It’s hard to believe that this newest bull market is nearly two years old. It seems like just yesterday we were talking about the 2022 bearish downturn amid a 40-year high in inflation. And as much heat as the Fed took for failing to act quickly enough to combat high prices, inflationary measures have gradually trended back toward their long-term target.

Large-cap tech companies have mainly led the way since then. These companies were able to best weather the storm coming out of that period, and their earnings trajectory stabilized first as the economic outlook became clearer.

Times are changing now. The Fed just cut interest rates for the first time in more than four years. Markets have been pricing in an anticipated series of cuts for some time. As this bull evolves and takes the next step in its progression, we’ve started to see large-cap tech lag and rate-sensitive areas assume the driver’s seat as the rally broadens out.

This is a healthy and necessary rotation in terms of the sustainability of this new bull market. It makes sense when we think about it; as inflation softens, markets gain confidence in upcoming interest rate cuts. Lower yields tend to help small-cap stocks gain traction, which are generally more interest-rate sensitive. Since these companies typically have a higher cost of borrowing, declining yields serve as a tailwind moving forward.

Over the last two years, naysayers have frustratingly pointed out that large-cap tech was propping up the market. The “weak breadth” argument remained front and center until earlier this year, when the rate-cut narrative finally gained some steam.

And now, the bull’s biggest weakness could soon become its biggest strength. Not only is a shift toward rate-sensitive areas logical, we have plenty of data to back it up. But first, let’s take a deeper dive into what this latest rate cut may mean for stocks moving forward.

Historical Returns Following Interest Rate Cuts

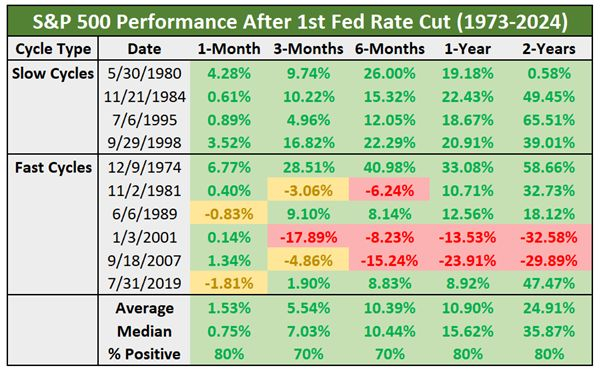

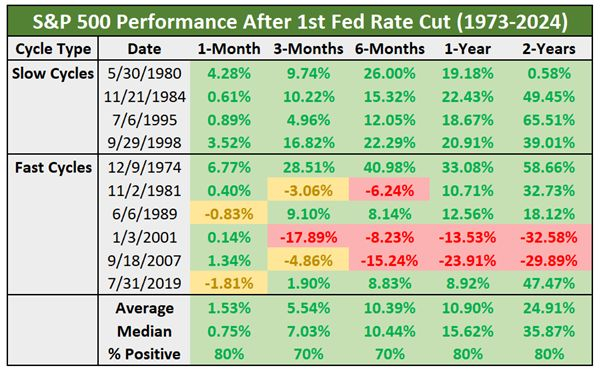

Context matters when it comes to interest rate cuts and stock performance. But generally speaking, when the US economy has avoided a recession in the year following the first cut of a new cycle, stocks have ripped higher. And it’s the slow-cut cycles wherein markets really tend to do well.

Now, why is that the case? It’s because in fast easing cycles, it usually means something has gone wrong and the Fed needs to act quickly (like in 2007-2008, as the economy headed toward the Financial Crisis and Great Recession).

On the other hand, slow easing cycles are associated with resilient economies and ongoing growth. The Fed has made it clear this time around that it plans to cut rates slowly, which is music to our ears. As we can see below, the S&P 500 widely outperforms in the 1st year of slow easing cycles versus fast ones:

Image Source: Zacks Investment Research

Looking one year out following the first rate cut during slow cycles, the S&P 500 has averaged a return of more than 20% (as opposed to just 4.6% during fast cycles). The takeaway here is to keep an open mind about better-than-expected market outcomes moving forward.

Looking Ahead to Small-Cap Performance

That’s all well and good for large-cap companies in the S&P 500, but what about smaller companies? The Russell 2000 – a group of stocks with $2 billion and under in market value – is a good gauge to use for these companies.

