We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Robinhood (HOOD) Surges 66% YTD: Is it a Good Time to Buy?

Read MoreHide Full Article

Robinhood Markets, Inc. (HOOD - Free Report) has had an impressive run this year, with the stock skyrocketing 66.3%.

This impressive rise has significantly outpaced the 15.5% rally of the industry it belongs to and the 13.4% growth of the Zacks S&P 500 composite.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

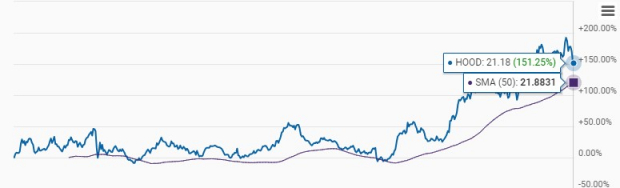

Technical indicators suggest continued strength for HOOD. The stock trades above its 50-day moving average, signaling robust upward momentum and price stability. This positive trend can be attributed to the efforts that the company is undertaking to diversify revenues and expand globally.

HOOD Stock Trades Above 50-Day Average Image Source: Zacks Investment Research

Given the continuous strength of Robinhood shares, many investors might be tempted to buy the stock. However, the pertinent question remains — is it the right time to invest in HOOD? It is essential to delve into the details and analyze various factors before answering this.

Global and Domestic Expansion Plans: Venturing Beyond Trading

Robinhood became extremely popular among younger generations riding on the meme stock wave in early 2021. Nonetheless, since its IPO in July 2021, a lot has happened on the company front.

The company has evolved from a brokerage firm mainly trading in digital assets, including Bitcoin (BTC), to become a much more mature and diversified entity as it expanded into retirement and credit card accounts.

Looking at the numbers, in 2021, the company majorly depended on transaction-based revenues (almost 75% of total revenues) to generate income. In 2023, this came down to 42% of total revenues.

Robinhood acquired Pluto Capital Inc., an innovative AI-powered investment research platform, earlier this month. This marks a significant step as the company aims to enhance its offerings with intelligent, data-driven investing tools. With the integration of Pluto’s advanced capabilities, the company is set to revolutionize the investment experience for its users.

This is part of HOOD’s broader strategy to expand its global and domestic footprint and become a comprehensive financial services provider. In sync with this, the company announced plans to acquire Bitstamp, the global cryptocurrency exchange, for approximately $200 million in June 2024. The move underscores Robinhood's commitment to diversifying its product offerings beyond traditional transaction-related revenues.

With this impending acquisition, Robinhood positions itself to compete directly with major crypto exchanges like Binance and Coinbase Global, Inc. (COIN - Free Report) . Bitstamp's core spot exchange, which features more than 85 tradable assets, coupled with its popularity in Europe and Asia, will significantly enhance Robinhood’s crypto offerings.

Also, the company launched its trading app in the U.K. this March. HOOD is also contemplating offering cryptocurrency futures in the United States and Europe soon.

Further, it plans to launch CME-based futures in the United States for Bitcoin and Ether. Since the approval of U.S. Bitcoin exchange-traded funds (ETFs) in January, the demand for futures has risen. Robinhood intends to capitalize on this to diversify revenues.

Initiatives to change the revenue mix and not depend exclusively on volatile transaction-based revenues give HOOD solid leverage.

Rewarding Shareholders

In May, Robinhood announced a share buyback plan. The company’s board of directors approved a share repurchase program authorizing it to repurchase up to $1 billion of its outstanding common stock.

While the plan doesn’t have an expiration date, the company expects to buy back shares in two to three years, starting from third-quarter 2024.

HOOD’s chief financial officer, Jason Warnick, stated, “As our business and cash flow have continued to grow, we’re excited to announce a $1 billion share repurchase program to return value to shareholders.”

Robinhood is on solid ground, with ample cash reserves. As of Mar 31, 2024, it reported cash and cash equivalents of $4.7 billion.

Regulatory Hurdle

Robinhood's push into the global crypto market comes amid ongoing regulatory challenges in the United States. In May, the company received a Wells notice from the U.S. Securities and Exchange Commission (“SEC”) concerning the tokens traded on its platform, reflecting the complex regulatory landscape for crypto firms.

