With just one month left in 2024, investors are eager to build on what has already been a landmark year. Following a remarkable +45% surge higher in the S&P 500 since the October 2023 lows, the bullish momentum continues to push stocks to new heights.

This rally has been fueled by rate cuts from the Federal Reserve, enthusiasm for AI-related stocks, and post-election optimism driven by expectations of lower taxes and deregulation.

Together, these drivers have propelled the S&P 500 to an impressive +27% gain for the year. And there are very few signs suggesting the bulls will ease up before the year ends.

Where do investors go from here after such a historic rally?

A bull market like this one often stirs excitement, but it can also lead to trouble for those chasing peaks. Instead of rushing in and hitting the buy button, investors should focus on crafting a thoughtful, strategic plan to position themselves for the opportunities 2025 may bring.

Let us explore how 2024 is likely to finish and lay out a game plan for what promises to be an exciting year ahead.

Bulls Closing Out a Monster Year

The bull run started in late 2023 despite all the negativity surrounding higher interest rates, inflation and geopolitical events. Investors who were scared away by the narrative of a recession, flipped bullish when it became clear that the Fed would start cutting interest rates.

And the buying has continued to be strong as we look to end the year with historic moves in individual stocks.

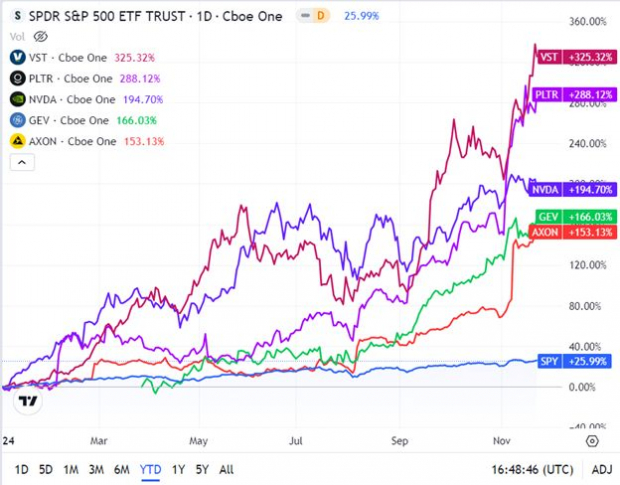

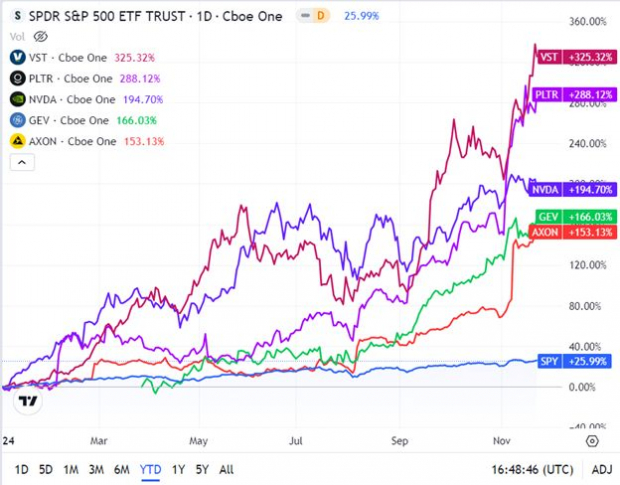

The S&P and the Nasdaq are both looking to close out gains well over +20% for the year. And with that, there are plenty of stocks that have experienced huge moves year to date.

Below are the top performers of the S&P 500, along with a chart showing how they have performed versus the S&P since the start of the year.

1) Vistra (VST) +325%

2) Palantir (PLTR) +288%

3) NVIDIA (NVDA) +187%

4) GE Vernova (GEV) 166%

5) Axon Enterprise (AXON) 153%

Image Source: TradingView

These are life-changing moves for investors, but there seems to be more meat on the bone as we close out the year. If the S&P can make fresh highs once more, investors should look for the index to close 2024 around the 6100-6150 area.

More . . .

------------------------------------------------------------------------------------------------------

Deadline Approaching: Zacks 7 Best Stocks for December

From 220 Zacks Rank #1 Strong Buy stocks, our experts hand-picked these 7 compelling companies as the most likely to spike NOW. While we can’t guarantee 100% success, they are likely to jump sooner and climb higher than any others you could buy this month.

Report distribution is limited, so don’t miss out. The deadline is Sunday, December 1st.

