The stock market may have had a rough start in 2025, but taking a step back reveals a much bigger story—one of an extraordinary rally. From the 2023 lows to the 2025 highs, the S&P 500 surged more than 60%! This buying frenzy was powered by Federal Reserve rate cuts, AI-fueled enthusiasm, and post-election optimism surrounding lower taxes and deregulation.

That momentum has recently hit a speed bump. The S&P has pulled back by as much as 10% from its peak, with concerns over tariffs triggering profit-taking and forcing investors to ask:

Where do we go from here?

All bull markets eventually end—but until they do, pullbacks create opportunity. Buying the dip often works, but blindly chasing sell-offs is not a strategy. Instead, investors need a disciplined approach to navigate 2025 and position themselves for the next wave of opportunity.

Below, we will break down how the year has started and map out a game plan for what could be another exciting chapter in this historic rally.

2025 Winners

Despite the recent pullback, opportunities remain abundant. Timing a "buy the dip" strategy can be tricky, but one of the most reliable approaches in a weak market is following relative strength. Stocks that hold up best during a correction are often the ones leading the next breakout.

Even as the broader market consolidates, leadership stocks continue to emerge, defying the pullback and signaling where investors are still willing to put their money to work.

These names tend to have strong fundamentals, high growth potential, or a compelling narrative that keeps buyers engaged. Understanding where the strength is can provide an edge, whether the market rebounds quickly or remains volatile.

Below, we highlight the top-performing stocks in the S&P 500 year-to-date and how they have fared relative to the broader market:

1) Sandisk (SNDK): +52%

2) CVS Health (CVS): +48%

3) Super Micro Computer (SMCI): +40%

4) Phillip Morris (PM): +25%

5) Vertex Pharmaceuticals (VRTX): +24%

Image Source: TradingView

While the broader market has pulled back, these stocks are still attracting buyers. Their resilience suggests strong underlying demand, making them candidates to lead the next leg higher if the market rebounds—or hold up better if volatility continues.

Keeping an eye on relative strength in these names can provide valuable insight into where investors are positioning for the months ahead.

More . . .

------------------------------------------------------------------------------------------------------

See ALL Zacks’ Long-Term Picks for Only $1

Through good markets and bad, one unique stock-picking method has more than doubled the market’s average gain with an incredible +23.9% per year.

To help you take advantage of opportunities in today’s market, we’re opening the vault to reveal all our long-term recommendations. You’ll see stocks priced under $10... income investments... hidden value stocks and more.

All for just $1.

Special opportunity ends at midnight Sunday, March 23.

See Stocks Now >>

------------------------------------------------------------------------------------------------------

Reasons to Remain Bullish

The 2024 rally was driven by three key factors that should continue to give investors reasons to remain bullish.

1) Easing Monetary Policy

In 2024, declining inflation rates allowed the Federal Reserve to implement multiple interest rate cuts. Lower interest rates reduce the appeal of money market funds, which held $6.67 trillion in assets as of November 2024, making equities a more attractive alternative.

This shift is bullish for stocks, as investors are incentivized to put their cash to work in risk assets.

In December, the market had priced in just one rate cut for 2025. However, the recent equity sell-off—along with concerns that tariffs could weigh on economic growth—has shifted expectations. The FedWatch tool now suggests the possibility of up to 75 basis points in cuts by year-end.

If inflation remains under control, the Fed has room to ease further, providing a potential tailwind for equities even in the face of macroeconomic uncertainties.

