We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

• U.S. inflation data, • The start of Q3 earnings, • A French budget, and • Possibly, a big rate cut from New Zealand.

Investors are also on edge -- as Middle East tensions escalate.

Meanwhile, Japan's new Prime Minister, Shigeru Ishiba, is in the spotlight.

Next are Reuters' five world market themes, reordered for equity traders -

(1) U.S. Q3 Earnings Season: Kicking into Gear

U.S. third-quarter earnings season is about to kick into gear, posing a test for a stock market near record highs and trading at elevated valuations.

JPMorgan Chase (JPM), Wells Fargo (WFC), and BlackRock (BLK), report on Friday. Other results earlier in the week include PepsiCo (PEP), and Delta Air Lines (DAL).

S&P 500 companies overall are expected to have increased Q3 earnings by +5.3% from a year earlier, according to LSEG IBES.

Thursday's September U.S. consumer price index, meanwhile, will be closely watched for signs that inflation is moderating.

Investors are already anticipating hefty rate cuts, after the Federal Reserve kicked off its easing cycle last month.

Elsewhere, investors will seek to gauge the economic fallout from a dockworker strike, as U.S. East Coast and Gulf Coast ports reopened on Thursday.

(2) One solid year of war for Israel and Hamas

One year on from Hamas' Oct. 7th attack on Israel and the region looks on the brink of a sprawling war that could potentially reshape the oil-rich Middle East.

The conflict, which has killed more than 42,000 people, the vast majority in Gaza, is spreading. Israeli troops are now in neighboring Lebanon, home to Iran-backed Hezbollah; Iran launched a large-scale missile attack on Israel earlier this week.

Global markets have remained broadly unfazed. Oil prices, the main conduit for tremors further afield, have jumped about +8% this week, but soft demand and ample supply globally have kept a lid on gains.

A further escalation between Iran and Israel could change that, especially if Israel strikes Iran's oil facilities, an option that U.S. President Joe Biden said was under discussion.

The scars of the conflict are visible on Israel's economy, which has suffered a number of sovereign downgrades and seen its default insurance spike and bonds slide.

(3) What is Japan’s New Prime Minister Going to Do?

When Shigeru Ishiba surprised markets by winning the contest to become Japan's prime minister, investors rushed to re-position themselves for higher interest rates.

A week on and the landscape looks different, as Ishiba back-flipped not just on monetary policy, but on prior market-unfriendly support for higher corporate and capital gains taxes.

It's perhaps not surprising for a hawk to hide his talons with a snap election looming on Oct. 27th.

Even so, Ishiba was unabashedly blunt, saying after a meeting with the Bank of Japan - whose independence Ishiba has pledged to honor - that the economy is not ready for further rate hikes.

The yen, which had been surging, slid past 147 to a six-week trough by Thursday. Japanese stocks rebounded from their steepest slide since early August.

Check back in a month from now for any further policy flip-flops.

(4) On Thursday, France’ New Government Presents its First Budget

France's new government presents its long-awaited budget to parliament on Thursday. It's planning a 60-billion-euro belt-tightening drive, around 2.0% of GDP, next year.

It reckons spending cuts and tax hikes should bring the deficit, seen rising to -6.1% this year in the latest upward revision, to 5% by end-2025.

The target date for reaching the euro zone's 3.0% deficit limit is also being pushed back to 2029 from 2027.

That's bad news just ahead of rating reviews kicking off with Fitch next Friday.

Markets are not impressed.

Having eased slightly, the extra premium France pays for its 10-year debt over Germany's widened back to just under 80 bps, near its highest since August.

Ultimately, what may matter more is whether Prime Minister Michel Barnier can pass the budget, given a divided parliament that has investors questioning how long his government will last.

(5) On Wednesday, Oct. 9th, the Reserve Bank of New Zealand (RBNZ) Meets.

A reluctant joiner to global easing, the Reserve Bank of New Zealand is catching up fast.

It meets on Oct. 9th.

Traders reckon the central bank could follow the Fed's example and cut rates by half a point.

The RBNZ cut rates by 25 bps to 5.25% in August, a year ahead of its own projections.

Markets price in a drop below 3% by end-2025. This will still be above where traders think U.S. and euro area rates will be.

Shorter-term investors are neutral towards the kiwi, but hedge funds have lapped it up this year.

Positioning and potentially higher rates than others might insulate New Zealand's currency.

So could the return of so-called carry trades and in this case, essentially a bearish bet on the yen in favor of bullish ones on high-yielders such as the kiwi.

