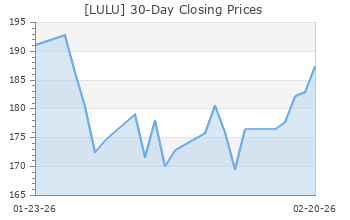

lululemon athletica (LULU)

(Delayed Data from NSDQ)

$321.17 USD

+23.27 (7.81%)

Updated Nov 1, 2024 04:00 PM ET

After-Market: $320.98 -0.19 (-0.06%) 7:58 PM ET

3-Hold of 5 3

D Value A Growth D Momentum B VGM

Company Summary

Founded in 1998 and based in Vancouver, Canada, lululemon athletica inc. is a yoga-inspired athletic apparel company that creates lifestyle components. The company designs, manufactures and distributes athletic apparel and accessories for women, men and female youth.

The company offers a line of apparel assortment, including fitness pants, shorts, tops and jackets designed for healthy lifestyle and athletic pursuits, such as yoga, training, and running as well as other sweaty and general fitness under the lululemon athletica brand name. Its fitness-related items comprise an array of accessories like bags, socks, underwear, yoga ...

Company Summary

Founded in 1998 and based in Vancouver, Canada, lululemon athletica inc. is a yoga-inspired athletic apparel company that creates lifestyle components. The company designs, manufactures and distributes athletic apparel and accessories for women, men and female youth.

The company offers a line of apparel assortment, including fitness pants, shorts, tops and jackets designed for healthy lifestyle and athletic pursuits, such as yoga, training, and running as well as other sweaty and general fitness under the lululemon athletica brand name. Its fitness-related items comprise an array of accessories like bags, socks, underwear, yoga mats, instructional yoga DVDs, water bottles and other equipments.

The company sells its products primarily in North America through a chain of corporate-owned and retail stores, outlets and warehouse sales, independent franchises, and a network of wholesale accounts. The company has an e-commerce site with an aim to rapidly expand its online business.

The company has entered into license and supply agreements with partners in the Middle East and Mexico, through which they are permitted to operate lululemon branded retail locations in the United Arab Emirates, Kuwait, Qatar, Oman, Bahrain, and Mexico. They also have the rights to sell lululemon products via the company’s e-commerce websites in these countries.

Under these arrangements, the company supplies its license partners with lululemon products, training and other support. While the initial agreement term for the Middle East expires in January 2020, the term for Mexico expires in November 2026.

The company conducts its business through two segments: company-operated stores and direct to consumer. As of Jul 28, 2024, LULU operated 721 stores.

General Information

lululemon athletica inc

1818 CORNWALL AVENUE

VANCOUVER, A1 V6J 1C7

Phone: 604-732-6124

Fax: 604-874-6124

Web: https://corporate.lululemon.com

Email: investors@lululemon.com

| Industry | Textile - Apparel |

| Sector | Consumer Discretionary |

| Fiscal Year End | January |

| Last Reported Quarter | 10/31/2024 |

| Exp Earnings Date | 12/5/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 2.73 |

| Current Year EPS Consensus Estimate | 14.02 |

| Estimated Long-Term EPS Growth Rate | 9.80 |

| Exp Earnings Date | 12/5/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 297.90 |

| 52 Week High | 516.39 |

| 52 Week Low | 226.01 |

| Beta | 1.24 |

| 20 Day Moving Average | 1,968,031.62 |

| Target Price Consensus | 315.55 |

| 4 Week | 18.78 |

| 12 Week | 34.54 |

| YTD | -37.18 |

| 4 Week | 19.25 |

| 12 Week | 25.50 |

| YTD | -47.70 |

| Shares Outstanding (millions) | 122.78 |

| Market Capitalization (millions) | 39,432.13 |

| Short Ratio | NA |

| Last Split Date | 7/12/2011 |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 22.91 |

| Trailing 12 Months | 23.77 |

| PEG Ratio | 2.34 |

| vs. Previous Year (Q0/Q-4) | 17.54% |

| vs. Previous Quarter (Q0/Q-1) | 24.02% |

| vs. Previous Year (Q0/Q-4) | 7.33% |

| vs. Previous Quarter (Q0/Q-1) | 7.34% |

| Price/Book | 9.78 |

| Price/Cash Flow | 20.25 |

| Price / Sales | 3.95 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 42.59 |

| 4/30/24 | 42.64 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 25.55 |

| 4/30/24 | 25.50 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 2.43 |

| 4/30/24 | 2.72 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 1.46 |

| 4/30/24 | 1.75 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 17.07 |

| 4/30/24 | 16.82 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 16.34 |

| 4/30/24 | 16.09 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 22.96 |

| 4/30/24 | 22.61 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 32.84 |

| 4/30/24 | 33.76 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 2.88 |

| 4/30/24 | 2.73 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 0.00 |

| 4/30/24 | 0.00 |

| 10/31/24 | Pending Next EPS Report |

| 7/31/24 | 0.00 |

| 4/30/24 | 0.00 |