Pfizer (PFE)

(Delayed Data from NYSE)

$28.09 USD

-0.21 (-0.74%)

Updated Nov 1, 2024 04:00 PM ET

After-Market: $28.11 +0.02 (0.07%) 7:58 PM ET

3-Hold of 5 3

B Value F Growth A Momentum C VGM

Company Summary

New York-based Pfizer markets a wide range of drugs and vaccines. Pfizer’s Biopharma reporting segment includes three broad therapeutic areas, Primary Care (Internal Medicine, Vaccines, Migraine and COVID-19 products), Specialty Care (Inflammation & Immunology, Rare Disease and Hospital [excluding Paxlovid]) and Oncology.

In November 2020, Pfizer spun off its Upjohn unit, its off-patent branded and generic established medicines business, and combined it with generic drugmaker Mylan to create a new generic pharmaceutical company called Viatris. The Consumer Healthcare (CHC) segment, an over-the-counter (OTC) medicines business, was merged with Glaxo’s unit in ...

Company Summary

New York-based Pfizer markets a wide range of drugs and vaccines. Pfizer’s Biopharma reporting segment includes three broad therapeutic areas, Primary Care (Internal Medicine, Vaccines, Migraine and COVID-19 products), Specialty Care (Inflammation & Immunology, Rare Disease and Hospital [excluding Paxlovid]) and Oncology.

In November 2020, Pfizer spun off its Upjohn unit, its off-patent branded and generic established medicines business, and combined it with generic drugmaker Mylan to create a new generic pharmaceutical company called Viatris. The Consumer Healthcare (CHC) segment, an over-the-counter (OTC) medicines business, was merged with Glaxo’s unit in July 2019 to form a new joint venture (JV). However, Glaxo divested the CHC JV into a new company called Haleon in July 2022. Pfizer owns a stake of 23% in Haleon and plans to sell the stake in a disciplined manner.

Pfizer’s key acquisitions include Seagen in 2023, Biohaven, Global Blood Therapeutics and Arena Pharmaceuticals in 2022, Array BioPharma in 2019, Medivation and Anacor in 2016, Hospira in 2015, King Pharmaceuticals in 2011 and Wyeth in 2009.

Its key divestitures include Hospira infusion systems business to ICU Medical in 2017, Nutrition business to Nestlé in 2012 and Capsugel unit to Kohlberg Kravis Roberts & Co L.P. in 2011. In June 2013, Pfizer gave up its stake in its Animal Health business, which was spun off in early 2013 and started trading on NYSE from Feb 1, 2013 under the name Zoetis.

Worldwide sales were $58.5 billion in 2023 (down 42%). Primary Care accounted for 52.0% of total revenues. Specialty Care accounted for 25.6% and Oncology accounted for 19.9% of total revenues.

General Information

Pfizer Inc

66 HUDSON BOULEVARD EAST

NEW YORK, NY 10001

Phone: 212-733-2323

Fax: 302-655-5049

Email: NA

| Industry | Large Cap Pharmaceuticals |

| Sector | Medical |

| Fiscal Year End | December |

| Last Reported Quarter | 9/30/2024 |

| Exp Earnings Date | 2/4/2025 |

EPS Information

| Current Quarter EPS Consensus Estimate | 0.53 |

| Current Year EPS Consensus Estimate | 2.85 |

| Estimated Long-Term EPS Growth Rate | 10.70 |

| Exp Earnings Date | 2/4/2025 |

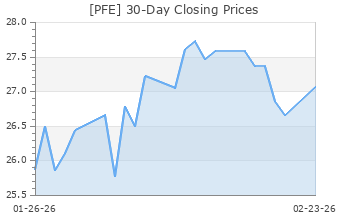

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 28.30 |

| 52 Week High | 31.54 |

| 52 Week Low | 25.20 |

| Beta | 0.67 |

| 20 Day Moving Average | 36,105,912.00 |

| Target Price Consensus | 32.75 |

| 4 Week | -1.71 |

| 12 Week | -1.61 |

| YTD | -2.43 |

| 4 Week | -1.33 |

| 12 Week | -8.22 |

| YTD | -18.76 |

| Shares Outstanding (millions) | 5,666.69 |

| Market Capitalization (millions) | 159,177.47 |

| Short Ratio | NA |

| Last Split Date | 7/1/1999 |

| Dividend Yield | 5.98% |

| Annual Dividend | $1.68 |

| Payout Ratio | 0.65 |

| Change in Payout Ratio | 0.12 |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 9.84 |

| Trailing 12 Months | 10.89 |

| PEG Ratio | 0.92 |

| vs. Previous Year (Q0/Q-4) | 723.53% |

| vs. Previous Quarter (Q0/Q-1) | 76.67% |

| vs. Previous Year (Q0/Q-4) | 33.78% |

| vs. Previous Quarter (Q0/Q-1) | 33.27% |

| Price/Book | 1.81 |

| Price/Cash Flow | 9.44 |

| Price / Sales | 2.65 |

| 9/30/24 | 16.40 |

| 6/30/24 | 8.42 |

| 3/31/24 | 8.64 |

| 9/30/24 | 6.67 |

| 6/30/24 | 3.52 |

| 3/31/24 | 3.70 |

| 9/30/24 | Pending Next EPS Report |

| 6/30/24 | 0.86 |

| 3/31/24 | 1.05 |

| 9/30/24 | Pending Next EPS Report |

| 6/30/24 | 0.60 |

| 3/31/24 | 0.78 |

| 9/30/24 | 24.53 |

| 6/30/24 | 13.89 |

| 3/31/24 | 14.83 |

| 9/30/24 | 7.07 |

| 6/30/24 | -4.66 |

| 3/31/24 | -0.56 |

| 9/30/24 | 6.49 |

| 6/30/24 | -7.48 |

| 3/31/24 | -3.25 |

| 9/30/24 | Pending Next EPS Report |

| 6/30/24 | 15.52 |

| 3/31/24 | 16.35 |

| 9/30/24 | 1.80 |

| 6/30/24 | 2.20 |

| 3/31/24 | 2.25 |

| 9/30/24 | Pending Next EPS Report |

| 6/30/24 | 0.65 |

| 3/31/24 | 0.66 |

| 9/30/24 | Pending Next EPS Report |

| 6/30/24 | 39.53 |

| 3/31/24 | 39.85 |