Zacks #1 Rank (STRONG BUY) Stocks

(1) Twilio (TWLO - Free Report) ): This is a $66 a share, Internet-Software industry stock, with a market cap of $10.7B. I see a Zacks Value score of D, a Zacks Growth score of A, and a Zacks Momentum score of C.

Image Source: Zacks Investment Research

Headquartered in San Francisco, Twilio Inc. was founded in 2007, and got listed on the NYSE in June 2016.

Twilio provides a Cloud Communications Platform-as-a-Service.

The company enables developers to build, scale and operate real-time communications within software applications.

The company’s platform consists of three layers, Engagement Cloud, Programmable Communications Cloud and Super Network.

• Twilio’s Programmable Communications Cloud software allows developers to embed voice, messaging, video and authentication capabilities.

• The company runs a cloud-based Application Programming Interfaces or API, which allows software developers to programmatically make and receive phone calls, text messages and video chats. The advantage of this is that now small app developers can add rich communications features to their apps at a very low cost. By using Twilio’s software, companies can develop such embed communication applications and website that will help them better connect with end customers.

• The Super Network is a software layer which enables its customers' software to communicate with connected devices globally.

The company operates globally, with 22 data centers across nine regions. Twilio uses Amazon Web Service (AWS) to host its platform.

Notably, Amazon had invested during Twilio’s Series E round funding in 2015.

The company boasts a strong clientele which includes the likes of Uber, Facebook, Home Depot, Nordstrom, Netflix, Salesforce and X/Twitter among others. The company ended 2023 with more than 305,000 active customers.

Twilio delivered revenues of $4.15 billion in 2023, up approximately 9% from full-year 2022.

The company generates majority of its revenues from customers located in the U.S. In 2022, these customers accounted for approximately 66% of Twilio’s total revenue, while the remaining 34% was contributed by customers located outside the country.

Its 10 largest customers generated approximately 10% of 2023 total revenue. In 2023, revenue from Active Customer Accounts represented over 99% of total revenue.

(2) Assurant (AIZ - Free Report) ): This is a $196 a share, Insurance – Multi-line industry stock, with a market cap of $10.3B. I see a Zacks Value score of B, a Zacks Growth score of D, and a Zacks Momentum score of B.

Image Source: Zacks Investment Research

Founded in 1969 and headquartered in New York, Assurant Inc. is a global provider of risk management solutions in the housing and lifestyle markets, protecting where people live and the goods they buy.

The company operates in North America, Latin America, Europe and Asia Pacific. Assurant was incorporated as a Delaware corporation in 2004.

The company reports through two reportable segments: Global Lifestyle and Global Housing.

Global Lifestyle segment (80% of 2023 Net earned premiums) provides mobile device protection products and related services and extended service products and related services for consumer electronics and appliances (referred to as Connected Living); vehicle protection and related services (referred to as Global Automotive); and credit and other insurance products (referred to as Global Financial Services).

Global Lifestyle operates globally, with about 82% of its revenues from North America, 8% from Latin America, 5% from Europe and 5% from Asia Pacific for the year ended Dec 31st, 2022.

Global Housing segment (20%) provides lender-placed homeowners insurance, lender-placed manufactured housing insurance, lender-placed flood insurance; and renters insurance and related products (referred to as Multifamily Housing), as well as voluntary manufactured housing and other insurance.

This segment is comprised of two key lines of business, Homeowners and Renters and Other.

On Aug 1st, 2018, Assurant sold its Mortgage Solutions business, which comprised property inspection and preservation, valuation and title services and other property risk management services.

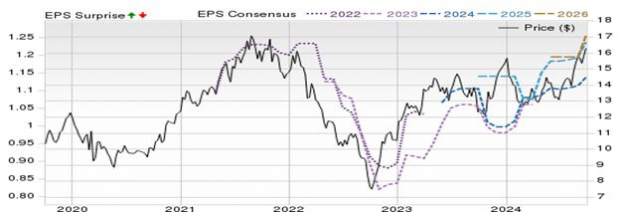

(3) J. Sainsbury (JSAIY - Free Report) ): This is a $16 a share, Retail-Supermarkets industry stock, with a market cap of $9.3B. I see a Zacks Value score of A, a Zacks Growth score of C, and a Zacks Momentum score of A.

Image Source: Zacks Investment Research

J. Sainsbury PLC is a leading U.K. food retailer, with interests in financial services.

It consists of: Sainsbury's Supermarkets, Sainsbury's Local, Bells Stores, Jackson’s Stores, J.B. Beaumont, Sainsbury's Online, and Sainsbury's Bank.

The company employs 148,000 people.

Key Global Macro

It’s a fairly quiet week -- on the global macro indicator front. Thursday’s U.S. CPI data for SEP stand out, as the exception.