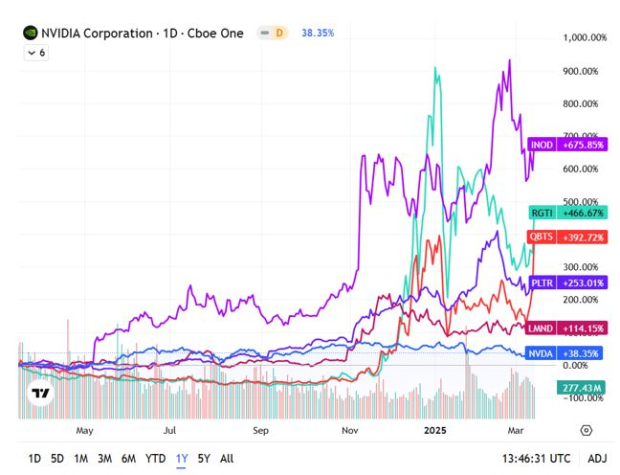

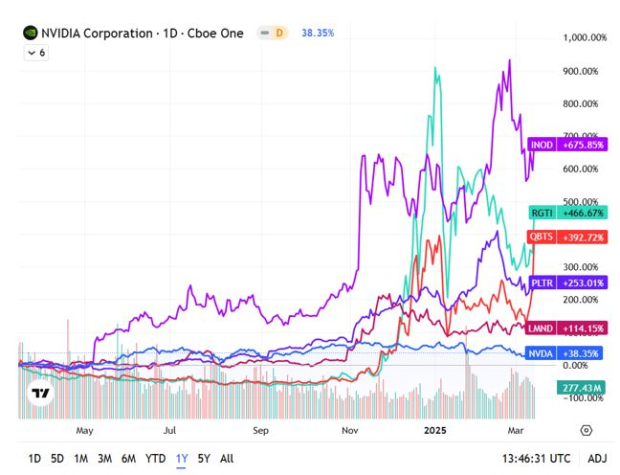

2) AI/Quantum Euphoria

The artificial intelligence boom has taken center stage in the market, initially concentrated in a handful of major stocks, but then shifting to smaller names. The buying frenzy expanded to any stock that dealt in quantum or AI, which created a bubble-like atmosphere in the space.

With the recent sell-off, these names have seen a violent correction. The question now is which of these stocks is a huge buying opportunity for the longer-term.

While NVIDIA (NVDA) remained the poster child of AI and is still up +38% year-over-year, the broader AI sector has seen incredible gains. Even after the recent dip, many stocks in the space have doubled or even tripled over the past year, proving that AI remains one of the most powerful investment themes in the market.

Let us look at some gains over the last year:

1) Innodata (INOD): +675%

2) Rigetti Computing (RGTI): +466%

3) D-Wave Quantum (QBTS): +392%

4) Palantir Technologies (PLTR): +253%

5) Lemonade, Inc. (LMND): +114%

Image Source: TradingView

My prediction for 2025 is that momentum in the AI sector will continue to build as more applications and use cases are realized. The biggest opportunities may lie in lesser-known companies with the potential to double, triple, or even 10X as they carve out their niches in the growing AI ecosystem. Investors who dig deeper into emerging players could uncover significant upside in the coming year.

3) Getting Past Tariffs

The constant headlines around tariffs have been creating significant uncertainty for investors, which has contributed to recent selling pressure. However, if the trade war rhetoric begins to cool and we gain more clarity on future policies, the market could see a notable rally.

Beyond that, corporate tax cuts and deregulation—policies that have historically fueled economic growth—remain central to Washington's broader fiscal agenda. These initiatives have the potential to drive greater business investment, foster innovation, and boost profitability, all of which serve as key catalysts for a stronger stock market.

Buying a Dip After a Historic Rally

A bull market is certainly thrilling as there’s ample opportunity to profit. However, late in 2024 many investors caught a case of FOMO (fear of missing out). So now, the sell-off has caught some investors off guard, while others want to buy the dip.

But before we press the buy button, let’s put last year’s historic rally into context.

In 2024, the S&P 500 only experienced 15 down weeks during its 24% ascent, with the maximum drawdown being 10%, which occurred during a one-month sell-off over the summer.

So far in 2025, the market has had five red weeks and five green weeks, with the index down about 4%. Investors have already witnessed the 10% drawdown, and now the question is whether we have seen the worst of it or if there is more to come.

While it is tempting to jump back in when the market dips, it is crucial to assess the broader economic landscape and individual stock valuations before making a move. A dip may be an opportunity, but buying at the right time requires careful consideration of both short-term market fluctuations and long-term growth potential.

Investor 4-Step Game Plan 2025

In today’s market, investors are looking at stocks at all-time highs while navigating potential risks ahead. It is essential to have a well-thought-out game plan. Here is a four-step process to consider as the year ends:

1) 2025 Risks: Tariff Headlines and Economic Contraction

It seems like every day brings a new headline about tariffs, and this ongoing uncertainty isn’t good for the stock market. Companies are left with difficult decisions—should they raise prices to pass on the cost of tariffs to customers, or absorb the costs themselves, leading to squeezed margins and lower profits?

