Rambus (RMBS)

(Real Time Quote from BATS)

$51.48 USD

-1.87 (-3.51%)

Updated Nov 15, 2024 11:38 AM ET

3-Hold of 5 3

D Value C Growth B Momentum D VGM

Rambus (RMBS) Price Targets

| Average Price Target | Highest Price Target | Lowest Price Target | Upside to Average Price Target |

|---|---|---|---|

| $67.60 | $85.00 | $55.00 | 26.71% |

![]() Find the top stocks with the greatest target price potential and Zacks Rank of 1 or 2

Find the top stocks with the greatest target price potential and Zacks Rank of 1 or 2

Price Target

Based on short-term price targets offered by five analysts, the average price target for Rambus comes to $67.60. The forecasts range from a low of $55.00 to a high of $85.00. The average price target represents an increase of 26.71% from the last closing price of $53.35.

Analyst Price Targets (5 )

Broker Rating

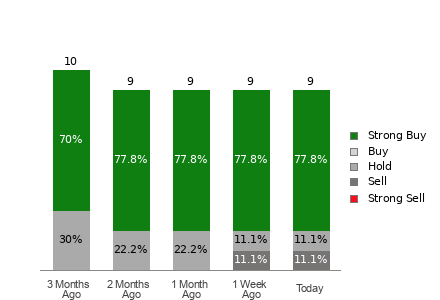

Rambus currently has an average brokerage recommendation (ABR) of 1.00 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by five brokerage firms. The current ABR compares to an ABR of 1.00 a month ago based on three recommendations.

Of the five recommendations deriving the current ABR, five are Strong Buy, representing 100% of all recommendations. A month ago, Strong Buy represented 100%.

Broker Rating Breakdown

Brokerage Recommendations

| Today | 1 Week Ago | 1 Month Ago | 2 Months Ago | 3 Months Ago | |

|---|---|---|---|---|---|

| Strong Buy | 5 | 4 | 3 | 4 | 4 |

| Buy | 0 | 0 | 0 | 0 | 0 |

| Hold | 0 | 0 | 0 | 0 | 0 |

| Sell | 0 | 0 | 0 | 0 | 0 |

| Strong Sell | 0 | 0 | 0 | 0 | 0 |

| ABR | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Analyst Upgrades/Downgrades

| Date | Brokerage Firm | Analyst | Previous | Current |

|---|---|---|---|---|

| 11/11/2024 | Loop Capital Markets | Gary Mobley | Not Available | Strong Buy |

| 11/6/2024 | Wells Fargo Securities | Aaron Rakers | Not Available | Strong Buy |

| 9/10/2024 | Rosenblatt Securities | Kevin E Cassidy | Strong Buy | Strong Buy |

| 4/27/2024 | Susquehanna Financial Group | Mehdi Hosseini | Strong Buy | Strong Buy |

1. Not Ident. Many of the brokerage firms who provide Zacks data ask that we keep their identity confidential.

2. In most cases the # of brokers listed above is less than the # of brokerage firms that have a recommendation on the stock. That is because some firms prohibit Zacks from displaying detailed information on their recommendations such as in the upgrade/downgrade table.

Average Brokerage Rating

| Current ABR | 1.00 |

| ABR (Last week) | 1.00 |

| # of Recs in ABR | 5 |

| Average Target Price | $67.60 |

| LT Growth Rate | NA |

| Industry | Electronics - Semiconductors |

| Industry Rank by ABR | 133 of 252 |

| Current Quarter EPS Est: | 0.58 |

RMBS FAQs

Rambus, Inc. (RMBS) currently has an average brokerage recommendation (ABR) of 1.00 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 5 brokerage firms.

The average price target for Rambus, Inc. (RMBS) is $67.60. The current on short-term price targets is based on 1 reports.

The forecasts for Rambus, Inc. (RMBS) range from a low of $55 to a high of $85. The average price target represents a increase of $26.71 from the last closing price of $53.35.

The current UPSIDE for Rambus, Inc. (RMBS) is 26.71%

Based on short-term price targets offered by five analysts, the average price target for Rambus comes to $67.60. The forecasts range from a low of $55.00 to a high of $85.00. The average price target represents an increase of 26.71% from the last closing price of $53.35.