On Monday, Mainland China reports its SEP foreign currency reserves. $3.3T is expected, up from 3.288T the month prior. Massive.

Japan’s leading economic index for AUG comes out. Expect 107.4, down from the prior 109.3. Decelerating.

Four Fed speakers (Bowman, Kashkari, Bostic, and Musalem) tee-up comments.

On Tuesday, the U.S. goods overall trade balance for AUG comes out. -$72.3B is what to expect, after a prior $78.8B.

On Wednesday, the Reserve Bank of New Zealand’s (RBNZ) policy rate decision comes out. Expect a 50-bps cut to 4.75%, from 5.25%.

On Thursday, Mainland China’s Foreign Direct Investment (FDI) for SEPT comes out. The prior reading shows an abysmal -31.5% y/y decline.

The U.S. Consumer Price Index (CPI) for SEP comes out. Expect +0.2% m/m to follow a +0.3% m/m print in AUG.

Traders should expect a lower +2.3% y/y broad CPI print in SEP. The broad CPI marked a lower +2.5% y/y. The core ex-food and energy CPI rested at +3.2% y/y.

On Friday, the U.S. Producer Price Index (PPI) for SEP comes out. Ex-food and energy PPI was +2.4% y/y, in the prior AUG reading.

The University of Michigan consumer sentiment index for OCT (preliminary) comes out. The prior SEP reading was 70.1.

Conclusion

Zacks Research Director Sheraz Mian put down 4 key earnings points, Oct. 2nd, 2024.

(1) Estimates for Q3-24 have come down since the start of the quarter on July 1st.

The magnitude of estimate cuts is significantly bigger, than what we had seen in the comparable periods, of other recent quarters.

This negative shift in the revisions trend reverses the prior favorable development, on this front, in recent quarters.

(2) Total S&P500 earnings are currently expected to be up +3.7% from the same period last year on +5.1% higher revenues.

Earnings estimates have steadily come down since the start of the period, with the current +3.7% growth pace down from +6.9% at the start of July.

(3) Earnings growth is expected to accelerate after the modest growth in Q3.

Double-digit earnings growth highlights the forecast for the S&P500 index, in each of the following four quarters.

(4) Not only is the year-over-year growth pace in aggregate earnings expected to accelerate over the next four periods.

Zacks also expects the absolute dollar level of quarterly earnings to reach new all-time records, in each quarter.

Enjoy a successful week, trading and investing!

John Blank, PhD. Zacks Chief Equity Strategist and Economist

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Global Week Ahead: Q3 Earnings Season

It's a packed Global Week Ahead.

Traders can expect:

• U.S. inflation data,

• The start of Q3 earnings,

• A French budget, and

• Possibly, a big rate cut from New Zealand.

Investors are also on edge -- as Middle East tensions escalate.

Meanwhile, Japan's new Prime Minister, Shigeru Ishiba, is in the spotlight.

Next are Reuters' five world market themes, reordered for equity traders -

(1) U.S. Q3 Earnings Season: Kicking into Gear

U.S. third-quarter earnings season is about to kick into gear, posing a test for a stock market near record highs and trading at elevated valuations.

JPMorgan Chase (JPM), Wells Fargo (WFC), and BlackRock (BLK), report on Friday. Other results earlier in the week include PepsiCo (PEP), and Delta Air Lines (DAL).

S&P 500 companies overall are expected to have increased Q3 earnings by +5.3% from a year earlier, according to LSEG IBES.

Thursday's September U.S. consumer price index, meanwhile, will be closely watched for signs that inflation is moderating.

Investors are already anticipating hefty rate cuts, after the Federal Reserve kicked off its easing cycle last month.

Elsewhere, investors will seek to gauge the economic fallout from a dockworker strike, as U.S. East Coast and Gulf Coast ports reopened on Thursday.

(2) One solid year of war for Israel and Hamas

One year on from Hamas' Oct. 7th attack on Israel and the region looks on the brink of a sprawling war that could potentially reshape the oil-rich Middle East.

The conflict, which has killed more than 42,000 people, the vast majority in Gaza, is spreading. Israeli troops are now in neighboring Lebanon, home to Iran-backed Hezbollah; Iran launched a large-scale missile attack on Israel earlier this week.

Global markets have remained broadly unfazed. Oil prices, the main conduit for tremors further afield, have jumped about +8% this week, but soft demand and ample supply globally have kept a lid on gains.

A further escalation between Iran and Israel could change that, especially if Israel strikes Iran's oil facilities, an option that U.S. President Joe Biden said was under discussion.

The scars of the conflict are visible on Israel's economy, which has suffered a number of sovereign downgrades and seen its default insurance spike and bonds slide.

