One important lesson I have learned over the years is that though Wall Street may face challenges, concerns, and doubts, stocks can brush these concerns aside in bull markets to climb the proverbial “Wall of Worry.” This year is an excellent example of the “Wall of Worry” in action.

Despite war and escalating tensions in Europe and the Middle East, widespread recession fears, currency volatility, and political uncertainty, the S&P 500 Index is on track for one of its best election years on record.

Wall Street is the master manipulator. Modern technology makes today one of the most exciting times to be an investor. The advent of the internet, smartphones, search engines and high-tech trading platforms have evened the playing field in a sense for individual investors.

Unlike years ago, more investors can succeed without being part of a prestigious Wall Street bank or a particular industry. However, the hyperconnected, click-bait-driven world, can also be detrimental to investors.

Today, anyone connected to the internet or watching TV knows about and is informed in minutes about every global war escalation and every economic news headline.

While more information intake is generally a positive for humanity, it can often be very detrimental for investors. From firsthand investing experience, I know that information overload can impede sound judgment in the stock market.

Learning from my more than two decades of investing and working with new clients, I have found that amateur investors too often get caught up in headlines, leading to knee-jerk emotional decisions. In other words, amateur investors focus on overly complicated (and stale) economic data and headlines, losing the forest through the trees.

Amateur Investors Overcomplicate Markets

As I mentioned earlier, inexperienced investors who strive to tackle the stock market delve straight into the overcomplicated and complex realms of Wall Street, studying every piece of macroeconomic data. Unlike most careers, on Wall Street, you don’t get paid to do more work; instead, you get paid to make wise decisions.

Throughout my career, I have gone from losing money consistently to making money consistently. I credit my success to focusing on simplicity. Eager new investors suffer from paralysis by analysis, while seasoned investors leave their egos at the door and focus on what actually works. As Leonardo Da Vinci once proclaimed, “Simplicity is the ultimate sophistication.”

What is the First Principles Theory?

First principles theory is a powerful way of thinking that has stood the test of time. The method is linked to and goes as far back as the infamous Aristotle (who was around in 384 BC). It is also touted and used by modern-day thinkers and innovators like Tesla (TSLA) CEO Elon Musk.

First principles theory solves problems by whittling them down to their most simple truths and reasoning from them to generate fresh insights or solutions. Instead of depending on established and accepted methods of analysis, first principle theory, when practiced properly, challenges assumptions so that we can grasp the core principles involved.

While on my continuous and never-ending quest to uncover the simplest stock markets truths, I am also sure to keep my ego in check. Though I am never afraid to get my hands dirty and do the work on my own, I also understand that reinventing the wheel is unnecessary. Instead, I focus on those who have already cracked the stock market code and work from what they have already discovered and made public.

Continued . . .

-----------------------------------------------------------------------------------------------------

Deadline Approaching: Zacks 7 Best Stocks for September

From 220 Zacks Rank #1 Strong Buy stocks, our experts handpicked these 7 compelling companies as the most likely to spike NOW. While we can’t guarantee 100% success, they are likely to jump sooner and climb higher than any others you could buy this month.

Report distribution is limited, so don’t miss out. Deadline is midnight Sunday, September 1.

Hurry - See Stocks Now >>

------------------------------------------------------------------------------------------------------

Stanley Druckenmiller’s Track Record is Unmatched

One inconvenient truth investors learn with experience is that most hedge funds and professional money managers actually underperform the S&P 500 Index over the long term (all while taking their 2 & 20!). Nevertheless, there are a few outliers, the biggest being Stanley Druckenmiller.

Druckenmiller is a prominent billionaire investor, hedge fund manager, and philanthropist who rose to fame for his pivotal role as the leading portfolio manager at George Soros’s Quantum Fund.

Druckenmiller notably orchestrated the trade that led to the devaluation of the British pound in 1992, now known as the event that “broke the Bank of England.” Following his tenure at Quantum Fund, Druckenmiller established his own hedge fund, Duquesne Capital.

