We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Is Devon Energy (DVN) a Buy Following Williston Basin Deal?

Read MoreHide Full Article

Independent energy company Devon Energy Corporation (DVN - Free Report) recently announced that it has inked a deal to acquire the Williston Basin business of Grayson Mill Energy for $5 billion. DVN will finance the transaction with $3.25 billion in cash and $1.75 billion in stocks. Following the necessary approval, this transaction is expected to be closed in the third quarter of 2024.

Devon Energy has gained 2.7% in the year-to-date period compared with the industry’s rally of 3%.

Image Source: Zacks Investment Research

Key Takeaways for Devon Energy

Devon Energy's multi-basin portfolio focuses on high-margin assets with significant long-term growth potential. It has operations in Williston Basin and the recent acquisition will further strengthen its operation in this region. This acquisition will increase DVN’s net acre position in Williston Basin to 430,000 acres from 123,000 acres, while production will triple to 150,000 barrels of oil equivalents per day (Boe/d) from 50,000 Boe/d.

The company expects to realize up to $50 million in average annual cash flow savings from operating efficiencies and marketing synergies, courtesy of the enhanced scale of the combined business. The acquired business will boost operating margins in the Williston Basin due to the midstream infrastructure ownership in 950 miles of gathering systems, an extensive network of disposal wells and crude storage terminals.

This acquisition is expected to take the annual total production volume of Devon Energy to 765,000 Boe per day and the company will have to revise its existing 2024 production range upward to accommodate the higher volumes from Williston Basin.

This acquisition will be accretive to DVN's earnings, cash flows and net asset value, enabling it to increase returns to its shareholders.

Deal to Increase Value for Shareholders

Devon Energy returned $430 million to its shareholders in the first quarter of 2024 through share buybacks, fixed dividends and variable dividends.

This accretive acquisition will allow management to further increase its shareholders' value. Due to the accretive nature of this transaction to free cash flow, the company's board of directors has increased its share-repurchase authorization by 67% to $5 billion through mid-year 2026. The company also expects this acquisition to be accretive to dividend payout in 2025 and beyond. Check DVN’s dividend history here.

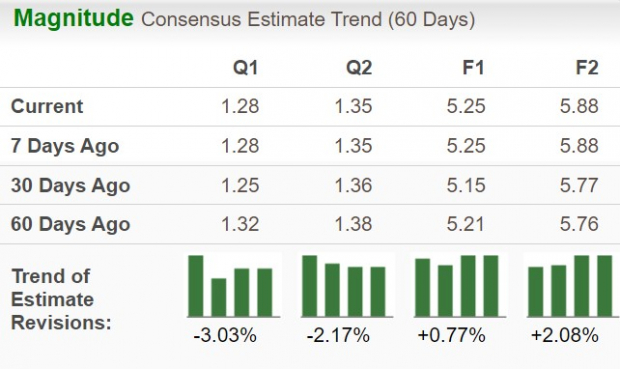

Estimates Moving Up

The Zacks Consensus Estimate for Devon Energy’s 2024 and 2025 earnings per share has moved up 0.8% and 2.08%, respectively, in the past 60 days. The upward revision in earnings estimates indicates analysts’ increasing confidence in the stock.

The Zacks Consensus Estimate for 2024 earnings per share of its peer Occidental Petroleum (OXY - Free Report) has gone up by 0.3% in the past 60 days.

Image Source: Zacks Investment Research

Returns Better Than the Industry

Devon Energy’s return on invested capital (ROIC) has outperformed the industry average in the trailing 12 months. ROIC of DVN was 8.77% compared with the industry average of 7.4%. The company has been investing effectively in profitable projects, which is evident from its ROIC.

Image Source: Zacks Investment Research

DVN’s trailing 12-month return on equity is 29.02%, ahead of the industry average of 17.23%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

Image Source: Zacks Investment Research

Trading at a Discount

Devon Energy shares are somewhat inexpensive on a relative basis, with its current trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA TTM) being 4.76X compared with its industry average of 7.8.

Image Source: Zacks Investment Research

Summing Up

Devon Energy’s move to expand operations in the Williston Basin is going to extend inventory life to up to 10 years, boost its total production volumes, be accretive to its earnings and cash flow, and create immediate value for the company. . Devon Energy has a balanced exposure to oil, natural gas and NGL production, and its low-cost production structure boosts margins. The company has access to premium markets that improve the realized prices of its products.

