Costco Wholesale (COST)

(Delayed Data from NSDQ)

$874.18 USD

-4.91 (-0.56%)

Updated Oct 31, 2024 03:59 PM ET

After-Market: $873.37 -0.66 (-0.08%) 4:50 PM ET

2-Buy of 5 2

C Value B Growth C Momentum B VGM

Costco (COST) Price Targets

| Average Price Target | Highest Price Target | Lowest Price Target | Upside to Average Price Target |

|---|---|---|---|

| $950.48 | $1,065.00 | $755.00 | 8.12% |

Price Target

Based on short-term price targets offered by 31 analysts, the average price target for Costco comes to $950.48. The forecasts range from a low of $755.00 to a high of $1,065.00. The average price target represents an increase of 8.12% from the last closing price of $879.09.

Analyst Price Targets (31)

Broker Rating

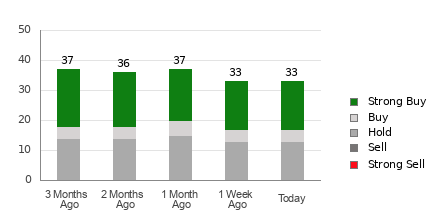

Costco currently has an average brokerage recommendation (ABR) of 1.78 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 34 brokerage firms. The current ABR compares to an ABR of 1.80 a month ago based on 33 recommendations.

Of the 34 recommendations deriving the current ABR, 19 are Strong Buy and three are Buy. Strong Buy and Buy respectively account for 55.88% and 8.82% of all recommendations. A month ago, Strong Buy made up 54.55%, while Buy represented 9.09%.

Broker Rating Breakdown

Brokerage Recommendations

| Today | 1 Week Ago | 1 Month Ago | 2 Months Ago | 3 Months Ago | |

|---|---|---|---|---|---|

| Strong Buy | 19 | 19 | 18 | 20 | 20 |

| Buy | 3 | 3 | 3 | 3 | 3 |

| Hold | 12 | 12 | 12 | 8 | 8 |

| Sell | 0 | 0 | 0 | 0 | 0 |

| Strong Sell | 0 | 0 | 0 | 0 | 0 |

| ABR | 1.78 | 1.78 | 1.80 | 1.60 | 1.60 |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Analyst Upgrades/Downgrades

| Date | Brokerage Firm | Analyst | Previous | Current |

|---|---|---|---|---|

| 10/22/2024 | Not Identified | Not Identified | Not Available | Strong Buy |

| 10/17/2024 | Tigress Financial Partners | Ivan Feinseth | Moderate Buy | Moderate Buy |

| 9/30/2024 | Not Identified | Not Identified | Hold | Hold |

| 9/27/2024 | Wells Fargo Securities | Edward J Kelly | Hold | Hold |

| 9/27/2024 | Roth Capital Partners | William Kirk | Hold | Hold |

| 9/24/2024 | Truist Securities | Scot Ciccarelli | Strong Buy | Hold |

| 9/23/2024 | Not Identified | Not Identified | Not Available | Hold |

| 9/23/2024 | Raymond James | Bobby Griffin | Moderate Buy | Moderate Buy |

| 9/16/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

| 9/15/2024 | Northcoast Research | Chuck Cerankosky | Hold | Hold |

| 9/10/2024 | Atlantic Equities | Daniela Nikolova Nedialkova | Not Available | Hold |

| 9/6/2024 | Telsey Advisory Group | Joseph Feldman | Strong Buy | Strong Buy |

| 9/6/2024 | Evercore Partners | Gregory S Melich | Strong Buy | Strong Buy |

| 9/6/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

| 9/6/2024 | Loop Capital Markets | Laura Champine | Strong Buy | Strong Buy |

| 8/12/2024 | BMO Capital Markets | Kelly A Bania | Strong Buy | Strong Buy |

| 8/8/2024 | D.A. Davidson | Michael Baker | Hold | Hold |

| 8/8/2024 | Goldman Sachs | Katharine A Mcshane | Strong Buy | Strong Buy |

| 8/8/2024 | Not Identified | Not Identified | Moderate Buy | Strong Buy |

| 7/12/2024 | Cowen & Co. | Oliver Chen | Strong Buy | Strong Buy |

| 7/12/2024 | Daiwa America | Kahori Tamada | Hold | Hold |

| 7/11/2024 | Not Identified | Not Identified | Hold | Hold |

| 7/11/2024 | Robert W. Baird & Co. | Peter S Benedict | Strong Buy | Strong Buy |

| 7/11/2024 | William Blair | Phillip Blee | Strong Buy | Strong Buy |

| 7/10/2024 | Not Identified | Not Identified | Hold | Hold |

| 5/28/2024 | Argus Research Corp. | Christopher Graja | Strong Buy | Strong Buy |

| 5/28/2024 | UBS | Michael L Lasser | Strong Buy | Strong Buy |

| 4/23/2024 | Not Identified | Not Identified | Hold | Hold |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Average Brokerage Rating

| Current ABR | 1.78 |

| ABR (Last week) | 1.78 |

| # of Recs in ABR | 34 |

| Average Target Price | $950.48 |

| LT Growth Rate | 9.20% |

| Industry | Retail - Discount Stores |

| Industry Rank by ABR | 72 of 252 |

| Current Quarter EPS Est: | 3.78 |

COST FAQs

Costco Wholesale Corporation (COST) currently has an average brokerage recommendation (ABR) of 1.78 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 34 brokerage firms.

The average price target for Costco Wholesale Corporation (COST) is $950.48. The current on short-term price targets is based on 16 reports.

The forecasts for Costco Wholesale Corporation (COST) range from a low of $755 to a high of $1065. The average price target represents a increase of $8.12 from the last closing price of $879.09.

The current UPSIDE for Costco Wholesale Corporation (COST) is 8.12%

Based on short-term price targets offered by 31 analysts, the average price target for Costco comes to $950.48. The forecasts range from a low of $755.00 to a high of $1,065.00. The average price target represents an increase of 8.12% from the last closing price of $879.09.