Intuitive Surgical (ISRG)

(Delayed Data from NSDQ)

$547.87 USD

-2.75 (-0.50%)

Updated Nov 22, 2024 04:00 PM ET

After-Market: $548.38 +0.51 (0.09%) 7:58 PM ET

3-Hold of 5 3

D Value C Growth C Momentum D VGM

Intuitive Surgical, Inc. (ISRG) Price Targets

| Average Price Target | Highest Price Target | Lowest Price Target | Downside to Average Price Target |

|---|---|---|---|

| $545.04 | $643.00 | $440.00 | -1.01% |

![]() Find the top stocks with the greatest target price potential and Zacks Rank of 1 or 2

Find the top stocks with the greatest target price potential and Zacks Rank of 1 or 2

Price Target

Based on short-term price targets offered by 24 analysts, the average price target for Intuitive Surgical, Inc. comes to $545.04. The forecasts range from a low of $440.00 to a high of $643.00. The average price target represents a decline of 1.01% from the last closing price of $550.62.

Analyst Price Targets (24)

Broker Rating

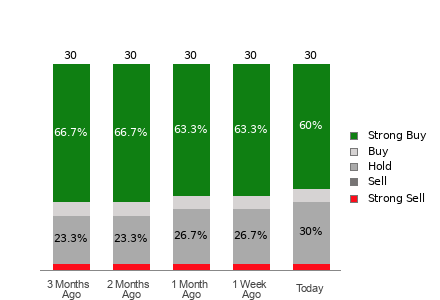

Intuitive Surgical, Inc. currently has an average brokerage recommendation (ABR) of 1.67 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 27 brokerage firms. The current ABR compares to an ABR of 1.69 a month ago based on 26 recommendations.

Of the 27 recommendations deriving the current ABR, 17 are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 62.96% and 7.41% of all recommendations. A month ago, Strong Buy made up 61.54%, while Buy represented 7.69%.

Broker Rating Breakdown

Brokerage Recommendations

| Today | 1 Week Ago | 1 Month Ago | 2 Months Ago | 3 Months Ago | |

|---|---|---|---|---|---|

| Strong Buy | 17 | 17 | 16 | 16 | 16 |

| Buy | 2 | 2 | 2 | 2 | 2 |

| Hold | 8 | 8 | 8 | 8 | 7 |

| Sell | 0 | 0 | 0 | 0 | 0 |

| Strong Sell | 0 | 0 | 0 | 0 | 0 |

| ABR | 1.67 | 1.67 | 1.69 | 1.69 | 1.64 |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Analyst Upgrades/Downgrades

| Date | Brokerage Firm | Analyst | Previous | Current |

|---|---|---|---|---|

| 10/24/2024 | Daiwa America | Narumi Nakagiri | Strong Buy | Strong Buy |

| 10/18/2024 | Not Identified | Not Identified | Hold | Hold |

| 10/18/2024 | Robert W. Baird & Co. | David Rescott | Strong Buy | Strong Buy |

| 10/18/2024 | BTIG | Ryan Zimmerman | Strong Buy | Strong Buy |

| 10/18/2024 | Piper Sandler | Adam C Maeder | Strong Buy | Strong Buy |

| 10/18/2024 | Wells Fargo Securities | Lawrence H Biegelsen | Strong Buy | Strong Buy |

| 10/18/2024 | Goldman Sachs | David H Roman | Strong Buy | Strong Buy |

| 10/18/2024 | William Blair | Brandon Vazquez | Strong Buy | Strong Buy |

| 10/18/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

| 10/18/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

| 10/18/2024 | SVB Securities | Michael Kratky | Strong Buy | Strong Buy |

| 10/14/2024 | Raymond James | Jayson T Bedford | Moderate Buy | Moderate Buy |

| 10/14/2024 | Mizuho SecuritiesUSA | Anthony Petrone | Hold | Hold |

| 10/8/2024 | Not Identified | Not Identified | Moderate Buy | Moderate Buy |

| 10/1/2024 | Evercore Partners | Vijay Kumar | Hold | Hold |

| 9/18/2024 | Not Identified | Not Identified | Hold | Hold |

| 8/28/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

| 8/2/2024 | Atlantic Equities | Ed Ridley-Day | Not Available | Strong Buy |

| 7/22/2024 | UBS | Danielle Antalffy | Hold | Hold |

| 7/18/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

| 7/16/2024 | Truist Securities | Richard Newitter | Strong Buy | Strong Buy |

| 7/10/2024 | Not Identified | Not Identified | Strong Buy | Strong Buy |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Average Brokerage Rating

| Current ABR | 1.67 |

| ABR (Last week) | 1.67 |

| # of Recs in ABR | 27 |

| Average Target Price | $545.04 |

| LT Growth Rate | 18.70% |

| Industry | Medical - Instruments |

| Industry Rank by ABR | 68 of 252 |

| Current Quarter EPS Est: | 1.76 |

ISRG FAQs

Intuitive Surgical, Inc. (ISRG) currently has an average brokerage recommendation (ABR) of 1.67 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 27 brokerage firms.

The average price target for Intuitive Surgical, Inc. (ISRG) is $545.04. The current on short-term price targets is based on 11 reports.

The forecasts for Intuitive Surgical, Inc. (ISRG) range from a low of $440 to a high of $643. The average price target represents a decline of $0.52 from the last closing price of $547.87.

The current DOWNSIDE for Intuitive Surgical, Inc. (ISRG) is 0.52%

Based on short-term price targets offered by 24 analysts, the average price target for Intuitive Surgical, Inc. comes to $545.04. The forecasts range from a low of $440.00 to a high of $643.00. The average price target represents a decline of 1.01% from the last closing price of $550.62.