To me, Druckenmiller’s track record at Duquesne is the most impressive in Wall Street history. From the funds start in the early 1980s until its close in 2010, Druckenmiller returned an average of 30% (about 3x the returns of the S&P 500) while never suffering a losing year. Outperforming by such a large margin while also remaining consistently profitable is unprecedented.

In the quote below, Druckenmiller explains what he learned had the most significant impact on the market through his long and illustrious career:

“Earnings don’t move the overall market; it’s the Federal Reserve Board. Focus on the central banks and focus on the movement of liquidity. Most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

What is Liquidity in the Stock Market?

Druckenmiller’s quote has had a profound impact on my career. While earnings impact an individual stock’s short-term fluctuations, investors should never discount the importance and the impact of liquidity.

Remember, roughly 75% of a stock’s movement is attributed to the general market’s movement. That said, to know where your stock will move, you need to understand the market’s moves, and thus the movement of liquidity.

On Wall Street, liquidity pertains to the availability of cash or assets that can be easily traded and converted into cash without affecting their value. In essence, liquidity represents how smoothly financial transactions can take place. Adequate liquidity facilitates a healthy, stable market.

The Fed Controls Liquidity

Jerome Powell and the Federal Reserve are the single biggest influencers of liquidity in the U.S. system. The Fed shapes liquidity levels through monetary policy measures such as interest rate changes. A “dovish” Fed means low interest rates that decrease the cost of borrowing and generally stimulate the economy and the stock market.

However, when inflation rears its ugly head, like in early 2022, the Fed is forced to raise rates to slow down business and quell inflation. Higher rates typically lead to a lower stock market.

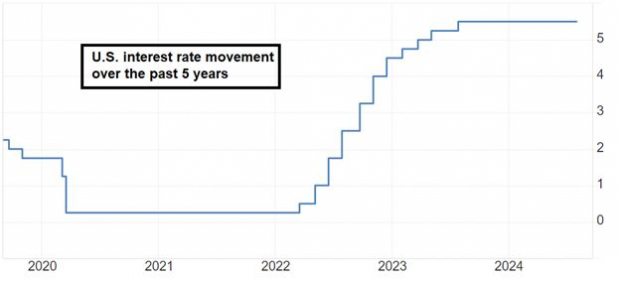

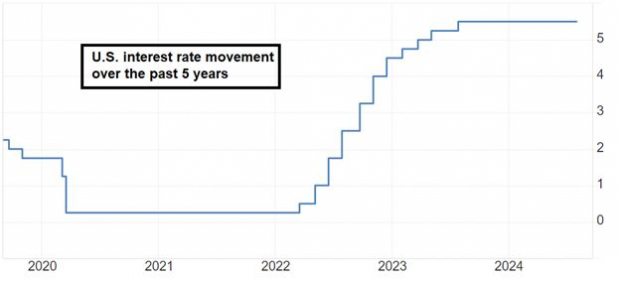

In March of 2022, Jerome Powell broke the streak of easy monetary policy and started raising interest rates to quell rampant, pandemic-induced inflation.

Image Source: Trading Economics

From March 2022 to July 2023, Powell raised interest rates 11 times from 0.25% to over 5%. Sure enough, as Druckenmiller explained, the bull market driven by liquidity (low interest rates) ended in 2022 when Jerome Powell and the Fed became “hawkish” and increased rates.

Image Source: TradingView

U.S. Payrolls Revised Down

News broke this week that the U.S. is revising payrolls down by more than 800,000.

A non-first principles thinker may assume that a weakening jobs market will lead to a corrective stock market. Nevertheless, stocks have been strong despite the newest revelations about the health (or lack thereof) of the U.S. jobs market.

Back to liquidity.

Remember, we have concluded, by looking at the market versus rates and listening to the greatest modern-day trader, that liquidity is king. With that in mind, investors have to understand what the key drivers of monetary policy are.