There’s no doubt that small-caps have lagged throughout this latest bull market. But they began to perk up heading into this past week’s rate announcement, with the Russell 2000 index climbing about 12% from the August low (at the time of this writing). It’s almost as if they were trying to tell us something.

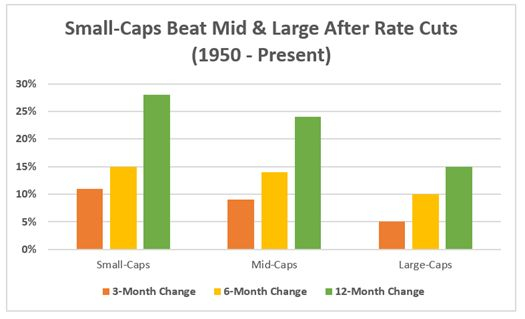

And they were. As we can see below, on a forward 3-month, 6-month, and 12-month basis, small-caps have outperformed both their mid- and large-cap counterparts following the first rate cut of a new cycle (with data going back to 1950):

Image Source: Zacks Investment Research

Of course, every rate-cut cycle is slightly different. This time around, the Fed initiated the first cut with stocks near all-time highs, not to mention substantial gains from the bottom of the 2022 bear market along with a looming presidential election.

Continued . . .

------------------------------------------------------------------------------------------------------

Ultimate Access Is Only $1

Starting today, for one month, you are invited to see the real-time buys and sells from all our private portfolios for only $1. And you won't be obligated to spend another cent.

These portfolios closed 177 double and triple-digit gains already this year. While not all our picks are winners, members saw gains of +190.3%, +200.3%, +263.2%, and even +812.0%.¹

Special opportunity ends at midnight Sunday, September 22.

Start Zacks Ultimate Access Now >>

------------------------------------------------------------------------------------------------------

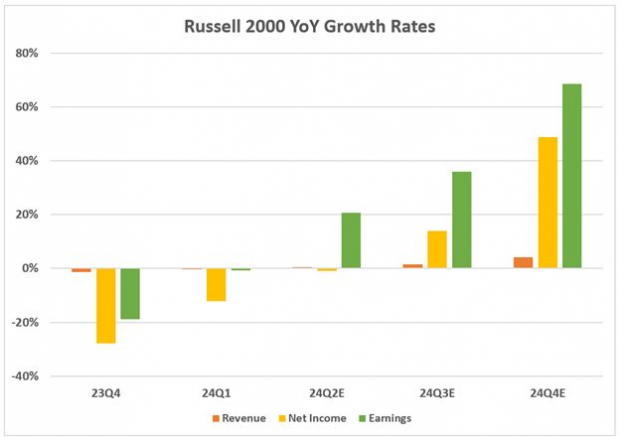

But let’s keep in mind, what is the market’s primary concern? Earnings. And earnings-per-share growth expectations for small-cap companies are rising, with analysts anticipating that Russell 2000 constituents will grow at a persuasively faster rate than the S&P 500 in the coming quarters:

Image Source: Zacks Investment Research

In addition, small-cap valuations remain fairly attractive relative to large-caps. Adding small-cap exposure to portfolios provides another opportunity for diversification as well.

Remember that these charts don’t predict anything about this cycle. They’re meant to demonstrate a wide range of potential outcomes so that readers aren’t led astray, particularly with all the noise out there from the financial media.

Final Thoughts

There are many reasons to be optimistic in the second year of this new bull market. The move in stocks is undoubtedly supported by fundamentals including corporate earnings growth and a resilient economy.

Let’s also remember that bull markets have averaged over 5 years in length going back 75 years. This is a long-term game that requires a long-term mindset.

Of course, that doesn’t mean the market will move up in a straight line. Even during the most bullish of times, there are always pullbacks and corrections (and bear markets) along the way. But in order to take advantage of secular bull trends (which is what we’re in now), we need to embrace the volatility when it comes.

We shouldn’t fear interest rate cuts, as stocks have performed admirably after the central bank begins the easing process – particularly in slow cycles. We’ve seen a shift into rate-sensitive areas, a healthy rotation that is vital to the sustainability of this bull market and one that looks to benefit small-caps in particular.

And given that we’re in an election year that is showing a trending market and fairly little volatility, the probability of further gains ahead remains enticing from a historical perspective.

