Digital Realty Trust (DLR)

(Real Time Quote from BATS)

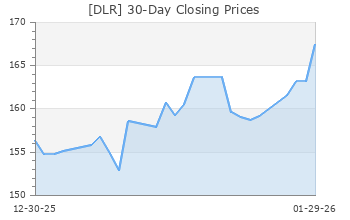

$174.53 USD

-6.49 (-3.59%)

Updated Nov 6, 2024 03:14 PM ET

3-Hold of 5 3

F Value D Growth A Momentum D VGM

Company Summary

Digital Realty Trust is engaged in the ownership, acquisition, repositioning and management of the technology-related real estate. Specifically, the company offers data center, colocation and interconnection solutions for domestic and international tenants through its portfolio of data centers located throughout North America, Europe, South America, Asia, Australia and Africa.

Headquartered in Austin, TX, Digital Realty is diversified in major metropolitan areas where data center and technology customers are concentrated. As of June 30, 2024, the company’s portfolio comprised 310 data centers, with 237 properties in the consolidated portfolio and 73 in the managed and non-managed unconsolidated portfolio. ...

Company Summary

Digital Realty Trust is engaged in the ownership, acquisition, repositioning and management of the technology-related real estate. Specifically, the company offers data center, colocation and interconnection solutions for domestic and international tenants through its portfolio of data centers located throughout North America, Europe, South America, Asia, Australia and Africa.

Headquartered in Austin, TX, Digital Realty is diversified in major metropolitan areas where data center and technology customers are concentrated. As of June 30, 2024, the company’s portfolio comprised 310 data centers, with 237 properties in the consolidated portfolio and 73 in the managed and non-managed unconsolidated portfolio. Particularly, the consolidated portfolio comprised 103 data centers in North America, 111 in Europe, 11 in the Asia Pacific and 12 in Africa. The total portfolio comprised roughly 41.2 million net rentable square feet, excluding 8.5 million square feet of space under active development and 5.1 million square feet of space held for future development.

In March 2024, Digital Realty joined forces with Mitsubishi Corporation to form a data center development joint venture ("JV"). The collaboration marks a significant milestone in both companies’ expansion strategy. Digital Realty has retained a 35% equity interest in the joint venture, while Mitsubishi retained remaining a 65% interest, with an initial investment of approximately $200 million. Each partner will fund its pro rata share of the remaining development costs for the two facilities, which are slated for initial completion and commencement in late 2024.

In December 2023, Digital Realty entered into a JV worth $7 billion with Blackstone Inc., to develop four hyperscale data center campuses across Frankfurt, Paris and Northern Virginia, supporting around 500 megawatts of total IT load upon full build-out. In January 2024, the companies established the first phase of their hyperscale data center development joint venture. The second phase, subject to obtaining the required approvals, is scheduled to close later in 2024.

Note: All EPS numbers presented in this report represents funds from operations (FFO) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

General Information

Digital Realty Trust, Inc

5707 SOUTHWEST PARKWAY BUILDING 1 SUITE 275

AUSTIN, TX 78735

Phone: 737-281-0101

Fax: 415-738-6501

Web: http://www.digitalrealty.com

Email: investorrelations@digitalrealty.com

| Industry | REIT and Equity Trust - Other |

| Sector | Finance |

| Fiscal Year End | December |

| Last Reported Quarter | 9/30/2024 |

| Exp Earnings Date | 2/20/2025 |

EPS Information

| Current Quarter EPS Consensus Estimate | 1.71 |

| Current Year EPS Consensus Estimate | 6.66 |

| Estimated Long-Term EPS Growth Rate | 4.60 |

| Exp Earnings Date | 2/20/2025 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 181.02 |

| 52 Week High | 193.88 |

| 52 Week Low | 126.22 |

| Beta | 0.59 |

| 20 Day Moving Average | 1,795,725.25 |

| Target Price Consensus | 171.96 |

| 4 Week | 14.37 |

| 12 Week | 21.03 |

| YTD | 34.51 |

| 4 Week | 13.74 |

| 12 Week | 13.74 |

| YTD | 10.95 |

| Shares Outstanding (millions) | 331.71 |

| Market Capitalization (millions) | 60,046.62 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 2.70% |

| Annual Dividend | $4.88 |

| Payout Ratio | 0.74 |

| Change in Payout Ratio | 0.01 |

| Last Dividend Payout / Amount | 9/13/2024 / $1.22 |

Fundamental Ratios

| P/E (F1) | 27.19 |

| Trailing 12 Months | 27.34 |

| PEG Ratio | 5.86 |

| vs. Previous Year (Q0/Q-4) | 3.09% |

| vs. Previous Quarter (Q0/Q-1) | 1.21% |

| vs. Previous Year (Q0/Q-4) | 2.05% |

| vs. Previous Quarter (Q0/Q-1) | 5.49% |

| Price/Book | 2.86 |

| Price/Cash Flow | 20.30 |

| Price / Sales | 10.94 |

| 9/30/24 | 2.24 |

| 6/30/24 | 5.93 |

| 3/31/24 | 6.37 |

| 9/30/24 | 1.00 |

| 6/30/24 | 2.61 |

| 3/31/24 | 2.72 |

| 9/30/24 | 1.61 |

| 6/30/24 | 1.78 |

| 3/31/24 | 1.29 |

| 9/30/24 | Pending Next EPS Report |

| 6/30/24 | 1.78 |

| 3/31/24 | 1.29 |

| 9/30/24 | 8.04 |

| 6/30/24 | 20.58 |

| 3/31/24 | 21.24 |

| 9/30/24 | 8.04 |

| 6/30/24 | 20.58 |

| 3/31/24 | 21.24 |

| 9/30/24 | 8.98 |

| 6/30/24 | 22.05 |

| 3/31/24 | 22.78 |

| 9/30/24 | 63.24 |

| 6/30/24 | 64.90 |

| 3/31/24 | 60.04 |

| 9/30/24 | NA |

| 6/30/24 | NA |

| 3/31/24 | NA |

| 9/30/24 | 0.81 |

| 6/30/24 | 0.81 |

| 3/31/24 | 0.91 |

| 9/30/24 | 45.94 |

| 6/30/24 | 45.78 |

| 3/31/24 | 48.52 |