What Drives Interest Rates?

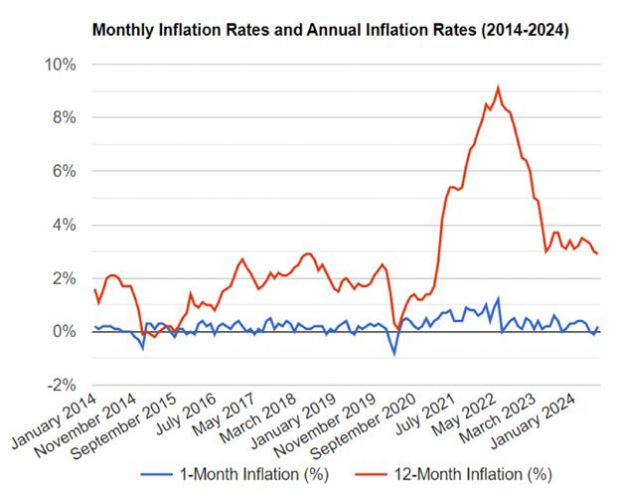

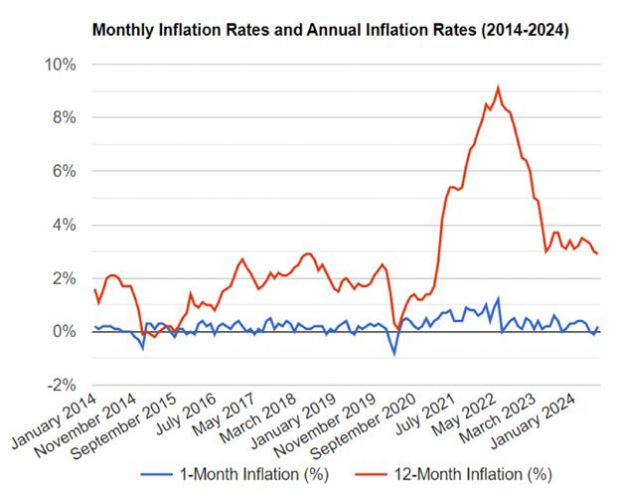

Recall that high inflation drove Jerome Powell to hike interest rates in 2022. Since his 180-degree turn from dovish to hawkish, Powell has essentially reached his goal of tamping down inflation. The annual inflation rate has plunged from nosebleed levels above 9% in 2022 to a manageable 2.9% today in 2024.

Image Source: U.S. Inflation Calculator

Powell Confirms Rate Cuts

To bring it all together, inflation is tamed and the economy, specifically the jobs market, is showing real signs of cracking. The combination of broken inflation and a weakening economy is presumably the recipe for rate cuts.

Finally, last Friday, investors’ biggest question of the year was answered: “Will the Federal Reserve cut interest rates in 2024?” In his most anticipated speech of the year, Fed Chair Jerome Powell finally put on his “dovish” cap and confirmed rate cuts, saying, “The time has come for policy to adjust. The direction of travel is clear.”

Rate Cut Impact on Stocks

Now that we have proven that a rate cut is highly likely by the end of 2024, let’s examine whether the historical data points agree with our liquidity hypothesis.

According to a Charles Schwab study, the Fed has cut rates 14 times since 1929. Of the 14 occurrences, 12 resulted in the S&P 500 Index being higher 12 months after the first rate cut.

Not only was the market higher 86% of the time one year after the first rate cut, but returns were dramatically higher than the S&P 500 Index (about 18%).

Meanwhile, 2001 and 2007 were the two instances where stocks were lower one year later. In 2001, the internet bubble burst, and the 9/11 attacks shocked investors. In 2008, risky subprime mortgages set off the global financial crisis.

Will Stocks be Higher in 2025?

The overall data suggests that as long as Wall Street can avoid a black swan event like 2001 or 2007, interest rates and Federal Reserve liquidity will drive stocks higher over the next 12 months.

