ONEOK (OKE)

(Delayed Data from NYSE)

$93.36 USD

-3.52 (-3.63%)

Updated Nov 1, 2024 04:00 PM ET

After-Market: $93.68 +0.32 (0.34%) 7:58 PM ET

3-Hold of 5 3

C Value C Growth A Momentum B VGM

Company Summary

Tulsa, OK-based ONEOK Inc. was founded in 1906. The company is an energy company engaged in natural gas and natural gas liquids (NGL) businesses. On Jun 30, 2017, ONEOK acquired all the shares of ONEOK Partners. In September 2023, ONEOK completed its acquisition of Magellan Midstream Partners, L.P. for $18.8 billion. The agreement opened up Magellan's primarily fee-based refined products and crude oil transportation business to ONEOK.

ONEOK Inc.’s operations are divided into three reportable business segments: Natural Gas Gathering and Processing, Natural Gas Liquids, Natural Gas Pipelines, and Refined Products and Crude.

As of Dec 31, 2023, the ...

Company Summary

ONEOK Inc.’s operations are divided into three reportable business segments: Natural Gas Gathering and Processing, Natural Gas Liquids, Natural Gas Pipelines, and Refined Products and Crude.

As of Dec 31, 2023, the Natural Gas Gathering and Processing, Natural Gas Liquids, Natural Gas Pipelines and Refined Products and Crude segments contributed 23.4%, 57.3%, 10.5% and 8.8% to adjusted EBITDA, respectively.

The Natural Gas Gathering and Processing segment provides nondiscretionary services to producers that include gathering and processing of natural gas produced from crude oil and natural gas wells. This segment gathers and processes natural gas in the Mid-Continent region.

The Natural Gas Liquids segment owns and operates facilities that gather, fractionate, treat and distribute NGLs and store NGL products, primarily in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region where it provides nondiscretionary services to producers of NGLs.

The Natural Gas Pipelines segment owns and operates regulated natural gas transmission pipelines and natural gas storage facilities. Other and eliminations is a non-operating segment consisting of the operating and leasing operations of the company’s headquarters building and related parking facility and other amounts needed to reconcile ONEOK’s reportable segments to its consolidated financial statements.

The new Refined Products and Crude segment transports, stores and distributes Refined Products, certain NGLs and crude oil, as well as conducts certain commodity-related activities, including liquids blending, fractionation and marketing.

General Information

ONEOK, Inc

100 WEST 5TH ST

TULSA, OK 74103

Phone: 918-588-7000

Fax: 918-588-7273

Web: http://www.oneok.com

Email: oneokinvestorrelations@oneok.com

| Industry | Oil and Gas - Production Pipeline - MLB |

| Sector | Oils-Energy |

| Fiscal Year End | December |

| Last Reported Quarter | 9/30/2024 |

| Exp Earnings Date | 2/24/2025 |

EPS Information

| Current Quarter EPS Consensus Estimate | 1.48 |

| Current Year EPS Consensus Estimate | 5.15 |

| Estimated Long-Term EPS Growth Rate | 4.50 |

| Exp Earnings Date | 2/24/2025 |

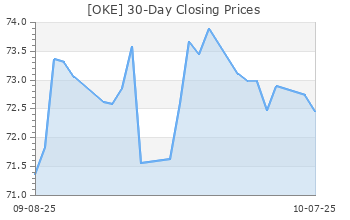

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 96.88 |

| 52 Week High | 98.43 |

| 52 Week Low | 63.33 |

| Beta | 1.66 |

| 20 Day Moving Average | 2,378,570.50 |

| Target Price Consensus | 101.27 |

| 4 Week | -1.96 |

| 12 Week | 9.84 |

| YTD | 32.95 |

| 4 Week | -1.58 |

| 12 Week | 2.46 |

| YTD | 10.70 |

| Shares Outstanding (millions) | 584.18 |

| Market Capitalization (millions) | 54,539.44 |

| Short Ratio | NA |

| Last Split Date | 6/4/2012 |

| Dividend Yield | 4.24% |

| Annual Dividend | $3.96 |

| Payout Ratio | 0.83 |

| Change in Payout Ratio | -0.24 |

| Last Dividend Payout / Amount | 11/1/2024 / $0.99 |

Fundamental Ratios

| P/E (F1) | 18.12 |

| Trailing 12 Months | 19.53 |

| PEG Ratio | 3.99 |

| vs. Previous Year (Q0/Q-4) | 19.19% |

| vs. Previous Quarter (Q0/Q-1) | -11.28% |

| vs. Previous Year (Q0/Q-4) | 19.91% |

| vs. Previous Quarter (Q0/Q-1) | 2.64% |

| Price/Book | 3.23 |

| Price/Cash Flow | 15.87 |

| Price / Sales | 2.74 |

| 9/30/24 | 16.84 |

| 6/30/24 | 15.54 |

| 3/31/24 | 15.94 |

| 9/30/24 | 6.08 |

| 6/30/24 | 5.78 |

| 3/31/24 | 5.74 |

| 9/30/24 | 0.81 |

| 6/30/24 | 0.62 |

| 3/31/24 | 0.70 |

| 9/30/24 | Pending Next EPS Report |

| 6/30/24 | 0.41 |

| 3/31/24 | 0.48 |

| 9/30/24 | 14.05 |

| 6/30/24 | 13.41 |

| 3/31/24 | 12.54 |

| 9/30/24 | 14.05 |

| 6/30/24 | 13.41 |

| 3/31/24 | 12.54 |

| 9/30/24 | 18.52 |

| 6/30/24 | 17.67 |

| 3/31/24 | 16.53 |

| 9/30/24 | 28.91 |

| 6/30/24 | 28.61 |

| 3/31/24 | 28.18 |

| 9/30/24 | 16.89 |

| 6/30/24 | 15.28 |

| 3/31/24 | 16.26 |

| 9/30/24 | 1.59 |

| 6/30/24 | 1.22 |

| 3/31/24 | 1.24 |

| 9/30/24 | 61.42 |

| 6/30/24 | 54.90 |

| 3/31/24 | 55.42 |