The notice came because of the alleged violation of registrations as a securities broker and transfer agent. Dan Gallagher, Robinhood’s chief legal, compliance and corporate affairs office, said, “We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

Likewise, the SEC filed a lawsuit against Coinbase in June 2023 on the allegations of operating an unregistered exchange by allowing the sale of certain crypto tokens the agency considers as investment securities and, hence, part of the SEC’s jurisdiction.

Upward Estimate Trajectory

Analysts seem to be bullish about Robinhood’s prospects. Over the past seven days, the Zacks Consensus Estimate for 2024 and 2025 earnings has moved upward.

Estimate Revision Trend

Image Source: Zacks Investment Research

This upward adjustment reflects a positive sentiment among analysts and suggests encouraging prospects.

HOOD Trades at a Discount

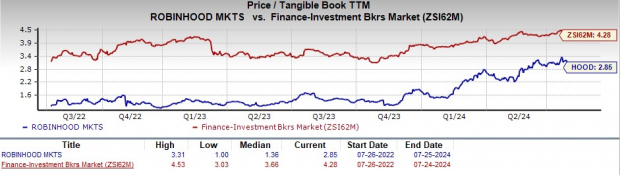

Currently, HOOD is trading at 2.85X 12-month trailing Price/Tangible Book (P/TB), below its two-year median of 3.31X. Meanwhile, the industry’s P/TB TTM multiple sits at 4.28X. The company’s valuation looks cheap compared with its own range and the industry average.

Price-to-Tangible Book Ratio (TTM) Image Source: Zacks Investment Research

Hence, from a valuation perspective, Robinhood shares present an attractive buying opportunity. Despite the rally, the stock is still undervalued. The market is yet to fully recognize or price the company’s growth prospects.

Not Too Late to Own the HOOD Stock

A thorough analysis shows that Robinhood is on the right path to expand/diversify operations. With the stock market rally likely to continue because of several favorable macroeconomic developments, the company will keep benefiting from rising trading volume.

On top of this, HOOD’s initiatives to keep adding new products and services and plans to become a global entity by venturing across Europe and Asia Pacific regions, organically and through buyouts, align with its expansion efforts. Hence, the company is well-poised to ride the growth trajectory.

The positive sentiments of analysts are echoed in the upward estimate revision trends, and despite the recent rally, the valuation still looks cheap. All these indicate that investing in this Zacks Rank #2 (Buy) stock will be a wise decision before the price moves significantly away from its current level. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Robinhood (HOOD) Surges 66% YTD: Is it a Good Time to Buy?

Robinhood Markets, Inc. (HOOD - Free Report) has had an impressive run this year, with the stock skyrocketing 66.3%.

This impressive rise has significantly outpaced the 15.5% rally of the industry it belongs to and the 13.4% growth of the Zacks S&P 500 composite.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Technical indicators suggest continued strength for HOOD. The stock trades above its 50-day moving average, signaling robust upward momentum and price stability. This positive trend can be attributed to the efforts that the company is undertaking to diversify revenues and expand globally.

HOOD Stock Trades Above 50-Day Average

Image Source: Zacks Investment Research

Given the continuous strength of Robinhood shares, many investors might be tempted to buy the stock. However, the pertinent question remains — is it the right time to invest in HOOD? It is essential to delve into the details and analyze various factors before answering this.

Global and Domestic Expansion Plans: Venturing Beyond Trading

Robinhood became extremely popular among younger generations riding on the meme stock wave in early 2021. Nonetheless, since its IPO in July 2021, a lot has happened on the company front.

The company has evolved from a brokerage firm mainly trading in digital assets, including Bitcoin (BTC), to become a much more mature and diversified entity as it expanded into retirement and credit card accounts.

Looking at the numbers, in 2021, the company majorly depended on transaction-based revenues (almost 75% of total revenues) to generate income. In 2023, this came down to 42% of total revenues.

Robinhood acquired Pluto Capital Inc., an innovative AI-powered investment research platform, earlier this month. This marks a significant step as the company aims to enhance its offerings with intelligent, data-driven investing tools. With the integration of Pluto’s advanced capabilities, the company is set to revolutionize the investment experience for its users.