Either way, the uncertainty surrounding tariffs can harm the economy. The ripple effects create hesitation in business planning and can reduce consumer spending, which ultimately impacts corporate earnings.

For investors, this means it is crucial to identify which stocks may be most vulnerable to tariff-related disruptions. Extra research is needed when picking stocks in this environment, but doing so can help protect against potential losses driven by tariff headlines.

Additionally, the Atlanta Fed's GDP model recently downgraded its Q1 GDP estimate to -2.4%. This signals a potential contraction, making it essential for investors to monitor economic data points and adjustments to models like this. These updates serve as critical indicators, helping investors determine whether to proceed with caution or seize buying opportunities.

2) Be Open to More Pullbacks

Sometimes, the market does not need a specific catalyst to sell-off. As momentum fades, investors may simply start to take profits, causing the market to lose steam.

However, the recent sell-off has clearly been news driven surrounding tariffs. So, with that news, investors need to be open to more volatility and more sell-offs.

One strategy to consider is hedging—whether through options, futures, or inverse ETFs. For those preferring a more straightforward approach, selling some stocks into rallies can raise cash, providing the flexibility to capitalize on the next dip.

3) Sell The Rips and Buy the Dips

In our Q4 game plan, we mentioned that SPX 6150 was a possible target, but cautioned to watch for a pullback in January or February. Sure enough, selling began in late February, and many support levels quickly broke down.

These former support levels have now turned into resistance, so it’s important to identify key levels for selling the rips and buying the dips.

Selling the Rips

50-day Moving Average: Currently 5935 SPX

200-Day Moving Average: Currently 5740 SPX

50% Fibonacci Retracement (2025 highs to lows): 5830 SPX

61.8% Fibonacci Retracement: 5910 SPX

The above levels are where investors can exit base positions and even take the short side.

Buy the Dips

2025 Low and 61.8% Retrace (August lows to recent highs): 5500 SPX

2024 Q1 Resistance: 5270 SPX

50% Fibonacci Retracement (Oct 2023 lows to 2025 highs): 5120 SPX

61.8% Fibonacci Retracement: 4880 SPX

Investors should consider nibbling at these levels during any sell-off. If support is confirmed, they can fully allocate cash into equities. The bears are in control until SPX is over 5950.

A move into the 4800-5050 range would be my “All-in” buy zone, where investors are typically rewarded on a long-term timeframe.

4) Make A Wishlist and Target the Early 2025 Winners

Pullbacks like the one we are seeing now are the perfect time to create a wish list. Take note of the stocks you want to buy and be ready to act when the market reaches the technical support levels we discussed above.

Historically, early winners in Q1 tend to maintain their momentum throughout the rest of the year. Keeping an eye on these strong performers can provide a haven during market pullbacks, offering opportunities to add to positions in quality stocks when the broader market weakens.

Of course, things can change for a company throughout the year, so make sure to utilize the Zacks Rank to verify that the stock you are watching has earnings strength behind it.

The Bottom Line

While the market has hit a speed bump in 2025, the overall outlook remains promising, with major themes like easing monetary policy, the AI boom, and potential tariff resolution continuing to drive the bullish case.

Pullbacks, while unsettling, offer investors a chance to recalibrate their portfolios, buy quality stocks at more attractive prices, and position for the next market move.

Looking ahead, the most successful investors will be those who recognize that the market moves in cycles. While volatility can challenge even the most seasoned investors, those who have a game plan and stay informed will be better equipped to navigate the ups and downs.

Finding Profit Opportunities in Today’s Market

In today’s uncertainty, one thing is certain: focus on identifying healthy companies with strong fundamentals and future growth potential. Getting into long-term investments can increase your profit potential exponentially. It can also help protect your portfolio during pullbacks and corrections.

And today, you can get unrestricted access to all the real-time buys and sells from all our long-term portfolios that cover a number of strategies, including growth, value, ETFs, income, and dividends.

Our private long-term investing services closed 44 double and triple-digit wins in 2024 alone. Even though we can't guarantee future success, recent gains reached as high as +124.8%, +198.4%, and even +263.2%.¹

You'll also get access to Zacks Premium with powerful research, tools and analysis, such as the Zacks #1 Rank List, Equity Research Reports, Zacks Earnings ESP Filter, Premium Screener, and more.