Profit From What the Market is Telling Us Now

The Dow has eclipsed its all-time high closes from last month while the S&P 500 is within striking distance of breaking out to new highs, all but erasing their pullback/corrections from previous weeks. And momentum is back on the upside. Remember, 75% of stocks move with the market. That means right now is a time to be bullish.

And while data shows a majority of stocks are likely to be climbing, a select few are set to outshine all the others.

To help you take advantage, Zacks has just released a brand-new Special Report, 7 Best Stocks for the Next 30 Days. Today, you're invited to be one of the first to see it.

Our team has meticulously analyzed the latest Zacks Rank #1 Strong Buys and handpicked seven promising companies poised for significant price increases.

Recent 7 Best recommendations have delivered impressive gains of +18.1%, +19.8% and +24.2% within just one month.¹

And while we can’t guarantee future performance, these new picks have the potential to be even more lucrative given the current market momentum.

Today, for just $1, you can access the 7 Best Stocks Special Report and gain 30-day access to the picks and commentary from all our private trading and investing services in real time as part of Zacks Ultimate.

I encourage you to take advantage right away. The earlier you get in, the greater profits you stand to make. But don't delay. We're limiting the number of investors who share our 7 Best Stocks, so this opportunity ends at midnight Sunday, September 1.

Look into 7 Best Stocks and check out Zacks' portfolios for 30 Days for just $1 >>

Andrew Rocco

Stock Strategist

Andrew is Zacks' technology stock strategist. His passion is making money on stocks along with education, where he aims to provide valuable insights from both a fundamental and technical perspective in his Technology Innovators portfolio.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.

Image: Bigstock

How Do Stocks React to Rate Cuts?

One important lesson I have learned over the years is that though Wall Street may face challenges, concerns, and doubts, stocks can brush these concerns aside in bull markets to climb the proverbial “Wall of Worry.” This year is an excellent example of the “Wall of Worry” in action.

Despite war and escalating tensions in Europe and the Middle East, widespread recession fears, currency volatility, and political uncertainty, the S&P 500 Index is on track for one of its best election years on record.

Wall Street is the master manipulator. Modern technology makes today one of the most exciting times to be an investor. The advent of the internet, smartphones, search engines and high-tech trading platforms have evened the playing field in a sense for individual investors.

Unlike years ago, more investors can succeed without being part of a prestigious Wall Street bank or a particular industry. However, the hyperconnected, click-bait-driven world, can also be detrimental to investors.

Today, anyone connected to the internet or watching TV knows about and is informed in minutes about every global war escalation and every economic news headline.

While more information intake is generally a positive for humanity, it can often be very detrimental for investors. From firsthand investing experience, I know that information overload can impede sound judgment in the stock market.

Learning from my more than two decades of investing and working with new clients, I have found that amateur investors too often get caught up in headlines, leading to knee-jerk emotional decisions. In other words, amateur investors focus on overly complicated (and stale) economic data and headlines, losing the forest through the trees.

Amateur Investors Overcomplicate Markets

As I mentioned earlier, inexperienced investors who strive to tackle the stock market delve straight into the overcomplicated and complex realms of Wall Street, studying every piece of macroeconomic data. Unlike most careers, on Wall Street, you don’t get paid to do more work; instead, you get paid to make wise decisions.

Throughout my career, I have gone from losing money consistently to making money consistently. I credit my success to focusing on simplicity. Eager new investors suffer from paralysis by analysis, while seasoned investors leave their egos at the door and focus on what actually works. As Leonardo Da Vinci once proclaimed, “Simplicity is the ultimate sophistication.”

What is the First Principles Theory?

First principles theory is a powerful way of thinking that has stood the test of time. The method is linked to and goes as far back as the infamous Aristotle (who was around in 384 BC). It is also touted and used by modern-day thinkers and innovators like Tesla (TSLA) CEO Elon Musk.