Hurry – See Stocks Now >>

------------------------------------------------------------------------------------------------------

Reasons to Remain Bullish

This impressive rally has been driven by three key factors that should continue to give investors reasons to remain bullish:

1) Easing Monetary Policy

In 2024, declining inflation rates have led the Federal Reserve to implement multiple interest rate cuts over the past six months.

When the Fed cuts rates, money market funds, which held $6.67 trillion in assets as of November 2024, become less attractive compared to other investments like S&P 500 index funds, as the returns they offer decrease.

This is bullish for stocks as investors are motivated to put their money to work.

With several rate cuts already in 2024 and potentially two more by March 2025, the shift in monetary policy may continue to push investors toward equities.

While further cuts may slow down, ongoing economic growth continues to bolster investor confidence. The challenge for the Fed in 2025 will be preventing the economy from overheating, which could reignite inflation. So, while the bulls can stay the course, investors should not expect the Fed to be overly dovish in 2025.

2) AI Euphoria

The Artificial Intelligence (AI) boom has taken center stage in the market, initially concentrated in a handful of major stocks. However, the buying frenzy has recently expanded, driving nearly every AI-related name to new heights.

While NVIDIA (NVDA) captured most of the spotlight throughout the year, the past month has seen smaller AI players delivering astonishing returns:

LMND: +169%

INOD: +125%

PLTR: +50%

AI: +48%

PRCT+37%

Image Source: TradingView

I predict momentum in the AI sector will continue to build as more applications and use cases are realized. The biggest opportunities may lie in lesser-known companies with the potential to double, triple, or even 10X as they carve out their niches in the growing AI ecosystem. Investors who dig deeper into emerging players could uncover significant upside in the coming year.

3) Election Clarity to Fuel Optimism

Now that the uncertainty surrounding the election is behind us, the stock market is welcoming a more predictable and favorable policy environment. President-elect Trump has set expectations for lower taxes and deregulation—two tailwinds that historically align with bullish market behavior. These policies could boost corporate earnings, spark additional business investments and sustain economic growth.

Without the distraction of election volatility, investors can focus on these growth-positive developments. Historically, markets perform well in the first year of a presidency when businesses gain clarity on the regulatory and fiscal landscape.

The combination of pro-business policies and strong economic fundamentals positions the market to build on 2024’s impressive gains well into 2025.

Are Investors Chasing Returns?

This bull market is certainly thrilling, and there’s ample opportunity to profit. However, investors must remain rational and avoid succumbing to the fear of missing out (FOMO).

Since October 30, 2023, the S&P 500 has only seen 14 down weeks during its +45% ascent, with the maximum drawdown being -10%, which occurred during a one-month selloff over the summer.

Such a massive 52-week rally is rare, prompting me to look back at how often something similar has happened in the past. It turns out that this kind of move has only occurred three times since 1980.

One of the most memorable instances occurred in 2020, when the market surged by over +50% following the sharp downturn caused by the COVID-19 pandemic. This recovery was driven by government stimulus, the reopening of economies and optimism around vaccines.

Another major surge occurred during the dot-com boom of the late 1990s, when technology and internet stocks drove the market to a significant peak in early 2000, reflecting the speculative nature of that era.

A similar rally took place in the early 1980s, as the S&P 500 climbed more than +40% following the severe recession of the early part of the decade, buoyed by economic recovery and fiscal reforms under the Reagan administration.

Each of these rallies highlights how market optimism, driven by different catalysts like economic recovery, technological advancements and fiscal policy, can lead to exceptional gains.

While the momentum might continue, investors need to have a game plan and an ability to adjust to changing market conditions.

Investor 4-Step Game Plan 2025

In today’s market, investors are looking at stocks at all-time highs while navigating potential risks ahead. It is essential to have a well-thought-out game plan. Here is a four-step process to consider as the year ends:

1) 2025 Risks: Watch for Tariffs and An Inflation Comeback

Recent CPI and PPI inflation readings came in higher than expected, though the market largely brushed this off. Nevertheless, inflation remains a key factor to monitor, especially as the Federal Reserve continues to lower rates and the economy shows signs of strength.

Additionally, President-elect Trump has indicated plans to implement tariffs in 2025, which could introduce inflationary pressures.

If inflation resurges, it could eventually weigh on investor sentiment as we move through next year, possibly cooling the current market enthusiasm.

2) Expect a Pullback

Sometimes the market does not need a catalyst to sell off. At some point, investors just start to sell as the market runs out of steam.

It is always prudent to take some profits, and now may be a great time to do so. The historical rally suggests that a pullback could be in the cards early next year, and investors should prepare for that.