Time-Sensitive Bonus: When you check out our unique Zacks Investor Collection arrangement today, you're invited to download our just-released briefing, Presidential Profits: 6 Stocks to Ride Under The New Administration.

It reveals trades with significant upside during President Trump's second term in office. His policies and proposals will become powerful tailwinds for each of these picks – and investors could see substantial gains in the months ahead.

Keep in mind, the opportunity to look into Zacks Investor Collection and download our Presidential Profits Special Report ends at midnight on Sunday, March 23.

Look into Zacks Investor Collection and Presidential Profits Special Report now >>

Good Investing,

Jeremy Mullin

Zacks Stock Strategist

Jeremy Mullin is a stock strategist who combines the fundamental power of the Zacks Rank, technical analysis and computer driven trading to find the best trades.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.

Image: Bigstock

Market Pullback After a Historic Rally: What Investors Should Do Now

The stock market may have had a rough start in 2025, but taking a step back reveals a much bigger story—one of an extraordinary rally. From the 2023 lows to the 2025 highs, the S&P 500 surged more than 60%! This buying frenzy was powered by Federal Reserve rate cuts, AI-fueled enthusiasm, and post-election optimism surrounding lower taxes and deregulation.

That momentum has recently hit a speed bump. The S&P has pulled back by as much as 10% from its peak, with concerns over tariffs triggering profit-taking and forcing investors to ask:

Where do we go from here?

All bull markets eventually end—but until they do, pullbacks create opportunity. Buying the dip often works, but blindly chasing sell-offs is not a strategy. Instead, investors need a disciplined approach to navigate 2025 and position themselves for the next wave of opportunity.

Below, we will break down how the year has started and map out a game plan for what could be another exciting chapter in this historic rally.

2025 Winners

Despite the recent pullback, opportunities remain abundant. Timing a "buy the dip" strategy can be tricky, but one of the most reliable approaches in a weak market is following relative strength. Stocks that hold up best during a correction are often the ones leading the next breakout.

Even as the broader market consolidates, leadership stocks continue to emerge, defying the pullback and signaling where investors are still willing to put their money to work.

These names tend to have strong fundamentals, high growth potential, or a compelling narrative that keeps buyers engaged. Understanding where the strength is can provide an edge, whether the market rebounds quickly or remains volatile.

Below, we highlight the top-performing stocks in the S&P 500 year-to-date and how they have fared relative to the broader market:

1) Sandisk (SNDK): +52%

2) CVS Health (CVS): +48%

3) Super Micro Computer (SMCI): +40%

4) Phillip Morris (PM): +25%

5) Vertex Pharmaceuticals (VRTX): +24%

Image Source: TradingView

While the broader market has pulled back, these stocks are still attracting buyers. Their resilience suggests strong underlying demand, making them candidates to lead the next leg higher if the market rebounds—or hold up better if volatility continues.

Keeping an eye on relative strength in these names can provide valuable insight into where investors are positioning for the months ahead.

More . . .

------------------------------------------------------------------------------------------------------

See ALL Zacks’ Long-Term Picks for Only $1

Through good markets and bad, one unique stock-picking method has more than doubled the market’s average gain with an incredible +23.9% per year.

To help you take advantage of opportunities in today’s market, we’re opening the vault to reveal all our long-term recommendations. You’ll see stocks priced under $10... income investments... hidden value stocks and more.

All for just $1.

Special opportunity ends at midnight Sunday, March 23.

See Stocks Now >>

------------------------------------------------------------------------------------------------------

Reasons to Remain Bullish

The 2024 rally was driven by three key factors that should continue to give investors reasons to remain bullish.

1) Easing Monetary Policy

In 2024, declining inflation rates allowed the Federal Reserve to implement multiple interest rate cuts. Lower interest rates reduce the appeal of money market funds, which held $6.67 trillion in assets as of November 2024, making equities a more attractive alternative.

This shift is bullish for stocks, as investors are incentivized to put their cash to work in risk assets.

In December, the market had priced in just one rate cut for 2025. However, the recent equity sell-off—along with concerns that tariffs could weigh on economic growth—has shifted expectations. The FedWatch tool now suggests the possibility of up to 75 basis points in cuts by year-end.

