We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

3 Satellite Stocks That Investors Could Keep an Eye on in 2025

Read MoreHide Full Article

Satellite and Communication industry players have gained healthy momentum over the past few years, driven by increasing commercial space exploration and Earth observation. With the advent of 5G, the expansion of IoT and reliance on real-time data, satellite technologies are playing a crucial role in providing connectivity to remote locations and supporting global communications networks. As the satellite industry evolves, stocks like Gilat Satellite Networks (GILT - Free Report) , Globalstar (GSAT - Free Report) and Iridium Communications (IRDM - Free Report) are poised to benefit from these trends in 2025.

The Growing Importance of Satellite Communication

Global Connectivity: Satellites provide communication and internet services to remote and underserved areas where terrestrial networks are unavailable. It ensures reliable internet access for ships, aircraft and passengers, even in the middle of oceans or at high altitudes. Satellites play a crucial role in disaster response and recovery. They provide real-time data for monitoring wildfires, hurricanes and floods, enabling better planning and faster relief efforts.

Per a report from Grand View Research, the global satellite communication market is estimated to witness a CAGR of 10% from 2024 to 2030. This growth is expected to be driven by the rising demand for High-throughput Satellite (“HTS”) systems, which offer higher capacity and faster data speeds. These systems are ideal for data-heavy uses like video streaming, remote sensing and IoT connectivity. The healthy adoption of satellite communication in government and defense sectors is fueling the demand for HTS capacity.

Technological Advancements: Satellite manufacturing has changed significantly. Standard designs and computer tools are now used to customize communications systems, making production faster and cheaper. Satellites are built in assembly lines, with automated processes for integration and testing. The extent of testing is lowered after prototyping and the completion of the initial production.

A key trend in this industry is the rise of Low Earth Orbit satellite networks tailored to IoT applications. These satellites provide benefits like lower latency, stronger signals and higher data speeds, making them ideal for IoT communication. They use advanced technologies, including narrowband and low-power protocols, to enhance IoT connectivity and efficiently utilize satellite resources.

Countries with advanced space programs gain military, economic and scientific benefits, but the complexity of space technology limits such capabilities to a few nations. Demand for small satellites is growing worldwide, with North America leading, followed by Asia Pacific, Europe and other regions. North America dominates on the back of several government satellite launches, with companies aligning their products to meet U.S. defense and global intelligence needs.

Challenges Weighing on the Satellite Industry

Even though technology has made satellites cheaper, building, launching and maintaining them can still be costly. These high expenses could be very challenging for smaller companies and countries. The growing demand for satellite communication frequencies leads to competition and regulatory complexities. The proliferation of satellite technology conflicts with national security interests, leading to geopolitical tensions.

A significant proportion of the industry's revenue comes from the U.S. government, which may grow with higher defense and space budgets. Increased demand for space-based intelligence and communication could boost investments. However, a weak global economy might reduce spending, and issues like supply-chain delays and inflation could raise costs and cause delays.

3 Satellite Stocks to Consider in 2025

Globalstar: Covington, LA-based Globalstar offers satellite voice and data services to commercial and recreational users in more than 120 countries worldwide. Its products include mobile and fixed satellite telephones, simplex and duplex satellite data modems, and flexible service packages. Globalstar serves various sectors, such as oil and gas, government, mining, forestry, commercial fishing, utilities, military, transportation and heavy construction.

The company’s focus on expanding its spectrum and wholesale capacity services, particularly in the government and consumer sectors, is creating tailwinds. GSAT successfully completed its first 5G data call on the Band n53 spectrum. This achievement boosts connectivity with download speeds of 100 Mbps and upload speeds of 60 Mbps, supporting advanced applications like robotics, AR and high-quality video streaming. It was made possible using XCOM RAN radios and 5G modules, highlighting the potential of Band n53 for future mobile technologies.

Image Source: Zacks Investment Research

At Investor Day 2024, it reiterated its 2024 revenue guidance of $245-250 million, with a 54% adjusted EBITDA margin. For 2025, revenues are expected to be in the range of $260-285 million, with an adjusted EBITDA margin of around 50%. Globalstar expects revenues to more than double, exceeding $495 million, with adjusted EBITDA margins above 54% in the long term.

The Zacks Consensus Estimate for current-year earnings is pegged at a loss of 2 cents per share, which remained unchanged in the past 30 days. The stock has risen 77.5% in the past six months. GSAT currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Gilat Satellite Networks: Based in Petah Tikva, Israel, GILT is a top provider of satellite-based broadband services, including designing and manufacturing advanced equipment and innovative technology. Gilat’s solutions support a range of applications, including broadband access, cellular backhaul, enterprise services, in-flight connectivity (IFC), maritime, trains, defense, and public safety, all while meeting high service standards.