One option is to hedge, whether through options, futures or inverse ETFs. Alternatively, a simpler approach is to sell some stocks and raise cash, giving you the flexibility to buy on the next dip.

My end-of-year S&P targets have already been met, but we could see a slight extension to 6150 before an aggressive pullback—around 2-3% above current levels.

With many short-term treasury bills offering a risk-free return of over 4%, it may make sense to park cash in these instruments while waiting for a sell-off.

3) Look For Support on Any Sell Off

I anticipate a pullback, but strong support will be found at key technical levels. Many investors who missed the rally are waiting for an entry point, so it is important to monitor these levels in the S&P:

50-day Moving Average: Currently 5820 SPX

200-Day Moving Average: Currently 5440

50% Fibonacci Retracement: 5040 SPX

61.8% Fibonacci Retracement: 4800 SPX

Investors should consider nibbling at these levels during any sell-off. If support is confirmed, they can fully allocate cash into equities. A pullback to the 200-day moving average would represent a 12% drawdown, which is common in volatile markets.

A move into the 4800-5050 range would be my “All-in” buy zone, with 2025 year-end targets potentially nearing 6500 for the S&P 500.

4) Target the Early 2025 Winners

When a pullback begins, it is time to make a wish list. Make a note of the stocks that you want to buy now and when we get a pullback scenario like we discussed above, it is time to pounce on those names.

Typically, the early winners in January continue higher into year's end, so tracking those winning stocks can be beneficial.

Of course, things can change for a company throughout the year, so make sure to utilize the Zacks Rank to verify that the stock you are watching has earnings strength behind it.

How to Profit from What the Market is Telling Us Now

The stock market is soaring into the final month of 2024, riding the waves of optimism, innovation and policy clarity. With a powerful mix of easing monetary policy, the electrifying rise of AI and pro-business post-election sentiment, the stage is set for continued growth.

As we turn toward 2025, this is no time to sit on the sidelines. The market's momentum suggests that the next wave of growth could be just beginning.

By embracing a strategic plan, investors can position themselves to ride this bullish tide, seizing opportunities to build portfolios for both short-term gains and long-term success.

The future looks bright, and the best is yet to come!

Take Advantage Today

Zacks has just released a brand-new Special Report, 7 Best Stocks for the Next 30 Days, and you're invited to be one of the first to see it.

Our team of experts combed through the latest Zacks Rank #1 Strong Buys and handpicked seven exciting companies poised for significant price increases. They're likely to jump sooner and climb higher than any other stock you could buy this month.

Today, you can access the 7 Best Stocks report for just $1. When you do, you'll also get 30-day access to all of Zacks’ private portfolios for the same dollar.

I encourage you to take advantage right away. The earlier you get in, the greater profits you stand to make. But don't delay. We're limiting the number of investors who share our 7 Best Stocks, so this opportunity will end midnight Sunday, December 1.

Download 7 Best Stocks for the Next 30 Days and check out Zacks' portfolios for just $1 >>

Good Investing,

Jeremy Mullin

Zacks Stock Strategist

Jeremy Mullin is a stock strategist who combines the fundamental power of the Zacks Rank, technical analysis and computer driven trading to find the best trades. Discover all of his current recommendations in Zacks Commodity Innovators and Zacks Counterstrike.

Image: Bigstock

An Investor Game Plan After a Historic Rally

With just one month left in 2024, investors are eager to build on what has already been a landmark year. Following a remarkable +45% surge higher in the S&P 500 since the October 2023 lows, the bullish momentum continues to push stocks to new heights.

This rally has been fueled by rate cuts from the Federal Reserve, enthusiasm for AI-related stocks, and post-election optimism driven by expectations of lower taxes and deregulation.

Together, these drivers have propelled the S&P 500 to an impressive +27% gain for the year. And there are very few signs suggesting the bulls will ease up before the year ends.

Where do investors go from here after such a historic rally?

A bull market like this one often stirs excitement, but it can also lead to trouble for those chasing peaks. Instead of rushing in and hitting the buy button, investors should focus on crafting a thoughtful, strategic plan to position themselves for the opportunities 2025 may bring.

Let us explore how 2024 is likely to finish and lay out a game plan for what promises to be an exciting year ahead.

Bulls Closing Out a Monster Year

The bull run started in late 2023 despite all the negativity surrounding higher interest rates, inflation and geopolitical events. Investors who were scared away by the narrative of a recession, flipped bullish when it became clear that the Fed would start cutting interest rates.