If inflation remains under control, the Fed has room to ease further, providing a potential tailwind for equities even in the face of macroeconomic uncertainties.

2) AI/Quantum Euphoria

The artificial intelligence boom has taken center stage in the market, initially concentrated in a handful of major stocks, but then shifting to smaller names. The buying frenzy expanded to any stock that dealt in quantum or AI, which created a bubble-like atmosphere in the space.

With the recent sell-off, these names have seen a violent correction. The question now is which of these stocks is a huge buying opportunity for the longer-term.

While NVIDIA (NVDA) remained the poster child of AI and is still up +38% year-over-year, the broader AI sector has seen incredible gains. Even after the recent dip, many stocks in the space have doubled or even tripled over the past year, proving that AI remains one of the most powerful investment themes in the market.

Let us look at some gains over the last year:

1) Innodata (INOD): +675%

2) Rigetti Computing (RGTI): +466%

3) D-Wave Quantum (QBTS): +392%

4) Palantir Technologies (PLTR): +253%

5) Lemonade, Inc. (LMND): +114%

Image Source: TradingView

My prediction for 2025 is that momentum in the AI sector will continue to build as more applications and use cases are realized. The biggest opportunities may lie in lesser-known companies with the potential to double, triple, or even 10X as they carve out their niches in the growing AI ecosystem. Investors who dig deeper into emerging players could uncover significant upside in the coming year.

3) Getting Past Tariffs

The constant headlines around tariffs have been creating significant uncertainty for investors, which has contributed to recent selling pressure. However, if the trade war rhetoric begins to cool and we gain more clarity on future policies, the market could see a notable rally.

Beyond that, corporate tax cuts and deregulation—policies that have historically fueled economic growth—remain central to Washington's broader fiscal agenda. These initiatives have the potential to drive greater business investment, foster innovation, and boost profitability, all of which serve as key catalysts for a stronger stock market.

Buying a Dip After a Historic Rally

A bull market is certainly thrilling as there’s ample opportunity to profit. However, late in 2024 many investors caught a case of FOMO (fear of missing out). So now, the sell-off has caught some investors off guard, while others want to buy the dip.

But before we press the buy button, let’s put last year’s historic rally into context.

In 2024, the S&P 500 only experienced 15 down weeks during its 24% ascent, with the maximum drawdown being 10%, which occurred during a one-month sell-off over the summer.

So far in 2025, the market has had five red weeks and five green weeks, with the index down about 4%. Investors have already witnessed the 10% drawdown, and now the question is whether we have seen the worst of it or if there is more to come.

While it is tempting to jump back in when the market dips, it is crucial to assess the broader economic landscape and individual stock valuations before making a move. A dip may be an opportunity, but buying at the right time requires careful consideration of both short-term market fluctuations and long-term growth potential.

Investor 4-Step Game Plan 2025

In today’s market, investors are looking at stocks at all-time highs while navigating potential risks ahead. It is essential to have a well-thought-out game plan. Here is a four-step process to consider as the year ends:

1) 2025 Risks: Tariff Headlines and Economic Contraction

It seems like every day brings a new headline about tariffs, and this ongoing uncertainty isn’t good for the stock market. Companies are left with difficult decisions—should they raise prices to pass on the cost of tariffs to customers, or absorb the costs themselves, leading to squeezed margins and lower profits?

Either way, the uncertainty surrounding tariffs can harm the economy. The ripple effects create hesitation in business planning and can reduce consumer spending, which ultimately impacts corporate earnings.

For investors, this means it is crucial to identify which stocks may be most vulnerable to tariff-related disruptions. Extra research is needed when picking stocks in this environment, but doing so can help protect against potential losses driven by tariff headlines.

Additionally, the Atlanta Fed's GDP model recently downgraded its Q1 GDP estimate to -2.4%. This signals a potential contraction, making it essential for investors to monitor economic data points and adjustments to models like this. These updates serve as critical indicators, helping investors determine whether to proceed with caution or seize buying opportunities.

2) Be Open to More Pullbacks

Sometimes, the market does not need a specific catalyst to sell-off. As momentum fades, investors may simply start to take profits, causing the market to lose steam.