(3) What is Japan’s New Prime Minister Going to Do?

When Shigeru Ishiba surprised markets by winning the contest to become Japan's prime minister, investors rushed to re-position themselves for higher interest rates.

A week on and the landscape looks different, as Ishiba back-flipped not just on monetary policy, but on prior market-unfriendly support for higher corporate and capital gains taxes.

It's perhaps not surprising for a hawk to hide his talons with a snap election looming on Oct. 27th.

Even so, Ishiba was unabashedly blunt, saying after a meeting with the Bank of Japan - whose independence Ishiba has pledged to honor - that the economy is not ready for further rate hikes.

The yen, which had been surging, slid past 147 to a six-week trough by Thursday. Japanese stocks rebounded from their steepest slide since early August.

Check back in a month from now for any further policy flip-flops.

(4) On Thursday, France’ New Government Presents its First Budget

France's new government presents its long-awaited budget to parliament on Thursday. It's planning a 60-billion-euro belt-tightening drive, around 2.0% of GDP, next year.

It reckons spending cuts and tax hikes should bring the deficit, seen rising to -6.1% this year in the latest upward revision, to 5% by end-2025.

The target date for reaching the euro zone's 3.0% deficit limit is also being pushed back to 2029 from 2027.

That's bad news just ahead of rating reviews kicking off with Fitch next Friday.

Markets are not impressed.

Having eased slightly, the extra premium France pays for its 10-year debt over Germany's widened back to just under 80 bps, near its highest since August.

Ultimately, what may matter more is whether Prime Minister Michel Barnier can pass the budget, given a divided parliament that has investors questioning how long his government will last.

(5) On Wednesday, Oct. 9th, the Reserve Bank of New Zealand (RBNZ) Meets.

A reluctant joiner to global easing, the Reserve Bank of New Zealand is catching up fast.

It meets on Oct. 9th.

Traders reckon the central bank could follow the Fed's example and cut rates by half a point.

The RBNZ cut rates by 25 bps to 5.25% in August, a year ahead of its own projections.

Markets price in a drop below 3% by end-2025. This will still be above where traders think U.S. and euro area rates will be.

Shorter-term investors are neutral towards the kiwi, but hedge funds have lapped it up this year.

Positioning and potentially higher rates than others might insulate New Zealand's currency.

So could the return of so-called carry trades and in this case, essentially a bearish bet on the yen in favor of bullish ones on high-yielders such as the kiwi.

Zacks #1 Rank (STRONG BUY) Stocks

(1) Twilio (TWLO - Free Report) ): This is a $66 a share, Internet-Software industry stock, with a market cap of $10.7B. I see a Zacks Value score of D, a Zacks Growth score of A, and a Zacks Momentum score of C.

Image Source: Zacks Investment Research

Headquartered in San Francisco, Twilio Inc. was founded in 2007, and got listed on the NYSE in June 2016.

Twilio provides a Cloud Communications Platform-as-a-Service.

The company enables developers to build, scale and operate real-time communications within software applications.

The company’s platform consists of three layers, Engagement Cloud, Programmable Communications Cloud and Super Network.

• Twilio’s Programmable Communications Cloud software allows developers to embed voice, messaging, video and authentication capabilities.

• The company runs a cloud-based Application Programming Interfaces or API, which allows software developers to programmatically make and receive phone calls, text messages and video chats. The advantage of this is that now small app developers can add rich communications features to their apps at a very low cost. By using Twilio’s software, companies can develop such embed communication applications and website that will help them better connect with end customers.

• The Super Network is a software layer which enables its customers' software to communicate with connected devices globally.

The company operates globally, with 22 data centers across nine regions. Twilio uses Amazon Web Service (AWS) to host its platform.

Notably, Amazon had invested during Twilio’s Series E round funding in 2015.

The company boasts a strong clientele which includes the likes of Uber, Facebook, Home Depot, Nordstrom, Netflix, Salesforce and X/Twitter among others. The company ended 2023 with more than 305,000 active customers.

Twilio delivered revenues of $4.15 billion in 2023, up approximately 9% from full-year 2022.

The company generates majority of its revenues from customers located in the U.S. In 2022, these customers accounted for approximately 66% of Twilio’s total revenue, while the remaining 34% was contributed by customers located outside the country.

Its 10 largest customers generated approximately 10% of 2023 total revenue. In 2023, revenue from Active Customer Accounts represented over 99% of total revenue.

(2) Assurant (AIZ - Free Report) ): This is a $196 a share, Insurance – Multi-line industry stock, with a market cap of $10.3B. I see a Zacks Value score of B, a Zacks Growth score of D, and a Zacks Momentum score of B.

