We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Mortgage Rates Are Falling: A Boon for 2 Warren Buffett Stocks

Read MoreHide Full Article

Warren Buffett-led Berkshire Hathaway Inc.’s (BRK.B - Free Report) portfolio hasn’t fared badly against the S&P 500’s return amid a higher interest rate environment. However, Buffett hopes for interest rate cuts like several market pundits as it would jack up the share price of two of his beloved housing stocks NVR, Inc. (NVR - Free Report) and Lennar Corporation (LEN - Free Report) . Here’s why –

Freddie Mac Report: U.S. Mortgage Rates Drop

According to Freddie Mac, for the week ending Sept. 12, the 30-year fixed-rate mortgage slipped to its lowest level since February 2023. The rate on the 30-year loan averaged 6.2%, down from the four-week and 52-week averages of 6.34% and 6.93%, respectively. The 30-year mortgage rate hovered around the 7% mark for most of the year, but since late July, it has begun to cool off and has fallen since then.

The 15-year fixed mortgage average rate was 5.27%, down from the four-week and 52-week averages of 5.47% and 6.21%, respectively, a positive development for aspiring homeowners, added Freddie Mac. Have a look at the chart, which shows that mortgage rates in the United States continued to soften over the past year –

Image Source: Freddie Mac

Why Are Mortgage Rates Falling?

An increase in expectations of a much-awaited interest rate cut in the Federal Reserve’s September policy meeting is pushing the yields on long-term bonds lower leading to a drop in mortgage rates.

The Fed is expected to trim interest rates as price pressures ebb toward the central bank’s 2% target. The interest rate cut would be the first one since March 2020, when the Fed slashed rates to boost economic growth derailed due to the pandemic. The interest rates have remained elevated for the past 14months, waiting for economic conditions to improve.

According to the CME FedWatch Tool, around 59% of market participants expect the Fed to trim interest rates by 50 basis points in the upcoming policy meeting. Nearly 41% of traders are pricing in a quarter-point interest rate cut.

Image Source: CME Group

Drop in Mortgage Rates to Boost 2 Warren Buffett Stocks

The steady decline in mortgage rates on interest rate cut expectations should increase new home purchases, and boost homebuilders’ bottom line. Thus, two of Warren Buffett’s homebuilders, NVR and Lennar, are expected to see an increase in their stock prices.

After giving away his stake in D.R. Horton, Inc. (DHI - Free Report) , the Oracle of Omaha hung onto these housing stocks as they would benefit from urbanization and a strong brand value. Berkshire Hathaway has roughly $100 million of NVR shares and around $26 million of Lennar shares as of the company’s latest 13F filing, citing a CNBC article.

Key NVR Tailwinds: Increase in New Orders, Very Strong ROE

NVR’s profit margin is expected to improve as the company has witnessed an increase in new orders. In the second quarter, NVR’s new orders increased by 3% to 6,067 units from 5,905 units a year ago.

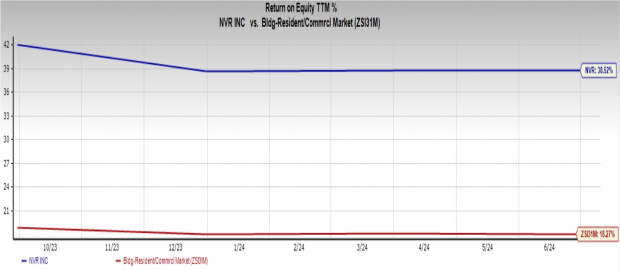

NVR has proficiently generated profits as the company’s return on equity (ROE) is 38.5%, more than the Building Products - Home Builders industry’s 18.3%. An ROE of more than 20% is usually considered very strong.

p>

Image Source: Zacks Investment Research

NVR’s expected earnings growth rate for the next five years is 7.6%. Its shares have gained 33.9% so far this year.

Image Source: Zacks Investment Research

Key LEN Tailwinds: Dynamic Pricing Model, Lower Debt

Lennar is well-positioned to gain from its dynamic pricing model, which helps the company set prices based on demand trends and ever-changing market scenarios. This, in turn, aids Lennar in improving cash flow and return on inventory.

Lennar has a debt-to-equity of 8.3%, less than the industry’s 15.4%, a tell-tale sign that the company has less debt on its balance sheet than its peers, and can operate more efficiently in the long run.

Image Source: Zacks Investment Research

LEN’s expected earnings growth rate for the next five years is 7.8%. Its shares have gained 24.7% year to date.