Here’s to hoping history rhymes once again.

How to Seize Opportunities in the Rate-Cut Era

One of the best ways investors stay informed and ensure their portfolios are balanced and well-positioned for future growth is by seeing what stocks the pros are picking.

That's why I'm pleased to offer you full 30-day, real-time access to every stock and ETF we're recommending as part of our celebrated Zacks Ultimate service.

All of our expert led portfolios are grounded in Zacks Rank fundamentals. Don't miss your chance to see the picks from ready-to-fly stocks under $10, to professional options trades… from surging tech buys, to long-term value stocks… and from home run investments, to income recommendations.

These portfolios already closed 177 positions with double and triple-digit profits this year. While we can't promise every stock will be a winner, members following these picks saw gains of +190.3%, +200.3%, +263.2%, and even +812.0%.¹

Your cost for all this is only $1, and there's not 1 cent of obligation to spend anything more.

Free Bonus: You'll also receive the Zacks AI Total Package, which is a bundle of five Special Reports, each highlighting a unique way to target huge gains with little-known AI stocks. These companies that make AI possible could hand you the biggest profits in the weeks, months, and years ahead.

Your opportunity ends at midnight Sunday, September 22.

Access Zacks Ultimate and Download Zacks AI Total Package Now for $1 >>

All the best,

Bryan Hayes

Bryan Hayes, CFA manages the Zacks Income Investor and Headline Trader Services and has deep experience in both long-term and short-term investing. He invites you to take advantage of our unique $1 opportunity.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.

Image: Bigstock

The Times They Are A-Changin': Rate-Sensitive Rotation Underway

It’s hard to believe that this newest bull market is nearly two years old. It seems like just yesterday we were talking about the 2022 bearish downturn amid a 40-year high in inflation. And as much heat as the Fed took for failing to act quickly enough to combat high prices, inflationary measures have gradually trended back toward their long-term target.

Large-cap tech companies have mainly led the way since then. These companies were able to best weather the storm coming out of that period, and their earnings trajectory stabilized first as the economic outlook became clearer.

Times are changing now. The Fed just cut interest rates for the first time in more than four years. Markets have been pricing in an anticipated series of cuts for some time. As this bull evolves and takes the next step in its progression, we’ve started to see large-cap tech lag and rate-sensitive areas assume the driver’s seat as the rally broadens out.

This is a healthy and necessary rotation in terms of the sustainability of this new bull market. It makes sense when we think about it; as inflation softens, markets gain confidence in upcoming interest rate cuts. Lower yields tend to help small-cap stocks gain traction, which are generally more interest-rate sensitive. Since these companies typically have a higher cost of borrowing, declining yields serve as a tailwind moving forward.

Over the last two years, naysayers have frustratingly pointed out that large-cap tech was propping up the market. The “weak breadth” argument remained front and center until earlier this year, when the rate-cut narrative finally gained some steam.

And now, the bull’s biggest weakness could soon become its biggest strength. Not only is a shift toward rate-sensitive areas logical, we have plenty of data to back it up. But first, let’s take a deeper dive into what this latest rate cut may mean for stocks moving forward.

Historical Returns Following Interest Rate Cuts

Context matters when it comes to interest rate cuts and stock performance. But generally speaking, when the US economy has avoided a recession in the year following the first cut of a new cycle, stocks have ripped higher. And it’s the slow-cut cycles wherein markets really tend to do well.

Now, why is that the case? It’s because in fast easing cycles, it usually means something has gone wrong and the Fed needs to act quickly (like in 2007-2008, as the economy headed toward the Financial Crisis and Great Recession).

On the other hand, slow easing cycles are associated with resilient economies and ongoing growth. The Fed has made it clear this time around that it plans to cut rates slowly, which is music to our ears. As we can see below, the S&P 500 widely outperforms in the 1st year of slow easing cycles versus fast ones:

Image Source: Zacks Investment Research

Looking one year out following the first rate cut during slow cycles, the S&P 500 has averaged a return of more than 20% (as opposed to just 4.6% during fast cycles). The takeaway here is to keep an open mind about better-than-expected market outcomes moving forward.

Looking Ahead to Small-Cap Performance

That’s all well and good for large-cap companies in the S&P 500, but what about smaller companies? The Russell 2000 – a group of stocks with $2 billion and under in market value – is a good gauge to use for these companies.

