We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Regions Financial (RF) Rides on Robust Loan Amid High Costs

Read MoreHide Full Article

Regions Financial Corporation (RF - Free Report) is well-positioned for top-line growth, driven by robust loan balances. The company’s strong liquid profile will continue to support its capital distribution activities. However, pressure on mortgage income due to high rates and elevated expenses remain near-term concerns.

Regions Financial’s presence in strategic markets with strong economic and business trends supports its organic growth.

The bank has witnessed a steady growth in its loan balances over the past few years. The company's strong presence in strategic markets across the Southeastern and Midwest United States positions it to capitalize on favorable economic and business trends in the regions, which will fuel the loan growth in the upcoming period.

Driven by solid loan balances and high interest rates, both net interest income and net interest margin witnessed improvement in the past. With a solid foundation and strategic market presence, Regions Financial is well-poised for sustained growth in the long run.

The company is making significant efforts to enhance shareholder value through its capital-deployment activities. In July 2023, the bank announced a 20% increase in its quarterly common stock dividend to 24 cents per share. In April 2022, Regions Financial’s board of directors announced a share repurchase program of up to $2.5 billion of common stock from second-quarter 2022 through fourth-quarter 2024. As of Mar 31, 2024, $2.13 billion shares remained available under the authorization.

As of Mar 31, 2024, it had long-term borrowings of $3.33 billion, whereas the liquidity sources aggregated $40.7 billion. Given the company’s robust liquidity, its capital deployment activities seem sustainable and will drive investors’ confidence in the stock.

Regions Financial prioritizes investment in talent and technology to support growth. The company introduced digital platforms and redesigned mobile apps for its business clients in order to increase active users of mobile banking and digital sales. As of Mar 31, 2024, the company's digital sales increased 17% from the Mar 31, 2022, level while its mobile banking active users rose 16% during the same time frame.

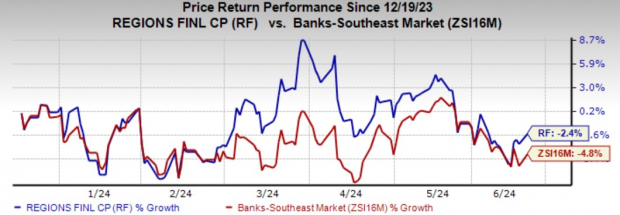

RF currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 2.4% over the past six months against the industry’s decline of 4.8%.

Image Source: Zacks Investment Research

However, Regions Financial continues to record an increase in expenses. The rise was due to an increase in salaries and employee benefit expenses and other expenses. Despite the company’s efforts to lower costs with expense management actions, its ongoing investment in technology advancement and franchise strengthening will keep costs high in the near term.

Regions Financial’s mortgage income, which is a key component of its non-interest income, witnessed a steady decrease over the past few years. The decline was mainly due to lower mortgage production and sales as a result of higher market interest rates. Sparse inventories have tanked up with rapid house price appreciation over the past year, thus wearing down affordability in the market. High mortgage rates are likely to continue affecting residential first mortgage loan origination volume and margins in the upcoming period, thereby impeding mortgage income.

Stocks to Consider

Some better-ranked bank stocks worth mentioning are First Community Bankshares, Inc. (FCBC - Free Report) and Origin Bancorp, Inc. (OBK - Free Report) .

First Community Bankshares’ 2024 earnings estimates have been revised 8.8% upward in the past 60 days. The company’s shares have lost 1.3% over the past month. At present, FCBC sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Origin Bancorp’s 2024 earnings estimates have moved north by 9.1% in the past 60 days. The stock has gained 2.2% over the past six months. Currently, OBK sports a Zacks Rank #1.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Regions Financial (RF) Rides on Robust Loan Amid High Costs

Regions Financial Corporation (RF - Free Report) is well-positioned for top-line growth, driven by robust loan balances. The company’s strong liquid profile will continue to support its capital distribution activities. However, pressure on mortgage income due to high rates and elevated expenses remain near-term concerns.

Regions Financial’s presence in strategic markets with strong economic and business trends supports its organic growth.

The bank has witnessed a steady growth in its loan balances over the past few years. The company's strong presence in strategic markets across the Southeastern and Midwest United States positions it to capitalize on favorable economic and business trends in the regions, which will fuel the loan growth in the upcoming period.

Driven by solid loan balances and high interest rates, both net interest income and net interest margin witnessed improvement in the past. With a solid foundation and strategic market presence, Regions Financial is well-poised for sustained growth in the long run.

The company is making significant efforts to enhance shareholder value through its capital-deployment activities. In July 2023, the bank announced a 20% increase in its quarterly common stock dividend to 24 cents per share. In April 2022, Regions Financial’s board of directors announced a share repurchase program of up to $2.5 billion of common stock from second-quarter 2022 through fourth-quarter 2024. As of Mar 31, 2024, $2.13 billion shares remained available under the authorization.

As of Mar 31, 2024, it had long-term borrowings of $3.33 billion, whereas the liquidity sources aggregated $40.7 billion. Given the company’s robust liquidity, its capital deployment activities seem sustainable and will drive investors’ confidence in the stock.

Regions Financial prioritizes investment in talent and technology to support growth. The company introduced digital platforms and redesigned mobile apps for its business clients in order to increase active users of mobile banking and digital sales. As of Mar 31, 2024, the company's digital sales increased 17% from the Mar 31, 2022, level while its mobile banking active users rose 16% during the same time frame.

RF currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 2.4% over the past six months against the industry’s decline of 4.8%.

Image Source: Zacks Investment Research

However, Regions Financial continues to record an increase in expenses. The rise was due to an increase in salaries and employee benefit expenses and other expenses. Despite the company’s efforts to lower costs with expense management actions, its ongoing investment in technology advancement and franchise strengthening will keep costs high in the near term.

Regions Financial’s mortgage income, which is a key component of its non-interest income, witnessed a steady decrease over the past few years. The decline was mainly due to lower mortgage production and sales as a result of higher market interest rates. Sparse inventories have tanked up with rapid house price appreciation over the past year, thus wearing down affordability in the market. High mortgage rates are likely to continue affecting residential first mortgage loan origination volume and margins in the upcoming period, thereby impeding mortgage income.

Stocks to Consider

Some better-ranked bank stocks worth mentioning are First Community Bankshares, Inc. (FCBC - Free Report) and Origin Bancorp, Inc. (OBK - Free Report) .

First Community Bankshares’ 2024 earnings estimates have been revised 8.8% upward in the past 60 days. The company’s shares have lost 1.3% over the past month. At present, FCBC sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Origin Bancorp’s 2024 earnings estimates have moved north by 9.1% in the past 60 days. The stock has gained 2.2% over the past six months. Currently, OBK sports a Zacks Rank #1.