And the buying has continued to be strong as we look to end the year with historic moves in individual stocks.

The S&P and the Nasdaq are both looking to close out gains well over +20% for the year. And with that, there are plenty of stocks that have experienced huge moves year to date.

Below are the top performers of the S&P 500, along with a chart showing how they have performed versus the S&P since the start of the year.

1) Vistra (VST) +325%

2) Palantir (PLTR) +288%

3) NVIDIA (NVDA) +187%

4) GE Vernova (GEV) 166%

5) Axon Enterprise (AXON) 153%

Image Source: TradingView

These are life-changing moves for investors, but there seems to be more meat on the bone as we close out the year. If the S&P can make fresh highs once more, investors should look for the index to close 2024 around the 6100-6150 area.

More . . .

------------------------------------------------------------------------------------------------------

Deadline Approaching: Zacks 7 Best Stocks for December

From 220 Zacks Rank #1 Strong Buy stocks, our experts hand-picked these 7 compelling companies as the most likely to spike NOW. While we can’t guarantee 100% success, they are likely to jump sooner and climb higher than any others you could buy this month.

Report distribution is limited, so don’t miss out. The deadline is Sunday, December 1st.

Hurry – See Stocks Now >>

------------------------------------------------------------------------------------------------------

Reasons to Remain Bullish

This impressive rally has been driven by three key factors that should continue to give investors reasons to remain bullish:

1) Easing Monetary Policy

In 2024, declining inflation rates have led the Federal Reserve to implement multiple interest rate cuts over the past six months.

When the Fed cuts rates, money market funds, which held $6.67 trillion in assets as of November 2024, become less attractive compared to other investments like S&P 500 index funds, as the returns they offer decrease.

This is bullish for stocks as investors are motivated to put their money to work.

With several rate cuts already in 2024 and potentially two more by March 2025, the shift in monetary policy may continue to push investors toward equities.

While further cuts may slow down, ongoing economic growth continues to bolster investor confidence. The challenge for the Fed in 2025 will be preventing the economy from overheating, which could reignite inflation. So, while the bulls can stay the course, investors should not expect the Fed to be overly dovish in 2025.

2) AI Euphoria

The Artificial Intelligence (AI) boom has taken center stage in the market, initially concentrated in a handful of major stocks. However, the buying frenzy has recently expanded, driving nearly every AI-related name to new heights.

While NVIDIA (NVDA) captured most of the spotlight throughout the year, the past month has seen smaller AI players delivering astonishing returns:

LMND: +169%

INOD: +125%

PLTR: +50%

AI: +48%

PRCT+37%

Image Source: TradingView

I predict momentum in the AI sector will continue to build as more applications and use cases are realized. The biggest opportunities may lie in lesser-known companies with the potential to double, triple, or even 10X as they carve out their niches in the growing AI ecosystem. Investors who dig deeper into emerging players could uncover significant upside in the coming year.

3) Election Clarity to Fuel Optimism

Now that the uncertainty surrounding the election is behind us, the stock market is welcoming a more predictable and favorable policy environment. President-elect Trump has set expectations for lower taxes and deregulation—two tailwinds that historically align with bullish market behavior. These policies could boost corporate earnings, spark additional business investments and sustain economic growth.

Without the distraction of election volatility, investors can focus on these growth-positive developments. Historically, markets perform well in the first year of a presidency when businesses gain clarity on the regulatory and fiscal landscape.

The combination of pro-business policies and strong economic fundamentals positions the market to build on 2024’s impressive gains well into 2025.

Are Investors Chasing Returns?

This bull market is certainly thrilling, and there’s ample opportunity to profit. However, investors must remain rational and avoid succumbing to the fear of missing out (FOMO).

Since October 30, 2023, the S&P 500 has only seen 14 down weeks during its +45% ascent, with the maximum drawdown being -10%, which occurred during a one-month selloff over the summer.

Such a massive 52-week rally is rare, prompting me to look back at how often something similar has happened in the past. It turns out that this kind of move has only occurred three times since 1980.

One of the most memorable instances occurred in 2020, when the market surged by over +50% following the sharp downturn caused by the COVID-19 pandemic. This recovery was driven by government stimulus, the reopening of economies and optimism around vaccines.

Another major surge occurred during the dot-com boom of the late 1990s, when technology and internet stocks drove the market to a significant peak in early 2000, reflecting the speculative nature of that era.

A similar rally took place in the early 1980s, as the S&P 500 climbed more than +40% following the severe recession of the early part of the decade, buoyed by economic recovery and fiscal reforms under the Reagan administration.