However, the recent sell-off has clearly been news driven surrounding tariffs. So, with that news, investors need to be open to more volatility and more sell-offs.

One strategy to consider is hedging—whether through options, futures, or inverse ETFs. For those preferring a more straightforward approach, selling some stocks into rallies can raise cash, providing the flexibility to capitalize on the next dip.

3) Sell The Rips and Buy the Dips

In our Q4 game plan, we mentioned that SPX 6150 was a possible target, but cautioned to watch for a pullback in January or February. Sure enough, selling began in late February, and many support levels quickly broke down.

These former support levels have now turned into resistance, so it’s important to identify key levels for selling the rips and buying the dips.

Selling the Rips

50-day Moving Average: Currently 5935 SPX

200-Day Moving Average: Currently 5740 SPX

50% Fibonacci Retracement (2025 highs to lows): 5830 SPX

61.8% Fibonacci Retracement: 5910 SPX

The above levels are where investors can exit base positions and even take the short side.

Buy the Dips

2025 Low and 61.8% Retrace (August lows to recent highs): 5500 SPX

2024 Q1 Resistance: 5270 SPX

50% Fibonacci Retracement (Oct 2023 lows to 2025 highs): 5120 SPX

61.8% Fibonacci Retracement: 4880 SPX

Investors should consider nibbling at these levels during any sell-off. If support is confirmed, they can fully allocate cash into equities. The bears are in control until SPX is over 5950.

A move into the 4800-5050 range would be my “All-in” buy zone, where investors are typically rewarded on a long-term timeframe.

4) Make A Wishlist and Target the Early 2025 Winners

Pullbacks like the one we are seeing now are the perfect time to create a wish list. Take note of the stocks you want to buy and be ready to act when the market reaches the technical support levels we discussed above.

Historically, early winners in Q1 tend to maintain their momentum throughout the rest of the year. Keeping an eye on these strong performers can provide a haven during market pullbacks, offering opportunities to add to positions in quality stocks when the broader market weakens.

Of course, things can change for a company throughout the year, so make sure to utilize the Zacks Rank to verify that the stock you are watching has earnings strength behind it.

The Bottom Line

While the market has hit a speed bump in 2025, the overall outlook remains promising, with major themes like easing monetary policy, the AI boom, and potential tariff resolution continuing to drive the bullish case.

Pullbacks, while unsettling, offer investors a chance to recalibrate their portfolios, buy quality stocks at more attractive prices, and position for the next market move.

Looking ahead, the most successful investors will be those who recognize that the market moves in cycles. While volatility can challenge even the most seasoned investors, those who have a game plan and stay informed will be better equipped to navigate the ups and downs.

Finding Profit Opportunities in Today’s Market

In today’s uncertainty, one thing is certain: focus on identifying healthy companies with strong fundamentals and future growth potential. Getting into long-term investments can increase your profit potential exponentially. It can also help protect your portfolio during pullbacks and corrections.

And today, you can get unrestricted access to all the real-time buys and sells from all our long-term portfolios that cover a number of strategies, including growth, value, ETFs, income, and dividends.

Our private long-term investing services closed 44 double and triple-digit wins in 2024 alone. Even though we can't guarantee future success, recent gains reached as high as +124.8%, +198.4%, and even +263.2%.¹

You'll also get access to Zacks Premium with powerful research, tools and analysis, such as the Zacks #1 Rank List, Equity Research Reports, Zacks Earnings ESP Filter, Premium Screener, and more.

Time-Sensitive Bonus: When you check out our unique Zacks Investor Collection arrangement today, you're invited to download our just-released briefing, Presidential Profits: 6 Stocks to Ride Under The New Administration.

It reveals trades with significant upside during President Trump's second term in office. His policies and proposals will become powerful tailwinds for each of these picks – and investors could see substantial gains in the months ahead.

Keep in mind, the opportunity to look into Zacks Investor Collection and download our Presidential Profits Special Report ends at midnight on Sunday, March 23.

Look into Zacks Investor Collection and Presidential Profits Special Report now >>

Good Investing,

Jeremy Mullin

Zacks Stock Strategist

Jeremy Mullin is a stock strategist who combines the fundamental power of the Zacks Rank, technical analysis and computer driven trading to find the best trades.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.