Exelon (EXC)

(Delayed Data from NSDQ)

$38.15 USD

-1.15 (-2.93%)

Updated Nov 1, 2024 04:00 PM ET

After-Market: $38.17 +0.02 (0.05%) 7:58 PM ET

3-Hold of 5 3

B Value D Growth A Momentum B VGM

Exelon (EXC) Price Targets

| Average Price Target | Highest Price Target | Lowest Price Target | Upside to Average Price Target |

|---|---|---|---|

| $43.27 | $47.00 | $39.00 | 10.10% |

Price Target

Based on short-term price targets offered by 15 analysts, the average price target for Exelon comes to $43.27. The forecasts range from a low of $39.00 to a high of $47.00. The average price target represents an increase of 10.1% from the last closing price of $39.30.

Analyst Price Targets (15)

Broker Rating

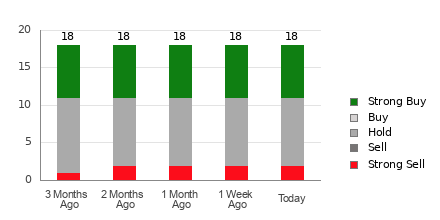

Exelon currently has an average brokerage recommendation (ABR) of 2.56 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 18 brokerage firms. The current ABR compares to an ABR of 2.56 a month ago based on 18 recommendations.

Of the 18 recommendations deriving the current ABR, five are Strong Buy, representing 27.78% of all recommendations. A month ago, Strong Buy represented 27.78%.

Broker Rating Breakdown

Brokerage Recommendations

| Today | 1 Week Ago | 1 Month Ago | 2 Months Ago | 3 Months Ago | |

|---|---|---|---|---|---|

| Strong Buy | 5 | 5 | 5 | 4 | 4 |

| Buy | 0 | 0 | 0 | 0 | 0 |

| Hold | 12 | 12 | 12 | 12 | 12 |

| Sell | 0 | 0 | 0 | 0 | 0 |

| Strong Sell | 1 | 1 | 1 | 1 | 1 |

| ABR | 2.56 | 2.56 | 2.56 | 2.65 | 2.65 |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Analyst Upgrades/Downgrades

| Date | Brokerage Firm | Analyst | Previous | Current |

|---|---|---|---|---|

| 10/21/2024 | KeyBanc Capital Markets | Sophie Karp | Hold | Hold |

| 10/10/2024 | Goldman Sachs | Carly Davenport | Strong Sell | Strong Sell |

| 9/25/2024 | BMO Capital Markets | James M Thalacker | Strong Buy | Strong Buy |

| 9/20/2024 | UBS | Research Department | Hold | Hold |

| 9/19/2024 | Not Identified | Not Identified | Not Available | Strong Buy |

| 9/10/2024 | Guggenheim Securities | Shahriar Pourreza | Hold | Hold |

| 8/20/2024 | Scotiabank | Andrew Weisel | Hold | Hold |

| 8/14/2024 | Not Identified | Not Identified | Hold | Hold |

| 8/2/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

| 8/2/2024 | Evercore Partners | Durgesh Chopra | Hold | Hold |

| 8/2/2024 | Mizuho SecuritiesUSA | Anthony C Crowdell | Strong Buy | Strong Buy |

| 8/2/2024 | Wells Fargo Securities | Neil A Kalton | Hold | Hold |

| 8/1/2024 | Not Identified | Not Identified | Hold | Hold |

| 7/29/2024 | Seaport Research Partners | Angie Storozynski | Hold | Hold |

| 7/22/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Average Brokerage Rating

| Current ABR | 2.56 |

| ABR (Last week) | 2.56 |

| # of Recs in ABR | 18 |

| Average Target Price | $43.27 |

| LT Growth Rate | 5.70% |

| Industry | Utility - Electric Power |

| Industry Rank by ABR | 95 of 252 |

| Current Quarter EPS Est: | 0.61 |

EXC FAQs

Exelon Corporation (EXC) currently has an average brokerage recommendation (ABR) of 2.56 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 18 brokerage firms.

The average price target for Exelon Corporation (EXC) is $43.27. The current on short-term price targets is based on 9 reports.

The forecasts for Exelon Corporation (EXC) range from a low of $39 to a high of $47. The average price target represents a increase of $13.42 from the last closing price of $38.15.

The current UPSIDE for Exelon Corporation (EXC) is 13.42%

Based on short-term price targets offered by 15 analysts, the average price target for Exelon comes to $43.27. The forecasts range from a low of $39.00 to a high of $47.00. The average price target represents an increase of 10.1% from the last closing price of $39.30.