Each of these rallies highlights how market optimism, driven by different catalysts like economic recovery, technological advancements and fiscal policy, can lead to exceptional gains.

While the momentum might continue, investors need to have a game plan and an ability to adjust to changing market conditions.

Investor 4-Step Game Plan 2025

In today’s market, investors are looking at stocks at all-time highs while navigating potential risks ahead. It is essential to have a well-thought-out game plan. Here is a four-step process to consider as the year ends:

1) 2025 Risks: Watch for Tariffs and An Inflation Comeback

Recent CPI and PPI inflation readings came in higher than expected, though the market largely brushed this off. Nevertheless, inflation remains a key factor to monitor, especially as the Federal Reserve continues to lower rates and the economy shows signs of strength.

Additionally, President-elect Trump has indicated plans to implement tariffs in 2025, which could introduce inflationary pressures.

If inflation resurges, it could eventually weigh on investor sentiment as we move through next year, possibly cooling the current market enthusiasm.

2) Expect a Pullback

Sometimes the market does not need a catalyst to sell off. At some point, investors just start to sell as the market runs out of steam.

It is always prudent to take some profits, and now may be a great time to do so. The historical rally suggests that a pullback could be in the cards early next year, and investors should prepare for that.

One option is to hedge, whether through options, futures or inverse ETFs. Alternatively, a simpler approach is to sell some stocks and raise cash, giving you the flexibility to buy on the next dip.

My end-of-year S&P targets have already been met, but we could see a slight extension to 6150 before an aggressive pullback—around 2-3% above current levels.

With many short-term treasury bills offering a risk-free return of over 4%, it may make sense to park cash in these instruments while waiting for a sell-off.

3) Look For Support on Any Sell Off

I anticipate a pullback, but strong support will be found at key technical levels. Many investors who missed the rally are waiting for an entry point, so it is important to monitor these levels in the S&P:

50-day Moving Average: Currently 5820 SPX

200-Day Moving Average: Currently 5440

50% Fibonacci Retracement: 5040 SPX

61.8% Fibonacci Retracement: 4800 SPX

Investors should consider nibbling at these levels during any sell-off. If support is confirmed, they can fully allocate cash into equities. A pullback to the 200-day moving average would represent a 12% drawdown, which is common in volatile markets.

A move into the 4800-5050 range would be my “All-in” buy zone, with 2025 year-end targets potentially nearing 6500 for the S&P 500.

4) Target the Early 2025 Winners

When a pullback begins, it is time to make a wish list. Make a note of the stocks that you want to buy now and when we get a pullback scenario like we discussed above, it is time to pounce on those names.

Typically, the early winners in January continue higher into year's end, so tracking those winning stocks can be beneficial.

Of course, things can change for a company throughout the year, so make sure to utilize the Zacks Rank to verify that the stock you are watching has earnings strength behind it.

How to Profit from What the Market is Telling Us Now

The stock market is soaring into the final month of 2024, riding the waves of optimism, innovation and policy clarity. With a powerful mix of easing monetary policy, the electrifying rise of AI and pro-business post-election sentiment, the stage is set for continued growth.

As we turn toward 2025, this is no time to sit on the sidelines. The market's momentum suggests that the next wave of growth could be just beginning.

By embracing a strategic plan, investors can position themselves to ride this bullish tide, seizing opportunities to build portfolios for both short-term gains and long-term success.

The future looks bright, and the best is yet to come!

Take Advantage Today

Zacks has just released a brand-new Special Report, 7 Best Stocks for the Next 30 Days, and you're invited to be one of the first to see it.

Our team of experts combed through the latest Zacks Rank #1 Strong Buys and handpicked seven exciting companies poised for significant price increases. They're likely to jump sooner and climb higher than any other stock you could buy this month.

Today, you can access the 7 Best Stocks report for just $1. When you do, you'll also get 30-day access to all of Zacks’ private portfolios for the same dollar.

I encourage you to take advantage right away. The earlier you get in, the greater profits you stand to make. But don't delay. We're limiting the number of investors who share our 7 Best Stocks, so this opportunity will end midnight Sunday, December 1.

Download 7 Best Stocks for the Next 30 Days and check out Zacks' portfolios for just $1 >>

Good Investing,

Jeremy Mullin

Zacks Stock Strategist

Jeremy Mullin is a stock strategist who combines the fundamental power of the Zacks Rank, technical analysis and computer driven trading to find the best trades. Discover all of his current recommendations in Zacks Commodity Innovators and Zacks Counterstrike.