the past seven days. Shares of CRARY have gained 18.3% in the past year. Currently, the stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BMA’s 2024 earnings estimates have risen 29.6% over the past 30 days. Shares of BMA have gained 32.6% over the past three months. At present, the stock also sports a Zacks Rank #1.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Deutsche Bank (DB) Buys Aviation Loans Portfolio From NORD/LB

Deutsche Bank AG (DB - Free Report) has acquired loans worth €1.67 billion ($1.77 billion) from Norddeutsche Landesbank’s (“NORD/LB”) aircraft financing portfolio of €2.75 billion. The deal is expected to close in the second half of 2024, subject to approval from the antitrust authorities.

The purchase price of the deal has been kept under wraps.

The loans were acquired through a competitive bidding process and are backed by commercial passenger aircraft.

The loan portfolio is being taken over by DB’s Global Credit Financing & Solutions unit, which holds a diversified lending portfolio, comprising renewable energy finance, energy transition finance, infrastructure and transportation finance and asset backed financing.

NORD/LB has been an active player in the aircraft financing business for more than 40 years. Its current portfolio includes approximately 300 financed aircraft and engines. By selling the majority of its aircraft financing portfolio to Deutsche Bank, NORD/LB is seeking to shift its focus to renewable energy financing sectors.

Ross Duncan, co-head of the global transportation finance team at Deutsche Bank, said, “This deal plays to our strengths and our deep experience in this sector. It is an opportunity for us to acquire high quality loans with an attractive return profile.”

DB’s previous efforts to grow inorganically include the acquisition of Numis, which was completed in October 2023. The deal with Numis is expected to support the bank’s Asset Management segment in the coming months. Such strategic initiatives are expected to aid revenues for the bank in the future.

In the past three months, DB has gained 7.9% compared with the industry’s 1.1% growth.

Image Source: Zacks Investment Research

Currently, Deutsche Bank carries a Zacks Rank #3 (Hold).

Favorable Foreign Bank Stocks

Some better-ranked stocks from the finance space are Crédit Agricole S.A. (CRARY - Free Report) and Banco Macro S.A. (BMA - Free Report) .

CRARY’s 2024 earnings estimates have increased 8.9% over the past seven days. Shares of CRARY have gained 18.3% in the past year. Currently, the stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BMA’s 2024 earnings estimates have risen 29.6% over the past 30 days. Shares of BMA have gained 32.6% over the past three months. At present, the stock also sports a Zacks Rank #1.