There’s no doubt that small-caps have lagged throughout this latest bull market. But they began to perk up heading into this past week’s rate announcement, with the Russell 2000 index climbing about 12% from the August low (at the time of this writing). It’s almost as if they were trying to tell us something.

And they were. As we can see below, on a forward 3-month, 6-month, and 12-month basis, small-caps have outperformed both their mid- and large-cap counterparts following the first rate cut of a new cycle (with data going back to 1950):

Image Source: Zacks Investment Research

Of course, every rate-cut cycle is slightly different. This time around, the Fed initiated the first cut with stocks near all-time highs, not to mention substantial gains from the bottom of the 2022 bear market along with a looming presidential election.

Continued . . .

------------------------------------------------------------------------------------------------------

Ultimate Access Is Only $1

Starting today, for one month, you are invited to see the real-time buys and sells from all our private portfolios for only $1. And you won't be obligated to spend another cent.

These portfolios closed 177 double and triple-digit gains already this year. While not all our picks are winners, members saw gains of +190.3%, +200.3%, +263.2%, and even +812.0%.¹

Special opportunity ends at midnight Sunday, September 22.

Start Zacks Ultimate Access Now >>

------------------------------------------------------------------------------------------------------

But let’s keep in mind, what is the market’s primary concern? Earnings. And earnings-per-share growth expectations for small-cap companies are rising, with analysts anticipating that Russell 2000 constituents will grow at a persuasively faster rate than the S&P 500 in the coming quarters:

Image Source: Zacks Investment Research

In addition, small-cap valuations remain fairly attractive relative to large-caps. Adding small-cap exposure to portfolios provides another opportunity for diversification as well.

Remember that these charts don’t predict anything about this cycle. They’re meant to demonstrate a wide range of potential outcomes so that readers aren’t led astray, particularly with all the noise out there from the financial media.

Final Thoughts

There are many reasons to be optimistic in the second year of this new bull market. The move in stocks is undoubtedly supported by fundamentals including corporate earnings growth and a resilient economy.

Let’s also remember that bull markets have averaged over 5 years in length going back 75 years. This is a long-term game that requires a long-term mindset.

Of course, that doesn’t mean the market will move up in a straight line. Even during the most bullish of times, there are always pullbacks and corrections (and bear markets) along the way. But in order to take advantage of secular bull trends (which is what we’re in now), we need to embrace the volatility when it comes.

We shouldn’t fear interest rate cuts, as stocks have performed admirably after the central bank begins the easing process – particularly in slow cycles. We’ve seen a shift into rate-sensitive areas, a healthy rotation that is vital to the sustainability of this bull market and one that looks to benefit small-caps in particular.

And given that we’re in an election year that is showing a trending market and fairly little volatility, the probability of further gains ahead remains enticing from a historical perspective.

Here’s to hoping history rhymes once again.

How to Seize Opportunities in the Rate-Cut Era

One of the best ways investors stay informed and ensure their portfolios are balanced and well-positioned for future growth is by seeing what stocks the pros are picking.

That's why I'm pleased to offer you full 30-day, real-time access to every stock and ETF we're recommending as part of our celebrated Zacks Ultimate service.

All of our expert led portfolios are grounded in Zacks Rank fundamentals. Don't miss your chance to see the picks from ready-to-fly stocks under $10, to professional options trades… from surging tech buys, to long-term value stocks… and from home run investments, to income recommendations.

These portfolios already closed 177 positions with double and triple-digit profits this year. While we can't promise every stock will be a winner, members following these picks saw gains of +190.3%, +200.3%, +263.2%, and even +812.0%.¹

Your cost for all this is only $1, and there's not 1 cent of obligation to spend anything more.

Free Bonus: You'll also receive the Zacks AI Total Package, which is a bundle of five Special Reports, each highlighting a unique way to target huge gains with little-known AI stocks. These companies that make AI possible could hand you the biggest profits in the weeks, months, and years ahead.

Your opportunity ends at midnight Sunday, September 22.

Access Zacks Ultimate and Download Zacks AI Total Package Now for $1 >>

All the best,

Bryan Hayes

Bryan Hayes, CFA manages the Zacks Income Investor and Headline Trader Services and has deep experience in both long-term and short-term investing. He invites you to take advantage of our unique $1 opportunity.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.