Lumen Technologies (LUMN)

(Delayed Data from NYSE)

$5.40 USD

-0.12 (-2.17%)

Updated Jan 10, 2025 04:00 PM ET

After-Market: $5.38 -0.02 (-0.37%) 7:58 PM ET

3-Hold of 5 3

B Value C Growth B Momentum B VGM

Company Summary

Based in Monroe, LA, Lumen Technologies is an international facilities-based technology and communications company, which operates one of the most interconnected networks globally

Lumen offers clients across its business and mass markets segments with wide ranging integrated products and services necessary to keep up with the rapidly-evolving digital world. It conducts its business operations under three brand names — Lumen (flagship brand which serves the enterprise and wholesale markets), Quantum Fiber (offers fiber-based services to residential and small business clients) and CenturyLink (offers legacy copper-based services).

The company’...

Company Summary

Based in Monroe, LA, Lumen Technologies is an international facilities-based technology and communications company, which operates one of the most interconnected networks globally

Lumen offers clients across its business and mass markets segments with wide ranging integrated products and services necessary to keep up with the rapidly-evolving digital world. It conducts its business operations under three brand names — Lumen (flagship brand which serves the enterprise and wholesale markets), Quantum Fiber (offers fiber-based services to residential and small business clients) and CenturyLink (offers legacy copper-based services).

The company’s terrestrial and subsea fiber optic long-haul network throughout North America, Europe, Latin America and Asia Pacific connects to metropolitan fiber networks that it operates.

It provides services in more than 60 countries, with a major portion of its revenues being derived in the United States.

The communications service provider has two reportable segments – Business and Mass Markets.

Business (78.7% of aggregate revenues in third-quarter 2024): Under this segment, the company categorizes products and services revenue among the following product categories– Compute & Application Services, IP & Data Services, Fiber Infrastructure Services and Voice & Other.

Mass Markets (21.3%): The segment provides products and services to residential and small business customers under three categories — Fiber Broadband, Other Broadband and Voice and Other.

General Information

Lumen Technologies, Inc

100 CenturyLink Drive

Monroe, LA 71203

Phone: 318-388-9000

Fax: 318-388-9562

Web: http://www.lumen.com

Email: investor.relations@lumen.com

| Industry | Technology Services |

| Sector | Business Services |

| Fiscal Year End | December |

| Last Reported Quarter | 12/31/2024 |

| Exp Earnings Date | 2/4/2025 |

EPS Information

| Current Quarter EPS Consensus Estimate | -0.08 |

| Current Year EPS Consensus Estimate | -0.38 |

| Estimated Long-Term EPS Growth Rate | NA |

| Exp Earnings Date | 2/4/2025 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 5.52 |

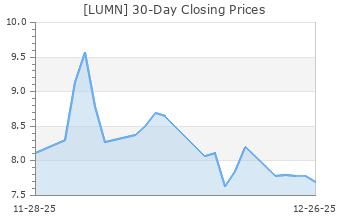

| 52 Week High | 10.33 |

| 52 Week Low | 0.97 |

| Beta | 1.28 |

| 20 Day Moving Average | 10,382,054.00 |

| Target Price Consensus | 4.66 |

| 4 Week | -15.63 |

| 12 Week | -12.62 |

| YTD | 1.69 |

| 4 Week | -12.38 |

| 12 Week | -12.40 |

| YTD | 3.31 |

| Shares Outstanding (millions) | 1,014.81 |

| Market Capitalization (millions) | 5,479.98 |

| Short Ratio | NA |

| Last Split Date | 4/1/1999 |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | NA |

| Change in Payout Ratio | NA |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | NA |

| Trailing 12 Months | NA |

| PEG Ratio | NA |

| vs. Previous Year (Q0/Q-4) | -44.44% |

| vs. Previous Quarter (Q0/Q-1) | 0.00% |

| vs. Previous Year (Q0/Q-4) | -11.54% |

| vs. Previous Quarter (Q0/Q-1) | -1.44% |

| Price/Book | 16.05 |

| Price/Cash Flow | 1.71 |

| Price / Sales | 0.41 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | -49.74 |

| 6/30/24 | -18.52 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | -0.64 |

| 6/30/24 | -0.49 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | 1.20 |

| 6/30/24 | 1.01 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | 1.20 |

| 6/30/24 | 1.01 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | -1.62 |

| 6/30/24 | -1.22 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | -16.06 |

| 6/30/24 | -15.06 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | -16.94 |

| 6/30/24 | -15.79 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | 0.34 |

| 6/30/24 | 0.46 |

| 12/31/24 | NA |

| 9/30/24 | NA |

| 6/30/24 | NA |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | 53.05 |

| 6/30/24 | 39.51 |

| 12/31/24 | Pending Next EPS Report |

| 9/30/24 | 98.15 |

| 6/30/24 | 97.53 |