First principles theory solves problems by whittling them down to their most simple truths and reasoning from them to generate fresh insights or solutions. Instead of depending on established and accepted methods of analysis, first principle theory, when practiced properly, challenges assumptions so that we can grasp the core principles involved.

While on my continuous and never-ending quest to uncover the simplest stock markets truths, I am also sure to keep my ego in check. Though I am never afraid to get my hands dirty and do the work on my own, I also understand that reinventing the wheel is unnecessary. Instead, I focus on those who have already cracked the stock market code and work from what they have already discovered and made public.

Continued . . .

-----------------------------------------------------------------------------------------------------

Deadline Approaching: Zacks 7 Best Stocks for September

From 220 Zacks Rank #1 Strong Buy stocks, our experts handpicked these 7 compelling companies as the most likely to spike NOW. While we can’t guarantee 100% success, they are likely to jump sooner and climb higher than any others you could buy this month.

Report distribution is limited, so don’t miss out. Deadline is midnight Sunday, September 1.

Hurry - See Stocks Now >>

------------------------------------------------------------------------------------------------------

Stanley Druckenmiller’s Track Record is Unmatched

One inconvenient truth investors learn with experience is that most hedge funds and professional money managers actually underperform the S&P 500 Index over the long term (all while taking their 2 & 20!). Nevertheless, there are a few outliers, the biggest being Stanley Druckenmiller.

Druckenmiller is a prominent billionaire investor, hedge fund manager, and philanthropist who rose to fame for his pivotal role as the leading portfolio manager at George Soros’s Quantum Fund.

Druckenmiller notably orchestrated the trade that led to the devaluation of the British pound in 1992, now known as the event that “broke the Bank of England.” Following his tenure at Quantum Fund, Druckenmiller established his own hedge fund, Duquesne Capital.

To me, Druckenmiller’s track record at Duquesne is the most impressive in Wall Street history. From the funds start in the early 1980s until its close in 2010, Druckenmiller returned an average of 30% (about 3x the returns of the S&P 500) while never suffering a losing year. Outperforming by such a large margin while also remaining consistently profitable is unprecedented.

In the quote below, Druckenmiller explains what he learned had the most significant impact on the market through his long and illustrious career:

“Earnings don’t move the overall market; it’s the Federal Reserve Board. Focus on the central banks and focus on the movement of liquidity. Most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

What is Liquidity in the Stock Market?

Druckenmiller’s quote has had a profound impact on my career. While earnings impact an individual stock’s short-term fluctuations, investors should never discount the importance and the impact of liquidity.

Remember, roughly 75% of a stock’s movement is attributed to the general market’s movement. That said, to know where your stock will move, you need to understand the market’s moves, and thus the movement of liquidity.

On Wall Street, liquidity pertains to the availability of cash or assets that can be easily traded and converted into cash without affecting their value. In essence, liquidity represents how smoothly financial transactions can take place. Adequate liquidity facilitates a healthy, stable market.

The Fed Controls Liquidity

Jerome Powell and the Federal Reserve are the single biggest influencers of liquidity in the U.S. system. The Fed shapes liquidity levels through monetary policy measures such as interest rate changes. A “dovish” Fed means low interest rates that decrease the cost of borrowing and generally stimulate the economy and the stock market.

However, when inflation rears its ugly head, like in early 2022, the Fed is forced to raise rates to slow down business and quell inflation. Higher rates typically lead to a lower stock market.

In March of 2022, Jerome Powell broke the streak of easy monetary policy and started raising interest rates to quell rampant, pandemic-induced inflation.

Image Source: Trading Economics

From March 2022 to July 2023, Powell raised interest rates 11 times from 0.25% to over 5%. Sure enough, as Druckenmiller explained, the bull market driven by liquidity (low interest rates) ended in 2022 when Jerome Powell and the Fed became “hawkish” and increased rates.