Strength in the defense sector bodes well for Gilat as demand for defense SATCOM solutions grows due to NGSO expansion and geopolitical events. It expects to close the Stellar Blu Solutions buyout by the end of 2024, enhancing the IFC portfolio. This is expected to add $120-$150 million in annual revenues and improve its non-GAAP results. Once Stellar Blu reaches its full manufacturing capacity in the second half of 2025, its EBITDA margin is projected to exceed 10%.

Image Source: Zacks Investment Research

However, the company's decision to end its operations in Russia due to the limitations and restrictions on business activities there is affecting its outlook for 2024. GILT has tightened its revenue guidance to $305-$315 million, which represents a 17% year-over-year improvement at the midpoint.

The Zacks Consensus Estimate for current-year earnings is pegged at 48 cents per share, which remained unchanged in the past 30 days. GILT currently carries a Zacks Rank #2. The stock has risen 32.7% in the past six months.

Image Source: Zacks Investment Research

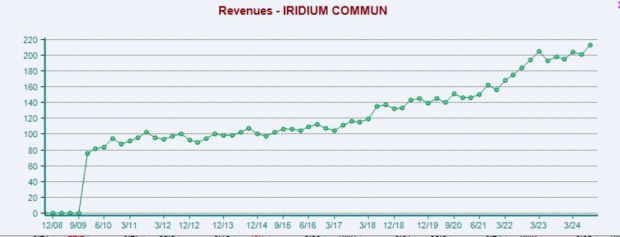

Iridium Communications: Based in McLean, VA, Iridium Communications is a satellite communications company that offers dedicated commercial global voice and data communications services to both businesses and governments in the United States as well as globally. IRDM also works with non-governmental organizations. It operates under three segments, namely Service, Subscriber equipment, and Engineering and support services.

The company is benefiting from rising demand across its three business segments and strong cost management. Engineering and support revenues are set to grow due to ongoing projects with the Space Development Agency. Driven by momentum, Iridium has raised its full-year 2024 guidance. It now forecasts OEBITDA to be between $465 million and $470 million, up from the previous range of $460-$470 million. Service revenues are projected to grow around 5%, slightly down from the prior estimate of 4-6%. Image Source: Zacks Investment Research

However, equipment sales in 2024 are anticipated to decline year over year, returning to pre-2022 levels. The company's high debt load and increased competition remain challenges.

The Zacks Consensus Estimate for current-year earnings is pegged at 80 cents per share, which remained unchanged in the past 60 days. IRDM currently carries a Zacks Rank #3 (Hold). The stock has risen 7.4% in the past six months.

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Satellite Stocks That Investors Could Keep an Eye on in 2025

Satellite and Communication industry players have gained healthy momentum over the past few years, driven by increasing commercial space exploration and Earth observation. With the advent of 5G, the expansion of IoT and reliance on real-time data, satellite technologies are playing a crucial role in providing connectivity to remote locations and supporting global communications networks. As the satellite industry evolves, stocks like Gilat Satellite Networks (GILT - Free Report) , Globalstar (GSAT - Free Report) and Iridium Communications (IRDM - Free Report) are poised to benefit from these trends in 2025.

The Growing Importance of Satellite Communication

Global Connectivity: Satellites provide communication and internet services to remote and underserved areas where terrestrial networks are unavailable. It ensures reliable internet access for ships, aircraft and passengers, even in the middle of oceans or at high altitudes. Satellites play a crucial role in disaster response and recovery. They provide real-time data for monitoring wildfires, hurricanes and floods, enabling better planning and faster relief efforts.

Per a report from Grand View Research, the global satellite communication market is estimated to witness a CAGR of 10% from 2024 to 2030. This growth is expected to be driven by the rising demand for High-throughput Satellite (“HTS”) systems, which offer higher capacity and faster data speeds. These systems are ideal for data-heavy uses like video streaming, remote sensing and IoT connectivity. The healthy adoption of satellite communication in government and defense sectors is fueling the demand for HTS capacity.

Technological Advancements: Satellite manufacturing has changed significantly. Standard designs and computer tools are now used to customize communications systems, making production faster and cheaper. Satellites are built in assembly lines, with automated processes for integration and testing. The extent of testing is lowered after prototyping and the completion of the initial production.

A key trend in this industry is the rise of Low Earth Orbit satellite networks tailored to IoT applications. These satellites provide benefits like lower latency, stronger signals and higher data speeds, making them ideal for IoT communication. They use advanced technologies, including narrowband and low-power protocols, to enhance IoT connectivity and efficiently utilize satellite resources.