Image Source: Zacks Investment Research

Founded in 1969 and headquartered in New York, Assurant Inc. is a global provider of risk management solutions in the housing and lifestyle markets, protecting where people live and the goods they buy.

The company operates in North America, Latin America, Europe and Asia Pacific. Assurant was incorporated as a Delaware corporation in 2004.

The company reports through two reportable segments: Global Lifestyle and Global Housing.

Global Lifestyle segment (80% of 2023 Net earned premiums) provides mobile device protection products and related services and extended service products and related services for consumer electronics and appliances (referred to as Connected Living); vehicle protection and related services (referred to as Global Automotive); and credit and other insurance products (referred to as Global Financial Services).

Global Lifestyle operates globally, with about 82% of its revenues from North America, 8% from Latin America, 5% from Europe and 5% from Asia Pacific for the year ended Dec 31st, 2022.

Global Housing segment (20%) provides lender-placed homeowners insurance, lender-placed manufactured housing insurance, lender-placed flood insurance; and renters insurance and related products (referred to as Multifamily Housing), as well as voluntary manufactured housing and other insurance.

This segment is comprised of two key lines of business, Homeowners and Renters and Other.

On Aug 1st, 2018, Assurant sold its Mortgage Solutions business, which comprised property inspection and preservation, valuation and title services and other property risk management services.

(3) J. Sainsbury (JSAIY - Free Report) ): This is a $16 a share, Retail-Supermarkets industry stock, with a market cap of $9.3B. I see a Zacks Value score of A, a Zacks Growth score of C, and a Zacks Momentum score of A.

Image Source: Zacks Investment Research

J. Sainsbury PLC is a leading U.K. food retailer, with interests in financial services.

It consists of: Sainsbury's Supermarkets, Sainsbury's Local, Bells Stores, Jackson’s Stores, J.B. Beaumont, Sainsbury's Online, and Sainsbury's Bank.

The company employs 148,000 people.

Key Global Macro

It’s a fairly quiet week -- on the global macro indicator front. Thursday’s U.S. CPI data for SEP stand out, as the exception.

On Monday, Mainland China reports its SEP foreign currency reserves. $3.3T is expected, up from 3.288T the month prior. Massive.

Japan’s leading economic index for AUG comes out. Expect 107.4, down from the prior 109.3. Decelerating.

Four Fed speakers (Bowman, Kashkari, Bostic, and Musalem) tee-up comments.

On Tuesday, the U.S. goods overall trade balance for AUG comes out. -$72.3B is what to expect, after a prior $78.8B.

On Wednesday, the Reserve Bank of New Zealand’s (RBNZ) policy rate decision comes out. Expect a 50-bps cut to 4.75%, from 5.25%.

On Thursday, Mainland China’s Foreign Direct Investment (FDI) for SEPT comes out. The prior reading shows an abysmal -31.5% y/y decline.

The U.S. Consumer Price Index (CPI) for SEP comes out. Expect +0.2% m/m to follow a +0.3% m/m print in AUG.

Traders should expect a lower +2.3% y/y broad CPI print in SEP. The broad CPI marked a lower +2.5% y/y. The core ex-food and energy CPI rested at +3.2% y/y.

On Friday, the U.S. Producer Price Index (PPI) for SEP comes out. Ex-food and energy PPI was +2.4% y/y, in the prior AUG reading.

The University of Michigan consumer sentiment index for OCT (preliminary) comes out. The prior SEP reading was 70.1.

Conclusion

Zacks Research Director Sheraz Mian put down 4 key earnings points, Oct. 2nd, 2024.

(1) Estimates for Q3-24 have come down since the start of the quarter on July 1st.

The magnitude of estimate cuts is significantly bigger, than what we had seen in the comparable periods, of other recent quarters.

This negative shift in the revisions trend reverses the prior favorable development, on this front, in recent quarters.

(2) Total S&P500 earnings are currently expected to be up +3.7% from the same period last year on +5.1% higher revenues.

Earnings estimates have steadily come down since the start of the period, with the current +3.7% growth pace down from +6.9% at the start of July.

(3) Earnings growth is expected to accelerate after the modest growth in Q3.

Double-digit earnings growth highlights the forecast for the S&P500 index, in each of the following four quarters.

(4) Not only is the year-over-year growth pace in aggregate earnings expected to accelerate over the next four periods.

Zacks also expects the absolute dollar level of quarterly earnings to reach new all-time records, in each quarter.

Enjoy a successful week, trading and investing!

John Blank, PhD.

Zacks Chief Equity Strategist and Economist