This is part of HOOD’s broader strategy to expand its global and domestic footprint and become a comprehensive financial services provider. In sync with this, the company announced plans to acquire Bitstamp, the global cryptocurrency exchange, for approximately $200 million in June 2024. The move underscores Robinhood's commitment to diversifying its product offerings beyond traditional transaction-related revenues.

With this impending acquisition, Robinhood positions itself to compete directly with major crypto exchanges like Binance and Coinbase Global, Inc. (COIN - Free Report) . Bitstamp's core spot exchange, which features more than 85 tradable assets, coupled with its popularity in Europe and Asia, will significantly enhance Robinhood’s crypto offerings.

Also, the company launched its trading app in the U.K. this March. HOOD is also contemplating offering cryptocurrency futures in the United States and Europe soon.

Further, it plans to launch CME-based futures in the United States for Bitcoin and Ether. Since the approval of U.S. Bitcoin exchange-traded funds (ETFs) in January, the demand for futures has risen. Robinhood intends to capitalize on this to diversify revenues.

Initiatives to change the revenue mix and not depend exclusively on volatile transaction-based revenues give HOOD solid leverage.

Rewarding Shareholders

In May, Robinhood announced a share buyback plan. The company’s board of directors approved a share repurchase program authorizing it to repurchase up to $1 billion of its outstanding common stock.

While the plan doesn’t have an expiration date, the company expects to buy back shares in two to three years, starting from third-quarter 2024.

HOOD’s chief financial officer, Jason Warnick, stated, “As our business and cash flow have continued to grow, we’re excited to announce a $1 billion share repurchase program to return value to shareholders.”

Robinhood is on solid ground, with ample cash reserves. As of Mar 31, 2024, it reported cash and cash equivalents of $4.7 billion.

Regulatory Hurdle

Robinhood's push into the global crypto market comes amid ongoing regulatory challenges in the United States. In May, the company received a Wells notice from the U.S. Securities and Exchange Commission (“SEC”) concerning the tokens traded on its platform, reflecting the complex regulatory landscape for crypto firms.

The notice came because of the alleged violation of registrations as a securities broker and transfer agent. Dan Gallagher, Robinhood’s chief legal, compliance and corporate affairs office, said, “We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

Likewise, the SEC filed a lawsuit against Coinbase in June 2023 on the allegations of operating an unregistered exchange by allowing the sale of certain crypto tokens the agency considers as investment securities and, hence, part of the SEC’s jurisdiction.

Upward Estimate Trajectory

Analysts seem to be bullish about Robinhood’s prospects. Over the past seven days, the Zacks Consensus Estimate for 2024 and 2025 earnings has moved upward.

Estimate Revision Trend

Image Source: Zacks Investment Research

This upward adjustment reflects a positive sentiment among analysts and suggests encouraging prospects.

HOOD Trades at a Discount

Currently, HOOD is trading at 2.85X 12-month trailing Price/Tangible Book (P/TB), below its two-year median of 3.31X. Meanwhile, the industry’s P/TB TTM multiple sits at 4.28X. The company’s valuation looks cheap compared with its own range and the industry average.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

Hence, from a valuation perspective, Robinhood shares present an attractive buying opportunity. Despite the rally, the stock is still undervalued. The market is yet to fully recognize or price the company’s growth prospects.

Not Too Late to Own the HOOD Stock

A thorough analysis shows that Robinhood is on the right path to expand/diversify operations. With the stock market rally likely to continue because of several favorable macroeconomic developments, the company will keep benefiting from rising trading volume.

On top of this, HOOD’s initiatives to keep adding new products and services and plans to become a global entity by venturing across Europe and Asia Pacific regions, organically and through buyouts, align with its expansion efforts. Hence, the company is well-poised to ride the growth trajectory.

The positive sentiments of analysts are echoed in the upward estimate revision trends, and despite the recent rally, the valuation still looks cheap. All these indicate that investing in this Zacks Rank #2 (Buy) stock will be a wise decision before the price moves significantly away from its current level. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.