Image Source: TradingView

U.S. Payrolls Revised Down

News broke this week that the U.S. is revising payrolls down by more than 800,000.

A non-first principles thinker may assume that a weakening jobs market will lead to a corrective stock market. Nevertheless, stocks have been strong despite the newest revelations about the health (or lack thereof) of the U.S. jobs market.

Back to liquidity.

Remember, we have concluded, by looking at the market versus rates and listening to the greatest modern-day trader, that liquidity is king. With that in mind, investors have to understand what the key drivers of monetary policy are.

What Drives Interest Rates?

Recall that high inflation drove Jerome Powell to hike interest rates in 2022. Since his 180-degree turn from dovish to hawkish, Powell has essentially reached his goal of tamping down inflation. The annual inflation rate has plunged from nosebleed levels above 9% in 2022 to a manageable 2.9% today in 2024.

Image Source: U.S. Inflation Calculator

Powell Confirms Rate Cuts

To bring it all together, inflation is tamed and the economy, specifically the jobs market, is showing real signs of cracking. The combination of broken inflation and a weakening economy is presumably the recipe for rate cuts.

Finally, last Friday, investors’ biggest question of the year was answered: “Will the Federal Reserve cut interest rates in 2024?” In his most anticipated speech of the year, Fed Chair Jerome Powell finally put on his “dovish” cap and confirmed rate cuts, saying, “The time has come for policy to adjust. The direction of travel is clear.”

Rate Cut Impact on Stocks

Now that we have proven that a rate cut is highly likely by the end of 2024, let’s examine whether the historical data points agree with our liquidity hypothesis.

According to a Charles Schwab study, the Fed has cut rates 14 times since 1929. Of the 14 occurrences, 12 resulted in the S&P 500 Index being higher 12 months after the first rate cut.

Not only was the market higher 86% of the time one year after the first rate cut, but returns were dramatically higher than the S&P 500 Index (about 18%).

Meanwhile, 2001 and 2007 were the two instances where stocks were lower one year later. In 2001, the internet bubble burst, and the 9/11 attacks shocked investors. In 2008, risky subprime mortgages set off the global financial crisis.

Will Stocks be Higher in 2025?

The overall data suggests that as long as Wall Street can avoid a black swan event like 2001 or 2007, interest rates and Federal Reserve liquidity will drive stocks higher over the next 12 months.

Profit From What the Market is Telling Us Now

The Dow has eclipsed its all-time high closes from last month while the S&P 500 is within striking distance of breaking out to new highs, all but erasing their pullback/corrections from previous weeks. And momentum is back on the upside. Remember, 75% of stocks move with the market. That means right now is a time to be bullish.

And while data shows a majority of stocks are likely to be climbing, a select few are set to outshine all the others.

To help you take advantage, Zacks has just released a brand-new Special Report, 7 Best Stocks for the Next 30 Days. Today, you're invited to be one of the first to see it.

Our team has meticulously analyzed the latest Zacks Rank #1 Strong Buys and handpicked seven promising companies poised for significant price increases.

Recent 7 Best recommendations have delivered impressive gains of +18.1%, +19.8% and +24.2% within just one month.¹

And while we can’t guarantee future performance, these new picks have the potential to be even more lucrative given the current market momentum.

Today, for just $1, you can access the 7 Best Stocks Special Report and gain 30-day access to the picks and commentary from all our private trading and investing services in real time as part of Zacks Ultimate.

I encourage you to take advantage right away. The earlier you get in, the greater profits you stand to make. But don't delay. We're limiting the number of investors who share our 7 Best Stocks, so this opportunity ends at midnight Sunday, September 1.

Look into 7 Best Stocks and check out Zacks' portfolios for 30 Days for just $1 >>

Andrew Rocco

Stock Strategist

Andrew is Zacks' technology stock strategist. His passion is making money on stocks along with education, where he aims to provide valuable insights from both a fundamental and technical perspective in his Technology Innovators portfolio.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.