Image Source: Zacks Investment Research

Fear Not, If the Fed Doesn’t Cut Rates

In the worst-cum-worst situation, if the Fed doesn’t cut interest rates, shares of NVR and Lennar would still scale upward, thanks to the presidential election in November. Kamala Harris, a Democratic nominee wants to boost construction activity and provide financial assistance to first-time home buyers.

Image: Shutterstock

Mortgage Rates Are Falling: A Boon for 2 Warren Buffett Stocks

Warren Buffett-led Berkshire Hathaway Inc.’s (BRK.B - Free Report) portfolio hasn’t fared badly against the S&P 500’s return amid a higher interest rate environment. However, Buffett hopes for interest rate cuts like several market pundits as it would jack up the share price of two of his beloved housing stocks NVR, Inc. (NVR - Free Report) and Lennar Corporation (LEN - Free Report) . Here’s why –

Freddie Mac Report: U.S. Mortgage Rates Drop

According to Freddie Mac, for the week ending Sept. 12, the 30-year fixed-rate mortgage slipped to its lowest level since February 2023. The rate on the 30-year loan averaged 6.2%, down from the four-week and 52-week averages of 6.34% and 6.93%, respectively. The 30-year mortgage rate hovered around the 7% mark for most of the year, but since late July, it has begun to cool off and has fallen since then.

The 15-year fixed mortgage average rate was 5.27%, down from the four-week and 52-week averages of 5.47% and 6.21%, respectively, a positive development for aspiring homeowners, added Freddie Mac. Have a look at the chart, which shows that mortgage rates in the United States continued to soften over the past year –

Image Source: Freddie Mac

Why Are Mortgage Rates Falling?

An increase in expectations of a much-awaited interest rate cut in the Federal Reserve’s September policy meeting is pushing the yields on long-term bonds lower leading to a drop in mortgage rates.

The Fed is expected to trim interest rates as price pressures ebb toward the central bank’s 2% target. The interest rate cut would be the first one since March 2020, when the Fed slashed rates to boost economic growth derailed due to the pandemic. The interest rates have remained elevated for the past 14months, waiting for economic conditions to improve.

According to the CME FedWatch Tool, around 59% of market participants expect the Fed to trim interest rates by 50 basis points in the upcoming policy meeting. Nearly 41% of traders are pricing in a quarter-point interest rate cut.

Image Source: CME Group

Drop in Mortgage Rates to Boost 2 Warren Buffett Stocks

The steady decline in mortgage rates on interest rate cut expectations should increase new home purchases, and boost homebuilders’ bottom line. Thus, two of Warren Buffett’s homebuilders, NVR and Lennar, are expected to see an increase in their stock prices.

After giving away his stake in D.R. Horton, Inc. (DHI - Free Report) , the Oracle of Omaha hung onto these housing stocks as they would benefit from urbanization and a strong brand value. Berkshire Hathaway has roughly $100 million of NVR shares and around $26 million of Lennar shares as of the company’s latest 13F filing, citing a CNBC article.

Key NVR Tailwinds: Increase in New Orders, Very Strong ROE

NVR’s profit margin is expected to improve as the company has witnessed an increase in new orders. In the second quarter, NVR’s new orders increased by 3% to 6,067 units from 5,905 units a year ago.

NVR has proficiently generated profits as the company’s return on equity (ROE) is 38.5%, more than the Building Products - Home Builders industry’s 18.3%. An ROE of more than 20% is usually considered very strong.

p>

Image Source: Zacks Investment Research

NVR’s expected earnings growth rate for the next five years is 7.6%. Its shares have gained 33.9% so far this year.

Image Source: Zacks Investment Research

Key LEN Tailwinds: Dynamic Pricing Model, Lower Debt

Lennar is well-positioned to gain from its dynamic pricing model, which helps the company set prices based on demand trends and ever-changing market scenarios. This, in turn, aids Lennar in improving cash flow and return on inventory.

Lennar has a debt-to-equity of 8.3%, less than the industry’s 15.4%, a tell-tale sign that the company has less debt on its balance sheet than its peers, and can operate more efficiently in the long run.

Image Source: Zacks Investment Research

LEN’s expected earnings growth rate for the next five years is 7.8%. Its shares have gained 24.7% year to date.

Image Source: Zacks Investment Research

Fear Not, If the Fed Doesn’t Cut Rates

In the worst-cum-worst situation, if the Fed doesn’t cut interest rates, shares of NVR and Lennar would still scale upward, thanks to the presidential election in November. Kamala Harris, a Democratic nominee wants to boost construction activity and provide financial assistance to first-time home buyers.

Moreover, millennials are about to settle into a family life leading to increased demand for houses, a blessing for NVR and Lennar. Both stocks have a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.