This can be a favorable entry point for investors, given the positive movement in earnings estimates, strong return on capital and the company trading at a discount. Devon currently has a VGM Score of A, which indicates a strong performance.

Those who already own this Zacks Rank #3 (Hold) stock would do well to retain it in their portfolio.

Image: Bigstock

Is Devon Energy (DVN) a Buy Following Williston Basin Deal?

Independent energy company Devon Energy Corporation (DVN - Free Report) recently announced that it has inked a deal to acquire the Williston Basin business of Grayson Mill Energy for $5 billion. DVN will finance the transaction with $3.25 billion in cash and $1.75 billion in stocks. Following the necessary approval, this transaction is expected to be closed in the third quarter of 2024.

Devon Energy has gained 2.7% in the year-to-date period compared with the industry’s rally of 3%.

Image Source: Zacks Investment Research

Key Takeaways for Devon Energy

Devon Energy's multi-basin portfolio focuses on high-margin assets with significant long-term growth potential. It has operations in Williston Basin and the recent acquisition will further strengthen its operation in this region. This acquisition will increase DVN’s net acre position in Williston Basin to 430,000 acres from 123,000 acres, while production will triple to 150,000 barrels of oil equivalents per day (Boe/d) from 50,000 Boe/d.

The company expects to realize up to $50 million in average annual cash flow savings from operating efficiencies and marketing synergies, courtesy of the enhanced scale of the combined business. The acquired business will boost operating margins in the Williston Basin due to the midstream infrastructure ownership in 950 miles of gathering systems, an extensive network of disposal wells and crude storage terminals.

This acquisition is expected to take the annual total production volume of Devon Energy to 765,000 Boe per day and the company will have to revise its existing 2024 production range upward to accommodate the higher volumes from Williston Basin.

This acquisition will be accretive to DVN's earnings, cash flows and net asset value, enabling it to increase returns to its shareholders.

Deal to Increase Value for Shareholders

Devon Energy returned $430 million to its shareholders in the first quarter of 2024 through share buybacks, fixed dividends and variable dividends.

This accretive acquisition will allow management to further increase its shareholders' value. Due to the accretive nature of this transaction to free cash flow, the company's board of directors has increased its share-repurchase authorization by 67% to $5 billion through mid-year 2026. The company also expects this acquisition to be accretive to dividend payout in 2025 and beyond. Check DVN’s dividend history here.

Estimates Moving Up

The Zacks Consensus Estimate for Devon Energy’s 2024 and 2025 earnings per share has moved up 0.8% and 2.08%, respectively, in the past 60 days. The upward revision in earnings estimates indicates analysts’ increasing confidence in the stock.

The Zacks Consensus Estimate for 2024 earnings per share of its peer Occidental Petroleum (OXY - Free Report) has gone up by 0.3% in the past 60 days.

Image Source: Zacks Investment Research

Returns Better Than the Industry

Devon Energy’s return on invested capital (ROIC) has outperformed the industry average in the trailing 12 months. ROIC of DVN was 8.77% compared with the industry average of 7.4%. The company has been investing effectively in profitable projects, which is evident from its ROIC.

Image Source: Zacks Investment Research

DVN’s trailing 12-month return on equity is 29.02%, ahead of the industry average of 17.23%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

Image Source: Zacks Investment Research

Trading at a Discount

Devon Energy shares are somewhat inexpensive on a relative basis, with its current trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA TTM) being 4.76X compared with its industry average of 7.8.

Image Source: Zacks Investment Research

Summing Up

Devon Energy’s move to expand operations in the Williston Basin is going to extend inventory life to up to 10 years, boost its total production volumes, be accretive to its earnings and cash flow, and create immediate value for the company.

.

Devon Energy has a balanced exposure to oil, natural gas and NGL production, and its low-cost production structure boosts margins. The company has access to premium markets that improve the realized prices of its products.

This can be a favorable entry point for investors, given the positive movement in earnings estimates, strong return on capital and the company trading at a discount. Devon currently has a VGM Score of A, which indicates a strong performance.

Those who already own this Zacks Rank #3 (Hold) stock would do well to retain it in their portfolio.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here