Countries with advanced space programs gain military, economic and scientific benefits, but the complexity of space technology limits such capabilities to a few nations. Demand for small satellites is growing worldwide, with North America leading, followed by Asia Pacific, Europe and other regions. North America dominates on the back of several government satellite launches, with companies aligning their products to meet U.S. defense and global intelligence needs.

Challenges Weighing on the Satellite Industry

Even though technology has made satellites cheaper, building, launching and maintaining them can still be costly. These high expenses could be very challenging for smaller companies and countries. The growing demand for satellite communication frequencies leads to competition and regulatory complexities. The proliferation of satellite technology conflicts with national security interests, leading to geopolitical tensions.

A significant proportion of the industry's revenue comes from the U.S. government, which may grow with higher defense and space budgets. Increased demand for space-based intelligence and communication could boost investments. However, a weak global economy might reduce spending, and issues like supply-chain delays and inflation could raise costs and cause delays.

3 Satellite Stocks to Consider in 2025

Globalstar: Covington, LA-based Globalstar offers satellite voice and data services to commercial and recreational users in more than 120 countries worldwide. Its products include mobile and fixed satellite telephones, simplex and duplex satellite data modems, and flexible service packages. Globalstar serves various sectors, such as oil and gas, government, mining, forestry, commercial fishing, utilities, military, transportation and heavy construction.

The company’s focus on expanding its spectrum and wholesale capacity services, particularly in the government and consumer sectors, is creating tailwinds. GSAT successfully completed its first 5G data call on the Band n53 spectrum. This achievement boosts connectivity with download speeds of 100 Mbps and upload speeds of 60 Mbps, supporting advanced applications like robotics, AR and high-quality video streaming. It was made possible using XCOM RAN radios and 5G modules, highlighting the potential of Band n53 for future mobile technologies.

Image Source: Zacks Investment Research

At Investor Day 2024, it reiterated its 2024 revenue guidance of $245-250 million, with a 54% adjusted EBITDA margin. For 2025, revenues are expected to be in the range of $260-285 million, with an adjusted EBITDA margin of around 50%. Globalstar expects revenues to more than double, exceeding $495 million, with adjusted EBITDA margins above 54% in the long term.

The Zacks Consensus Estimate for current-year earnings is pegged at a loss of 2 cents per share, which remained unchanged in the past 30 days. The stock has risen 77.5% in the past six months. GSAT currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Gilat Satellite Networks: Based in Petah Tikva, Israel, GILT is a top provider of satellite-based broadband services, including designing and manufacturing advanced equipment and innovative technology. Gilat’s solutions support a range of applications, including broadband access, cellular backhaul, enterprise services, in-flight connectivity (IFC), maritime, trains, defense, and public safety, all while meeting high service standards.

Strength in the defense sector bodes well for Gilat as demand for defense SATCOM solutions grows due to NGSO expansion and geopolitical events. It expects to close the Stellar Blu Solutions buyout by the end of 2024, enhancing the IFC portfolio. This is expected to add $120-$150 million in annual revenues and improve its non-GAAP results. Once Stellar Blu reaches its full manufacturing capacity in the second half of 2025, its EBITDA margin is projected to exceed 10%.

Image Source: Zacks Investment Research

However, the company's decision to end its operations in Russia due to the limitations and restrictions on business activities there is affecting its outlook for 2024. GILT has tightened its revenue guidance to $305-$315 million, which represents a 17% year-over-year improvement at the midpoint.

The Zacks Consensus Estimate for current-year earnings is pegged at 48 cents per share, which remained unchanged in the past 30 days. GILT currently carries a Zacks Rank #2. The stock has risen 32.7% in the past six months.

Image Source: Zacks Investment Research

Iridium Communications: Based in McLean, VA, Iridium Communications is a satellite communications company that offers dedicated commercial global voice and data communications services to both businesses and governments in the United States as well as globally. IRDM also works with non-governmental organizations. It operates under three segments, namely Service, Subscriber equipment, and Engineering and support services.

The company is benefiting from rising demand across its three business segments and strong cost management. Engineering and support revenues are set to grow due to ongoing projects with the Space Development Agency. Driven by momentum, Iridium has raised its full-year 2024 guidance. It now forecasts OEBITDA to be between $465 million and $470 million, up from the previous range of $460-$470 million. Service revenues are projected to grow around 5%, slightly down from the prior estimate of 4-6%.

Image Source: Zacks Investment Research

However, equipment sales in 2024 are anticipated to decline year over year, returning to pre-2022 levels. The company's high debt load and increased competition remain challenges.

The Zacks Consensus Estimate for current-year earnings is pegged at 80 cents per share, which remained unchanged in the past 60 days. IRDM currently carries a Zacks Rank #3 (Hold). The stock has risen 7.4% in the past six months.

Image Source: Zacks Investment Research